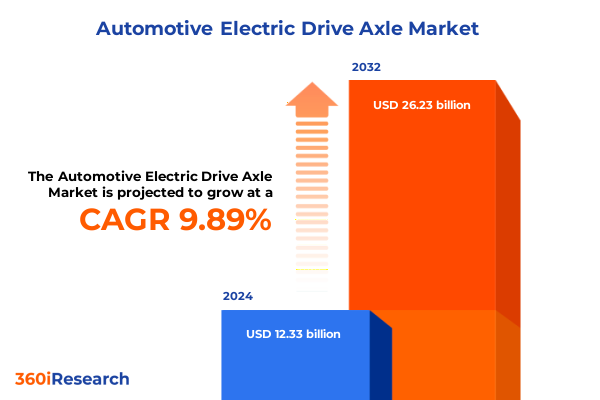

The Automotive Electric Drive Axle Market size was estimated at USD 13.52 billion in 2025 and expected to reach USD 14.85 billion in 2026, at a CAGR of 9.92% to reach USD 26.23 billion by 2032.

Unveiling the Pivotal Role of Electric Drive Axles in Accelerating the Future of Sustainable Automotive Mobility Across Global Transportation Ecosystems

Electric drive axles have rapidly emerged as critical enablers in the automotive sector’s journey toward sustainable mobility, offering a compact, efficient, and integrated solution for power transmission and vehicle control. Over the past decade, the drive toward electrification has matured from niche pilot programs to large-scale production models, reflecting profound changes in consumer expectations, regulatory mandates, and technological capabilities. In this context, electric drive axles integrate motor, power electronics, and gear reduction components into a single assembly that enhances efficiency while reducing vehicle mass and complexity.

As governments worldwide impose ever-stricter emissions standards and set ambitious net-zero targets, the acceleration of electric vehicle (EV) adoption has propelled electric drive axle innovation to the forefront of automotive R&D agendas. Additionally, the convergence of digitization, advanced materials, and precision manufacturing has lowered the barriers to mass deployment, enabling manufacturers to optimize torque distribution, improve energy recuperation, and deliver more responsive driving dynamics. Together, these trends underscore the transformative potential of electric drive axles to redefine vehicle architecture and reshape market competition.

Examining the Convergence of Technological Innovations Operational Efficiency Demands and Market Dynamics Redefining the Electric Drive Axle Landscape Today

The electric drive axle landscape is undergoing seismic shifts driven by breakthroughs in semiconductor technology, AI-enhanced control systems, and modular hardware architectures. Cutting-edge wide-bandgap silicon carbide and gallium nitride devices are pushing power density thresholds, enabling smaller, cooler-running inverters that integrate seamlessly into axle housings. At the same time, sophisticated torque vectoring algorithms and embedded sensors are empowering vehicle platforms to deliver superior handling, safety, and range optimization under varied driving conditions.

Moreover, partnerships between automakers, suppliers, and technology providers are redefining traditional value chains. Collaborative ecosystems now span joint ventures on motor development to software-centric alliances on predictive maintenance solutions. This fusion of expertise is accelerating time-to-market and reducing development costs. In parallel, a growing emphasis on circular economy principles is catalyzing material innovation and end-of-life recyclability for critical components, aligning supply chains with comprehensive sustainability objectives. Such transformative shifts are converging to establish a new competitive paradigm in which agility, integration, and technological depth determine leadership in electric drive axle offerings.

Analyzing the Far-Reaching Effects of Newly Imposed United States Tariffs on Electric Drive Axle Supply Chains and Competitive Dynamics in 2025

In 2025, the United States government introduced a series of tariffs targeting imported electric drive axle assemblies and critical raw materials, marking a strategic pivot toward bolstering domestic manufacturing capabilities. These tariffs have had a cascading effect on global supply chains, compelling component producers and OEMs to reassess sourcing strategies. Higher import duties on finished axles have incentivized onshore production investments, while tariffs on rare earth magnets and specialty steel have sparked conversations around material substitution and the geographic diversification of raw-material procurement.

Consequently, international suppliers have adapted by relocating production facilities closer to key markets or by establishing joint ventures with U.S.-based partners. While this realignment has enhanced supply chain resilience, it has also introduced complexity in cost structures and contractual negotiations. Furthermore, domestic axle manufacturers are seizing the opportunity to negotiate more favorable long-term agreements with raw-material producers. Collectively, these developments are shaping a new competitive landscape in which tariff-induced reconfiguration is as significant as technological differentiation in determining market positioning and profit margins.

Uncovering In-Depth Insights into Market Pathways Through Comprehensive Segmentation Based on Propulsion Vehicle Drive Axle Configurations and End User

The electric drive axle market can be dissected through multiple lenses that illuminate distinct growth pathways and adoption patterns. When examining propulsion type, core divergence emerges between battery electric vehicles, fuel cell electric vehicles, and plug-in hybrids. Each category presents unique torque, thermal management, and integration requirements, driving specialized motor winding configurations and power electronics adaptations to meet performance benchmarks.

A vehicle-type perspective further refines the landscape into commercial platforms and passenger cars. Within the commercial segment, applications span from heavy trucks requiring high-torque dual-motor solutions to light commercial vans prioritizing cost-effective single-motor architectures. The passenger car domain encapsulates hatchbacks optimized for urban efficiency, sedans balancing range and comfort, and SUVs where drivetrain robustness scales from compact city models to full-size off-road capable units, with midsize SUVs striking a balance between performance and practicality.

Drive axle type segmentation delineates dual-motor assemblies that enable advanced all-wheel-drive systems from single-motor variants aimed at two-wheel-drive cost-efficient models. Finally, examining end-user channels highlights the contrast between aftermarket services-where retrofit kits and maintenance spare parts demand modular, plug-and-play designs-and OEM production, which focuses on bespoke, high-volume assemblies tightly integrated into vehicle platforms. This multifaceted segmentation framework reveals how divergent technical requirements and end-market imperatives are directing suppliers toward differentiated product roadmaps and go-to-market strategies.

This comprehensive research report categorizes the Automotive Electric Drive Axle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drive Axle Type

- Propulsion Type

- End User

- Vehicle Type

Mapping Regional Growth Drivers and Challenges Across the Americas Europe Middle East Africa and Asia Pacific Dynamics Shaping Electric Drive Axle Adoption

Regional market dynamics in the electric drive axle sphere reflect a tapestry of regulatory regimes, infrastructure maturity, and industrial capabilities. In the Americas, supportive policy measures such as tax incentives and stringent emissions targets have accelerated installations of full-electric propulsion systems in both passenger and commercial fleets. Investment in charging networks across urban corridors is catalyzing demand for high-efficiency dual-motor axles that deliver performance consistency across diverse temperature profiles.

In Europe, the Middle East, and Africa, the regulatory impetus toward decarbonization coexists with a heterogeneous infrastructure landscape. Western European markets are pioneering hydrogen fuel cell technologies, driving specialized axle systems engineered for high-power density and rapid refueling cycles. Meanwhile, emerging economies within the region are prioritizing plug-in hybrid configurations to navigate grid constraints and incremental infrastructure build-out, shaping a dual-track approach to axle design and manufacturing footprint decisions.

Asia-Pacific stands out for its vertically integrated supply chains and aggressive national electrification mandates. Leading automakers and suppliers in East Asia are co-developing next-generation single-motor axles optimized for compact city vehicles, whereas resource-rich countries are exploring heavy commercial electric trucks supported by full-electric powertrains. These regional nuances underscore the importance of tailoring product architectures and partnership models to distinct regulatory and market maturity gradients.

This comprehensive research report examines key regions that drive the evolution of the Automotive Electric Drive Axle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Competitive Landscape and Strategic Positioning of Leading Manufacturers Pioneering Innovations in Electric Drive Axle Technologies Worldwide

The competitive landscape of electric drive axle development is dominated by a mix of longstanding tier-one suppliers and emerging specialized newcomers. Traditional automotive component manufacturers are leveraging their deep engineering heritage to integrate advanced power electronics and precision gear systems into holistic axle modules. Simultaneously, technology-centric disruptors are entering the fray with proprietary motor topologies and digital control platforms designed for rapid scalability in modular vehicle architectures.

Strategic collaborations between OEMs and axle system providers are becoming increasingly common, as leading automakers seek to secure differentiated performance while retaining supply chain flexibility. This pattern has elevated bespoke solutions-featuring integrated sensor arrays, over-the-air software updates, and predictive maintenance capabilities-as a key battleground for winning design-in contracts. Furthermore, the influx of private equity funding into specialized drive-train start-ups is intensifying competition around niche high-power applications, such as heavy-duty electric buses and specialized off-road vehicles.

In this evolving arena, companies that balance R&D investments in next-gen materials with robust manufacturing scale-up plans are most likely to capture leadership positions. A focus on seamless system integration, supported by digital twin validation and machine-learning optimization, distinguishes frontrunners poised to meet the rigorous demands of both mass-market and premium segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Electric Drive Axle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABM Greiffenberger Antriebstechnik GmbH

- American Axle & Manufacturing, Inc.

- AVL List GmbH

- Bonfiglioli Riduttori SpA

- BorgWarner Inc.

- Continental AG

- Dana Incorporated

- Drive System Design Ltd.

- Eaton Corporation plc

- GKN Automotive Limited

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- JTEKT Corporation

- Linamar Corporation

- Magna International Inc.

- Mitsubishi Electric Corporation

- Nidec Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Siemens AG

- Toyota Industries Corporation

- Valeo SA

- Vitesco Technologies Group AG

- YASA Limited

- ZF Friedrichshafen AG

Empowering Automotive Executives with Tactical Guidelines to Harness Advancement in Electric Drive Axles and Capitalize on Market Opportunities

To navigate the rapidly shifting electric drive axle market, industry leaders must adopt a proactive stance that aligns technological advancement with supply chain resilience. Prioritizing partnerships with semiconductor innovators will ensure timely access to the latest wide-bandgap devices, which are crucial for maximizing power density and thermal efficiency. Concurrently, forging strategic alliances with raw-material suppliers can mitigate exposure to tariff shocks and raw-material volatility, preserving cost competitiveness.

Investing in flexible manufacturing platforms that accommodate both single-motor and dual-motor configurations will provide the agility needed to serve diverse vehicle applications. Moreover, embedding digital service models-such as remote diagnostics and predictive maintenance-directly into axle units can unlock recurring revenue streams in the aftermarket space while enhancing overall customer satisfaction. Finally, embracing open-architecture software frameworks will facilitate rapid integration of new algorithms and over-the-air updates, reinforcing product differentiation and extending lifecycle value.

Detailing a Rigorous Multiphase Research Approach Blending Primary Data Collection Secondary Analysis and Expert Validation for Comprehensive Insights

The research underpinning this analysis was conducted through a multistage methodology designed to ensure accuracy, depth, and actionable relevance. Primary insights were gathered via in-depth interviews with senior R&D engineers, supply chain managers, and product strategy leads from leading global OEMs and tier-one suppliers. These interviews provided firsthand perspectives on design challenges, integration requirements, and emerging performance targets.

Concurrently, extensive secondary research was performed, including technical paper reviews, patent landscape analyses, and regulatory framework assessments. Publicly available financial reports and investor presentations were analyzed to identify investment flows and strategic priorities. Quantitative data was triangulated across multiple sources to validate trends and eliminate potential biases. Finally, expert panel workshops were conducted to refine key findings, challenge assumptions, and validate scenario projections. This comprehensive approach ensures that the resulting insights are grounded in industry realities and poised to guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Electric Drive Axle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Electric Drive Axle Market, by Drive Axle Type

- Automotive Electric Drive Axle Market, by Propulsion Type

- Automotive Electric Drive Axle Market, by End User

- Automotive Electric Drive Axle Market, by Vehicle Type

- Automotive Electric Drive Axle Market, by Region

- Automotive Electric Drive Axle Market, by Group

- Automotive Electric Drive Axle Market, by Country

- United States Automotive Electric Drive Axle Market

- China Automotive Electric Drive Axle Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Takeaways to Illuminate the Strategic Imperatives and Technological Trajectories Shaping the Evolution of Electric Drive Axle Market Frontiers

The evolution of electric drive axle technology reflects a broader transformation within the automotive industry, where electrification is no longer a niche proposition but an imperative. Seamless integration of motor, power electronics, and gearing into consolidated axle modules has unlocked new dimensions in vehicle efficiency, performance, and packaging flexibility. Meanwhile, tariff-driven shifts in supply chains underscore the need for localized production strategies and material diversification.

Comprehensive segmentation analysis reveals that each propulsion type, vehicle class, and end-user channel imposes distinct technical and commercial requirements, necessitating tailored product roadmaps. Regional differences in regulatory frameworks and infrastructure readiness further complicate the strategic planning matrix, demanding agile manufacturing footprints and adaptive partnership models. Against this backdrop, leading companies distinguish themselves through robust R&D investments, open-architecture software ecosystems, and vertically integrated yet flexible supply chains.

Looking ahead, the integration of digital services, advanced materials, and AI-driven control systems will chart the next frontier in electric drive axle development. Stakeholders that embrace collaborative innovation, secure strategic raw-material alliances, and align with evolving regulatory landscapes will be best positioned to capture value and drive the sustainable mobility revolution forward.

Connect with Ketan Rohom to Unlock Exclusive Insights and Accelerate Your Strategic Positioning by Securing the Electric Drive Axle Market Research Report

Interested decision-makers and stakeholders seeking to capitalize on the accelerating evolution of electric drive axle technologies are encouraged to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to obtain unparalleled access to the complete market research report. Engaging with Ketan will provide you with tailored intelligence on component innovations, supply chain adaptations, regulatory implications, and competitive positioning strategies. By securing this comprehensive analysis, your organization can streamline its strategic planning, uncover new revenue streams, and fortify its market presence against emerging global shifts. Connect today to transform insights into action and stay ahead in the dynamic electric drive axle arena.

- How big is the Automotive Electric Drive Axle Market?

- What is the Automotive Electric Drive Axle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?