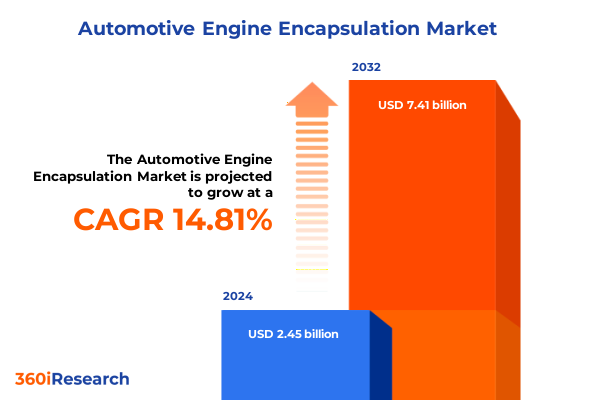

The Automotive Engine Encapsulation Market size was estimated at USD 2.76 billion in 2025 and expected to reach USD 3.12 billion in 2026, at a CAGR of 15.12% to reach USD 7.41 billion by 2032.

Setting the Stage for the Future of Automotive Engine Encapsulation with Emerging Technologies, Sustainability, and Regulatory Dynamics

Engine encapsulation technology maintains optimal engine temperatures, reduces fuel consumption, and dampens noise emissions, positioning it as a critical component in modern vehicle architecture rather than a mere afterthought

Moreover, stringent emissions and noise regulations across major markets have elevated encapsulation from an optional accessory to a standard requirement, compelling automakers to innovate solutions that align with both performance and compliance imperatives

As the automotive landscape evolves, encapsulation systems are increasingly integrated early in vehicle design cycles, converging thermal, acoustic, and structural functions to deliver enhanced driving comfort and regulatory adherence. This integration has catalyzed collaborations between OEMs, material scientists, and acoustic engineering firms to optimize encapsulation modules for diverse powertrains and operating environments.

Transformative Shifts Reshaping Automotive Engine Encapsulation Through Lightweight Materials and Electrification Driven by Performance and Emission Standards

The transition to lightweight composite materials has redefined encapsulation performance benchmarks, with automakers adopting polyurethane foams, glass fiber–reinforced plastics, and carbon fiber composites to achieve superior thermal and acoustic insulation without weight penalties

Simultaneously, the rise of advanced manufacturing techniques-such as automated 3D molding and precision design workflows-has enabled suppliers to produce encapsulation parts that conform precisely to complex engine geometries, optimizing airflow management and heat retention efficiency

Sustainability considerations have further accelerated the adoption of recyclable thermoplastics and low-VOC coatings; in 2024, over one-fifth of European encapsulation systems incorporated partially recycled polymers, underscoring a shift toward circular economy practices within supply chains

Meanwhile, electric and hybrid vehicle proliferation continues to reshape encapsulation requirements, as more than half of global suppliers now tailor solutions to battery thermal management and electric drive noise suppression, reflecting the market’s pivot toward electrification-led design strategies

Assessing the Cumulative Impact of the 2025 United States Tariffs on Automotive Engine Encapsulation Supply Chains and Material Costs

In April and May of 2025, the United States instituted 25 percent tariffs on all imported light-duty vehicles and automotive parts, including encapsulation components, marking a significant escalation in trade policy and trade-cost pressures

These tariffs compound existing duties on steel and aluminum, which impose 25–35 percent cost increases, as well as levies on semiconductor microcontrollers and battery components that elevate acquisition costs by up to 50 percent, driving an overall 7–12 percent increase in average vehicle production costs

North American just-in-time supply chains have experienced disruptions as components cross multiple borders, triggering customs delays and administrative hurdles; analysts project that up to a third of light-vehicle output could face bottlenecks due to proof-of-origin requirements and delayed parts flows

Although these higher duties were intended to bolster domestic production, many U.S. businesses have absorbed the increased costs rather than passing them entirely to consumers, with the government collecting an additional $55 billion in tariff revenue in 2025-an outcome that underscores both corporate resilience and margin squeeze within automotive supply networks

Unveiling Key Segmentation Insights Revealing How Technology, Engine Type, Material, Product, Vehicle Type, and Application Drive Market Opportunities

A technology-driven lens reveals that encapsulation systems are categorized into conformal coatings-spanning acrylic, silicone, and urethane formulations-precision injection molded parts in thermoplastic and thermoset variants, and durable potting solutions utilizing epoxy and silicone matrices, each addressing distinct performance and assembly requirements.

Examining engine type segmentation clarifies that diesel, electric, gasoline, and hybrid powertrains each present unique thermal and acoustic challenges, prompting tailored encapsulation designs that optimize efficiency and NVH characteristics for every propulsion architecture.

Material segmentation underscores a balance between composite materials for advanced insulation, metals for structural reinforcement, and polymers for cost-effective molding, reflecting the interplay of performance, weight reduction, and manufacturability in product development.

The market’s product segmentation distinguishes between standalone kits and component-level offerings-adhesives, coatings, and sealants-enabling OEMs and aftermarket providers to select modular or integrated encapsulation solutions based on serviceability and assembly workflows.

Vehicle type segmentation bifurcates demand between commercial and passenger platforms, where durability and longevity are prioritized in heavy-duty fleets, while passenger applications emphasize noise comfort and lightweight construction.

Finally, application segmentation differentiates between OEM-fitted systems engineered for line-fit performance and aftermarket solutions optimized for retrofit and service operations, illustrating how distribution channels align with end-user requirements across the vehicle lifecycle.

This comprehensive research report categorizes the Automotive Engine Encapsulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Engine Type

- Material

- Product

- Vehicle Type

- Application

Exploring Key Regional Dynamics Highlighting Distinct Trends and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia Pacific Markets

In the Americas, strong regulatory momentum toward stricter emissions and acoustic standards is steering automakers to adopt encapsulation systems that enhance warm-up times, improve fuel economy, and reduce under-hood noise. North American manufacturers increasingly integrate encapsulation early in vehicle platforms to meet both national and state-level requirements, underscoring the region’s role as a testing ground for next-generation thermal management solutions

Across Europe, Middle East & Africa, stringent Euro 7 noise and emissions regulations serve as catalysts for innovation in sustainable materials and advanced acoustic engineering. European OEMs and suppliers collaborate closely with specialized acoustic laboratories to validate dual-function encapsulation modules that simultaneously comply with environmental mandates and consumer expectations for quiet cabin environments

Asia-Pacific stands out as the largest regional market, accounting for nearly half of global encapsulation demand, driven by substantial automobile production in China, India, Japan, and South Korea. The region’s combination of high-volume manufacturing, rising vehicle electrification rates, and growing environmental awareness has accelerated adoption of lightweight composite and recyclable encapsulation materials, reinforcing APAC’s position at the forefront of market expansion

This comprehensive research report examines key regions that drive the evolution of the Automotive Engine Encapsulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Players and Competitive Strategies Driving Innovation and Collaboration in the Automotive Engine Encapsulation Landscape

Leading players such as ElringKlinger, Autoneum, and Continental have intensified partnerships with acoustic engineering firms to launch dual-function encapsulation modules, with more than 61 percent of new product introductions in 2025 featuring integrated thermal and noise management capabilities

Global chemical innovators including BASF, Evonik, and Greiner Foam International are advancing high-performance thermoplastics and recyclable polymer blends that meet stringent durability requirements while enabling lightweight construction, reinforcing sustainability objectives across the value chain

Automotive technology leaders such as ZF Friedrichshafen, BorgWarner, Schaeffler Technologies, and Robert Bosch have invested in digital twin simulations and automated 3D molding to produce encapsulation components precisely matched to both combustion and electric powertrain architectures, ensuring optimized thermal gradients and acoustic attenuation

Component specialists like 3M Company and UFP Technologies are differentiating through low-VOC adhesives and flame-retardant coatings, addressing regulatory compliance and serviceability needs while supporting rapid assembly and maintenance workflows in OEM and aftermarket channels

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Engine Encapsulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adler Pelzer Holding GmbH

- Aisin Seiki Co., Ltd.

- Autoneum Holding AG

- BASF SE

- Compagnie de Saint-Gobain S.A.

- Continental AG

- Dana Incorporated

- ElringKlinger AG

- Forvia NV

- Freudenberg SE

- Hutchinson SA

- Valeo SA

Delivering Actionable Recommendations for Industry Leaders to Navigate Market Dynamics and Capitalize on Emerging Opportunities in Engine Encapsulation

Industry leaders should prioritize expansion of localized manufacturing footprints to mitigate tariff-driven cost pressures while leveraging USMCA and other free-trade agreements to secure near-shore supply of critical encapsulation materials-a strategy already adopted by Taiwanese parts suppliers redirecting operations to Mexico and other compliant regions

Investing in advanced material R&D-particularly in bio-based polymers, recyclable thermoplastics, and multi-layer composite systems-will fortify competitive positioning by aligning product portfolios with evolving sustainability mandates and consumer preferences for eco-friendly vehicles.

Deploying digital twin and automated design workflows to accelerate prototyping and validation can reduce time-to-market for bespoke encapsulation solutions, enabling rapid adaptation to diverse engine architectures and regional regulatory requirements.

Forging collaborative partnerships with acoustic engineering firms, battery thermal specialists, and adhesives manufacturers will facilitate end-to-end module optimization, ensuring encapsulation systems deliver unified performance across thermal, acoustic, and structural dimensions.

Detailing Rigorous Research Methodology Employed to Deliver Insights on Automotive Engine Encapsulation Market with Data Triangulation and Analytical Rigor

This study combined extensive secondary research with primary interviews of industry stakeholders to ensure comprehensive coverage of market dynamics. Secondary sources included technical articles, trade journals, corporate filings, and regulatory publications, while primary inputs were gathered from supplier executives, OEM engineers, and materials experts.

Quantitative data was triangulated through cross-verification across multiple databases, regional trade statistics, and financial reports to corroborate trends such as material adoption rates, regional demand shifts, and tariff impacts. This rigorous approach minimized biases and increased the reliability of insights.

Qualitative analysis incorporated scenario planning and Porter’s Five Forces evaluations to assess competitive intensity, supplier power, and the influence of regulatory drivers. Custom frameworks were applied to segment the market by technology, engine type, material, product, vehicle type, and application, facilitating granular opportunity mapping.

Finally, iterative validation workshops with industry practitioners refined forecasts and strategic recommendations, resulting in an actionable and robust framework that aligns with stakeholder needs and evolving market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Engine Encapsulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Engine Encapsulation Market, by Technology

- Automotive Engine Encapsulation Market, by Engine Type

- Automotive Engine Encapsulation Market, by Material

- Automotive Engine Encapsulation Market, by Product

- Automotive Engine Encapsulation Market, by Vehicle Type

- Automotive Engine Encapsulation Market, by Application

- Automotive Engine Encapsulation Market, by Region

- Automotive Engine Encapsulation Market, by Group

- Automotive Engine Encapsulation Market, by Country

- United States Automotive Engine Encapsulation Market

- China Automotive Engine Encapsulation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Evolution of Automotive Engine Encapsulation and Strategic Imperatives for Stakeholders to Secure Sustainable Growth

The analysis confirms that automotive engine encapsulation has transitioned from a niche acoustic solution to an integral design element driven by regulatory mandates, electrification trends, and sustainability imperatives. As lightweight composite materials, advanced manufacturing techniques, and recyclable polymers gain traction, the market will continue to evolve in complexity and strategic importance.

Tariff pressures introduced in 2025 underscore the need for agile supply chain strategies, including localization and near-shoring, to preserve cost competitiveness while maintaining performance standards. Regional dynamics highlight differentiated pathways: North America’s regulatory enforcement, EMEA’s sustainability leadership, and APAC’s volume-driven innovation each present unique opportunities.

Market leaders that embrace material innovation, digital design workflows, and collaborative ecosystems will be best positioned to capture value. By aligning product portfolios with the shift toward electric and hybrid powertrains, while satisfying increasingly stringent noise and emission regulations, stakeholders can secure long-term growth and strengthen their competitive edge in this high-value market segment.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence and Drive Strategic Decisions in Automotive Engine Encapsulation

To obtain the full Automotive Engine Encapsulation market research report and gain an in-depth understanding of evolving trends, emerging opportunities, and strategic imperatives, please reach out to Ketan Rohom (Associate Director, Sales & Marketing) to place your order and receive a tailored consultation that will empower your organization’s strategic decisions and competitive positioning in this dynamic market.

- How big is the Automotive Engine Encapsulation Market?

- What is the Automotive Engine Encapsulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?