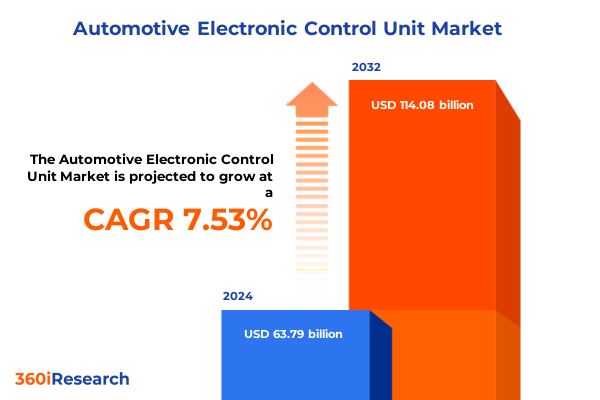

The Automotive Electronic Control Unit Market size was estimated at USD 68.06 billion in 2025 and expected to reach USD 72.62 billion in 2026, at a CAGR of 7.65% to reach USD 114.08 billion by 2032.

Setting the stage for advanced automotive electronic control units by highlighting foundational trends that are redefining vehicle intelligence and operational efficiency

The accelerating complexity of modern vehicles underscores the pivotal importance of electronic control units in orchestrating powertrain performance, safety mechanisms, and in-vehicle experiences. As electrification intensifies and software increasingly defines functionality, control units have transitioned from isolated modules to deeply integrated systems essential for delivering enhanced driving dynamics, regulatory compliance, and user-centric services.

In this landscape, the proliferation of sensor arrays and advanced driver assistance systems has driven exponential growth in ECU count per vehicle. Manufacturers are navigating the dual challenge of managing a heterogeneous network of legacy controllers while pursuing consolidation through next-generation domain controllers and zonal architectures. These shifts reflect the imperative to optimize vehicle weight, streamline software updates, and enhance cybersecurity resilience.

Against this backdrop, industry stakeholders must obtain a nuanced understanding of regulatory pressures, technological breakthroughs, supply chain vulnerabilities, and competitive positioning. This executive summary synthesizes critical market drivers, transformative shifts, tariff impacts, segmentation deep dives, regional outlooks, and strategic recommendations to guide informed decision making and support technology roadmaps.

Unveiling transformative shifts reshaping the automotive control unit landscape through software defined architectures and electrification imperatives

Over recent years, the automotive electronic control unit landscape has been reshaped by disruptive forces that transcend traditional component boundaries. The rise of software defined vehicles has accelerated consolidation of disparate controllers into centralized compute platforms, reducing complexity while enabling over-the-air upgrades that extend functional lifecycles and improve cybersecurity safeguards.

Concurrently, electrification has introduced new requirements for high-voltage battery management systems and power distribution controls, demanding ECUs capable of managing rapid charge cycles, thermal regulation, and energy recuperation. The integration of domain centralized and zonal architectures further exemplifies this transformation, shifting from a distributed topology of dozens of standalone modules to fewer, more powerful units overseeing entire vehicular domains or zones.

Advances in semiconductor technologies-including the adoption of system-on-chip designs and hardware accelerated real-time processing-have unlocked the potential for enhanced automotive artificial intelligence and sensor fusion capabilities. This convergence of hardware innovation and software modularity is redefining the role of ECUs, transforming them from deterministic controllers into intelligent nodes within a holistic digital vehicle ecosystem.

Assessing the cumulative effects of evolving United States tariff policies on automotive electronic control unit sourcing costs and supply chain resilience in 2025

Recent developments in United States trade policy have introduced significant cost pressures across the automotive electronic control unit supply chain. Under the Section 301 framework, tariffs on semiconductor imports are set to double to fifty percent on January 1, 2025, up from twenty-five percent, intensifying procurement costs for microcontrollers and power management chips required in ECU production. These increases compound earlier measures that raised duties on electric vehicle imports to one hundred percent as of September 27, 2024, creating cascading impacts on component sourcing strategies and supplier diversification efforts.

The cumulative effect of these tariffs is manifesting in extended lead times and elevated bills of materials, prompting original equipment manufacturers to reassess vendor relationships and explore regional supply networks. In parallel, component distributors and tier-one suppliers are recalibrating pricing structures, negotiating tariff mitigation through bonded warehousing and tariff engineering tactics, and accelerating localization of chip packaging and testing operations within North America.

As a result, engineering teams are tasked with balancing cost containment and performance requirements by optimizing ECU hardware baselines and prioritizing multi-source silicon strategies. The interplay between trade policy volatility and the rapid cadence of vehicle electrification underscores the imperative for dynamic procurement models that can adapt to evolving tariff landscapes.

Delivering key insights from multifaceted segmentation that dissect automotive control unit applications, propulsion types, vehicle classes and architectural paradigms

A comprehensive examination of market segmentation reveals nuanced demand drivers across applications, propulsion systems, vehicle classes, distribution channels, autonomy levels, and electronic architectures. Application insights underscore the breadth of ECU roles, encompassing climate control units, door control units and lighting control units within body electronics, brake control units and steering control units in chassis domains, engine control units and transmission control units powering the powertrain, safety and security systems such as airbag control units, antilock braking and electronic stability control, and telematics and infotainment functions spanning communication units, media infotainment units and navigation units.

Propulsion-based segmentation highlights divergent requirements for electric vehicles-including battery electric vehicles and fuel cell electric vehicles-hybrid configurations ranging from full hybrid to mild and plug-in hybrid formats, and internal combustion engines. Vehicle type classification captures demand differentials among heavy commercial vehicles such as buses and trucks, light commercial vehicles including pickups and vans, and passenger cars segmented into hatchbacks, sedans and SUVs. Distribution channel analysis contrasts aftermarket channels, both offline and online retail, with OEM supply chains, while autonomy segmentation spans Level One through Level Five capabilities, with Level Two features like adaptive cruise control and lane keeping assist, and Level Three innovations such as conditioned automated driving and traffic jam pilot. Finally, electronic architecture frameworks range from centralized and distributed designs to domain centralized architectures with separate controllers for body, chassis, infotainment and powertrain domains, and zonal architectures incorporating front, mid and rear zone controllers. This multidimensional segmentation underpins a precise understanding of where value is concentrated and how technological trajectories will influence ECU deployment strategies.

This comprehensive research report categorizes the Automotive Electronic Control Unit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Propulsion

- Level Of Autonomy

- Electronic Architecture

- Application

- Distribution Channel

Illuminating regional dynamics across the Americas, Europe Middle East and Africa and Asia Pacific that influence automotive electronic control unit adoption patterns

Regional dynamics play a critical role in shaping the development, production and adoption of electronic control units. In the Americas, automotive OEMs are advancing electrification programs and software integration, underpinned by robust domestic semiconductor investment incentives and supportive infrastructure development. This environment fosters collaboration between North American chip fabricators and automotive Tier One suppliers to co-develop next-generation controllers.

In Europe, the Middle East and Africa, stringent emissions regulations and safety standards are driving demand for advanced powertrain control modules and enhanced driver assistance ECUs. Regional policies promoting localized manufacturing and testing are encouraging strategic alliances between European automotive OEMs and semiconductor foundries to secure resilient supply chains.

Across the Asia-Pacific region, the rapid proliferation of electric and hybrid vehicles coupled with significant government subsidies has catalyzed volume production of ECUs. Local suppliers are scaling capacity to meet domestic demand while also competing in export markets, leveraging cost advantages and vertical integration strategies to deliver competitive electronic control solutions. These diverse regional trends collectively influence global product roadmaps, partnership models and investment priorities for control unit developers.

This comprehensive research report examines key regions that drive the evolution of the Automotive Electronic Control Unit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic profiles of leading global players driving innovation in automotive electronic control unit technologies through collaboration and investment

Global vendors are strategically positioning themselves through research alliances, targeted acquisitions and integrated software platforms in the competitive automotive control unit arena. Leading technology firms are expanding their domain controller portfolios to address the convergence of safety, connectivity and electrification requirements, while semiconductor companies are optimizing chip architectures for automotive-grade reliability and real-time processing performance.

Tier One suppliers are forging partnerships with cloud service providers to deliver secure over-the-air update mechanisms and vehicle data analytics infrastructures. Concurrently, established automotive component manufacturers are investing in specialized facilities for advanced packaging and testing of automotive microcontrollers to mitigate quality risks and reduce time to market. These collaborative initiatives reflect a broader industry imperative to harmonize hardware robustness with agile software deployment, ensuring that vehicles can rapidly adopt emerging features without compromising functional safety or regulatory compliance.

Through these strategic endeavors, key players are shaping the competitive landscape and establishing platforms that will dictate the pace and direction of next-generation ECU developments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Electronic Control Unit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Continental AG

- Delphi Technologies PLC

- DENSO Corporation

- Hella GmbH & Co. KGaA

- Hitachi Automotive Systems, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Lear Corporation

- Magna International Inc.

- Magneti Marelli S.p.A.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Sensata Technologies Holding PLC

- Valeo SA

- ZF Friedrichshafen AG

Presenting actionable recommendations for industry leaders to navigate technological disruption and policy uncertainties in automotive electronic control unit ecosystems

To navigate the accelerating pace of innovation and policy complexity within the electronic control unit sector, industry leaders should prioritize investment in adaptable software architectures that decouple functionality from hardware release cycles. This approach enables continuous feature enhancements, shorter time to customer and streamlined validation processes.

Moreover, diversifying supplier ecosystems by cultivating relationships with regional semiconductor foundries and packaging specialists can reduce exposure to tariff fluctuations and logistical disruptions. Establishing dual sourcing arrangements and qualifying alternative silicon variants early in the design process will foster resilience and competitive cost management.

In parallel, forging strategic partnerships with cloud and connectivity solution providers is essential for developing secure, scalable over-the-air update platforms and real-time data services. Organizations should also invest in cybersecurity capabilities and standardized communication protocols to protect against evolving threat vectors and ensure compliance with emerging regulatory frameworks.

Finally, building cross-functional teams that integrate engineering, procurement and legal expertise will enhance agility in responding to trade policy shifts and ensure alignment between technical roadmaps and commercial objectives.

Explaining the rigorous research methodology integrating primary interviews, secondary data sources and analytical validation for comprehensive market insights

This analysis integrates a structured research framework combining both primary and secondary research methodologies. In the secondary phase, industry publications, trade journals and regulatory filings were examined to capture the latest technological advancements, policy developments and competitive strategies. Publicly available patents and financial reports were also scrutinized to identify product roadmaps and investment trends.

Primary research included in-depth interviews with senior executives from automotive OEMs, Tier One suppliers, semiconductor fabricators and industry consultants. These discussions provided qualitative insights into emerging use cases, validation of supply chain challenges, and forward-looking perspectives on technology adoption.

Data triangulation was performed by cross-referencing inputs from diverse stakeholder groups, ensuring that findings reflect a consensus view and mitigate individual biases. Finally, thematic analysis techniques were applied to distill core insights and map interdependencies across market segments, regional dynamics and policy impacts. This rigorous approach ensures that the conclusions and recommendations presented are grounded in verifiable evidence and expert validation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Electronic Control Unit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Electronic Control Unit Market, by Vehicle Type

- Automotive Electronic Control Unit Market, by Propulsion

- Automotive Electronic Control Unit Market, by Level Of Autonomy

- Automotive Electronic Control Unit Market, by Electronic Architecture

- Automotive Electronic Control Unit Market, by Application

- Automotive Electronic Control Unit Market, by Distribution Channel

- Automotive Electronic Control Unit Market, by Region

- Automotive Electronic Control Unit Market, by Group

- Automotive Electronic Control Unit Market, by Country

- United States Automotive Electronic Control Unit Market

- China Automotive Electronic Control Unit Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Drawing conclusive perspectives on the evolution of automotive electronic control units and outlining strategic imperatives for future innovation pathways

The evolution of automotive electronic control units is defined by the convergence of software defined architectures, electrification imperatives and shifting global trade policies. As centralized and zonal architectures gain momentum, vehicles will rely on fewer, more powerful controllers that integrate diverse functionalities while delivering scalable performance and enhanced security.

Trade policy developments, particularly new tariff regimes, are reshaping sourcing strategies and accelerating regionalization of supply chains. At the same time, segmentation analysis highlights nuanced growth pockets across applications, propulsion types and vehicle classes, guiding investment priorities and partnership strategies.

Looking ahead, industry stakeholders must balance cost containment with innovation agility by embracing modular software infrastructures, diversifying supplier portfolios and reinforcing cybersecurity measures. Those who can integrate these strategic imperatives will be best positioned to lead the next wave of automotive control unit innovation and deliver differentiated vehicle experiences.

Engage directly with Ketan Rohom to secure the definitive automotive electronic control unit market research report tailored for strategic decision makers

Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive analysis can empower your strategic planning. Engage with a tailored discussion to uncover specific insights that address your organizational objectives and competitive priorities. Secure early access to proprietary findings and ensure your stakeholders are equipped with the most actionable intelligence in the automotive electronic control unit domain.

Position your team to capitalize on emerging opportunities and anticipate market shifts with confidence. Contact Ketan Rohom to initiate the process of acquiring the full report and transforming data into decisive action.

- How big is the Automotive Electronic Control Unit Market?

- What is the Automotive Electronic Control Unit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?