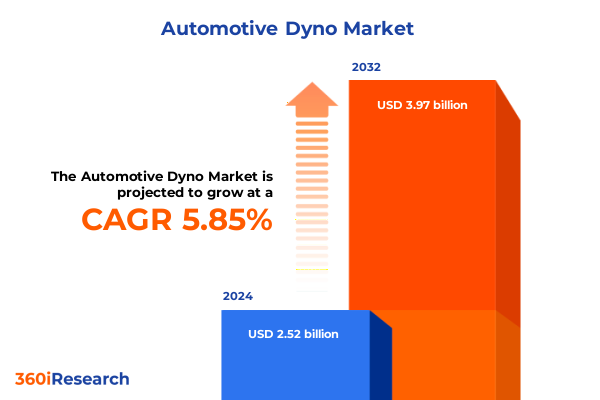

The Automotive Dyno Market size was estimated at USD 2.65 billion in 2025 and expected to reach USD 2.79 billion in 2026, at a CAGR of 5.93% to reach USD 3.97 billion by 2032.

Unleashing Perspectives on the Evolution of Automotive Dynamometer Platforms Driving Robust Vehicle Performance Testing Protocols and Industry Innovation

Over the past several decades, automotive dynamometers have evolved from rudimentary test rigs into sophisticated platforms capable of simulating real-world driving conditions with extraordinary precision. Once relegated to basic engine output measurements, modern dynamometer systems now serve as indispensable tools for validating powertrain performance, optimizing emissions compliance, and enabling next-generation vehicle technologies. This shift reflects the industry’s relentless pursuit of higher efficiency, tighter regulatory conformity, and enhanced customer experiences.

As new powertrain architectures-ranging from high-performance combustion engines to fully electric drivetrains-continue to emerge, research and development teams across OEMs and tier-one suppliers rely ever more heavily on dynamometer testing. Consequently, the inherent flexibility and reliability of these test systems have become non-negotiable prerequisites for gauging system durability, confirming acoustic and vibration benchmarks, and fine-tuning control algorithms. In addition, the ability to replicate complex transient load cycles enables engineers to uncover performance bottlenecks and validate software-driven strategies that maximize overall vehicle effectiveness.

Moving beyond traditional horsepower and torque assessments, advanced dynamometer platforms integrate high-fidelity instrumentation, real-time data analytics, and closed-loop control mechanisms. As a result, dynamometer applications increasingly intersect with model-based development, virtual calibration, and holistic vehicle systems engineering. This expanding role underscores the centrality of dynamometers within the broader automotive innovation ecosystem, foreshadowing a period of accelerated technological convergence and heightened market differentiation.

Redefining Traditional Testing Paradigms through Digitalization Automation and Electrification Innovations Transforming the Automotive Dynamometer Landscape

In recent years, the automotive dynamometer arena has witnessed a remarkable surge in digital and automated capabilities that are transforming traditional testing workflows. Engineers now leverage cloud-based architectures to orchestrate distributed test sequences, enabling remote operation of dynamometers and centralized oversight of data collection. This shift toward virtualization and network-connected testing infrastructure has not only enhanced operational efficiency but also laid the groundwork for advanced machine-learning applications that predict component wear and optimize maintenance schedules.

Concurrently, the integration of robotics and automated loading mechanisms has streamlined test preparation and turnaround times. Automated dynamometer systems can now execute complex test plans with minimal human intervention, ensuring consistent reproducibility and reducing the risk of operator-induced variability. Meanwhile, the rise of fully electric dynamometers-particularly within engine and chassis platforms-has delivered superior dynamic response and lower energy consumption compared to legacy hydraulic or mechanical loading configurations.

Furthermore, as electric and hybrid vehicles gain prominence, test facilities are reconfiguring their dyno suites to accommodate high-voltage safety protocols and bidirectional power flows. This transformative shift highlights the industry’s ability to adapt rapidly to emergent powertrain paradigms. Together, digitalization, automation, and electrification are redefining core testing paradigms, ushering in an era where agility, precision, and scalability are the new benchmarks for dynamometer performance.

Analyzing the Comprehensive Impact of United States 2025 Tariff Measures on Supply Chains Input Costs and Innovation Trajectories in Automotive Dynamometer Manufacturing

The United States’ escalating tariff environment in 2025 has had a profound and lasting influence on the automotive dynamometer supply chain and manufacturing economics. Building upon earlier Section 232 measures on steel and aluminum and Section 301 actions targeting specific imported components, additional levies introduced this year have driven up raw-material costs and reshaped vendor relationships. As manufacturers grapple with increased duties on imported drive rollers, high-precision sensors, and key electronic modules, the cumulative burden has incentivized many to pursue near-shoring strategies to mitigate duty exposure.

Consequently, original equipment manufacturers and test-equipment suppliers have undertaken comprehensive reviews of their supplier portfolios. Some have relocated key fabrication and assembly processes to domestic facilities or established strategic partnerships with North American foundries, thus reducing lead times and minimizing tariff risk. However, this transition has required significant capital outlays to retrofit production lines, certify new vendors, and maintain quality standards consistent with legacy imports.

In parallel, these tariff-driven pressures have accelerated the adoption of modular design philosophies that facilitate component interchangeability across global platforms. Such approaches enable suppliers to leverage duty-free bands for components valued below specific thresholds, thereby preserving margin integrity. Looking ahead, the interplay between ongoing trade policy evolution and supply-chain resilience initiatives will continue to shape innovation trajectories and competitive positioning within the dynamometer market.

Uncovering Critical Segmentation Dynamics across Product Vehicle Automation Sales Channel End Users and Applications Shaping Dyno Market Trajectories

A nuanced understanding of the automotive dynamometer market emerges when one considers multiple segmentation dimensions. Based on product type, the landscape includes both chassis dynamometers-spanning four-wheel, hub-mounted, and two-wheel configurations-and engine dynamometers differentiated by eddy current, electric, and water-brake loading systems. Within this context, four-wheel chassis dynos have demonstrated compelling utility for all-wheel-drive durability assessments, while two-wheel variants continue to serve motorcycle test benches and compact vehicle applications with agility and cost efficiency. Meanwhile, eddy current engine dynos remain favored for steady-state testing, and electric dynamometers have gained traction where high-speed responsiveness and regenerative power capabilities are paramount.

Shifting focus to vehicle type, commercial vehicles and heavy trucks often rely on high-torque, low-speed dynamometer cycles to validate drivetrain endurance, whereas passenger cars and motorcycles prioritize performance metrics and emissions compliance under more dynamic load profiles. Automation segmentation underscores the growing prevalence of fully automatic test cells, which optimize throughput and data consistency, yet manual and semi-automatic solutions retain relevance for bespoke calibration tasks and low-volume R&D programs.

Sales channels further diversify the market, with direct sales channels affording OEMs personalized service contracts and on-site integration, while distribution channels extend reach to independent test labs and academic institutions. Examining end-user categories reveals that educational institutions prioritize modular, demonstration-friendly platforms, motorsport teams demand the highest levels of precision and customization, and research institutes focus on adaptability for emerging powertrain research. Finally, application segmentation illuminates how durability testing, emissions verification, engine development, tuning, and holistic vehicle performance assessment each drive distinct equipment requirements and investment rationales.

This comprehensive research report categorizes the Automotive Dyno market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Automation

- Application

- End User

- Sales Channel

Exploring Regional Disparities and Growth Catalysts Across Americas Europe Middle East Africa and Asia Pacific Automotive Dynamometer Markets

Regional market dynamics reveal distinct priorities and growth catalysts across the Americas, Europe, Middle East & Africa, and Asia-Pacific territories. In the Americas, strong collaboration between OEM R&D centers and independent test labs has fostered a vibrant market for high-capacity four-wheel chassis dynamometers, particularly as North American regulators implement more stringent on-road emissions testing protocols. Furthermore, U.S. tariffs on imported components have encouraged domestic assembly of dynamometer cells, stimulating local supply-chain investments and service-network expansions.

In the Europe, Middle East & Africa region, tightening CO₂ emission targets and growing interest in alternative powertrains have spurred demand for multifunctional engine dynos capable of rapid reconfiguration across test cycles. European test houses lead in the development of virtual calibration techniques, integrating model-in-the-loop environments with physical test rigs. Meanwhile, Middle Eastern nations are investing in modernizing inspection infrastructure, driving a niche demand for portable two-wheel and hub-mounted dynamometers in motorcycle safety initiatives.

Asia-Pacific continues to emerge as a hotbed of production and innovation, driven by buoyant automotive manufacturing in China, India, and Southeast Asia. Local equipment manufacturers have captured significant market share by offering competitively priced water-brake dynamometers and entry-level chassis testing platforms. At the same time, Japan and South Korea maintain leadership in high-precision, electric dynamometer solutions tailored to advanced powertrain R&D.

This comprehensive research report examines key regions that drive the evolution of the Automotive Dyno market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Dynamometer Innovators and Strategies Driving Competitive Differentiation in Testing Equipment Market

Industry leaders are vying for differentiation through advanced technology portfolios, strategic alliances, and customer-centric service models. One prominent manufacturer has built its reputation on high-throughput chassis dynamometers equipped with integrated telemetry, enabling seamless data exchange between test cells and cloud analytics platforms. Another innovator has focused on modular engine dyno architectures that allow rapid swapping of loading units-eddy current, electric, or water-brake-thereby addressing diverse testing needs within a single footprint.

Strategic partnerships are also reshaping competitive positioning. A leading global supplier has entered into a technology collaboration with a digital-twin software provider, co-developing validation suites that marry physical dynamometer tests with virtual engine models. Such integrations not only reduce development time but also improve accuracy in predictive performance assessments. Meanwhile, an established legacy firm has pursued selective acquisitions of regional test-equipment service providers to bolster its aftermarket support network across high-growth markets in Asia-Pacific and the Americas.

Customer experience emerges as a key differentiator, with market frontrunners offering comprehensive service-level agreements that encompass preventive maintenance, software upgrades, and on-site operator training. This end-to-end approach not only accelerates ramp-up timelines but also creates recurring revenue streams that reinforce long-term customer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Dyno market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AVL List GmbH

- D2T Powertrain Engineering

- Dynocom Industries, Inc.

- Dynojet Research, Inc.

- Dynomerk Controls

- Dyno One, Inc.

- Froude Hofmann

- HORIBA Ltd.

- KAHN Industries, Inc.

- Land & Sea, Inc.

- MAHA Maschinenbau Haldenwang GmbH & Co. KG

- Meidensha Corporation

- MOTOMEA (Inc.)

- MTS Systems Corporation

- Mustang Dynamometer, Inc.

- NTS

- Power Test, Inc.

- Rototest International AB

- SAKOR Technologies, Inc.

- Schenck RoTec GmbH

- SGS SA

- Sierra Instruments, Inc.

- SuperFlow Technologies Group

- Taylor Dynamometer, Inc.

- V‑Tech Dynamometers

Empowering Industry Leaders with Strategic Imperatives to Optimize Automotive Dynamometer Investments and Operational Excellence

To maintain a competitive edge, industry leaders must adopt a multi-pronged strategy that balances technological investments with operational agility. First, prioritizing the deployment of fully automated dynamometer cells can dramatically increase throughput and reduce variability, freeing up skilled engineers to focus on value-added analysis and calibration tasks. At the same time, integrating digital twins and predictive maintenance algorithms will extend equipment uptime and provide actionable insights into future performance degradation.

In parallel, near-shoring critical components or forging joint-venture partnerships with local suppliers can mitigate the impact of evolving tariff landscapes and bolster supply-chain resilience. Organizations should also explore modular system architectures that facilitate rapid reconfiguration across engine and chassis testing modalities, thereby maximizing return on capital expenditures. Furthermore, enhancing service offerings through tiered support contracts and operator certification programs will not only elevate customer satisfaction but also generate stable recurring revenue.

Finally, continued investment in sustainability measures-such as energy-efficient electric loading units and regenerative braking capabilities-will align dynamometer facilities with broader corporate environmental goals. By championing these actionable imperatives, industry leaders can secure a robust market position, foster long-term customer loyalty, and navigate future market disruptions with confidence.

Transparent Methodological Framework Detailing Research Approaches Data Sources and Analytical Techniques Underpinning Dyno Market Insights

This research adopts a rigorous, mixed-methodology framework designed to capture the complexity of the automotive dynamometer market. Primary research comprised in-depth interviews with senior R&D executives, test-facility managers, and procurement specialists at OEMs, tier-one suppliers, and independent laboratories. These conversations yielded firsthand perspectives on emerging requirements, technology adoption hurdles, and regional regulatory influences.

To complement the qualitative insights, extensive secondary research was conducted across industry white papers, technical standards publications, and regulatory documentation to verify test protocols, emissions thresholds, and equipment specifications. Company annual reports and press releases provided granular detail on product launches, partnership announcements, and manufacturing footprint expansions.

Data triangulation ensured accuracy by cross-referencing multiple sources and aligning findings with observable market developments. Furthermore, segmentation analyses were validated by consulting leading market intelligence databases and corroborating with pricing benchmarks gathered through vendor surveys. This layered approach guarantees that the presented insights are both robust and reflective of real-world market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Dyno market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Dyno Market, by Product Type

- Automotive Dyno Market, by Vehicle Type

- Automotive Dyno Market, by Automation

- Automotive Dyno Market, by Application

- Automotive Dyno Market, by End User

- Automotive Dyno Market, by Sales Channel

- Automotive Dyno Market, by Region

- Automotive Dyno Market, by Group

- Automotive Dyno Market, by Country

- United States Automotive Dyno Market

- China Automotive Dyno Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Core Insights and Future Outlook Illuminating the Path Forward for Automotive Dynamometer Technology and Market Evolution

The automotive dynamometer landscape is undergoing rapid transformation, driven by the confluence of digitalization, stringent regulatory demands, and powertrain diversification. Throughout this executive summary, we have traced the evolution of these test platforms from basic measurement rigs to multifaceted laboratories that integrate advanced automation, connectivity, and data analytics. Moreover, we have examined how shifting tariff regimes have prompted supply-chain realignments and spurred modular design innovations.

Segmentation insights revealed that chassis and engine dynamometers continue to serve distinct use cases, with a clear trend toward electric loading systems and fully automatic test cells. Regional analysis highlighted robust activity in the Americas and Asia-Pacific, where manufacturing investments and regulatory shifts are fueling sustained demand, even as Europe maintains its leadership in virtual calibration and emissions-centered testing.

Looking forward, the intersection of digital twin technologies, AI-powered predictive maintenance, and next-generation powertrain testing will define the competitive frontier. Organizations that embrace these innovations while fortifying supply chains and enhancing customer-centric service models will be best positioned to shape the future of vehicle performance validation.

Engage with Ketan Rohom to Unlock Comprehensive Automotive Dynamometer Market Intelligence and Drive Strategic Business Growth

To harness the most comprehensive and forward-looking analysis of the automotive dynamometer landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing, for a personalized consultation. Ketan’s deep familiarity with market intricacies combined with his strategic insight will equip your team with the critical intelligence needed to outpace competitors and capitalize on emerging opportunities. Whether you require granular understanding of tariff impacts, advanced segmentation deep-dives, or targeted regional intelligence, Ketan can tailor a solution that aligns precisely with your organization’s objectives. Engage directly with Ketan to discuss how this market research report can inform your next investment decision, streamline procurement strategies, or support your innovation roadmap. Proactive engagement today empowers you to shape tomorrow’s victories in vehicle performance testing.

- How big is the Automotive Dyno Market?

- What is the Automotive Dyno Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?