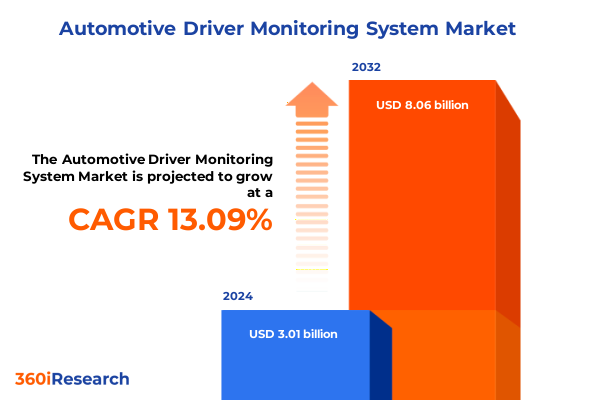

The Automotive Driver Monitoring System Market size was estimated at USD 3.40 billion in 2025 and expected to reach USD 3.80 billion in 2026, at a CAGR of 13.09% to reach USD 8.06 billion by 2032.

Introducing the Emerging Landscape of Automotive Driver Monitoring Systems and Their Critical Role in Enhancing Road Safety and Driver Well-Being

The automotive industry is in the midst of an unprecedented technological evolution, with driver monitoring systems at the forefront of safety and user experience innovations. As regulatory bodies around the world tighten mandates around distracted driving and fatigue detection, automakers are under growing pressure to integrate sophisticated intelligence into their vehicle platforms. This section introduces the fundamental concepts and key drivers that have made driver monitoring systems an indispensable element of modern automotive design.

Advancements in sensor technology, artificial intelligence algorithms, and semiconductor processing power have collectively enabled in-cabin monitoring solutions to transition from novel prototypes to production-ready systems. These innovations not only address safety regulations but also open new avenues for in-vehicle personalization, insurance telematics, and predictive maintenance. As consumer expectations rise alongside legislative requirements, the deployment of reliable, real-time monitoring tools is rapidly becoming a competitive imperative rather than a value-added option.

Moving beyond traditional seatbelt reminders and drowsiness warnings, today’s driver monitoring systems encompass comprehensive detection of distraction, emotion, and cognitive load. This multifaceted approach not only reduces accident risk but fosters greater trust in semi-autonomous and fully autonomous driving modes. By setting the stage for this report’s deeper analyses, the introduction highlights how these intertwined forces are shaping strategic priorities across OEMs, suppliers, and regulators alike.

Examining the Dramatic Technological Transformations and Industry Shifts That Are Reshaping Driver Monitoring Systems and Market Dynamics in the Automotive Sector

The driver monitoring system (DMS) segment has undergone dramatic transformation in response to rapid technological progress and shifting market expectations. Once limited to simple infrared sensors for eyelid tracking, modern solutions combine camera, EEG, infrared, and radar modalities to capture a holistic view of driver state. This convergence of sensing technologies has enabled more nuanced detection of micro-expressions, subtle physiological changes, and behavioral cues that can presage dangerous driving conditions.

At the same time, partnerships between technology innovators and traditional tier-one suppliers have redefined the competitive landscape. Companies with strengths in image processing, deep learning, and advanced radar platforms now collaborate closely with established automotive component manufacturers to integrate robust hardware with scalable software frameworks. These alliances are critical for balancing stringent reliability requirements, rigorous automotive-grade certifications, and the need for agile software updates in the field.

Moreover, as the industry moves toward increasing levels of vehicle autonomy, the role of continuous driver engagement shifts from supplementary safety net to central pillar of system validation. Regulatory bodies are articulating clear guidelines that mandate comprehensive driver monitoring for Level 2 and Level 3 automation, accelerating the pace of technology adoption. This section explores how these intertwined transformations are redefining value chains, accelerating innovation pipelines, and reshaping strategic priorities for all ecosystem participants.

Assessing the Far-Reaching Impacts of 2025 United States Tariffs on the Automotive Driver Monitoring System Value Chain and Cost Structures

The imposition of new tariffs in the United States throughout 2025 has created significant ripple effects across the driver monitoring system value chain. With duties applied to key semiconductors, optical modules, and sensor components, manufacturers face higher input costs that challenge traditional pricing models. These cost pressures are particularly acute at the hardware level, where precision cameras, infrared emitters, and radar transceivers constitute a substantial portion of the bill of materials.

As suppliers pass on these additional expenses, OEMs and tier-one integrators must reevaluate their sourcing strategies and negotiate new long-term agreements to mitigate financial impact. In response, some leading suppliers have shifted portions of production to tariff-exempt regions or invested in local manufacturing facilities to preserve competitive pricing. Others are accelerating consolidation efforts through strategic mergers and acquisitions, aiming to achieve economies of scale and stronger bargaining power with raw material providers.

Beyond cost considerations, the tariff environment has also influenced technology roadmaps. Companies are increasingly exploring software-centric enhancements-such as advanced machine learning algorithms and sensor fusion techniques-that can deliver performance gains without proportionally increasing hardware expenditure. This section analyzes these adaptive strategies, highlighting how 2025 tariffs have catalyzed a shift towards more balanced, resilient business models across the industry.

Unveiling the Strategic Segmentations Driving Detailed Insights Across Technology, Components, End Users, Applications and Vehicle Types

A nuanced understanding of market segmentation allows stakeholders to pinpoint areas of innovation and growth within the driver monitoring ecosystem. From a technology perspective, camera-based systems dominate current deployments, leveraging monocular and stereo vision architectures to detect eye movements, facial expressions, and head orientation. Meanwhile, EEG solutions with both dry and wet electrode designs offer direct measurement of neural activity for fatigue detection. Infrared-based monitoring utilizes both far infrared for thermal mapping and near infrared for detailed facial landmark tracking, and radar technologies spanning mmWave and short-range frequency bands provide non-invasive monitoring of respiratory rate and subtle body movements.

Component segmentation further refines this landscape. Hardware investments focus on high-performance processors optimized for real-time image and signal processing, alongside an array of sensors including cameras, infrared emitters, and radar modules. On the software side, the market bifurcates into sophisticated algorithms and middleware platforms. Within algorithmic development, deep learning approaches have become critical for high-accuracy gesture and emotion recognition, complementing traditional algorithms that excel in deterministic feature extraction and latency-sensitive applications.

End-user segmentation splits the demand between aftermarket solutions offered through Tier 1 and Tier 2 channels, and OEM-installed systems integrated during vehicle assembly. This distinction affects certification requirements, delivery timelines, and post-sales support models. Furthermore, application segmentation highlights three core use cases: distraction detection to identify inattentive driving behaviors, emotion recognition-leveraging facial and voice analysis to assess stress or aggression-and fatigue detection to guard against drowsiness-related accidents.

Lastly, vehicle type segmentation spans passenger vehicles, light commercial vehicles, and heavy commercial vehicles, with a growing emphasis on electric vehicles. Battery electric, fuel cell, and hybrid powertrains each introduce unique cabin environments and power budget constraints, which influence system design and deployment strategies. By examining these five segmentation dimensions, stakeholders can align product roadmaps and go-to-market strategies with precise customer needs and technical requirements.

This comprehensive research report categorizes the Automotive Driver Monitoring System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Components

- End User

- Application

- Vehicle Type

Identifying Key Regional Dynamics and Market Drivers Spanning the Americas, Europe Middle East & Africa and Asia Pacific for Driver Monitoring

Regional dynamics play a pivotal role in shaping the competitive contours of the driver monitoring system market. In the Americas, regulatory momentum from the National Highway Traffic Safety Administration and proactive OEM commitments to advanced driver assistance systems have elevated the demand for robust in-cabin monitoring solutions. Local suppliers emphasize modular, software-defined architectures that integrate seamlessly with North American vehicle platforms and comply with FMVSS and CSA standards.

Meanwhile, the Europe Middle East & Africa region demonstrates diverse regulatory landscapes, from the strict European Commission mandates on driver distraction to varying certification protocols in Middle Eastern and African markets. European OEMs leverage domestic technology hubs to pioneer infrared and radar-based solutions designed for stringent Euro NCAP safety ratings. At the same time, emerging markets in the Middle East and Africa are witnessing incremental uptake of aftermarket driver monitoring kits, driven by fleet safety initiatives and insurance-driven telematics programs.

In Asia-Pacific, a dual dynamic emerges where mature markets such as Japan and South Korea propel high-volume integration of camera and infrared technologies through homegrown automotive giants, while rapidly developing economies like India and Southeast Asia adopt more cost-competitive, aftermarket options. This region’s strong manufacturing base and semiconductor ecosystem foster accelerated product localization and faster time to market. Through these distinct regional lenses, companies can tailor their strategies to regulatory frameworks, consumer preferences, and supply chain infrastructures specific to each geography.

This comprehensive research report examines key regions that drive the evolution of the Automotive Driver Monitoring System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Strategic Partnerships Shaping Innovations and Competitive Advantages in Driver Monitoring System Market

The competitive landscape of driver monitoring systems is defined by a blend of legacy automotive suppliers, semiconductor innovators, and software visionaries. Tier-one component manufacturers leverage decades of automotive certification expertise to deliver camera modules and sensor arrays that meet rigorous reliability standards. Simultaneously, semiconductor fabs and fabless design houses push the boundaries of on-chip processing, embedding neural network accelerators that enable complex inference tasks directly within sensor hardware.

Alongside these established players, specialized software firms have emerged with deep expertise in computer vision and affective computing. By licensing their algorithms and middleware stacks to OEMs and tier-one integrators, these companies accelerate time to market and offer continuous improvement through over-the-air software updates. Partnerships and joint ventures are increasingly common, fusing hardware capabilities with cutting-edge artificial intelligence to create differentiated offers that address both safety regulations and enhanced user experiences.

New entrants, particularly those originating from the consumer electronics industry, are also challenging traditional hierarchies. These firms exploit economies of scale in camera production and cloud connectivity to deliver cost-effective, highly scalable solutions. Ultimately, success in this dynamic ecosystem requires a balanced portfolio of hardware IP, software innovation, and strategic alliances, underscoring the importance of agility and collaborative R&D in maintaining competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Driver Monitoring System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co. Ltd.

- Ambarella Inc.

- Aptiv PLC

- Cipia Vision Ltd.

- Continental AG

- Denso Corporation

- Faurecia SE

- Hitachi Ltd.

- Intel Corporation

- Jungo Connectivity Ltd.

- Magna International Inc.

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Omron Corporation

- Panasonic Corporation

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Seeing Machines Limited

- Smart Eye AB

- Texas Instruments Incorporated

- Valeo SA

- Visteon Corporation

- ZF Friedrichshafen AG

Presenting Actionable Strategies and Recommendations for Industry Leaders to Capitalize on Emerging Trends in Driver Monitoring Systems

To capitalize on the evolving landscape, industry leaders should prioritize a hybrid approach that balances hardware refinement with software sophistication. Investing in scalable, modular sensor platforms will enable rapid customization across vehicle segments without incurring prohibitive tooling costs. Concurrently, cultivating in-house or partnered expertise in deep learning frameworks and sensor fusion algorithms will enhance detection accuracy and reduce false-positive rates, increasing end-user trust and compliance with stringent safety protocols.

Supply chain resilience is another critical lever. Organizations should evaluate multi-sourcing strategies for key components and explore regional manufacturing partnerships to mitigate the impact of geopolitical uncertainties and trade policy fluctuations. Establishing collaborative research initiatives with semiconductor and materials providers can further unlock next-generation sensor innovations while sharing R&D risk.

On the application front, aligning product roadmaps with regulatory trajectories for automated driving will position companies as preferred technology partners. Early engagement with policy makers and participation in industry consortia can influence standards development and ensure compatibility with emerging safety guidelines. By embedding these strategic priorities into corporate planning and cross-functional teams, leaders can transform regulatory challenges into competitive differentiators.

Outlining the Rigorous Research Methodology Employed to Ensure Data Integrity and Comprehensive Insights in Driver Monitoring System Analysis

This research was underpinned by a rigorous, multi-phased methodology combining extensive secondary research with targeted primary validation. In the secondary phase, technical papers, patent filings, regulatory publications, and industry conference materials provided a foundation of quantitative and qualitative insights. Publicly available product specifications and financial disclosures were analyzed to map key technology benchmarks and business models.

The primary research phase engaged a cross-section of stakeholders, including OEM engineering leads, tier-one supplier executives, component manufacturers, regulatory authorities, and end-user fleet managers. Through in-depth interviews and structured questionnaires, we validated emerging trends, assessed technology adoption barriers, and gathered real-world performance feedback. These insights were triangulated against supply chain data and market-monitoring databases to ensure consistency and reliability.

To synthesize findings, a bottom-up approach was employed, linking component-level trends to application-level use cases and regional dynamics. Multiple rounds of internal workshops and expert reviews refined the analytical framework, while sensitivity analyses tested the robustness of key assumptions. This methodological rigor ensures that the conclusions and recommendations presented herein reflect an accurate, holistic view of the driver monitoring system landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Driver Monitoring System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Driver Monitoring System Market, by Technology

- Automotive Driver Monitoring System Market, by Components

- Automotive Driver Monitoring System Market, by End User

- Automotive Driver Monitoring System Market, by Application

- Automotive Driver Monitoring System Market, by Vehicle Type

- Automotive Driver Monitoring System Market, by Region

- Automotive Driver Monitoring System Market, by Group

- Automotive Driver Monitoring System Market, by Country

- United States Automotive Driver Monitoring System Market

- China Automotive Driver Monitoring System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Core Insights and Implications for Stakeholders Engaged in the Development and Deployment of Driver Monitoring Systems

The convergence of advanced sensing modalities, sophisticated algorithms, and evolving regulatory mandates has established driver monitoring systems as an indispensable facet of modern automotive safety and user experience. Camera, EEG, infrared, and radar technologies each bring distinct strengths to the detection of distraction, emotion, and fatigue, while component and application segmentation reveal targeted opportunities for product differentiation.

Regional dynamics underscore the necessity for tailored strategies, whether through compliance-focused OEM integrations in North America, Euro-centric safety innovations in Europe, or cost-optimized aftermarket solutions in Asia-Pacific. At the competitive level, success hinges on the seamless integration of hardware IP, software prowess, and strategic alliances that can navigate both technical complexity and shifting trade policies.

Ultimately, organizations that invest in modular sensor architectures, advanced machine learning pipelines, and robust supply chain frameworks will be best positioned to meet the dual imperatives of regulatory compliance and user-centric innovation. This report’s insights provide a roadmap to harness these drivers, enabling stakeholders to make informed decisions that align with the future trajectory of automotive safety and autonomous driving technologies.

Engage with Ketan Rohom to Unlock Exclusive Market Intelligence and Elevate Your Strategic Decision Making for Advanced Driver Monitoring Systems

If your organization is seeking to navigate the complexities of the automotive driver monitoring system landscape with confidence, our comprehensive research report provides an unparalleled depth of analysis. Partnering with Ketan Rohom, Associate Director of Sales & Marketing, ensures you receive personalized guidance and tailored insights that directly address your strategic objectives. With his expertise, you can engage in a consultative discussion to explore the nuances of technology adoption, regulatory influences, and competitive positioning in critical markets. Reach out to schedule a discovery call that delves into specific segments, regional dynamics, and company profiles most relevant to your business needs. By connecting with Ketan, you gain access not only to the full breadth of the report but also to expert support that can transform these findings into actionable strategies. Don’t let the rapid evolution of driver monitoring systems outpace your organization’s ambitions; collaborate with Ketan Rohom today to secure your copy of the report and accelerate your path to informed decision making and market leadership.

- How big is the Automotive Driver Monitoring System Market?

- What is the Automotive Driver Monitoring System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?