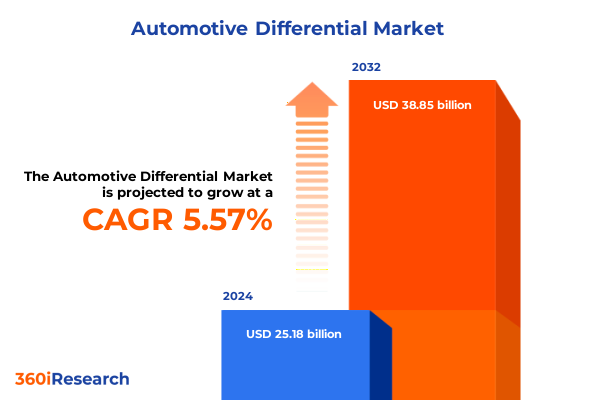

The Automotive Differential Market size was estimated at USD 26.47 billion in 2025 and expected to reach USD 27.83 billion in 2026, at a CAGR of 5.63% to reach USD 38.85 billion by 2032.

Understanding the Integral Role of Differentials in Modern Vehicles to Optimize Traction Control and Enhance Drivetrain Efficiency for Diverse Applications

The modern vehicle’s performance and safety hinge on a series of sophisticated components working in harmony, none more critical than the automotive differential. This mechanical marvel enables wheels to rotate at different speeds when cornering, ensuring optimal traction, handling precision, and driver confidence across varied driving conditions. Beyond its fundamental role in traditional drivetrains, the differential has evolved into a strategic enabler for advanced powertrain architectures, meeting the rigorous demands of high-performance sports cars, heavy-duty commercial vehicles, and the next generation of electric and hybrid platforms.

As market dynamics continue to shift under the influence of technological breakthroughs and regulatory pressures, stakeholders across the automotive value chain are recalibrating their approach to differential design, sourcing, and integration. Suppliers are introducing innovations in torque management and smart controls, while OEMs are increasingly prioritizing electrification and weight reduction to meet stringent emissions targets. Moreover, the push for digitalization and real-time diagnostics has begun to redefine how differentials are monitored and maintained over the lifespan of a vehicle. Consequently, a clear understanding of the differential’s evolving role is indispensable for executives, engineers, and strategists looking to capitalize on emerging opportunities.

This executive summary distills the most critical insights shaping the automotive differential landscape in 2025. It lays the groundwork for informed decision-making by framing the transformative shifts underway, exploring the ramifications of new trade measures, and highlighting segmentation, regional dynamics, and competitive positioning. By engaging with these findings, decision-makers will be well-equipped to anticipate market trends, align their product portfolios with future demand, and strengthen their competitive advantage.

Examining the Convergence of Mechanical Ingenuity and Digital Intelligence Transforming Differential Technologies and Driving the Future of Vehicle Dynamics

The automotive differential sector is undergoing a paradigm shift driven by technological convergence and changing consumer expectations. Electromechanical integration has started to redefine the way torque is distributed between wheels, moving beyond purely mechanical systems toward electronic torque vectoring that offers real-time adaptability. This shift is accelerating the adoption of advanced limited slip differentials and torque vectoring solutions, particularly in performance-oriented passenger vehicles and the growing electric vehicle (EV) segment. Manufacturers are deploying embedded sensors and actuators to achieve precise torque split and seamless transition between driving modes, thereby improving ride comfort and energy efficiency.

Simultaneously, the rise of autonomous driving and connected vehicles demands intelligent differential management that can be coordinated with other vehicle control systems. Active differentials that communicate with stability control, steering, and braking systems are becoming standard in higher vehicle segments, reducing understeer and oversteer tendencies. This integration not only enhances safety but also optimizes tire wear and extends component life. Furthermore, material innovation, such as the use of high-strength alloys and composite housings, is reducing weight while maintaining durability under extreme loads, aligning with broader industry goals of lowering carbon footprints and enhancing vehicle efficiency.

These transformative developments are reshaping supply chain structures, prompting partnerships between component specialists and software providers. As the market moves toward software-defined differentials, collaboration with technology firms and tier-two suppliers specializing in control algorithms and embedded systems is proving essential. Together, these advances signal a new era in which mechanical ingenuity and digital intelligence converge to deliver unparalleled driving experiences and robust operational performance across all vehicle segments.

Assessing How Recent U.S. Steel and Aluminum Tariffs of 2025 Have Reshaped Sourcing Strategies Supply Chain Resilience and Production Footprints

The recent implementation of targeted tariffs on steel and aluminum imports by the United States in early 2025 has imposed significant cost pressures on differential manufacturers and their upstream suppliers. Steel, a primary raw material for differential gears and housings, now carries an additional levy that has led to higher input costs across the value chain. Many tier-one producers have responded by negotiating longer supplier contracts and exploring domestic sourcing alternatives to mitigate the financial impact. Meanwhile, the aluminum tariff has raised extrusion and casting expenses for housing components, incentivizing manufacturers to reengineer parts to reduce weight or to substitute alternative alloys with a more favorable tariff profile.

In parallel, incentives designed to promote on-shore manufacturing under recent trade policy adjustments have encouraged several leading differential producers to expand their facilities within North America. This nearshoring trend addresses concerns over tariff volatility and supply chain resilience, albeit at the expense of elevated labor and energy costs. Local content requirements associated with federal incentives have further reinforced the rationale for in-region component production, particularly for entities supporting the domestic EV sector under the Inflation Reduction Act’s clean vehicle provisions. As a result, some suppliers have strategically diversified production footprints, balancing capacity across U.S. facilities and low-cost neighboring markets to optimize total landed costs.

The cumulative effect of these trade measures extends beyond cost escalation. They are reshaping procurement strategies, compelling companies to reexamine partner networks, and reevaluate long-term supply agreements. Firms that have proactively adopted flexible manufacturing arrangements and realigned sourcing strategies demonstrate greater agility, reducing lead times and fostering quicker response to market demand fluctuations. In contrast, those with rigid global supply chains face heightened risk of margin erosion and inventory bottlenecks, underscoring the critical need for a strategic approach that reconciles tariff pressures with operational efficiency.

Unveiling Key Differential Technology and Drive System Trends Across Segmented Applications Illustrating Evolving Preferences and Performance Priorities

Analyzing the market by differential type reveals distinct trajectories for each configuration. Open differentials, historically valued for their simplicity and cost effectiveness, remain prevalent in entry-level passenger vehicles but are gradually ceding ground to limited slip differentials, which now dominate segments demanding superior traction control. Within the limited slip category, clutch-based designs continue to offer reliable performance, while gear-type and Torsen solutions are favored for their durability under higher torque loads. Viscous couplings serve niche applications where gradual torque transfer is preferred. The torque vectoring differential, either electronic or mechanical, has gained traction in high-end sports cars and luxury SUVs, underscoring the shift toward dynamic performance and precise handling.

When viewed through the lens of drive system, 2WD retains its strong presence in cost-sensitive light commercial and passenger vehicle segments, whereas 4WD and AWD options have expanded in higher-margin sectors, driven by consumer demand for all-terrain capability and enhanced safety. The proliferation of AWD, in particular, is intertwined with the electrification trend, as electric motors at each axle enable seamless torque distribution without complex mechanical linkages.

Segmentation by application highlights distinct growth vectors. Heavy commercial vehicles, such as buses and heavy trucks, increasingly adopt advanced locking differentials to maximize payload efficiency on varied terrain. Light commercial vehicles, including pickup trucks and vans, balance utility with comfort, often employing limited slip solutions for improved stability under load. Passenger vehicles showcase the most diversity, leveraging hatchback and sedan models to introduce torque vectoring at accessible price points, while multi-purpose vehicles and SUVs prioritize adjustable traction settings for family-oriented versatility.

Navigating distribution channels, many OEMs and aftermarket participants continue to rely on traditional offline networks for installation and service, yet the online channel has surged in importance for parts sourcing and diagnostic tool procurement. This dual approach reflects a broader industry progression toward integrated sales strategies that combine physical expertise with digital convenience, meeting end-user expectations for speed, transparency, and technical support.

This comprehensive research report categorizes the Automotive Differential market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Differential Type

- Drive System

- Application

- Distribution Channel

Dissecting Regional Differential Market Dynamics Highlighting Distinct Adoption Patterns Technological Leadership and Infrastructure Considerations

Regional analysis reveals nuanced patterns of adoption and innovation across the globe. In the Americas, a mature automotive ecosystem places strong emphasis on performance differentials for trucks, SUVs, and premium passenger cars. Manufacturers in North America have prioritized the development of electronically controlled locking and torque vectoring solutions to align with stringent safety regulations and consumer demand for off-road capability. Investment in local manufacturing under new trade incentives has further solidified the region’s strategic importance, bolstering supply chain stability.

The Europe, Middle East & Africa cluster demonstrates a robust appetite for both high-performance and eco-friendly differential systems. European OEMs are at the forefront of integrating torque vectoring into plug-in hybrid and battery electric vehicles, leveraging strong governmental incentives for zero-emission mobility. Meanwhile, Middle Eastern markets, grappling with extreme temperatures and challenging terrains, increasingly adopt locking differentials to support heavy commercial and off-road vehicles. In Africa, infrastructure constraints elevate the demand for rugged, mechanically simple open and locking differentials that can withstand minimal maintenance environments.

Asia-Pacific stands as the largest manufacturing hub, characterized by a diverse mix of global OEM plants and thriving domestic suppliers. The region’s rapid EV penetration, particularly in China and Southeast Asia, has accelerated the development of compact torque vectoring units optimized for electric motors. Japanese and South Korean companies continue to lead in the refinement of limited slip and Torsen technologies, while India and Southeast Asian markets balance cost sensitivity with the gradual integration of advanced systems for premium vehicle segments. Collectively, these regional dynamics underscore the strategic importance of tailoring product portfolios to address varied regulatory frameworks, customer expectations, and infrastructure realities across each geography.

This comprehensive research report examines key regions that drive the evolution of the Automotive Differential market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Differential Suppliers Showcasing Strategic Investments Partnerships and Technological Differentiation That Define Competitive Advantage

A competitive analysis of leading differential suppliers reveals a diverse set of strategic approaches. Dana Incorporated, with its longstanding heritage in drivetrain solutions, has intensified research into electronic torque vectoring for electric vehicles and light trucks. The company’s investments in modular platform designs facilitate seamless integration across varying architectures, underscoring a commitment to scalability and performance.

American Axle & Manufacturing (AAM) leverages its deep expertise in traditional gear and clutch systems while expanding its foray into hybrid and electric differential production. Strategic partnerships with OEMs have allowed AAM to co-develop bespoke locking and limited slip solutions tailored to emerging EV platforms. In tandem, the firm is optimizing its global footprint to balance cost efficiency with rapid delivery capabilities.

GKN Automotive stands out for its pioneering work in torque vectoring and e-Axle systems, carving out a leadership position in European and Chinese electric mobility ventures. Their vertically integrated operations, encompassing motor, differential, and power electronics, position the company as a critical partner for EV OEMs seeking end-to-end propulsion solutions.

BorgWarner, renowned for its diverse portfolio from turbochargers to e-Drives, has channeled substantial resources into advanced differential technologies, particularly electronic limited slip and multi-plate clutch systems. Through acquisitions and joint ventures, the company continues to broaden its technological breadth and global reach.

JTEKT Corporation, backed by its strong bearings and steering components heritage, differentiates through precision engineering and material science innovations. Their torque vectoring offerings emphasize low inertia and high responsiveness, tailored to both motorsport and premium consumer applications. Together, these companies exemplify the strategic diversity and innovation intensity shaping the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Differential market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Axle & Manufacturing, Inc.

- Auburn Gear Inc.

- BorgWarner Inc.

- Dana Incorporated

- Eaton Corporation plc

- GKN Driveline (UK) Limited

- Hasco Corporation

- Huayu (Automotive Systems) Co., Ltd.

- Hyundai WIA Corporation

- Jietu Transmission Parts Co., Ltd.

- JTEKT Corporation

- Lianhao Corporation

- Linamar Corporation

- Magna International Inc.

- Meritor Inc.

- Musashi Seimitsu Industry Co., Ltd.

- Neapco Holdings LLC

- PowerTrax

- R.T. Quaife Engineering Ltd.

- Schaeffler Technologies AG & Co. KG

- Sona BLW Precision Forgings Limited

- Tanhas Corporation

- Trump Industrial Corporation

- ZF Friedrichshafen AG

- Zhejiang Wanxiang Group Corporation

Implementing a Comprehensive Strategy Focusing on Technological Innovation Supply Chain Agility and Sustainability to Strengthen Market Leadership

Industry leaders seeking to capitalize on these market dynamics should pursue a multifaceted strategic agenda. First, prioritizing research and development in electronic torque vectoring will address growing demand for integrated powertrain control and differentiated driving experiences. Collaborating with software specialists to refine control algorithms and user-definable driving modes can further enhance product appeal and foster OEM partnerships.

Simultaneously, supply chain diversification must be elevated from risk mitigation to a core component of corporate strategy. Establishing a balanced network of domestic and nearshore production assets will reduce exposure to tariff volatility while ensuring resilient access to key raw materials. This approach should be complemented by vendor risk assessments and flexible contract terms that allow rapid scaling in response to demand fluctuations.

Sustainability considerations are increasingly influencing procurement and design decisions. Leaders should invest in lightweight materials and recyclable components, aligning differential architectures with broader vehicle decarbonization goals. Transparent reporting on material sourcing and lifecycle emissions will strengthen supplier relationships and enhance brand reputation among environmentally conscious consumers and regulators.

Finally, embracing omnichannel distribution strategies that integrate digital sales platforms with traditional service networks will address evolving customer expectations for immediate access and technical support. Delivering value-added services, such as remote diagnostics and predictive maintenance alerts, can differentiate offerings in a crowded aftermarket and OEM landscape. By executing this integrated blueprint, differential suppliers and OEMs can secure long-term growth, operational resilience, and technological leadership.

Detailing the Robust Multi-Source Research Approach Integrating Technical Review Expert Interviews and Rigorous Data Triangulation

The research underpinning this analysis employed a rigorous methodology combining secondary data synthesis, expert interviews, and triangulation of multiple information sources. Initially, a thorough review of publicly available technical standards, patent filings, and regulatory frameworks provided foundational insights into differential configurations, materials, and performance benchmarks. This was complemented by an examination of trade policies and tariff schedules to assess the macroeconomic context influencing raw material procurement.

Primary data collection involved structured interviews with senior engineers, product managers, and procurement executives across OEMs and tier-one suppliers. These discussions yielded firsthand perspectives on design priorities, technology adoption cycles, and supply chain constraints. Additionally, interviews with policy analysts and trade specialists illuminated the strategic implications of recent tariff measures and incentive programs.

To ensure the reliability of findings, data points were cross-verified through multiple channels, including manufacturer press releases, technical white papers, and independent industry forums. Qualitative insights were coded and analyzed to identify recurring themes, while discrepancies were investigated through follow-up inquiries. Finally, draft conclusions were subjected to peer review by subject matters experts to validate interpretations and reinforce analytical rigor. This comprehensive approach ensures that the conclusions presented herein rest on a robust evidentiary basis and reflect the latest industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Differential market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Differential Market, by Differential Type

- Automotive Differential Market, by Drive System

- Automotive Differential Market, by Application

- Automotive Differential Market, by Distribution Channel

- Automotive Differential Market, by Region

- Automotive Differential Market, by Group

- Automotive Differential Market, by Country

- United States Automotive Differential Market

- China Automotive Differential Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Mechanical Expertise Digital Innovation and Strategic Resilience to Navigate the Evolving Landscape of Automotive Differential Technologies

The automotive differential sector stands at the intersection of tradition and innovation. While the mechanical principles that govern torque distribution remain fundamental to vehicle dynamics, the industry’s trajectory is unmistakably digital and electrified. Advances in torque vectoring, material engineering, and sensor integration are redefining performance standards across utility, commercial, and passenger vehicle segments. Concurrently, external pressures-from trade policies to environmental mandates-are reshaping strategies for manufacturing, sourcing, and product development.

Organizations that embrace these shifts early will secure competitive advantage by delivering differentiated products that meet evolving consumer expectations and regulatory requirements. Effective navigation of tariff-induced cost headwinds demands strategic supply chain realignment, supported by domestic investments and flexible supplier ecosystems. At the same time, sustaining momentum in R&D and forging partnerships with software innovators will unlock new frontiers in adaptive drivetrain control.

Ultimately, success in this dynamic landscape hinges on the ability to integrate mechanical expertise with digital intelligence, operational resilience, and a steadfast commitment to sustainability. By synthesizing the insights articulated in this executive summary, industry participants can make informed decisions that drive growth, enhance performance, and shape the future of vehicle propulsion.

Empower Your Organization with Expert Guidance to Secure the Definitive Automotive Differential Market Research Report and Drive Informed Strategic Decisions

If you are seeking deeper strategic insights, practical guidance, and a comprehensive examination tailored to your organization’s specific needs, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan leverages extensive industry expertise to help you navigate the complexities of the automotive differential market and unlock growth opportunities. Engage now to secure your copy of the full market research report and equip your team with the intelligence necessary to stay ahead in an evolving competitive landscape.

- How big is the Automotive Differential Market?

- What is the Automotive Differential Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?