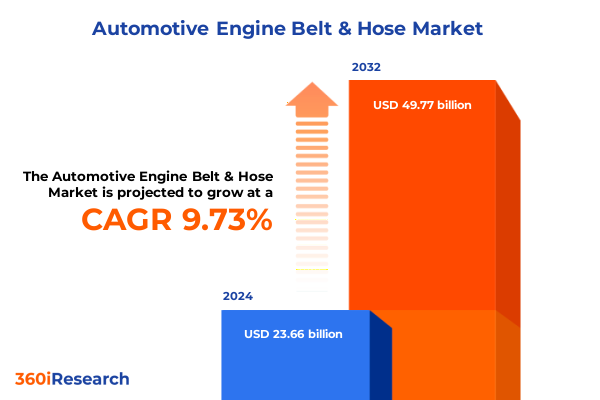

The Automotive Engine Belt & Hose Market size was estimated at USD 25.66 billion in 2025 and expected to reach USD 27.83 billion in 2026, at a CAGR of 9.92% to reach USD 49.77 billion by 2032.

Unveiling the Critical Role of Engine Belt and Hose Systems in Modern Automotive Performance and Reliability Across Diverse Vehicle Platforms

The engine belt and hose ecosystem stands as a foundational component of vehicle performance and reliability, sustaining critical functions from power transmission to thermal management. An intricate web of material compositions, design geometries, and manufacturing precision underpins the ability of these components to meet rigorous operational demands under extreme temperatures and mechanical stresses. As engines evolve in complexity and regulatory frameworks tighten around emissions and fuel efficiency, the performance tolerances for belts and hoses have become more stringent, positioning them at the forefront of automotive innovation.

In recent years, the convergence of powertrain electrification and advanced combustion technologies has introduced new requirements for belt-driven accessories and fluid conveyance systems. Electrified vehicles, while reducing the number of traditional accessory drives, have simultaneously increased the need for robust coolant circulation and high-voltage conduit protection, thereby reshaping the conventional scope of belt and hose applications. Moreover, heightened consumer expectations for longer service intervals and minimal maintenance have driven a paradigm shift toward premium materials and predictive maintenance solutions.

The dynamics of global supply chains have also influenced how belt and hose solutions are sourced, manufactured, and distributed. Fluctuations in raw material availability, trade policy adjustments, and manufacturing technology advancements have underscored the importance of agility and resilience among suppliers and OEMs. In this environment, collaboration across the value chain-from material scientists and extrusion specialists to aftermarket distributors-has become imperative for sustaining product quality and cost competitiveness.

As we embark on an in-depth exploration of transformative shifts, policy impacts, and strategic imperatives, this introduction sets the stage for understanding why engine belt and hose systems represent a critical nexus of performance, safety, and innovation within the broader automotive landscape.

Exploring the Industry Transformation Driven by Electrification, Advanced Materials, and Digital Integration in Engine Belt and Hose Manufacturing

Over the past decade, the automotive engine belt and hose industry has undergone transformative shifts driven by technological breakthroughs and evolving vehicle architectures. Electrification has emerged as a paramount driver, prompting suppliers to reimagine traditional serpentine belt configurations in hybrid powertrains and to engineer flexible high-voltage cable conduits that replicate hose-like attributes. Concurrently, manufacturers are integrating sensors and smart monitoring devices directly into belt assemblies, enabling real-time data transmission on wear rates, tension variations, and even micro-fracture detection.

Material innovation has further catalyzed industry evolution, with composite reinforcements and thermoplastic elastomer compounds offering superior strength-to-weight ratios compared to conventional rubber counterparts. These advanced materials not only optimize dynamic balance and reduce rotational inertia but also enhance chemical resistance in fuel and coolant hoses, extending service life under increasingly aggressive fluid formulations. The adoption of injection molding and co-extrusion techniques has streamlined production workflows, allowing for seamless integration of multi-layer constructions that fortify barrier properties and thermal insulation.

Digital integration extends beyond the product itself to encompass manufacturing and supply chain processes. Industry 4.0 paradigms such as predictive maintenance analytics, digital twins, and blockchain-based traceability systems have been deployed to minimize downtime, ensure compliance with stringent regulatory mandates, and optimize inventory levels across global distribution networks. As a result, suppliers are developing collaborative digital platforms that enable OEM partners to visualize end-to-end component lifecycles, accelerating product iteration and reducing time to market.

Looking ahead, the interplay of electrification trends, advanced material chemistries, and digital transformation promises to redefine the boundaries of belt and hose design, performance, and supply chain integration. These converging shifts will shape how industry participants innovate and compete within a rapidly evolving mobility ecosystem.

Assessing How the 2025 United States Tariff Adjustments Have Reshaped Cost Structures, Supply Chains, and Competitive Dynamics in the Belt and Hose Sector

The introduction of tariff adjustments by the United States in early 2025 has exerted a cumulative impact on the global production and distribution of engine belt and hose components. By revising duty classifications and elevating tariff rates on specific imported assemblies, the policy changes have prompted manufacturers to reassess their sourcing strategies and supply chain architectures. Many suppliers have responded by relocating extrusion and molding operations closer to end-market hubs, thereby mitigating cross-border duties and shortening lead times for aftermarket and OEM customers.

These protective measures have also influenced cost structures, as raw material inputs such as specialized elastomers and composite fibers become subject to enhanced levies when imported into the United States. In turn, component pricing strategies have been adjusted, with downstream suppliers absorbing a portion of the increased costs through value-engineering measures or negotiating long-term agreements with domestic chemical producers. As cost pressures mount, collaboration between tier-one suppliers and OEM engineers has intensified, fostering joint development initiatives aimed at optimizing material usage without compromising durability or performance.

Moreover, the tariff environment has accelerated the trend toward vertical integration among some leading manufacturers. By bringing extrusion, compounding, and assembly in-house, these organizations can exert greater control over input costs and maintain consistent quality standards across their product portfolios. Simultaneously, regional free trade agreements and nearshoring opportunities have gained prominence, offering alternative avenues for suppliers to access key markets while circumventing punitive duty structures.

Overall, the 2025 tariff adjustments have acted as a catalyst for operational realignments, supply base diversification, and strategic partnerships within the belt and hose sector. As stakeholders navigate these evolving trade dynamics, the emphasis on cost containment, supply resilience, and regulatory compliance will remain paramount.

Revealing Critical Segmentation Insights Across Product Variants, Material Choices, End User Behaviors, Distribution Channels, and Vehicle Categories

A nuanced understanding of market segmentation is essential for stakeholders aiming to align product development and go-to-market approaches with end-user requirements. When viewed through the lens of product type, belt assemblies encompass the well-established serpentine configuration found in many modern internal combustion engine layouts, the precision-driven timing belt that synchronizes camshaft operation, and the V-ribbed belt that balances flexibility with load-bearing capacity. Complementing these are hose assemblies that facilitate vital functions including air intake routing, engine cooling fluid circulation, precise fuel delivery, and radiator coolant management, each demanding tailored design and material properties to withstand operational stresses.

Material type segmentation highlights a trajectory away from traditional rubber compounds toward composite-reinforced structures and thermoplastic elastomer blends. Composite reinforcements deliver enhanced dimensional stability and tensile strength - attributes particularly beneficial for high-load belt configurations - while thermoplastic elastomers enable complex geometries and mass production efficiencies in hose assemblies. Despite this shift, rubber continues to play a critical role in aftermarket replacement parts, valued for its cost-effective resilience and ease of compatibility with older vehicle platforms.

End-user preferences further delineate market dynamics, as aftermarket customers prioritize availability and proven fitment for routine maintenance, whereas original equipment manufacturers emphasize integrated design optimization and long-term performance validation. Distribution channels reflect evolving purchasing behaviors, with traditional brick-and-mortar networks remaining a cornerstone for urgent repairs, while online platforms gain traction among fleet managers and service providers seeking rapid component sourcing and bulk ordering convenience.

Vehicle type segmentation underscores the divergent demands of commercial vehicle fleets, which require heavy-duty belts and hoses engineered for high-mileage cycles and variable load conditions, compared to passenger cars that favor lighter designs optimized for noise, vibration, and harshness reduction. This layered segmentation framework equips industry participants with the intelligence needed to tailor materials, manufacturing processes, and marketing strategies to distinct customer segments.

This comprehensive research report categorizes the Automotive Engine Belt & Hose market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- End User

- Distribution Channel

- Vehicle Type

Analyzing Regional Market Dynamics and Growth Drivers Across the Americas, EMEA, and Asia Pacific Belt and Hose Ecosystem

Regional market dynamics exhibit distinct characteristics shaped by regulatory frameworks, production footprints, and end-user demand patterns. In the Americas, established aftermarket distribution networks and proximity to major engine manufacturing hubs have fostered a focus on rapid component availability and just-in-time delivery models. Suppliers operating within this region benefit from robust infrastructure for extrusion and compounding, enabling them to serve both legacy internal combustion platforms and emerging hybrid powerplant requirements with minimal transit delays.

Across Europe, the Middle East, and Africa, stringent emissions standards and weight reduction targets have fueled adoption of advanced material solutions and multi-layer hose constructions. Suppliers in EMEA are leveraging technical expertise in polymer science to introduce hoses with integrated thermal barriers and sensors for fluid condition monitoring. Concurrently, trade agreements among member states facilitate cross-border collaboration, allowing manufacturers to optimize production allocation based on localized material costs and labor efficiencies.

The Asia-Pacific region continues to experience rapid growth in vehicle production, underpinned by expanding passenger car ownership and burgeoning commercial fleet investments. In this dynamic market, cost competitiveness and scalability are paramount, driving suppliers to establish regional manufacturing centers that capitalize on lower labor costs and proximity to raw material sources. OEM partnerships in APAC increasingly emphasize co-development of bespoke belt and hose solutions that align with regional engine designs and anticipated regulatory evolutions.

These distinct regional profiles underscore the importance of a geographically sensitive strategy for component manufacturers, one that harmonizes local production capabilities with global design standards and end-user expectations.

This comprehensive research report examines key regions that drive the evolution of the Automotive Engine Belt & Hose market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Major Industry Players’ Strategic Initiatives, Technological Innovations, and Collaborative Efforts in the Belt and Hose Segment

Industry leaders within the engine belt and hose segment have responded to evolving market pressures through strategic initiatives that span product innovation, capacity expansion, and collaborative alliances. Major players, including established hose specialists and belt manufacturers traditionally focused on internal combustion applications, are now diversifying their portfolios to accommodate hybrid and electric powertrain ecosystems. By investing in research partnerships with polymer science institutes, these companies are accelerating the development of next-generation elastomer blends and composite reinforcements that deliver enhanced performance under new operating paradigms.

Simultaneously, leading suppliers are forging alliances with digital technology firms to embed condition monitoring sensors into assembly lines and finished products. These collaborations enable the development of predictive maintenance platforms, offering fleet operators and OEMs advanced diagnostics that preemptively flag wear anomalies or fluid degradation. The integration of such capabilities not only differentiates product offerings but also fosters recurring revenue streams through data-driven service models.

Capacity growth is another focal area, with top-tier manufacturers expanding their global footprint through greenfield facilities and strategic acquisitions. These investments are often coupled with lean manufacturing practices and Industry 4.0 automation to boost throughput while maintaining tight quality tolerances. At the same time, select companies are establishing captive material compounding operations to secure access to critical input chemistries, thereby insulating their supply chains from external disruptions and price volatility.

Through a combination of targeted innovation, digital enablement, and operational excellence, key companies are positioning themselves to capture both near-term opportunities and long-term shifts in powertrain architectures and end-user requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Engine Belt & Hose market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bando Chemical Industries, Ltd.

- Continental AG

- Dayco Products LLC

- Federal-Mogul Motorparts LLC

- Gates Corporation

- Hutchinson SA

- Mitsuboshi Belting Ltd.

- Optibelt GmbH

- Parker-Hannifin Corporation

- SKF Group

- Sumitomo Riko Company Limited

- The Goodyear Tire & Rubber Company

- Vinko Auto Industries Ltd.

Providing Actionable Strategic Recommendations for Industry Leaders to Navigate Evolving Challenges and Capitalize on Opportunities in the Belt and Hose Market

Industry participants seeking to navigate the complexities of the current belt and hose market environment should prioritize a dual focus on agility and differentiation. First, material research and development programs must be accelerated to refine composite and thermoplastic elastomer formulations that deliver weight savings, durability, and compatibility with evolving fluid chemistries. By collaborating closely with polymer suppliers and research institutions, organizations can reduce development cycles and rapidly introduce performance-differentiated products.

Second, digitization of the value chain should be advanced through the deployment of sensor integration and predictive analytics. Suppliers that embed condition monitoring capabilities into belt and hose assemblies will not only enhance product value but also create opportunities to establish long-term service agreements with OEMs and fleet operators. This model shifts the revenue mix toward subscription-based diagnostics and reinforces customer loyalty.

Third, diversification of the supply base and manufacturing footprint is critical to mitigating trade policy risks and raw material volatility. Developing regional compounding facilities or forging strategic alliances with nearshore partners can buffer cost fluctuations associated with tariff adjustments. Simultaneously, adopting flexible production systems and modular assembly lines will enable swift reconfiguration in response to regulatory changes or shifts in end-user demand.

Finally, strategic partnerships with OEM engineering teams and distribution network operators should be deepened to co-create custom solutions and streamline go-to-market execution. By aligning product roadmaps with customer development cycles and leveraging digital channels for targeted distribution, industry leaders can sustain competitive advantage amid rapidly evolving mobility trends.

Detailing the Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Triangulation Techniques

The methodology underpinning this analysis integrates a rigorous blend of primary and secondary research techniques, ensuring that insights are both comprehensive and empirically grounded. On the primary research front, in-depth interviews were conducted with a cross-section of stakeholders, including OEM component engineers, tier-one suppliers, aftermarket distributors, and material scientists. These conversations provided direct observations on evolving design requirements, procurement strategies, and technology adoption trajectories.

Secondary data sources encompassed industry publications, regulatory filings, trade association reports, and technical journals, offering historical context and benchmarking data on material performance, manufacturing capacities, and policy frameworks. By synthesizing information from these disparate sources, the analysis adjudicated between conflicting viewpoints and validated emerging themes through triangulation.

Quantitative data points, such as shipment volumes and production capacities, were cross-verified against established industry databases and proprietary company disclosures. Market mapping exercises were employed to delineate the geographic distribution of manufacturing hubs, raw material suppliers, and distribution networks, thereby highlighting potential bottlenecks and growth corridors.

Finally, qualitative insights were structured using a multi-layered segmentation framework that considers product variants, material compositions, end-user profiles, distribution pathways, and vehicle platforms. This approach ensures that strategic recommendations and competitive analyses are contextualized within the specific market niches that matter most to decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Engine Belt & Hose market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Engine Belt & Hose Market, by Product Type

- Automotive Engine Belt & Hose Market, by Material Type

- Automotive Engine Belt & Hose Market, by End User

- Automotive Engine Belt & Hose Market, by Distribution Channel

- Automotive Engine Belt & Hose Market, by Vehicle Type

- Automotive Engine Belt & Hose Market, by Region

- Automotive Engine Belt & Hose Market, by Group

- Automotive Engine Belt & Hose Market, by Country

- United States Automotive Engine Belt & Hose Market

- China Automotive Engine Belt & Hose Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Illuminate Market Trajectory, Emerging Trends, and Strategic Imperatives for the Belt and Hose Industry Moving Forward

This study has illuminated the critical interplay between technological innovation, regulatory environments, and supply chain resilience within the engine belt and hose market. By tracing transformative shifts such as electrification and digital integration, assessing the ripple effects of 2025 tariff realignments, and dissecting nuanced segmentation and regional dynamics, the analysis provides a holistic view of current market drivers and potential disruptors.

Key findings reveal that advanced materials and embedded monitoring capabilities are no longer peripheral considerations but central to delivering competitive advantage and meeting stringent performance benchmarks. Likewise, the strategic recalibration of sourcing and manufacturing footprints in response to trade policy shifts underscores the necessity of operational flexibility.

Looking ahead, stakeholders must navigate an environment where regulatory pressures, new vehicle architectures, and evolving distribution models converge to redefine market parameters. The imperative for collaboration across the value chain-from material innovators to OEM engineering teams and aftermarket distributors-will be paramount in charting a successful trajectory.

Ultimately, the insights articulated in this study serve as a strategic compass, guiding industry players toward informed decisions that balance innovation, cost efficiency, and market responsiveness.

Engage with Ketan Rohom to Unlock In-Depth Intelligence and Secure Your Comprehensive Belt and Hose Market Research Report Today

To explore how these in-depth insights can be tailored to your specific strategic objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will gain immediate access to a customizable briefing that highlights the most critical findings and actionable takeaways from this study. This collaboration will ensure your organization has a detailed understanding of the competitive landscape, supply chain nuances, and emerging technologies shaping the belt and hose market. Partnering with Ketan Rohom will streamline your path to informed decision-making and equip your team with the robust intelligence needed to drive growth and innovation. Secure your comprehensive market research report today and take the first step toward capitalizing on the opportunities and mitigating the risks detailed throughout this analysis.

- How big is the Automotive Engine Belt & Hose Market?

- What is the Automotive Engine Belt & Hose Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?