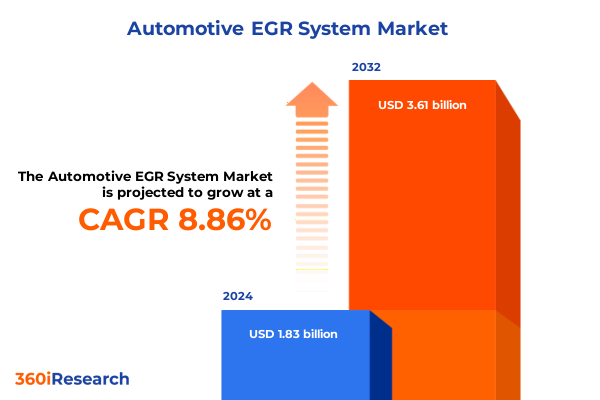

The Automotive EGR System Market size was estimated at USD 4.51 billion in 2025 and expected to reach USD 4.82 billion in 2026, at a CAGR of 7.19% to reach USD 7.34 billion by 2032.

Setting the Stage for Exhaust Gas Recirculation Systems: Understanding Market Dynamics, Technology Drivers, and Regulatory Imperatives

In today’s rapidly evolving automotive landscape, exhaust gas recirculation systems have emerged as critical enablers for meeting stringent emissions regulations while balancing performance, cost, and sustainability considerations. Beyond their fundamental role in reducing NOx emissions, EGR systems have become focal points of innovation, as manufacturers and suppliers collaborate on advanced valve architectures, material science breakthroughs, and integrated control strategies. As electrification continues to reshape powertrain portfolios, EGR technologies are being reimagined to optimize hybrid and mild-hybrid applications, making this an opportune time to examine the core drivers, challenges, and opportunities shaping the automotive EGR ecosystem.

Building on decades of incremental improvements, the current generation of EGR systems leverages precision-actuated valves, advanced thermal management, and predictive control algorithms to deliver improved engine efficiency and emissions reduction without compromising drivability. Meanwhile, regulatory bodies across North America, Europe, and Asia-Pacific are intensifying requirements, pressing OEMs and tier suppliers to accelerate their adoption of high-performance EGR solutions. Within this context, our analysis offers an in-depth look at the technological innovations, policy landscapes, and market forces that define the state of EGR systems in 2025, providing industry leaders with a clear understanding of critical success factors and emerging pathways to sustainable powertrain design.

Navigating Paradigm Shifts in Automotive Exhaust Gas Recirculation: Embracing Electrification, Advanced Materials, and Emerging Emission Standards

The automotive industry is experiencing transformative shifts that are redefining the role and design of exhaust gas recirculation systems. Rapid advancement in electrification has prompted OEMs to integrate EGR functions with hybrid control units, thereby enhancing fuel efficiency during transient driving cycles and ensuring seamless compliance with zero-emission mandates. Concurrently, breakthroughs in material science-such as corrosion-resistant stainless steel alloys and novel ceramic composites-are enabling EGR systems to withstand higher thermal loads, reduce wear, and extend service life. As a result, proactive suppliers are tailoring solutions to accommodate both conventional internal combustion engines and hybrid configurations, creating a new paradigm for EGR deployment.

Moreover, evolving emission standards in key markets are raising the bar for NOx reduction targets, compelling manufacturers to optimize EGR flow rates, cooler efficiency, and valve response times. In North America, the US Environmental Protection Agency’s Tier 3 updates and California’s low-emission vehicle mandates have spurred renewed investment in high-precision EGR modules. Meanwhile, in Europe, the imminent Euro 7 regulations are expected to tighten limits on particle number counts and nitrogen oxide levels, driving further innovation in cooled and passive EGR systems. These regulatory imperatives, paired with consumer demand for fuel-efficient performance, underline the transformative shifts reshaping the EGR system landscape.

Evaluating the Ripple Effects of 2025 United States Tariffs on Automotive EGR Supply Chains, Component Costs, and Strategic Sourcing Decisions

In 2025, the United States introduced targeted tariffs on imported automotive components, directly affecting the supply chain dynamics of EGR system production. As a consequence, steel and aluminum price fluctuations have exerted upward pressure on raw material procurement, leading manufacturers to explore alternative sourcing strategies. Many tier suppliers have responded by diversifying their supplier portfolios, shifting towards nearshoring initiatives and strengthening relationships with domestic mills. This recalibration has not only mitigated tariff-related cost burdens but also reduced lead times, enhancing inventory resilience in the face of global disruptions.

Furthermore, component manufacturers have increasingly invested in manufacturing footprint expansions within North America, a tactical response aimed at preserving cost structures and maintaining just-in-time delivery capabilities. Strategic partnerships between OEMs and local foundries have facilitated the adoption of higher-grade cast iron and stainless steel alloys, ensuring compliance with technical specifications while managing the impact of tariff-induced cost variability. In parallel, design optimization efforts-such as thinner-walled EGR coolers and simplified valve assemblies-are being pursued to offset material cost inflation, all of which reflect the cumulative repercussions of 2025 tariff policies on the EGR ecosystem in the United States.

Unlocking Market Insights Through Comprehensive Segmentation of Vehicle Categories, Engine Architectures, EGR Variants, Positioning, Materials, and Distribution Channels

An in-depth examination of EGR system segmentation reveals how distinct categories shape product innovation and go-to-market strategies. When classified by vehicle type, the industry’s focus spans passenger cars, light commercial vehicles and heavy commercial vehicles, each with unique driving cycles and emission control requirements. Engine type differentiation further refines the landscape: diesel engines, segmented into heavy duty diesel and light duty diesel, often necessitate robust cooled EGR solutions to manage NOx during high-load operations; gasoline engines, centered on direct injection architectures, leverage homogeneous charge mode and more advanced stratified charge mode configurations to balance emissions and fuel economy.

EGR type segmentation underscores the dichotomy between active and passive designs, where active EGR systems utilize solenoid valves-available in direct acting or pilot operated configurations-and stepper motor valves offered in brushed and brushless variants, delivering precise flow modulation. In contrast, passive EGR systems rely on backpressure without actuator intervention, with cooled and uncooled subtypes; cooled passive EGR splits into air to air and air to water cooled configurations to achieve optimal temperature control. Position-based categorization between internal and external EGR highlights spatial integration strategies, while material distinctions-cast iron, ceramic and stainless steel-emphasize durability and thermal performance trade-offs. Lastly, mounting choices between integrated and standalone modules and distribution channels segmented into OEM and aftermarket paths further illuminate the multiplicity of technical and commercial approaches within the overall EGR system domain.

This comprehensive research report categorizes the Automotive EGR System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Fuel Type

- Engine Size

- Engine Type

- Vehicle Type

- Sales Channel

Illuminating Regional Dynamics in the Automotive EGR Ecosystem: Key Trends, Adoption Patterns, and Growth Drivers Across Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in steering the evolution and adoption of EGR technologies across the globe. The Americas region has seen accelerated integration of cooled EGR in heavy duty diesel applications, propelled by rigorous EPA standards and California’s advanced low-emission zones. Technological collaboration between US and Canadian suppliers has fostered resilient supply chains, leveraging nearshore manufacturing hubs to meet localized demand and reduce logistical complexity. Shifting consumer preferences toward fuel economy in passenger cars have also spurred wider EGR adoption in light duty gasoline engines, particularly those employing direct injection with stratified charge mode for optimized combustion.

Across Europe, Middle East & Africa, regulatory alignment with Euro 6d and the forthcoming Euro 7 regime has intensified the deployment of both active and passive EGR solutions, especially within commercial fleets subject to urban low-emission zone levies. Partnerships between OEMs and regional foundries have enabled access to advanced stainless steel and ceramic materials, ensuring durability under high thermal stresses. In the Asia-Pacific arena, rapid urbanization and stringent China 6 and Bharat VI emission standards have catalyzed deployment of cooled EGR in diesel transit buses and heavy trucks, while rising demand for passenger cars has driven innovation in lightweight, standalone EGR modules for gasoline direct injection engines. Together, these regional narratives underscore how localized policy frameworks and infrastructure capacities inform strategic EGR system development.

This comprehensive research report examines key regions that drive the evolution of the Automotive EGR System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscapes and Strategic Moves of Leading EGR System Manufacturers to Uncover Innovation, Partnerships, and Market Positioning

A review of prominent EGR system players reveals a landscape defined by technological leadership, collaborative innovation, and strategic expansion. Leading global automotive suppliers have prioritized the integration of advanced stepper motor valves within active EGR modules to deliver millisecond-level response and adaptive flow control, leveraging proprietary control algorithms to optimize engine performance. Meanwhile, partnerships with material specialists have enabled access to corrosion-resistant alloys and high-temperature ceramics, extending component life cycles and minimizing maintenance requirements across diverse operating environments.

In addition, several key companies have embarked on joint ventures with OEMs and research institutions to accelerate development of integrated exhaust aftertreatment architectures. These alliances focus on seamless coordination between EGR, diesel particulate filters and selective catalytic reduction systems, underpinned by advanced sensor networks and predictive diagnostics. Expansion into emerging markets has been supported through local manufacturing setups in Asia-Pacific and the Americas, ensuring cost-effective supply and rapid aftermarket support. Collectively, these strategic initiatives by tier one suppliers and system integrators reflect a broad commitment to innovation, regulatory compliance, and customer-centric service in the global EGR segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive EGR System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BorgWarner Inc.

- Denso Corporation

- Rheinmetall AG

- Continental AG

- Valeo AG

- Mahle GmbH

- Caterpillar Inc.

- Korens, Inc.

- Marelli Europe S.p.A.

- Tenneco Inc.

- Aisan Industry Co., Ltd.

- Astemo, Ltd.

- BENTELER International AG

- Cummins Inc.

- Dana Incorporated

- Eaton Corporation plc

- Eberspächer Group GmbH & Co. KG,

- Forvia SE

- FUTABA INDUSTRIAL CO.,LTD.

- Gits Manufacturing Co.

- Hanon Systems Co., Ltd.

- Knorr-Bremse AG

- Mitsubishi Electric Corporation

- NISSENS AUTOMOTIVE A/S

- Parker-Hannifin Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Senior plc

- SRLine by Polcar

- Valeo SE

- Wells Vehicle Electronics, L.P.

- Wuxi Longsheng Technology Corp.

- Zhejiang Yinlun Machinery Co., Ltd.

Charting a Strategic Path Forward for Industry Leaders Seeking to Optimize EGR Technologies, Streamline Operations, and Enhance Regulatory Compliance

To capitalize on emerging opportunities within the EGR domain, industry leaders should adopt a multi-pronged approach that balances near-term operational efficiency with long-term technological differentiation. First, it is critical to invest in advanced materials research, exploring novel alloys and composite formulations that enhance thermal stability while reducing system weight. By collaborating with specialized foundries and academic research centers, organizations can fast-track material validation processes and secure intellectual property advantages. In parallel, diversification of supply chains through regional manufacturing hubs will mitigate tariff impacts and logistical disruptions and support agile response to regulatory changes.

Equally important is the acceleration of digital integration within EGR control systems. Incorporating predictive maintenance algorithms and real-time diagnostics into valve actuation strategies can reduce downtime and extend service intervals, providing a compelling value proposition for OEMs and aftermarket channels. Industry leaders should also pursue strategic alliances with OEM powertrain divisions to co-develop integrated exhaust architectures, ensuring seamless compatibility between EGR, aftertreatment and engine management units. By embracing these recommendations, suppliers and manufacturers can strengthen their competitive positioning and drive sustained value in a market shaped by evolving emission norms and shifting geopolitical landscapes.

Outlining Rigorous Research Methodologies Employed for Data Collection, Stakeholder Interviews, and Analytical Rigor Underpinning the EGR System Market Insights

This research draws upon a rigorous methodology combining primary and secondary data collection with analytical validation to ensure the highest levels of reliability and depth. Interviews with senior engineering managers at OEMs, product development leads at tier one suppliers, and regulatory affairs specialists provided firsthand insights into material selection, valve control strategies, and emissions compliance challenges. These qualitative inputs were complemented by a thorough review of technical patents, white papers, and academic publications focusing on advancements in EGR valve actuation and thermal management.

Secondary research encompassed evaluation of government regulations and industry standards across major markets, including US EPA guidelines, European Union directives and Asia-Pacific emission codes. Manufacturer catalogs, press releases and financial filings were analyzed to trace strategic initiatives, capacity expansions and partnership announcements. Throughout the process, the data underwent triangulation with cross-verified sources and expert consultations to ensure consistency. This combined approach delivered a comprehensive and authoritative view of the global EGR system landscape, underpinning the insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive EGR System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive EGR System Market, by Component Type

- Automotive EGR System Market, by Fuel Type

- Automotive EGR System Market, by Engine Size

- Automotive EGR System Market, by Engine Type

- Automotive EGR System Market, by Vehicle Type

- Automotive EGR System Market, by Sales Channel

- Automotive EGR System Market, by Region

- Automotive EGR System Market, by Group

- Automotive EGR System Market, by Country

- United States Automotive EGR System Market

- China Automotive EGR System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Key Takeaways and Strategic Imperatives Driving the Future of Exhaust Gas Recirculation Innovations and Regulatory Alignment

This executive summary has highlighted the pivotal trends shaping the automotive exhaust gas recirculation sector, from stringent emission regulations and electro-hybrid integration to the material and valve technology innovations driving efficiency gains. We have examined the nuanced implications of 2025 tariff measures in the United States and traced their cascading effects on supply chain optimization and strategic sourcing. Comprehensive segmentation perspectives have shed light on how vehicle categories, engine architectures and EGR system variants inform differentiated product strategies, while regional analyses have underscored the importance of localized policies and infrastructure in determining technology adoption pathways.

As the competitive arena evolves, leading suppliers are forging alliances, expanding manufacturing footprints and advancing digital control capabilities to deliver next-generation EGR platforms. By adopting the actionable recommendations outlined-ranging from material innovation partnerships and supply chain diversification to digital integration and OEM collaboration-stakeholders can position themselves for long-term success. Ultimately, the convergence of regulatory imperatives, technological breakthroughs and strategic foresight will chart the course for sustainable and compliant powertrain solutions that meet both industry objectives and environmental responsibilities.

Empowering Stakeholders to Secure Comprehensive EGR System Market Intelligence and Drive Informed Decisions with Expert Guidance from Ketan Rohom

Elevate your strategic decision-making by securing full access to our comprehensive analysis of the automotive exhaust gas recirculation system landscape. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this authoritative research can inform your product development, supply chain resilience, and regulatory compliance strategies. Reach out today to gain the detailed insights and tailored support needed to maintain a competitive advantage in an evolving regulatory and technological environment.

- How big is the Automotive EGR System Market?

- What is the Automotive EGR System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?