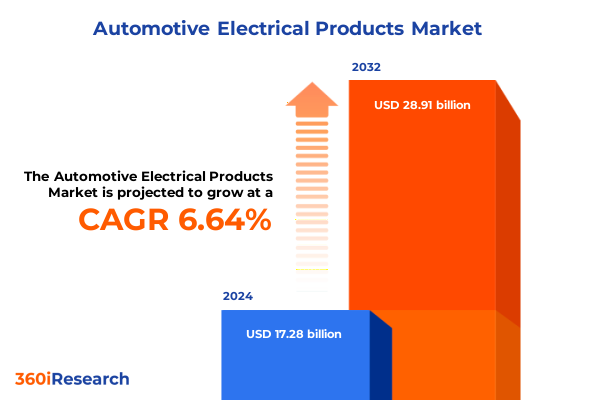

The Automotive Electrical Products Market size was estimated at USD 18.35 billion in 2025 and expected to reach USD 19.49 billion in 2026, at a CAGR of 6.71% to reach USD 28.91 billion by 2032.

Setting the Stage for the Future of Automotive Electrical Solutions Amid Rapid Electrification, Connectivity and Evolving Regulatory Landscape

Since the dawn of automotive innovation, electrical systems have evolved from rudimentary circuits powering basic lighting and ignition to sophisticated networks orchestrating vehicle performance, safety, and connectivity. Today, the convergence of electrification, digitalization, and autonomous driving ambitions has propelled electrical products from supporting players to central pillars in modern vehicle architecture. As original equipment manufacturers and tier suppliers adapt to this transformation, understanding foundational shifts and emerging imperatives is critical for capitalizing on new revenue streams and mitigating transitional risks.

This executive summary provides a concise yet comprehensive overview of the current dynamics shaping automotive electrical products. It begins by exploring the technological and market-driven forces catalyzing rapid change, then examines the cumulative effects of recent U.S. tariff measures. Next, it delves into multidimensional segmentation insights that reveal targeted innovation pathways and market opportunities. Regional variations are then unpacked to highlight growth drivers in key geographies. The analysis continues by profiling leading players whose strategic initiatives are redefining competitive boundaries and concludes with actionable recommendations for industry leaders. A clear exposition of research methodology precedes a conclusive synthesis of insights and imperatives to guide decision-making for stakeholders at every tier of the value chain.

Transformative Technological and Market Shifts Are Redefining the Automotive Electrical Products Landscape through Electrification and Autonomous Integration

Building on the foundational evolution of automotive electrics, the landscape is now experiencing unprecedented transformation driven by converging trends. Electrification is no longer confined to start-stop systems; it encompasses full battery electric vehicles supported by high-voltage architectures and advanced power electronics. Simultaneously, the drive for greater vehicle autonomy and enhanced safety has elevated sensors, control units, and connectivity modules to strategic focal points, with ADAS components such as camera, radar, and lidar sensors increasingly integrated into next-generation platforms.

Moreover, the proliferation of over-the-air software updates and vehicular connectivity has given rise to software-defined vehicles, where electrical architectures must support robust cybersecurity measures and seamless data exchange. This shift toward complexity and software integration underscores a transition from pure hardware supply to holistic, service-enabled offerings. As a result, alliances between semiconductor providers, software developers, and traditional automotive suppliers are forging new collaboration models that will define competitive advantage in the years ahead.

Assessing the Cumulative Effects of 2025 United States Tariffs on Automotive Electrical Product Supply Chains, Cost Structures and Strategic Sourcing

In 2025, an adjustment in United States tariff policy targeted select imported electrical components, precipitating a recalibration of global sourcing strategies. Suppliers heavily reliant on cross-border supply chains faced elevated input costs, compelling procurement teams to evaluate domestic manufacturing alternatives or to qualify new low-cost partners in tariff-neutral regions. These cost pressures spurred a wave of nearshoring initiatives, with several component manufacturers expanding capacity in North America to mitigate duties and ensure supply chain resilience.

In response, original equipment manufacturers have revisited contract terms, incorporating tariff-related contingencies and cost-pass-through clauses. At the same time, collaborative efforts between automakers and tier suppliers have intensified to optimize bill-of-materials structures and identify design modifications that reduce reliance on high-tariff parts. As these adjustments settle, the industry anticipates a more diversified sourcing footprint, characterized by balanced tradeoffs between cost optimization, quality standards, and regulatory compliance.

Extracting Deep Segmentation Insights Across Product, Vehicle, Distribution, Fuel and Voltage Dimensions to Illuminate Targeted Opportunities

Market segmentation reveals a multilayered ecosystem of product categories, beginning with traditional alternators, batteries, ignition systems, lighting modules, starter motors, switches, relays, and comprehensive wiring harnesses. Central to this evolution are electronic control units, which encompass body control, chassis control, engine control, telematics, and the increasingly critical ADAS control modules. Within the ADAS domain, camera, radar, and lidar sensors each serve distinct safety and automation functions, enabling adaptive cruise control, lane-keeping assist, and advanced collision avoidance.

Vehicle type classification spans heavy and light commercial vehicles, passenger cars, as well as three-wheelers and two-wheelers, reflecting the diverse power and packaging requirements across commercial and personal mobility segments. Distribution channel segmentation divides the landscape between original equipment manufacturing and aftermarket channels, with aftermarket further segmented into organized and unorganized networks that vary markedly in service capabilities. Fuel type distinctions capture the ongoing shift toward battery electric and hybrid vehicles alongside legacy internal combustion engine applications. Finally, voltage system segmentation highlights growth opportunities within high-voltage platforms at both 400V and 800V thresholds, while underscoring the enduring relevance of low-voltage systems for accessory and control circuits. Together, these segmentation lenses provide a comprehensive framework for mapping innovation, investment, and go-to-market strategies.

This comprehensive research report categorizes the Automotive Electrical Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fuel Type

- Voltage Systems

- Vehicle Type

- Distribution Channel

Uncovering Critical Regional Variations and Growth Drivers in the Americas, Europe Middle East & Africa and Asia-Pacific Automotive Electrical Markets

Regional analysis uncovers pronounced disparities in regulatory frameworks, adoption rates, and infrastructural readiness that shape the trajectory of electrical product demand. In the Americas, incentives for electric vehicles and a growing emphasis on domestic sourcing have accelerated deployment of high-voltage architectures and bolstered investment in powertrain electrification. Meanwhile, mature aftermarket networks in the United States and Canada continue to drive steady demand for replacement lighting, battery, and starter systems, even as OEM channels pivot toward advanced connectivity modules.

In the Europe, Middle East & Africa bloc, stringent emissions targets and comprehensive vehicle safety mandates have propelled rapid uptake of ADAS control modules and sophisticated sensor suites. The region’s robust automotive manufacturing footprint supports a virtuous cycle of innovation, where suppliers benefit from proximity to leading OEMs and regulatory incentives. Conversely, emerging markets across the Middle East and select African corridors present nascent opportunities for wiring harnesses and conventional electrical components as vehicle parc penetration expands.

The Asia-Pacific region remains the manufacturing heartland for automotive electrical products, driven by cost-competitive supply chains and a burgeoning domestic market for electrified vehicles. China’s policy support for New Energy Vehicles has sparked aggressive capacity additions in battery and power electronics, while Southeast Asian hubs are emerging as alternate production bases for wiring harnesses and starter motors. Across all three regions, the interplay of policy, infrastructure, and industrial capability dictates the pace and scale of technological adoption.

This comprehensive research report examines key regions that drive the evolution of the Automotive Electrical Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Shaping the Competitive Landscape of Automotive Electrical Products Through Technological Innovation and Strategic Partnerships

Leading suppliers have intensified efforts to expand technological capabilities and scale production of high-value components. Bosch has doubled down on power electronics research, focusing on silicon carbide inverter modules that enhance efficiency and thermal performance. Denso has broadened its sensor portfolio with advanced radar and camera fusion solutions designed for Level 2+ and Level 3 autonomous driving. Valeo has invested in 800V high-voltage charging interfaces and cutting-edge thermal management systems that support next-generation battery platforms.

Simultaneously, emerging challengers are carving niches in specialized sensor technologies and software-driven control units. Magna Electronics has launched a modular ECU architecture that enables over-the-air updates and personalized driver experiences. Marelli has introduced adaptive lighting systems that leverage AI-based image processing to optimize beam patterns. Partnerships between semiconductor firms and traditional component manufacturers are also proliferating, with collaborative ventures targeting integrated photonic sensors and next-wave power modules. These strategic initiatives together redefine competitive benchmarks and pave the way for new business models in the evolving automotive electrical ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Electrical Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- BLDC Pump Co., Ltd.

- Continental AG

- DENSO Corporation

- HELLA GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Marelli Holdings Co., Ltd.

- Mikuni Corporation

- Mitsubishi Electric Corporation

- Rheinmetall AG

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Strategic Actionable Recommendations to Empower Industry Leaders in Navigating Technological Disruption, Regulatory Dynamics and Supply Chain Complexities

To remain at the forefront of this dynamic market, companies must adopt a dual focus on near-term agility and long-term platform resilience. First, stakeholders should optimize supply chain structures by cultivating regional manufacturing hubs that mitigate tariff risks and enhance responsiveness to shifting end-market demands. Simultaneously, collaborative roadmaps with semiconductor and software vendors will be essential to integrate scalable, software-defined control units with agile development cycles.

Second, product roadmaps must prioritize modular architectures and platform convergence, enabling rapid feature deployment across multiple vehicle segments while containing bill-of-materials complexity. Investment in digital twins and virtual testing environments can further accelerate development timelines and reduce validation costs. Finally, forging joint innovation programs with OEMs and mobility service providers will unlock new revenue streams in vehicle-as-a-service and data-driven maintenance models. By grounding these initiatives in clear governance structures and cross-functional collaboration, industry leaders can navigate disruption with strategic clarity and operational excellence.

Research Methodology Outlining Robust Data Collection Approaches, Advanced Analytical Frameworks and Validation Protocols for Trustworthy Insights

This study employs a rigorous blend of primary and secondary research to ensure robustness and reliability. Primary insights derive from in-depth interviews with senior executives across OEMs, tier suppliers, and industry experts, supplemented by targeted surveys that capture real-time sentiment on technology adoption and sourcing strategies. Secondary data sources include technical white papers, regulatory publications, patent filings, and proprietary databases that collectively map the competitive landscape and delineate regulatory trajectories.

Analytical frameworks integrate segmentation analysis, value chain mapping, and scenario planning to evaluate the impact of emerging trends and policy shifts. Data triangulation techniques validate findings by cross-referencing multiple data points, while sensitivity analyses assess the resilience of strategic imperatives under varying market conditions. Quality control protocols, including peer reviews and methodological audits, underpin the final deliverables, ensuring that conclusions are grounded in verifiable evidence and reflect the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Electrical Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Electrical Products Market, by Product Type

- Automotive Electrical Products Market, by Fuel Type

- Automotive Electrical Products Market, by Voltage Systems

- Automotive Electrical Products Market, by Vehicle Type

- Automotive Electrical Products Market, by Distribution Channel

- Automotive Electrical Products Market, by Region

- Automotive Electrical Products Market, by Group

- Automotive Electrical Products Market, by Country

- United States Automotive Electrical Products Market

- China Automotive Electrical Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusion Highlighting Key Insights and Strategic Imperatives to Propel Stakeholders Forward in the Dynamic Automotive Electrical Product Landscape

The insights presented herein underscore that the future of automotive electrical products hinges on the convergence of electrification, connectivity, and software enablement. Companies that strategically realign their supply chains, embrace modular design principles, and cultivate collaborative innovation networks will be best positioned to capture emerging growth avenues. Moreover, regional nuances-from tariff-driven nearshoring in the Americas to regulatory-led ADAS acceleration in EMEA and manufacturing scale in Asia-Pacific-highlight the importance of tailored strategies aligned to local drivers.

As the industry transitions, the imperative for agility, precision, and forward-looking investment becomes paramount. Stakeholders must leverage the detailed segmentation and regional insights offered in this report to prioritize initiatives that balance cost efficiency with technological differentiation. Ultimately, success will favor those organizations that anticipate change, build resilient platforms, and cultivate an ecosystem of partnerships capable of navigating the complex terrain of tomorrow’s automotive landscape.

Engage with Ketan Rohom, Associate Director Sales & Marketing, to Secure Automotive Electrical Products Market Insights for Informed Strategic Decisions

Engage with Ketan Rohom to gain immediate access to a comprehensive exploration of product innovations, market trends, and strategic imperatives shaping the automotive electrical products landscape. By partnering with a seasoned Associate Director of Sales & Marketing, organizations will benefit from tailored guidance to align corporate strategies with the latest technological breakthroughs and evolving regulatory frameworks.

Reach out today to secure your copy of the in-depth market research report and empower your team to make data-driven decisions that drive competitive differentiation and sustainable growth in an increasingly electrified and connected automotive world.

- How big is the Automotive Electrical Products Market?

- What is the Automotive Electrical Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?