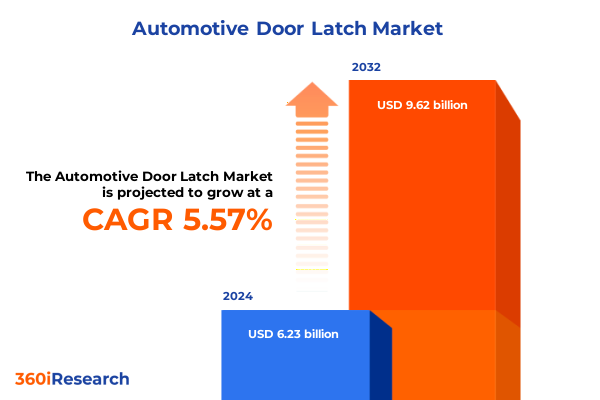

The Automotive Door Latch Market size was estimated at USD 6.57 billion in 2025 and expected to reach USD 6.92 billion in 2026, at a CAGR of 5.60% to reach USD 9.62 billion by 2032.

Pioneering the Future of Vehicle Security Through Advanced Door Latch Mechanisms That Redefine Automotive Access, Convenience, and Passenger Safety Across All Segments

The automotive door latch, though often taken for granted by many vehicle owners, serves as a fundamental element in vehicle safety, convenience, and overall user experience. Historically rooted in purely mechanical linkages and manual operation, the door latch has undergone a profound metamorphosis over the past decade as automakers and suppliers sought to address evolving consumer expectations and stringent regulatory standards. Today’s iteration of the door latch seamlessly integrates electronic controls, sensor-based actuation, and advanced materials to deliver unprecedented reliability and security without compromising on aesthetics or ergonomics. Future developments promise even greater convergence with vehicle connectivity and predictive maintenance systems, solidifying the door latch as a critical node in the broader vehicle architecture.^cite(turn0search0)^cite(turn0search2)

This document provides an executive-level overview of the automotive door latch domain, unpacking transformative shifts driven by electric and autonomous vehicle adoption, assessing the impact of new trade policies, and illuminating key segmentation and regional nuances. Leaders will find actionable intelligence on top-tier competitor strategies and practical recommendations to future-proof their operations in a market increasingly defined by digitalization, lightweight materials, and circular economy imperatives. By synthesizing robust primary and secondary research inputs, this summary sets the stage for informed decision-making that capitalizes on emerging opportunities while mitigating escalating risks associated with cost volatility and regulatory complexity.

Revolutionary Technological and Regulatory Forces Reshaping Automotive Door Latch Design and Elevating Safety, Connectivity, and Manufacturing Efficiency

Over the past five years, the automotive door latch landscape has been fundamentally altered by the convergence of digitalization, advanced safety mandates, and sustainability imperatives. Where mechanical latches once reigned supreme, electronically operated systems featuring anti-pinch protection, soft-close mechanisms, and remote actuation have rapidly gained traction, particularly in premium and electric vehicle segments.^cite(turn0search1)^cite(turn0search2)

Simultaneously, regulatory bodies worldwide have elevated crash safety and child-proofing requirements, compelling OEMs and tier-one suppliers to innovate at an accelerated pace. Automated latching systems equipped with real-time diagnostics and self-test capabilities now serve as standard fare in many new models. Moreover, the shift toward circular manufacturing has introduced recyclable polymers and high-strength composites into latch production, reflecting a broader industry commitment to carbon footprint reduction without sacrificing durability.^cite(turn0search0)

Looking ahead, the advent of autonomous mobility is expected to catalyze further transformation. Biometric access controls and gesture-based actuation systems are poised to redefine the concept of vehicle entry, while AI-driven predictive maintenance frameworks will minimize unplanned downtime by monitoring latch performance in real time. As these trends converge, stakeholders must realign their R&D and supply chain strategies to harness the next wave of door latch innovation.

Assessing the Compounding Effects of 2025 U.S. Tariff Policies on Automotive Door Latch Supply, Costs, and Strategic Sourcing Decisions

The reinstatement and expansion of U.S. Section 232 tariffs at the outset of 2025 have introduced pronounced headwinds for door latch manufacturers operating within North American supply chains. Steel imports now carry a 25% levy, and aluminum shipments face a 10% surcharge, directly affecting input costs for the majority of metallic latch components.^cite(turn1search1)

Beyond material surcharges, import duties on finished auto parts have risen to 25% under broader automotive tariff policy, prompting leading European OEMs to weigh localized production against sustained levies. Volkswagen’s acknowledgment of a $1.5 billion tariff‐related hit in early 2025 underscores the magnitude of this challenge and has prompted proposals for scalable U.S. investments to offset duties dollar-for-dollar.^cite(turn1news13)

The cumulative result is a landscape marked by compressed profit margins, extended lead times, and supply chain realignments as suppliers seek USMCA-compliant sourcing and onshore capacity expansions. Smaller tier-two and tier-three suppliers, in particular, face acute pressure to either absorb higher costs or exit critical contracts, heightening the risk of consolidation within the door latch segment. Strategic sourcing decisions and collaborative stakeholder engagements will be essential to mitigate the long-term repercussions of tariff-induced volatility.^cite(turn1search0)^cite(turn1search3)

Illuminating Multidimensional Segmentation Insights Revealing How Latch Type, Material, Application, Vehicle Class, and Distribution Channels Drive Market Dynamics

Analysis of latch type reveals a market bifurcated between the enduring demand for reliable mechanical systems and the rapid adoption of electronically operated mechanisms, the latter driven by their compatibility with advanced vehicle security and user convenience features. When examining material types, steel components dominate in high-load applications, while plastic and polymer composites are gaining favor for lightweight assemblies and complex geometries. In application segmentation, deck lid latches, hood latches, and side door latches each present distinct performance and regulatory criteria, driving specialized design and material choices tailored to function and safety compliance. Vehicle type segmentation further underscores divergent needs, with heavy commercial vehicles prioritizing rugged durability, light commercial vehicles balancing cost and performance, and passenger cars seeking sleek integration and feature-rich operation. Distribution channel segmentation separates the needs of OEMs, which demand just-in-time delivery and technical collaboration, from aftermarket channels, which emphasize ease of installation and durability over extended service intervals.^cite(turn0search1)^cite(turn0search2)

This comprehensive research report categorizes the Automotive Door Latch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Latch Type

- Component

- Material Type

- Application

- Vehicle Type

- Sales Channel

Deciphering Regional Market Nuances Across the Americas, Europe Middle East & Africa, and Asia-Pacific Highlights Strategic Growth and Competitive Advantages

In the Americas, the door latch market is characterized by a well-established OEM base augmented by a robust aftermarket ecosystem. However, evolving trade policies and the reactivation of Section 232 tariffs have compelled stakeholders to re-evaluate North American sourcing strategies and invest in localized production to preserve margin structures.^cite(turn1search1)

Across Europe, Middle East & Africa, innovation hubs in Germany and surrounding markets spearhead advancements in premium latch systems, integrating biometric recognition, energy-absorbing designs, and circular-economy materials. Compliance with stringent EU safety regulations continues to be the north star guiding product development and supplier selection, reinforcing the region’s reputation for cutting-edge automotive componentry.^cite(turn0search4)

In Asia-Pacific, surging vehicle production volumes and accelerating EV adoption underpin robust demand for both mechanical and electronic latch systems. Regional OEMs and suppliers are capitalizing on progressive safety mandates and government incentives to incorporate next-generation latches that support lightweight vehicle architectures and enhanced connectivity features, further solidifying the area’s leadership in component manufacturing and export to global markets.^cite(turn0search4)

This comprehensive research report examines key regions that drive the evolution of the Automotive Door Latch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Strategies and Innovations of Leading OEM and Tier-One Door Latch Manufacturers Shaping Industry Evolution and Competitive Positioning

Leading players in the door latch arena are distinguished by their focused investments in smart actuation technology, material innovation, and global footprint optimization. Magna International has introduced the Comfort+ rolling-friction latch, which significantly reduces noise and friction while integrating anti-pinch safeguards, signaling a shift toward mechanical ingenuity complemented by user comfort.^cite(turn0search2)

Aisin Seiki continues to expand its electronic latch portfolio with sensor-driven safety systems tailored to electric and autonomous vehicle platforms, reinforcing its strategic alignment with next-generation mobility trends. Valeo’s emphasis on composite-based, lightweight latches reflects the broader industry thrust toward weight reduction and improved energy efficiency, especially within electric vehicle segments. Kiekert’s development of gesture-based and energy-harvesting latch prototypes exemplifies how R&D pipelines are being leveraged to explore novel user interfaces and power-autonomous sensor networks.^cite(turn0search2)

Complementing these initiatives, tier-two specialists are forging alliances to secure raw material supply chains and digitize manufacturing processes. Collaborative ventures between Mitsubishi Electric Mobility Corporation and Aisin Corporation target xEV-specific latch components, while Brose’s investments in polymer composites demonstrate a commitment to scalable, sustainable mass production. Collectively, these strategies highlight a market in which technological differentiation and supply chain resilience define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Door Latch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AISIN CORPORATION

- Alka Enterprises

- Allegis Corporation

- Andersen Corporation

- ANSEI Corporation

- Babulal Gajadhar Prasad Agrawal & Company

- Brose Fahrzeugteile GmbH & Co. KG

- Continental AG

- Dura Automotive Systems, LLC

- Eberhard Manufacturing

- GECOM Corporation

- Honda Lock Mfg. Co., Ltd.

- Howden Joinery Ltd

- Huf Hülsbeck & Fürst GmbH & Co. KG

- IFB Automotive Private Limited

- Inteva Products LLC

- Kiekert AG

- Magal Engineering

- Magna International

- Minda Group

- MinebeaMitsumi Inc.

- Mitsui Kinzoku ACT Corporation

- Pella Corporation

- REHAU Incorporated

- SAE International

- Shivani Locks Pvt. Ltd.

- Strattec Security Corporation

- U-Shin Ltd.

- Valeo SA

- Vehicle Security Innovators

- WITTE Automotive GmbH

- Yanfeng International Automotive Technology Co. Ltd.

- ZF Friedrichshafen AG

Establishing Actionable Strategic Priorities for Industry Leaders to Navigate Technological Disruption, Tariff Volatility, and Shifting Consumer Demands in Door Latch Markets

Industry leaders should prioritize the integration of modular electronic latch architectures capable of rapid software updates and feature enhancements to maintain alignment with evolving vehicle electronic platforms. Establishing strategic partnerships with semiconductor suppliers and sensor specialists will be critical to mitigate current microchip shortages and to safeguard the continuous rollout of advanced actuation features.^cite(turn1search2)

To counter tariff-driven cost pressures, organizations must develop a dual-sourcing strategy that leverages USMCA-compliant facilities while maintaining a selective global footprint in low-cost regions. This approach, combined with aggressive negotiations on long-term metal purchase agreements, can buffer materials pricing volatility and preserve margin targets. Lean manufacturing principles, bolstered by additive manufacturing for low-volume or custom latch components, will further enhance flexibility and reduce lead times under fluctuating trade environments.^cite(turn1search0)

Finally, advancing sustainability objectives through the adoption of recycled polymers and closed-loop recycling programs not only addresses circular economy mandates but also differentiates offerings in a market increasingly attentive to corporate environmental responsibility. By embedding these recommendations into product roadmaps and supply chain strategies, stakeholders will be better positioned to convert disruption into competitive advantage.

Detailing a Robust Research Methodology Encompassing Primary Expert Interviews, Rigorous Secondary Data, and Advanced Analytical Frameworks to Ensure Unbiased Market Insights

This study employs a hybrid research methodology combining exhaustive secondary research with targeted primary engagements. Secondary inputs include annual reports, industry journals, and trade association publications, supplemented by real-time market intelligence from authoritative sources on semiconductor supply and tariffs. Primary research comprises in-depth interviews with product managers at OEMs, procurement heads at tier-one suppliers, and policy analysts tracking trade measures, ensuring direct validation of market drivers and challenges.

Analytical rigor is maintained through triangulation of quantitative data on production volumes, material cost trajectories, and regional trade flows, aligned with qualitative insights on technology adoption and regulatory compliance. A multi-layered validation process, involving cross-functional experts in engineering, finance, and sustainability, underpins the robustness of segmentation frameworks and competitive landscape assessments. This integrated methodology delivers a balanced perspective that is both granular enough for tactical planning and synthesized for C-suite strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Door Latch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Door Latch Market, by Latch Type

- Automotive Door Latch Market, by Component

- Automotive Door Latch Market, by Material Type

- Automotive Door Latch Market, by Application

- Automotive Door Latch Market, by Vehicle Type

- Automotive Door Latch Market, by Sales Channel

- Automotive Door Latch Market, by Region

- Automotive Door Latch Market, by Group

- Automotive Door Latch Market, by Country

- United States Automotive Door Latch Market

- China Automotive Door Latch Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights on Technological, Trade, and Regional Dynamics to Conclude on Future Trajectories and Strategic Imperatives in Automotive Door Latch Markets

The confluence of electrification, autonomy, and digitalization is irrevocably reshaping the automotive door latch domain, forcing stakeholders to realign their innovation pipelines, supply chain architectures, and commercial strategies. Geopolitical trade policies, manifested most acutely through U.S. tariffs on steel, aluminum, and finished auto parts, have underscored the necessity of resilient sourcing models and adaptive cost-management practices. Meanwhile, segmentation and regional analyses reveal both universal and localized imperatives, from biometrically enhanced premium latches in Germany to high-volume, cost-optimized systems in Asia-Pacific and aftermarket resiliency in the Americas.

As the industry advances, the ability to anticipate regulatory shifts, leverage cross-industry collaborations, and harness emerging materials will distinguish leaders from laggards. Firms that embrace data-driven decision frameworks, prioritize sustainable innovation, and invest in digital integration across the latch lifecycle will capture disproportionate value. This executive summary serves not only as a diagnostic of current market contours but as a strategic compass guiding organizations toward sustainable growth and competitive differentiation in the ever-evolving world of automotive door latches.

Engage with Ketan Rohom to Secure Comprehensive Automotive Door Latch Market Intelligence and Empower Data-Driven Decision Making for Strategic Growth Initiatives

The insights presented herein underscore the pivotal role of comprehensive, customized market intelligence in navigating the complex interplay of technological innovation, regulatory shifts, and global trade dynamics. By engaging directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch), organizations gain privileged access to the full suite of analysis, proprietary datasets, and expert perspectives that inform strategic investments and product roadmaps. Tailored consultations and bespoke add-on services can be arranged to address specific inquiries, whether optimizing supply chain resilience, refining product segmentation strategies, or anticipating competitive moves. Connect with Ketan to initiate your tailored engagement and transform high-level insights into tangible business outcomes.

- How big is the Automotive Door Latch Market?

- What is the Automotive Door Latch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?