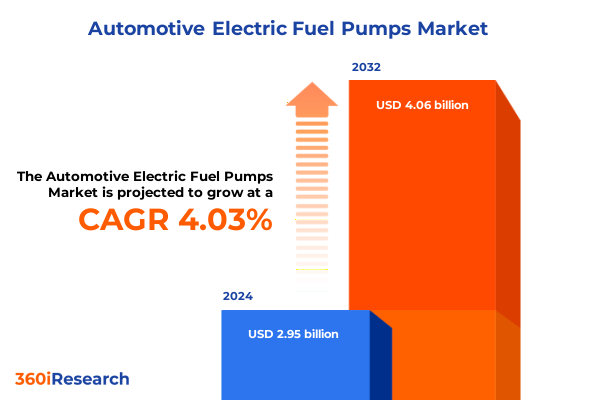

The Automotive Electric Fuel Pumps Market size was estimated at USD 3.07 billion in 2025 and expected to reach USD 3.19 billion in 2026, at a CAGR of 4.04% to reach USD 4.06 billion by 2032.

Discover the Crucial Role of Electric Fuel Pumps in Automotive Evolution and How Cutting-Edge Technologies Are Redefining Vehicle Performance

Electric fuel pumps represent a foundational component in modern automotive architectures, ensuring reliable fuel delivery across a diverse spectrum of vehicle applications. From high-performance passenger cars to robust commercial trucks and nimble two-wheelers, these electrically driven mechanisms maintain optimal fuel pressure, directly influencing engine efficiency, emissions performance, and overall drivability. As the automotive sector embraces increasingly stringent environmental regulations and transitions toward alternative fuel blends, the design and integration of electric fuel pumps have emerged as a critical competitive differentiator.

Furthermore, the convergence of electronic control systems and advanced materials engineering has elevated the electric fuel pump from a purely mechanical device to an intelligent subsystem capable of real-time monitoring and adaptive performance tuning. Innovations in high-pressure pump configurations, inline and in-tank designs, and low-pressure variants are expanding the scope of applications, while the integration of embedded sensors and communication interfaces enables predictive maintenance and remote diagnostics. This executive summary distills the latest industry trends, regulatory shifts, and strategic insights necessary for stakeholders to navigate the evolving landscape of electric fuel pump technologies.

Explore the Pivotal Industry Transformations Driven by Electrification, Digital Integration, and Emergent Regulatory Frameworks Shaping Fuel Pump Technologies

A seismic wave of transformation is reshaping the electric fuel pump landscape, driven by the convergence of electrification initiatives, evolving regulatory mandates, and the integration of digital intelligence. Historically confined to mechanical reliability and pressure delivery, modern electric fuel pumps are now engineered with sophisticated control algorithms, enabling dynamic adjustment in response to engine load, alternative fuel compositions, and stringent emissions standards. As a result, manufacturers are exploring novel materials such as high-grade polymers and corrosion-resistant alloys to ensure durability amidst higher thermal and chemical stresses.

Moreover, the industry’s migration toward hybrid powertrains and biofuel compatibility has prompted the development of modular pump architectures that can seamlessly transition between diesel, ethanol, and gasoline applications. These configurations facilitate streamlined assembly processes and reduce production complexity, while supporting rapid adaptation to region-specific fuel regulations. Concurrently, digital integration is enabling real-time telematics and onboard diagnostics, empowering OEMs and fleet operators with actionable insights to preempt failures and optimize maintenance intervals. Taken together, these transformative shifts underscore a period of unprecedented innovation, where cross-disciplinary collaboration and agile manufacturing practices are paramount to sustaining competitive advantage.

Assessing the Comprehensive Effects of Newly Implemented United States Tariffs in 2025 on Import Dynamics Supply Chains and Pricing Strategies

In 2025, the implementation of targeted United States tariffs on imported automotive components has exerted a pronounced influence on the electric fuel pump sector. Faced with levies on select origins, OEMs have been compelled to reassess sourcing strategies, pivoting toward domestic suppliers or nearshoring operations to mitigate cost escalations. Consequently, lead times for critical pump assemblies have lengthened in many cases, necessitating enhanced inventory buffers and more rigorous supplier performance metrics. In parallel, aftermarket channels have absorbed a portion of these cost pressures, transforming service pricing structures and heightening the emphasis on total cost of ownership for end users.

Beyond direct cost implications, the tariffs have catalyzed a wave of investment in localized manufacturing capabilities. Stakeholders are collaborating with regional foundries and precision machining facilities to bolster production agility and reduce exposure to global trade volatility. However, this pivot has also introduced challenges related to capacity ramp-up and workforce skilling, as domestic facilities adapt to sophisticated pump technologies previously concentrated in lower-cost geographies. Moreover, the reconfiguration of distribution networks has prompted OEMs and distributors to reevaluate partnership models, balancing the benefits of regional proximity against the risks of supply concentration.

Taken in aggregate, the cumulative impact of the 2025 tariff measures extends well beyond headline cost increases. It has reshaped competitive dynamics, accelerated the push for supply chain resilience, and amplified the strategic imperative for product differentiation. Organizations that embrace flexible sourcing, invest in digital supply chain visibility, and cultivate strong local supplier ecosystems will be best positioned to thrive in this recalibrated market environment.

Unpacking Segmentation Dynamics Across Vehicle Type Fuel Type Product Type and Distribution Channel to Illuminate Critical Market Variability

A nuanced appreciation of segmentation dynamics reveals the multifaceted nature of the electric fuel pump market. When examined through the prism of vehicle type, distinct requirements emerge across commercial trucks demanding high-durability pumps, off-road applications requiring ruggedized designs, passenger cars prioritizing noise and vibration suppression, and two-wheelers valuing compactness and energy efficiency. Each category drives unique engineering priorities, influencing decisions around material selection, pressure ratings, and electronic integration.

Shifting focus to fuel type segmentation, the market splits into diesel-centric modules optimized for high-pressure injection systems, ethanol-compatible pumps designed to withstand corrosive environments, and gasoline-oriented units balancing moderate pressures with cost efficiencies. These variations mandate targeted validation protocols and specialized sealing technologies to ensure longevity and performance consistency across differing chemical compositions.

Product type further refines market understanding, distinguishing high-pressure pumps essential for direct-injection engines from low-pressure variants supporting carbureted or port-injection architectures. Inline configurations facilitate straightforward integration into existing fuel lines, whereas in-tank pumps offer submersion cooling advantages, enhancing thermal management for high-output powertrains. Each design choice encapsulates trade-offs around packaging constraints, acoustic performance, and electrical demand.

Finally, distribution channel segmentation highlights strategic divergences between aftermarket and OEM pathways. Aftermarket distribution leverages established networks of distributors and rapidly growing online retail platforms to reach repair and upgrade markets, while original equipment supply relies on dealership networks and direct sales agreements to align closely with vehicle assembly cycles. Understanding the interplay of these distribution modalities is critical for stakeholders seeking to optimize channel performance and customer engagement.

This comprehensive research report categorizes the Automotive Electric Fuel Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Product Type

- Vehicle Type

- Distribution Channel

Delineating Regional Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Reveal Distinct Growth Enablers and Barriers

Regional analysis brings into sharp relief the divergent trajectories and enablers shaping electric fuel pump markets around the globe. In the Americas, demand is being propelled by regulatory tightening on emissions and a resurgence of interest in alternative fuels, prompting OEMs to expand production of ethanol-tolerant and gasoline direct-injection compatible pumps. North American manufacturing hubs are evolving to incorporate advanced robotics and additive manufacturing techniques, while aftermarket players ramp up online retail capabilities to serve a broadly distributed vehicle parc.

Conversely, the Europe, Middle East & Africa region is characterized by stringent Euro-VII emission targets and aggressive electrification roadmaps. As a result, European OEMs are investing heavily in high-pressure pump technologies for direct injection systems in passenger vehicles, even as Middle Eastern markets emphasize fuel quality compatibility and ruggedized configurations for harsh operating environments. Across Africa, nascent distribution infrastructures are fueling opportunities for both OEM partnerships and aftermarket channels to establish a foothold in rapidly urbanizing centers.

In the Asia-Pacific theatre, dynamic shifts are underway as China accelerates self-sufficiency goals and India advances ethanol blending mandates. Local pump manufacturers are leveraging economies of scale to drive down unit costs, while partnerships with global tier-one suppliers facilitate technology transfer and capacity expansion. Southeast Asian markets, in turn, exhibit strong growth potential, with a focus on compact pump designs for two-wheelers and light commercial vehicles. These regional nuances underscore the importance of tailored approaches in product development, regulatory compliance, and channel strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Electric Fuel Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Innovators Driving Advanced Electric Fuel Pump Developments Through Strategic Alliances and Technological Breakthroughs

A competitive landscape analysis highlights the strategic maneuvers of leading electric fuel pump manufacturers as they vie for market leadership. Established global entities have intensified research collaborations to push the boundaries of pressure output and control precision, while simultaneously forging alliances with material science specialists to explore lightweight composites and advanced coatings. At the same time, emerging players are capitalizing on niche applications, offering customized pump modules designed for biofuel compatibility and micro-hybrid systems.

Strategic partnerships between tier-one suppliers and OEMs are becoming increasingly prevalent, facilitating joint development programs that align pump performance specifications with powertrain integration requirements. In parallel, aftermarket specialists are investing in branded replacement pump lines and enhancing digital sales platforms to capture service revenue streams. Across the board, mergers and acquisitions activity has underscored the importance of scale and technology depth, as organizations seek to broaden their geographical footprints and consolidate their intellectual property portfolios.

These combined industry dynamics indicate a clear trajectory toward consolidation, vertical integration, and technology convergence. Companies that balance robust engineering prowess with agile go-to-market capabilities will secure a competitive edge in an environment where performance margins are increasingly dictated by system-level optimization and lifecycle value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Electric Fuel Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd

- Aptiv PLC

- Continental AG

- Denso Corporation

- Dorman Products

- Edelbrock, LLC

- Federal-Mogul Corporation

- General Motors Company

- Hitachi Astemo, Ltd

- MAHLE GmbH

- Mitsubishi Electric Corporation

- Pierburg GmbH

- Robert Bosch GmbH

- TI Fluid Systems PLC

Defining Strategic Action Plans for Industry Leaders to Capitalize on Emerging Opportunities Mitigate Disruptions and Enhance Competitive Positioning

Industry leaders must adopt a proactive stance to navigate the complex interplay of technological innovation, regulatory evolution, and global supply chain realignment. To begin with, investment in modular pump platforms offers the flexibility to address diverse vehicle architectures without proliferating unique part numbers, thereby streamlining manufacturing and reducing validation overhead. Complementary to this, embedding advanced diagnostics and connectivity features empowers predictive maintenance strategies that can lower total cost of ownership for end users and foster service-based revenue models.

Simultaneously, companies should cultivate resilient supply chain networks by balancing regional manufacturing capabilities with strategic raw material sourcing agreements. Nearshoring critical component production can mitigate tariff exposures and transportation risks, while digital supply chain visibility tools enable real-time demand forecasting and inventory optimization. In parallel, maintaining close collaboration with regulatory bodies and standards organizations ensures that product roadmaps remain aligned with forthcoming emissions and fuel quality mandates.

Finally, forging cross-sector partnerships-whether with advanced materials developers, telematics providers, or aftermarket distributors-can unlock new value pools and accelerate time to market. By integrating sustainability criteria into product and process design, industry leaders can further reinforce their competitive positioning in an era where environmental stewardship is increasingly intertwined with commercial success.

Outlining Rigorous Research Methodology Integrating Primary Insights Secondary Data and Analytical Frameworks to Ensure Robust Market Intelligence Delivery

The research underpinning this report combines primary qualitative and quantitative inputs with rigorous secondary analysis to deliver a holistic view of the electric fuel pump domain. Primary data was gathered through structured interviews with senior engineering executives at OEMs, supply chain managers at tier-one suppliers, and aftermarket distribution leads. These insights were triangulated with survey data from fleet operators and maintenance specialists to capture end-user perspectives on performance, reliability, and cost considerations.

Secondary research encompassed an exhaustive review of industry publications, technical standards, patent filings, and trade data across key regions. Analytical frameworks-including SWOT analysis, PESTEL assessment, and Porter’s Five Forces-were applied to elaborate on competitive pressures, regulatory influences, and macroeconomic variables. Data integrity was ensured through iterative validation workshops and methodological cross-checks, while proprietary models were utilized to map technology adoption curves and supply chain risk profiles.

By synthesizing diverse data streams within a structured analytical architecture, this methodology ensures that findings are both empirically grounded and strategically actionable. The result is a robust body of intelligence that equips stakeholders with the clarity needed to make informed investment, development, and market entry decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Electric Fuel Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Electric Fuel Pumps Market, by Fuel Type

- Automotive Electric Fuel Pumps Market, by Product Type

- Automotive Electric Fuel Pumps Market, by Vehicle Type

- Automotive Electric Fuel Pumps Market, by Distribution Channel

- Automotive Electric Fuel Pumps Market, by Region

- Automotive Electric Fuel Pumps Market, by Group

- Automotive Electric Fuel Pumps Market, by Country

- United States Automotive Electric Fuel Pumps Market

- China Automotive Electric Fuel Pumps Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Key Insights and Strategic Implications to Reinforce the Transformative Trajectory of Electric Fuel Pump Markets and Inform Decision Making

Electric fuel pump technology stands at the nexus of performance, emissions compliance, and supply chain resilience. Through this executive summary, we have explored how industry transformation is propelled by electrification trends, digital integration, and the cumulative effects of new tariff regimes. Segmentation and regional analyses reveal the multifactorial nature of market demands, underscoring the importance of tailored product architectures and channel strategies. Concurrently, competitive intelligence highlights the role of strategic partnerships and innovation ecosystems in driving differentiation.

Moving forward, stakeholders who prioritize modular design, predictive maintenance, and supply chain agility will be best positioned to capture value in a market defined by rapid regulatory shifts and evolving end-user expectations. In essence, success in the electric fuel pump arena requires a dual focus: pioneering technological advancements while reinforcing organizational resilience. With a clear understanding of market nuances and actionable insights at hand, decision-makers can confidently navigate this dynamic landscape and achieve sustainable growth.

Engage with Ketan Rohom for Exclusive Access to In-Depth Market Intelligence and Customized Consulting Solutions Tailored to Your Strategic Objectives

Engaging directly with Ketan Rohom offers unparalleled access to specialized analysis tailored to your organization’s unique strategic imperatives. By coordinating a consultation, you will receive a customized deep dive into electric fuel pump market drivers, competitive positioning, and technological trajectories. This personalized engagement ensures that your decision-making is informed by the most refined and actionable intelligence available. Reach out to schedule a strategic briefing and secure the comprehensive report that will empower your team to navigate disruptors, capitalize on emerging opportunities, and achieve sustainable growth in a rapidly evolving automotive ecosystem.

- How big is the Automotive Electric Fuel Pumps Market?

- What is the Automotive Electric Fuel Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?