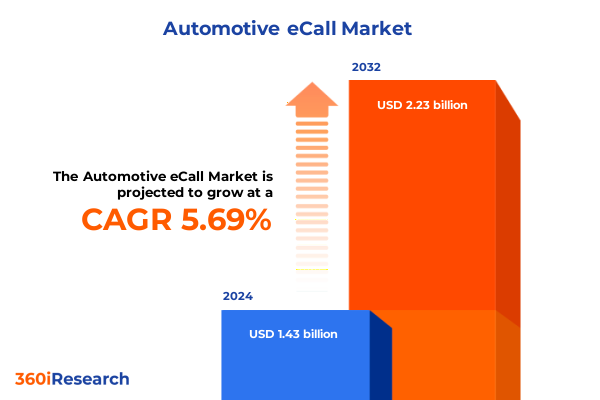

The Automotive eCall Market size was estimated at USD 1.50 billion in 2025 and expected to reach USD 1.59 billion in 2026, at a CAGR of 5.77% to reach USD 2.23 billion by 2032.

Unlocking the Strategic Importance of eCall in Driving Enhanced Roadside Safety and Streamlining Emergency Response Protocols Across the Automotive Ecosystem

The concept of eCall originated as a targeted response to the high human and economic costs of road traffic accidents, leveraging vehicle telematics and emergency networks to reduce trauma by accelerating the dispatch of first responders. In its most basic form, an eCall system automatically transmits a minimal set of data-such as time of incident, geolocation coordinates, and vehicle identification-to a public safety answering point once in-vehicle sensors detect a collision. This streamlined connection has proved particularly transformative in regions with dense traffic and variable emergency service coverage, enabling authorities to deploy resources with unprecedented speed and accuracy. The EU-wide 112 eCall initiative, for instance, has demonstrated how coordinated regulatory frameworks and interoperable technical standards can save lives by shortening response times by as much as 50% in rural areas and 40% in urban centers, while reducing fatalities by up to 4% annually.

Examining the Profound Technological, Regulatory, and Consumer-Driven Transformations Shaping the Future Trajectory of eCall Implementation Worldwide

The landscape of eCall implementation is undergoing a period of profound transformation, driven by rapid advancements in mobile networks, regulatory evolution, and shifting consumer expectations around connected vehicle services. With the imminent sunset of legacy 2G and 3G networks, next-generation eCall architectures are transitioning to IMS-based packet-switched communications over 4G and 5G, ensuring seamless interoperability between vehicles and public safety answering points. In February 2024, the European Commission ratified updated delegated regulations to mandate PSAP support for eCall over LTE and 5G, reflecting a broader industry need to future-proof emergency communications within increasingly software-defined vehicles. Concurrently, global telematics strategies are integrating artificial intelligence and edge computing to enhance crash detection accuracy, mitigate false alarms, and deliver richer pre-arrival information such as occupant severity predictions and real-time sensor telemetry.

Assessing the Far-Reaching Consequences of United States 2025 Section 232 Tariffs on Automotive eCall Supply Chains, Costs, and Industry Resilience

In March 2025, the United States invoked Section 232 of the Trade Expansion Act to impose a 25% tariff on imported automobiles and selected automotive components, citing national security concerns over the resilience of domestic supply chains. This decisive action has reverberated across the automotive ecosystem, prompting manufacturers to reassess sourcing strategies and accelerate localization efforts to mitigate cost pressures. A detailed White House fact sheet underscores that the tariff applies strictly to non-US content value, incentivizing OEMs to certify higher domestic content ratios under USMCA provisions. However, even domestically assembled vehicles remain exposed to incremental costs for imported parts-estimated to comprise up to 60% of average vehicle build costs-creating a complex calculus between tariff-driven price increases and contractual obligations with dealership networks.

Deriving Actionable Insights from eCall Market Segmentation Based on Vehicle Type, Connectivity Options, Sales Channels, Call Types, Transmissions, and Network Generations

A nuanced understanding of the eCall market emerges when the interplay of vehicle type, connectivity modality, distribution channel, call classification, transmission mechanism, and network generation is viewed holistically. Heavy commercial trucks demand ruggedized telematics control units with integrated eCall functionality to meet stringent uptime requirements, while compact passenger cars frequently rely on tethered smartphone-linked solutions that lower entry-level costs and simplify integration. In parallel, OEM-fitted systems are steadily outpacing aftermarket options by offering deeper integration with vehicle diagnostic buses and manufacturer telematics platforms, yet aftermarket solutions remain essential for legacy fleets. Furthermore, assistance calls-those seeking non-life-threatening support such as breakdown services-are proliferating alongside true emergency calls, requiring service providers to scale multitiered response centers. From the lens of transmission type, automatic transmissions often duplicate eCall triggers with gear-position sensors, whereas manual vehicles rely on airbag and acceleration triggers. Lastly, the lifecycle of eCall continues to evolve from 2G-based SMS approaches to 3G fall-backs and now full 4G/5G IP-based implementations, each generation unlocking enhanced data payloads and encryption standards.

This comprehensive research report categorizes the Automotive eCall market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Connectivity

- Call Type

- Transmission Type

- Network Generation

- Sales Channel

Unlocking Regional Growth Opportunities by Analyzing Key Drivers and Challenges for eCall Adoption in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping eCall adoption, as varied regulatory mandates, infrastructure maturity, and consumer expectations create distinct growth vectors. In the Americas, the absence of a federal eCall mandate has not stunted innovation; rather, telematics pioneers like OnStar and aftermarket integrators have filled the gap by forging partnerships with public safety answering points to furnish Automatic Crash Response features tailored for North American PSAP protocols. By contrast, Europe, Middle East & Africa (EMEA) benefits from a cohesive legal framework that standardizes eCall requirements across EU member states, with interoperability reinforced through delegated regulations and PSAP upgrade roadmaps. Meanwhile, Asia-Pacific markets exhibit rapid uptake driven by government-led smart city initiatives and aggressive automotive electrification programs; China, for instance, is upgrading its emergency response networks to accommodate eCall over 5G, dovetailing with national cybersecurity standards that mandate real-time anomaly detection and data governance controls.

This comprehensive research report examines key regions that drive the evolution of the Automotive eCall market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Advancements in eCall Technologies Across the Global Automotive Industry Landscape

Leading technology suppliers and Tier 1 integrators continue to push the boundaries of eCall capabilities, with a competitive landscape featuring legacy automotive OEM system providers, specialist telematics firms, and emerging software-centric entrants. Bosch Service Solutions, a pioneer since 2012, claims integration in more than 42 million vehicles across 60 countries, leveraging its global network to offer multilanguage support and redundant emergency call center coverage. Continental AG, Valeo, and Denso Corporation are each advancing connected safety platforms that fuse eCall with predictive maintenance and over-the-air update infrastructures, while Harman International and Telit are co-developing modular TCUs optimized for next-gen eCall and 5G slicing. Strategic alliances are reshaping market contours: Carbyne’s public safety cloud has been embedded into Bosch’s Latin American operations, slashing PSAP processing times by half. Semiconductor leaders including Infineon Technologies and STMicroelectronics are responding with hardware-level security modules to address expanding cybersecurity requirements, underscoring a collective push toward resilient, globally interoperable emergency communications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive eCall market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACTIA Group

- Analog Devices, Inc.

- Continental AG

- Fujitsu Limited

- Happiest Minds Technologies Pvt. Ltd.

- Infineon Technologies AG

- Intelematics Australia Pty Ltd.

- LG Electronics

- NXP Semiconductors N.V.

- Octo Telematics S.p.A.

- Robert Bosch GmbH

Strategic Recommendations for OEMs, Tier 1 Suppliers, and Service Providers to Maximize eCall Deployment, Ensure Regulatory Compliance, and Enhance Customer Value

OEMs should prioritize developing next-generation telematics control units that natively support IMS-based eCall over LTE and 5G, ensuring compatibility even as 2G/3G networks are phased out. Embracing cross-industry standardization efforts, such as ITU-T Y.4467/8 and UNECE R155 for cybersecurity, will reduce integration costs and foster greater PSAP interoperability. Collaborations between OEMs, telecom operators, and public safety organizations can facilitate shared infrastructure investments that scale coverage while distributing operational risk. Suppliers and service providers are advised to invest in AI-driven crash detection and severity prediction algorithms to enhance the accuracy of automatic calls and minimize false positives, ultimately strengthening PSAP trust in third-party systems. Additionally, establishing a transparent data governance framework aligned with global privacy regulations will assuage consumer concerns, enabling monetization of ancillary telematics services without compromising user consent. Finally, synthesizing lessons from regional pilots-whether in APAC smart cities or EMEA PSAP modernization programs-will accelerate best-practice adoption and reduce time to market for new eCall features.

Outlining a Rigorous Research Methodology Combining Primary Interviews, Secondary Sources, and Data Triangulation to Deliver High-Quality eCall Market Insights

This research employed a hybrid methodology combining extensive secondary research, expert interviews, and data triangulation to ensure robust market insights. We conducted a thorough review of publicly available regulations, technical standards, and industry whitepapers, supplemented by company press releases and patent filings to map the competitive landscape. Dozens of in-depth discussions with senior executives at OEMs, Tier 1 suppliers, and PSAP administrators provided qualitative validation of technology roadmaps and adoption barriers. The segmentation framework was constructed using a bottom-up approach informed by global vehicle registration data and telematics subscription trends, ensuring that each segment’s drivers and challenges are accurately captured. Wherever possible, findings were cross-checked against third-party industry surveys and academic publications to minimize bias and reinforce data integrity. Limitations of the study include variable PSAP reporting standards across jurisdictions and the evolving nature of 5G network rollouts, which may affect deployment timelines.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive eCall market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive eCall Market, by Vehicle Type

- Automotive eCall Market, by Connectivity

- Automotive eCall Market, by Call Type

- Automotive eCall Market, by Transmission Type

- Automotive eCall Market, by Network Generation

- Automotive eCall Market, by Sales Channel

- Automotive eCall Market, by Region

- Automotive eCall Market, by Group

- Automotive eCall Market, by Country

- United States Automotive eCall Market

- China Automotive eCall Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Critical Takeaways on eCall Evolution, Market Challenges, and Strategic Imperatives for Stakeholders to Navigate the Next Decade of Vehicle Connectivity

The evolution of eCall underscores a broader shift toward proactive, connected mobility solutions that safeguard occupants and optimize emergency response workflows. While regulatory mandates in regions like Europe have jumpstarted universal eCall integration, the landscape is diversifying, with advanced telematics, AI analytics, and next-gen networks reshaping expectations around safety, speed, and data fidelity. Tariff-driven supply chain recalibrations, regional infrastructure disparities, and rising cybersecurity imperatives present both challenges and opportunities for stakeholders willing to innovate collaboratively. By synthesizing segmentation nuances with emerging technology trajectories and regional policy contexts, this executive summary offers a consolidated view of where eCall stands today and where it must head to achieve seamless global adoption, enhanced interoperability, and measurable life-saving outcomes.

Connect Directly with Ketan Rohom to Obtain Your Definitive eCall Market Research Report and Gain a Competitive Advantage

To stay at the forefront of innovation in automotive safety and connectivity, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the definitive market research report on eCall solutions. Armed with data-driven insights, strategic analyses, and expert recommendations, this comprehensive report offers the clarity you need to outmaneuver competitors and capitalize on emerging opportunities. Engage with Ketan Rohom today to learn more about the report’s full scope, discuss tailored research packages, and access exclusive client briefings. Position your organization for success by investing in the knowledge that shapes tomorrow’s automotive emergency response landscape.

- How big is the Automotive eCall Market?

- What is the Automotive eCall Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?