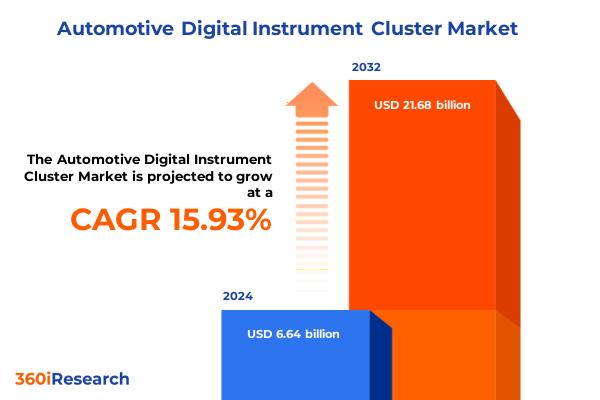

The Automotive Digital Instrument Cluster Market size was estimated at USD 7.70 billion in 2025 and expected to reach USD 8.83 billion in 2026, at a CAGR of 15.93% to reach USD 21.68 billion by 2032.

Exploring the Evolving Role of Digital Instrument Clusters in Enhancing Vehicle Intelligence Connectivity and Personalized Driver Engagement Experiences

Digital instrument clusters have swiftly transformed from mere tachometers and speedometers into sophisticated hubs of driver information and interaction. As automotive ecosystems evolve toward greater connectivity, electrification, and autonomy, the cluster has emerged as a central interface that synthesizes vehicle diagnostics, navigation data, infotainment, and advanced driver assistance system alerts. This evolution underscores how crucial it is for manufacturers and suppliers to understand the shifting expectations of drivers, who now demand seamless, personalized experiences backed by real-time analytics and high-definition graphics.

Against this backdrop of rapid innovation, the competitive environment has intensified, with original equipment manufacturers partnering with technology firms to deliver next-generation displays powered by LED, OLED, and high-performance TFT LCD panels. Concurrently, aftermarket providers are expanding retrofit offerings to cater to consumers seeking to upgrade legacy analog gauges. This dual-track progression illustrates the importance of capturing the viewpoints of diverse stakeholders-from vehicle type specialists to display technology innovators-and aligning product roadmaps with both OEM and aftermarket requirements. By fostering an integrated view of these forces, this executive summary sets the stage for a nuanced discussion on the pivotal trends reshaping the digital instrument cluster market.

Unveiling Key Technological Advancements and Ecosystem Dynamics Reshaping the Future of Automotive Instrument Cluster Solutions

Over the past decade, digital instrument clusters have undergone a fundamental metamorphosis driven by breakthroughs in display technologies, sensor integration, and software architectures. Initially dominated by basic TFT LCD layouts, the market now embraces OLED and LED displays that offer superior contrast, dynamic color range, and flexible form factors enabling curved and wrap-around designs. These advancements have unlocked new avenues for differentiating user experiences, allowing automakers to embed contextual alerts and interactive menus directly within the driver’s line of sight, thereby reducing cognitive load and improving safety.

Simultaneously, the proliferation of vehicle-to-everything communication and advanced driver assistance systems has necessitated a shift from static gauge clusters to modular digital platforms capable of over-the-air updates. Agile software frameworks now orchestrate real-time map overlays, predictive maintenance notifications, and adaptive automations that respond to driving conditions. Ecosystem convergence between infotainment systems and digital clusters is accelerating the integration of voice recognition, haptic feedback, and gesture controls, thus redefining how drivers engage with their vehicles. As these transformative shifts converge, industry participants must adapt strategies that embrace open standards, scalable architectures, and cross-functional collaboration to capture the full potential of the instrument cluster’s evolution.

Assessing the Ripple Effects of Recent U.S. Trade Policy Changes on Domestic Automotive Display Production Supply Chain Resilience and Cost Structures

The implementation of new tariff measures by the United States in early 2025 has had a profound impact on the economics of automotive display modules and associated subcomponents. By increasing duties on select imported semiconductors, flat panel displays, and precision printed circuit boards, OEMs and tiered suppliers have faced heightened input costs, compelling a reassessment of sourcing strategies across global supply networks. Many original equipment manufacturers have accelerated localization efforts, forging partnerships with domestic suppliers or shifting production to tariff-exempt zones to mitigate duty burdens and ensure continuity of supply.

These policy shifts have also influenced aftermarket channels, where replacement and retrofit offerings experienced cost recalibrations that trickled down to end consumers. Suppliers with diversified manufacturing footprints gained a competitive edge, while those reliant on imported components had to absorb or pass on increased expenses. As firms navigate this new tariff landscape, resilience has become a critical lens through which to evaluate supplier relationships, inventory management, and contract structures. Forward-looking stakeholders are now exploring alternate materials, strategic stockpiling, and dynamic hedging mechanisms to preserve margin targets without compromising innovation investments or delivery timelines.

Delving into Vehicle Classifications Installation Preferences Display Technologies Screen Dimensions and Powertrain Variations Driving Market Differentiation

An in-depth understanding of digital instrument cluster market segmentation unveils nuanced demand patterns influenced by vehicle class, installation type, display technology, screen size, and powertrain configuration. Within the realm of vehicle class, heavy commercial vehicles such as coach buses, heavy duty trucks, and medium duty trucks prioritize durability and high-visibility LED or TFT solutions, while light commercial vehicles including cargo vans, light duty buses, and pickup trucks balance cost efficiency with functional display requirements. Passenger cars stratified into economy, midrange, and luxury segments exhibit varied adoption curves, with economy models often integrating basic TFT LCD clusters and premium offerings showcasing fully programmable OLED or advanced edge-lit LED arrays.

Shifting to installation paradigms, aftermarket retrofits and replacements cater to fleet operators and enthusiasts seeking to upgrade aging analog dashboards, balancing ease of integration with cost sensitivity. Meanwhile, original equipment manufacturer channels led by tier-1 and tier-2 suppliers drive cutting-edge developments that embed machine learning algorithms and augmented reality overlays directly into first-fit clusters. Display technology preferences further shape design considerations: backlit and edge-lit LED solutions deliver robust brightness in heavy duty environments, whereas active matrix OLED panels infuse luxury vehicles with crisp contrast and minimal power draw and passive matrix OLED options allow mid-tier platforms to achieve cost-efficiency without sacrificing fluid visuals. In-plane switching and twisted nematic TFT LCD configurations remain prevalent across entry-level to mainstream platforms due to their proven reliability and competitive pricing.

Screen dimensions also play a decisive role in user experience, with up to seven-inch clusters dominating compact and entry-level vehicles, while seven to nine and nine to twelve-inch displays create more immersive dashboards in mainstream sedans and SUVs. Above twelve-inch options, segmented into twelve to fifteen and above fifteen-inch variants, are increasingly adopted in premium and electric vehicle lines to accommodate split-screen functionality and graphical customization. Lastly, the choice of powertrain-spanning battery electric and fuel cell electric vehicles, full, mild, and plug-in hybrids, as well as diesel and gasoline internal combustion engines-drives distinct feature sets. Electric powertrains often leverage high-resolution OLED or LED matrices to visualize battery management systems and range predictions, hybrids integrate adaptive alert systems to prompt powertrain transitions, and traditional ICE platforms focus on analog-style gauges augmented with digital overlays to streamline manufacturing integration.

This comprehensive research report categorizes the Automotive Digital Instrument Cluster market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Technology

- Screen Size

- Powertrain Type

- Vehicle Type

- Installation Type

Analyzing Regional Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Uncover Growth Drivers and Adoption Patterns

Regional dynamics continue to shape investment priorities and adoption rates for digital instrument clusters across the Americas, where North American OEMs emphasize regulatory compliance, driver safety mandates, and in-vehicle connectivity. Mexico’s growing light commercial vehicle assembly sector also fuels demand for localized display solutions that meet regional content requirements. Meanwhile, in Europe, Middle East & Africa, stringent emissions regulations and consumer expectations for premium user interfaces elevate demand for high-contrast OLED and adaptive display modules, particularly within luxury carmakers headquartered in Germany and the United Kingdom. The Gulf region’s rising fleet modernization programs further accelerate retrofit opportunities, creating niches for ruggedized cluster solutions tailored to commercial applications.

Turning to Asia-Pacific, rapid electrification initiatives in China, Japan, and South Korea spotlight custom digital clusters capable of integrating comprehensive battery management visuals and predictive maintenance insights. India’s expanding passenger car production fosters entry-level cluster deployments, whereas Southeast Asian markets are beginning to adopt midrange display formats, reflecting a gradual shift toward more sophisticated driver interfaces. Across these regions, local supply chain ecosystems, regulatory frameworks, and consumer preferences coalesce to influence design priorities, material sourcing, and partnership models for display technology providers.

This comprehensive research report examines key regions that drive the evolution of the Automotive Digital Instrument Cluster market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Trailblazers Strategic Collaborators and Innovative Disruptors Pioneering the Evolution of Digital Instrument Cluster Technologies

Industry leaders such as global tier-1 suppliers have intensified investment in next-generation digital cluster platforms, collaborating closely with semiconductor innovators to push the boundaries of brightness, refresh rates, and integrated processing power. At the same time, nimble disruptors specializing in OLED manufacturing have captured attention by pioneering flexible display geometries that seamlessly conform to curved dashboards and enable split-screen functionalities. Technology conglomerates are also extending their portfolios through strategic acquisitions of software firms specializing in human-machine interface design to bolster end-to-end solution offerings encompassing both hardware and intuitive user experiences.

Moreover, aftermarket specialists are forging channels with fleet operators and independent repair networks to offer turn-key retrofit kits that blend plug-and-play simplicity with advanced dashboard features. Collaborative ventures between automotive OEMs and entertainment brands have emerged to create customizable cluster themes, driving differentiation in premium segments. Across the value chain, forward-thinking organizations are leveraging modular architectures to support incremental feature roll-outs, optimizing time-to-market and reducing lifecycle costs. These strategic alignments underscore the sector’s shift from component-centric models toward integrated ecosystem collaborations that address evolving regulatory, technological, and consumer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Digital Instrument Cluster market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alps Alpine Co., Ltd.

- Aptiv PLC

- BOE Technology Group Co., Ltd.

- Continental AG

- Delphi Technologies PLC

- Denso Corporation

- Harman International Industries, Inc.

- Innolux Corporation

- Japan Display Inc.

- Kyocera Corporation

- LG Display Co., Ltd.

- Magneti Marelli S.p.A.

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Nippon Seiki Co., Ltd.

- Panasonic Automotive Systems Co., Ltd.

- Pioneer Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Toshiba Corporation

- Valeo S.A.

- Visteon Corporation

- Yazaki Corporation

Strategic Imperatives and Actionable Steps for Automotive Stakeholders to Harness Emerging Opportunities and Strengthen Competitive Positioning

Automotive stakeholders must prioritize an ecosystem approach that aligns design, software, and supply chain strategies to realize the full potential of digital instrument clusters. By establishing cross-functional teams that integrate user experience specialists, electronics engineers, and regulatory experts, organizations can accelerate the validation of novel display configurations while ensuring compliance with safety and emissions standards. Additionally, developing flexible sourcing frameworks that blend local manufacturing with global strategic partners will mitigate geopolitical and tariff-related risks while maintaining cost competitiveness.

Investment in scalable software platforms capable of over-the-air updates and real-time diagnostics will further ensure clusters remain adaptable to evolving cybersecurity threats, connectivity protocols, and feature sets. Engaging with tier-2 technology providers early in the concept phase can unlock proprietary machine learning and augmented reality capabilities, transforming the cluster into a dynamic driver assistance interface. Lastly, aligning product roadmaps with end-user insights-garnered through pilot programs and user feedback loops-will cultivate interfaces that resonate with diverse driver demographics, from fleet operators in commercial segments to tech-savvy consumers in premium electric vehicles.

Outlining the Rigorous Data Gathering Analytical Frameworks and Validation Processes Underpinning the Comprehensive Instrument Cluster Market Research

This report synthesizes primary insights derived from in-depth interviews with OEM design leads, tier-1 and tier-2 supplier executives, and aftermarket specialists, complemented by secondary research encompassing industry journals, regulatory filings, and publicly available technical papers. A rigorous analytical framework underpins the study, employing qualitative thematic analysis to distill technology trends and quantitative scoring matrices to evaluate regional adoption drivers. To ensure validity, data points were cross-verified with multiple independent sources and benchmarked against historical product roadmaps dating back five years.

Furthermore, the research leverages scenario planning to assess the implications of evolving trade policies, regulatory milestones, and anticipated shifts in consumer behavior. Statistical techniques such as cluster analysis were applied to segment vehicle classes, installation types, display technologies, screen sizes, and powertrain categories, fostering a granular understanding of market heterogeneity. The methodology’s transparency is bolstered by detailed documentation of data collection protocols, interview guides, and validation checklists to guarantee reproducibility and support strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Digital Instrument Cluster market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Digital Instrument Cluster Market, by Display Technology

- Automotive Digital Instrument Cluster Market, by Screen Size

- Automotive Digital Instrument Cluster Market, by Powertrain Type

- Automotive Digital Instrument Cluster Market, by Vehicle Type

- Automotive Digital Instrument Cluster Market, by Installation Type

- Automotive Digital Instrument Cluster Market, by Region

- Automotive Digital Instrument Cluster Market, by Group

- Automotive Digital Instrument Cluster Market, by Country

- United States Automotive Digital Instrument Cluster Market

- China Automotive Digital Instrument Cluster Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Core Insights Drawing Strategic Conclusions and Highlighting Essential Considerations for Future Progression in Automotive Display Ecosystems

The accelerating convergence of display technologies, software capabilities, and ecosystem partnerships heralds a new era for automotive instrument clusters. The strategic interplay between OLED, LED, and advanced TFT LCD options enables differentiated user experiences tailored to vehicle class and consumer expectations. Meanwhile, recent tariff adjustments have underscored the importance of versatile sourcing and operational resilience. Segmentation analysis reveals that distinct clusters of demand are emerging across heavy commercial vehicles, passenger cars, OEM and aftermarket channels, and the spectrum of powertrain architectures.

Regional insights have illuminated divergent adoption patterns shaped by regulatory environments, electrification agendas, and consumer sophistication levels in the Americas, EMEA, and Asia-Pacific. Leading companies are responding with modular platforms, strategic acquisitions, and collaborative ventures that bridge hardware innovation and intuitive software design. By synthesizing these insights, stakeholders can confidently navigate the complexities of the evolving digital display landscape and chart course for sustained differentiation.

Secure Exclusive Access to Deep Market Insights on Digital Instrument Clusters by Connecting with Associate Director Ketan Rohom for Report Acquisition

To capitalize on emerging opportunities in digital instrument cluster technologies, reach out to Ketan Rohom, Associate Director of Sales and Marketing. By engaging directly with him, decision-makers can secure access to the comprehensive research report that unpacks critical insights on evolving display architectures, integration strategies, and supply chain considerations. This tailored consultation will facilitate a deeper understanding of how to position product portfolios for maximum impact, optimize partnerships across the value chain, and implement future-ready solutions that resonate with end-users. Connect today to acquire this indispensable resource and ensure your organization remains at the forefront of innovation in automotive digital displays.

- How big is the Automotive Digital Instrument Cluster Market?

- What is the Automotive Digital Instrument Cluster Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?