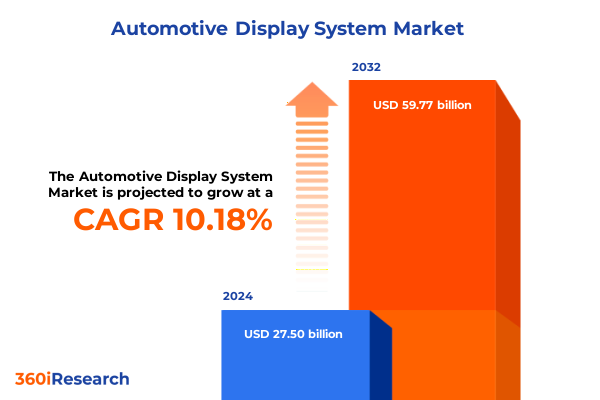

The Automotive Display System Market size was estimated at USD 30.14 billion in 2025 and expected to reach USD 33.04 billion in 2026, at a CAGR of 10.27% to reach USD 59.77 billion by 2032.

Pioneering the Road Ahead with Next-Generation In-Vehicle Display Systems That Redefine Driver Experience and Cockpit Functionality

Pioneering the Road Ahead with Next-Generation In-Vehicle Display Systems That Redefine Driver Experience and Cockpit Functionality

The automotive industry is witnessing a paradigm shift as advanced display technologies transition from optional luxuries to integral components of the modern cockpit. From the moment a driver initiates the ignition sequence, in-vehicle screens not only convey critical safety information but also cultivate an immersive, intuitive environment. As cars become increasingly connected, the dashboard evolves into a dynamic interface that orchestrates navigation, entertainment, and vehicle diagnostics with unprecedented clarity and responsiveness.

Moreover, the convergence of digital cockpits with advanced driver assistance systems is redefining human–machine interaction. Instrument clusters transition from rigid analog gauges to configurable digital dashboards, while head-up displays project vital data seamlessly into the driver’s line of sight. This fusion of clarity and context enhances situational awareness and promotes safer driving behaviors. Consequently, industry stakeholders are placing heightened emphasis on seamless integration, ergonomic design, and adaptive software architectures that can keep pace with rapidly emerging user expectations.

Revolutionary Technological Advances and Evolving Consumer Expectations Driving Disruption in In-Vehicle Display Ecosystems

Revolutionary Technological Advances and Evolving Consumer Expectations Driving Disruption in In-Vehicle Display Ecosystems

At the vanguard of today’s automotive display landscape, advancements in OLED and microLED technologies are pushing the envelope on brightness, contrast, and energy efficiency. The ability to render high-resolution imagery with deep blacks and vibrant colors has emboldened automakers to explore fully curved, bezel-free screens that seamlessly integrate with interior trim. In addition, adaptive brightness control powered by AI-driven ambient sensing is ensuring optimal readability under diverse lighting conditions.

Simultaneously, consumer expectations have matured, demanding not only superior visual performance but also multimodal control interfaces. Touch-sensitive displays are now complemented by gesture-based commands and voice recognition systems that intuitively interpret driver intent. As digital ecosystems expand, connectivity has become paramount, with wireless platforms enabling over-the-air updates and seamless smartphone integration. Consequently, stakeholders must strike a balance between hardware innovation and software agility, ensuring that display architectures remain scalable, secure, and future-ready.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Global Automotive Display Supply Chains and Component Sourcing Strategies

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Global Automotive Display Supply Chains and Component Sourcing Strategies

The introduction of new tariffs on automotive components in early 2025 has reverberated across global supply chains, compelling manufacturers to reevaluate sourcing strategies and cost structures. With higher duties imposed on imported display panels and semiconductor modules, several suppliers have accelerated the localization of production facilities within North America. This strategic pivot not only mitigates tariff exposure but also reduces lead times, enhancing supply chain resilience against future policy fluctuations.

Furthermore, the cumulative cost impact has prompted tier-one suppliers to renegotiate long-term agreements with key foundries and display fabricators. In turn, original equipment manufacturers are reassessing contract terms to share the burden of increased input expenses. Ultimately, this recalibration is fostering closer collaboration between automotive OEMs and their display partners, paving the way for joint investments in regional assembly hubs and R&D centers. As a result, companies that proactively adapted to the 2025 tariff regime are gaining a competitive edge through streamlined operations and improved delivery predictability.

Deep Analysis of Critical Display Type, Technology, Interface, Connectivity, Resolution, Vehicle and Channel Segments Reveals Strategic Opportunities

Deep Analysis of Critical Display Type, Technology, Interface, Connectivity, Resolution, Vehicle and Channel Segments Reveals Strategic Opportunities

Examination of display type segmentation underscores the distinct growth trajectories of head-up interfaces, infotainment consoles, and digital instrument clusters. Each reveals unique value propositions, from enhanced real-time tracking in head-up solutions to immersive multimedia experiences in center-stack panels. Transitioning to display technology segmentation, the interplay between LCD, LED, and OLED platforms highlights a gradual shift toward emissive architectures that deliver superior contrast and flexible form factors.

In the realm of interface technologies, gesture-based controls and touch-sensitive screens are redefining how drivers interact with vehicle systems, creating a seamless bridge between manual and digital modalities. Connectivity segmentation differentiates between wired modules, prized for their low latency, and wireless implementations that support rapid firmware upgrades and device pairing. Resolution segmentation further refines market dynamics, with 4K displays commanding premium positioning, Full HD modules catering to mainstream applications, and standard definition panels serving cost-sensitive segments.

Vehicle type delineation sheds light on the divergent needs of commercial versus passenger vehicles. Heavy and light commercial vehicles prioritize durability and operational efficiency, whereas convertibles, hatchbacks, sedans, and SUVs emphasize aesthetic integration and user-centric features. Finally, evaluating aftermarket versus OEM channels alongside offline and online sales pathways illuminates critical go-to-market considerations, from distributor partnerships to digital storefront strategies.

This comprehensive research report categorizes the Automotive Display System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Type

- Display Technology

- Interface Technology

- Connectivity

- Resolution

- Vehicle Type

- End-user

- Sales Channel

Comparative Examination of Regional Dynamics Across Americas, EMEA, and Asia-Pacific Unveils Diverse Automotive Display Market Trajectories

Comparative Examination of Regional Dynamics Across Americas, EMEA, and Asia-Pacific Unveils Diverse Automotive Display Market Trajectories

Within the Americas, the emphasis on domestic manufacturing and stringent safety regulations is propelling the adoption of advanced head-up and instrument cluster displays in both passenger and commercial vehicles. Meanwhile, software integration and connectivity features are receiving significant investment to meet North American consumer preferences for seamless smartphone integration and over-the-air update capabilities.

In Europe, the Middle East, and Africa region, automakers are focusing on sustainability and energy efficiency, driving demand for low-power OLED panels. Additionally, the high penetration of luxury vehicle brands in Europe has accelerated the uptake of customizable ambient lighting and curved center-stack displays. Regulatory harmonization across EMEA has also streamlined certification processes, expediting time-to-market for cutting-edge display innovations.

The Asia-Pacific landscape presents a complex tapestry of mature markets such as Japan and South Korea alongside emerging automotive hubs in India and Southeast Asia. Local display manufacturers in this region are leveraging scale to optimize cost efficiencies, while tier-one suppliers are forging strategic alliances to access next-generation miniLED and microLED backplane technologies. Consequently, Asia-Pacific remains a hotbed of innovation and competitive pricing pressure.

This comprehensive research report examines key regions that drive the evolution of the Automotive Display System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Leading Industry Players’ Strategic Moves, Collaborative Ventures, and Technological Innovations Shaping Competitive Positioning in Display Solutions

Uncovering Leading Industry Players’ Strategic Moves, Collaborative Ventures, and Technological Innovations Shaping Competitive Positioning in Display Solutions

Bosch has intensified its focus on advanced HUD modules, collaborating with semiconductor firms to bring AI-powered augmented reality overlays to series production. Continental is advancing its digital cockpit platform through joint-development agreements with display panel manufacturers to deliver fully scalable, updatable software ecosystems. Denso is investing heavily in OLED research, seeking to introduce flexible, curved panel designs that conform to next-generation interior architectures.

Panasonic’s alliance with leading graphics chipset providers has yielded high-performance infotainment systems capable of rendering 4K content with minimal latency. LG Display continues to expand its automotive-grade OLED fabs, aiming to reduce unit costs and increase output for global OEM customers. Additionally, smaller specialized suppliers are carving niches by offering gesture-sensing and haptic feedback modules that enhance user engagement and minimize driver distraction.

Collectively, these strategic moves underscore a broader industry trend toward collaborative innovation, with cross-border partnerships and co-development programs becoming essential for maintaining technological leadership. As competition intensifies, the ability to rapidly integrate hardware breakthroughs with robust software frameworks will differentiate market leaders from followers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Display System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alps Alpine Co., Ltd.

- AUO Corporation

- Basemark Oy

- BrightView Technologies, Inc.

- Continental AG

- CY Vision

- Denso Corporation

- Futurus Technology Co.Ltd

- Garmin Ltd.

- HannStar Display Corporation

- Hyundai Mobis Co., Ltd.

- Innolux Corporation

- Japan Display Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Nippon Seiki Co., Ltd.

- Panasonic Holdings Corporation

- Pioneer Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sharp Corporation

- Synaptics Incorporated

- TCL China Star Optoelectronics Technology Co.,Ltd.

- Valeo SA

- Visteon Corporation

- Yazaki Corporation

Strategic Imperatives for Automotive Display System Leaders to Capitalize on Emerging Technologies and Evolving Market Realities

Strategic Imperatives for Automotive Display System Leaders to Capitalize on Emerging Technologies and Evolving Market Realities

To maintain a competitive advantage, industry leaders should prioritize the development of modular display architectures that facilitate rapid feature upgrades and customization. Embracing open software standards and interoperable interfaces will enable seamless integration with third-party applications and ADAS modules. Additionally, investing in scalable manufacturing processes, including regional assembly lines, will mitigate geopolitical risks and ensure consistent quality across diverse markets.

Further, forging strategic partnerships with semiconductor foundries and materials innovators can accelerate the commercialization of next-generation display backplanes, such as microLED and flexible OLED. Engaging in co-innovation programs with mobility services providers will also unlock new revenue streams through subscription-based infotainment and telematics offerings. Ultimately, embedding sustainability considerations into product design-through recyclable materials and energy-efficient electronics-will align with tightening emissions regulations and growing consumer ecological awareness.

By adopting these imperatives, companies can position themselves to respond nimbly to regulatory shifts, evolving user expectations, and competitive pressures, driving long-term growth in the rapidly transforming automotive display arena.

Robust Multimodal Research Approach Integrating Primary Interviews, Secondary Data Analysis, and Qualitative Triangulation for Dependable Findings

Robust Multimodal Research Approach Integrating Primary Interviews, Secondary Data Analysis, and Qualitative Triangulation for Dependable Findings

This study synthesizes insights from in-depth interviews with senior executives across OEMs, tier-one suppliers, and industry analysts to capture firsthand perspectives on technology roadmaps, supply chain dynamics, and regulatory developments. These primary engagements were complemented by extensive secondary research, including white papers, patent filings, and regulatory filings, to ensure a comprehensive understanding of market drivers and constraints.

The methodology also integrates qualitative triangulation by cross-validating data points through multiple sources and stakeholder viewpoints. Market trends and emerging technologies were mapped using thematic frameworks, while risk factors such as trade policies and raw material volatility were systematically assessed. This blended approach ensures that the findings are not only grounded in empirical evidence but also enriched by strategic foresight, providing stakeholders with a reliable foundation for strategic planning and investment decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Display System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Display System Market, by Display Type

- Automotive Display System Market, by Display Technology

- Automotive Display System Market, by Interface Technology

- Automotive Display System Market, by Connectivity

- Automotive Display System Market, by Resolution

- Automotive Display System Market, by Vehicle Type

- Automotive Display System Market, by End-user

- Automotive Display System Market, by Sales Channel

- Automotive Display System Market, by Region

- Automotive Display System Market, by Group

- Automotive Display System Market, by Country

- United States Automotive Display System Market

- China Automotive Display System Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Insights to Illuminate the Next-Generation Evolution of Automotive Display Ecosystems

Synthesizing Core Findings and Strategic Insights to Illuminate the Next-Generation Evolution of Automotive Display Ecosystems

In consolidating the key insights, it becomes evident that the automotive display landscape is undergoing a seismic transformation driven by technological innovation, shifting consumer behaviors, and regulatory imperatives. The migration toward emissive display technologies, coupled with sophisticated interface modalities, is redefining cockpit design paradigms and elevating expectations for in-cabin experiences. Concurrently, dynamic policy environments and tariff considerations are reshaping global supply chains, underscoring the need for agile sourcing and localized production capabilities.

Strategically, segmentation analysis reveals that targeted investments in high-resolution, gesture-enabled, and wireless display solutions will unlock new value streams across both passenger and commercial vehicle segments. Regional disparities further emphasize the importance of tailored market entry and localization strategies. As industry players realign their portfolios through partnerships and co-development initiatives, the ability to integrate hardware advancements with scalable software frameworks will determine competitive differentiation.

Looking ahead, the interplay between sustainability objectives, safety regulations, and user-centric design will catalyze further innovation. Companies that proactively embrace flexible manufacturing, open software ecosystems, and strategic collaborations will be best positioned to navigate emerging challenges and capitalize on growth opportunities within the next-generation automotive display ecosystem.

Unlock In-Depth Automotive Display Insights with Personalized Consultation from Ketan Rohom, Associate Director of Sales and Marketing

Unlock Comprehensive Market Intelligence Through Personalized Engagement with Ketan Rohom

Embark on a journey beyond the executive summary by arranging a tailored consultation with Ketan Rohom, the Associate Director of Sales and Marketing. This personalized interaction will address your unique strategic imperatives, from deep dives into display technology roadmaps to scenario planning for evolving regulatory frameworks. By collaborating directly with an expert closely versed in the automotive display domain, you can expedite decision-making, refine your go-to-market strategies, and anticipate future disruptions.

Take advantage of this opportunity to secure the full market research report, which offers granular insights into competitive positioning, supply chain dynamics, and end-user adoption patterns. Engaging with our associate director will ensure that you receive customized analysis, enabling you to identify high-impact investments and partnership avenues. Contact our sales and marketing leadership today to transform insights into actionable outcomes and drive sustainable growth in the rapidly evolving automotive display industry

- How big is the Automotive Display System Market?

- What is the Automotive Display System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?