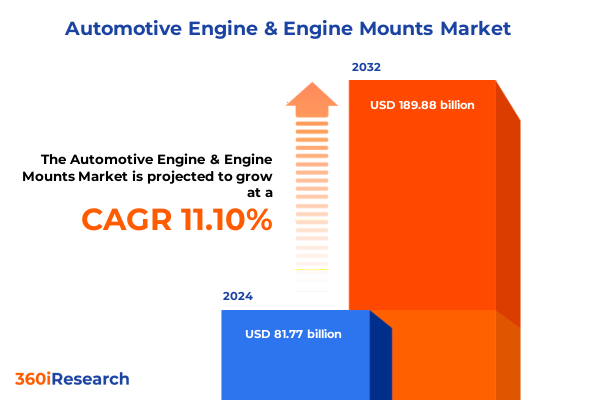

The Automotive Engine & Engine Mounts Market size was estimated at USD 89.77 billion in 2025 and expected to reach USD 98.56 billion in 2026, at a CAGR of 11.29% to reach USD 189.88 billion by 2032.

Unveiling the Intersection of Engine Innovations and Mounting Technologies Driving Automotive Performance and Reliability in an Evolving Market Landscape

In an era defined by stringent emissions regulations, rising consumer expectations, and a swift shift towards electrification, automotive engines and their corresponding mounting solutions have never been more critical to vehicle performance and reliability. As the heart of propulsion systems, engines serve as the nexus of power delivery, thermal management, and operational efficiency. Simultaneously, engine mounts ensure structural integrity by mitigating noise, vibration, and harshness, directly impacting ride comfort and component longevity.

Today, industry stakeholders grapple with a multifaceted landscape where legacy internal combustion platforms coexist with sophisticated electric powertrains and hybrid systems. This intricate ecosystem demands a nuanced understanding of how evolving materials, advanced manufacturing methods, and digital integration converge to shape next-generation engine and mount technologies. As consumer preferences pivot toward sustainability without compromising performance, automotive developers and suppliers must reconcile previously competing priorities in real time.

Against this backdrop, it is essential to examine the symbiotic relationship between power units and mounting assemblies. Engine mounts must be engineered to accommodate expanding torque profiles from high-output electric motors, as well as fluctuating vibration characteristics inherent in modern hybrid drivetrains. Consequently, strategic investment in resilient mounting architectures underpins the successful deployment of emerging powertrain innovations.

This executive summary distills comprehensive insights into recent market dynamics, key regulatory catalysts, and transformative technological shifts bearing on engine and mount sectors. By synthesizing segmentation analyses, regional nuances, and company profiles, the forthcoming sections equip decision makers with the strategic intelligence needed to navigate uncertainty, optimize product portfolios, and secure sustainable growth.

Exploring the Rapid Electrification, Digital Transformation, and Sustainability Imperatives Reshaping Powertrain and Mount Engineering Paradigms for Future Mobility

Over the past decade, mobility infrastructures have advanced at breakneck speed, propelled by the imperative for lower carbon footprints and enhanced connectivity. Electrification has emerged as a defining trend, transforming powertrain architectures and spawning an array of electric drive units that demand bespoke mounting philosophies. Simultaneously, the adoption of lightweight materials-such as carbon fiber reinforced polymers and high-strength alloys-has underscored the need for mounts that balance resilience with weight reduction targets.

Moreover, the digitalization of vehicle systems has introduced a new set of challenges and opportunities. Real-time condition monitoring, enabled by integrated sensors within mounts, offers predictive maintenance insights that can preempt costly downtime. Artificial intelligence and machine learning algorithms now interpret vibration and load data to optimize mounting stiffness and damping coefficients dynamically. This convergence of mechanical engineering and software intelligence heralds a transformative era in which mounts are no longer passive support components but active contributors to powertrain health.

In parallel, regulatory bodies across major markets have instituted rigorous testing protocols for crashworthiness, NVH performance, and thermal survivability. Compliance with evolving test standards compels original equipment manufacturers to iteratively refine mount design, integrating multi-layer damping materials and modular assembly concepts capable of meeting both global and region-specific mandates. Consequently, collaboration across the supply chain is intensifying, spanning material suppliers, component fabricators, and vehicle assemblers.

Furthermore, the growing emphasis on circular economy principles has spurred research into recyclable elastomers and sustainable hydraulic fluids for mount applications. By embedding eco-friendly practices into the design-for-manufacturability process, industry leaders are setting new benchmarks for environmental stewardship and resource efficiency. Taken together, these systemic shifts represent a leap forward in how engines and mounts are conceptualized, manufactured, and maintained.

Assessing the Compound Effects of New US Tariff Measures on Automotive Engine Parts and Mount Assemblies Impacting Costs, Supply Chain Resilience, and Market Dynamics

In early 2025, the United States government implemented a series of tariff adjustments targeting imported automotive components, including engine parts and mounting assemblies. The measures, designed to bolster domestic manufacturing and address trade imbalances, have introduced new complexities to cost structures and cross-border supply chains. Steel and aluminum levies, in particular, have elevated raw material expenses, prompting suppliers to reassess global sourcing strategies in light of higher input costs.

Consequently, manufacturers dependent on overseas production hubs have faced margin erosion or have been compelled to reallocate production to North American facilities. This shift has accelerated investments in automation and in-house metallurgical processes, aiming to offset tariff-induced cost pressures through enhanced productivity and localized value creation. Furthermore, contract renegotiations with tier-1 and tier-2 suppliers have become commonplace as stakeholders seek to share the burden of tariff escalation while ensuring uninterrupted component flow.

Additionally, the tariff landscape has reshaped inventory management philosophies. Firms now adopt dual sourcing models and strategic stockpiling of critical engine mount subassemblies to buffer against potential supply chain bottlenecks. This proactive stance enhances resilience but also imposes working capital constraints that reverberate through procurement and finance functions. Collaborative forecasting mechanisms, harnessing advanced analytics to predict tariff impacts on demand volumes, have emerged as best practices in this environment.

Finally, the cumulative effect of these policy changes is manifesting in shifting competitive dynamics. Domestic suppliers with fully integrated facilities are gaining market share, whereas import-reliant players reevaluate market participation strategies. As the tariff regime continues to evolve with potential bilateral negotiations and exemption reviews, agility and scenario planning remain imperative for navigating this fluid cost and trade framework.

Illuminating Key Market Segmentation Categories That Reveal Critical Insights into Engine Technologies, Mount Variants, Vehicle Classifications, Channels, and End User Demands

A granular view of the automotive engine and mount sectors must account for multiple lenses of segmentation that illuminate diverse performance drivers and customer requirements. Analysis based on engine type explores diesel, electric, gasoline, and hybrid powertrains, each presenting distinct vibration spectra, thermal profiles, and torque delivery patterns that dictate mount design criteria. Furthermore, mount type considerations encompass hydraulic, liquid filled, and rubber variants, reflecting a spectrum of damping capabilities and service life expectations aligned with varying operational regimes.

Equally pivotal is the classification of vehicle types into commercial vehicles and passenger cars, since heavy-duty transportation platforms demand robust mount architectures engineered for extended duty cycles, whereas passenger mobility emphasizes NVH refinement and compact packaging. In addition, end user dynamics contrast aftermarket channels with original equipment manufacturer integration, highlighting divergent priorities around cost optimization, certification processes, and installation complexity. Finally, sales channel analysis juxtaposes offline and online distribution networks, underscoring the growing influence of e-commerce platforms in aftermarket replacement sales alongside traditional brick-and-mortar supply chains.

By synthesizing these segmentation categories, stakeholders can tailor product roadmaps and marketing strategies to capitalize on nuanced growth pockets. For instance, electric powertrains coupled with hydraulic mount solutions are gaining traction in premium vehicle tiers, where performance and comfort benchmarks justify higher unit costs. Conversely, rubber mounts retain strong demand in cost-sensitive fleets and budget vehicle segments, especially when sourced via streamlined online channels that reduce overhead.

Ultimately, this multi-dimensional segmentation framework enables a more precise alignment of engineering innovation, distribution approaches, and end user value propositions, thereby enhancing the probability of commercial success within an increasingly heterogeneous marketplace.

This comprehensive research report categorizes the Automotive Engine & Engine Mounts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Type

- Mount Type

- Vehicle Type

- End User

- Sales Channel

Navigating Regional Disparities in Automotive Engine and Mount Markets Highlighting Growth Drivers, Regulatory Nuances, and Competitive Positioning across Global Territories

Understanding regional variances is critical for formulating effective market penetration and expansion strategies for engine and mount solutions. In the Americas, stringent emissions legislation in the United States and Canada is accelerating the roll-out of hybrid and electric powertrains, driving demand for mounts capable of accommodating both high torque scenarios and ultra-quiet cabin environments. Investment incentives for domestic production under recent trade policies further strengthen North American supply chain resilience, while aftermarket growth remains buoyed by an extensive network of repair and maintenance facilities.

Meanwhile, the Europe, Middle East & Africa region presents a tapestry of regulatory landscapes and consumer behaviors. Western European markets continue to pioneer zero-emission mandates, fostering rapid uptake of electric drivetrains that require bespoke liquid filled mounts for thermal damping in cold climates. In contrast, Middle Eastern and African markets prioritize diesel and gasoline platforms, underscored by robust demand for durable rubber mount systems suited to high-temperature conditions and variable fuel quality.

In the Asia-Pacific zone, a broad spectrum of market maturity levels characterizes demand for engine and mount technologies. Developed markets such as Japan and South Korea lead in lightweight hybrid integration and advanced hydraulic mount adoption, whereas emerging economies in Southeast Asia and India focus on cost-effective gasoline and diesel engines paired with traditional rubber mounts. E-commerce platforms are rapidly gaining traction for aftermarket purchases in urban centers, whereas rural areas continue to rely on established offline channels.

Collectively, these regional insights reveal the necessity of a differentiated approach to product development, supply chain design, and go-to-market execution, tailored to the unique regulatory, economic, and cultural contexts of each territory.

This comprehensive research report examines key regions that drive the evolution of the Automotive Engine & Engine Mounts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking the Strategic Footprint and Technological Leadership of Pioneering Companies Shaping the Evolution of Engine Systems and Mounting Solutions Globally

The competitive landscape of engine and mount suppliers is being redefined by companies that effectively integrate advanced materials science, lean manufacturing practices, and digital service offerings. Leading global component manufacturers leverage robust research and development centers to introduce next-generation hydraulic mounts that respond dynamically to variable load conditions, as well as compact electric motor mounts designed for high-frequency vibration attenuation in EV platforms.

Simultaneously, established powertrain producers are expanding their portfolios through strategic partnerships with elastomer specialists and additive manufacturing pioneers. This collaborative model accelerates the development of bespoke rubber and liquid filled mounts that meet stringent durability standards while facilitating rapid prototyping and customization for tier-1 automakers. OEMs, in turn, are increasingly forming long-term alliances with technology providers to co-develop integrated powertrain support systems optimized for specific vehicle architectures.

New entrants specializing in sensor-enabled mounts are also emerging, capitalizing on the intersection of IoT connectivity and predictive maintenance. These smart mount solutions embed miniature accelerometers and temperature sensors, transmitting real-time health data to fleet management platforms. By offering condition-based service triggers, such players differentiate themselves in aftermarket and commercial vehicle segments, where uptime and total cost of ownership are critical decision factors.

Overall, the key corporate strategies shaping industry progress center on vertical integration, cross-functional collaboration, and the infusion of digital capabilities into traditional mechanical components. Companies that can harmonize these elements will be best positioned to deliver high-value solutions aligned with evolving powertrain paradigms and end user expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Engine & Engine Mounts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BMW AG

- BorgWarner Inc.

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Mercedes-Benz Group AG

- Mitsubishi Heavy Industries, Ltd.

- Nissan Motor Co., Ltd.

- Stellantis N.V.

- Toyota Motor Corporation

- Volkswagen AG

- ZF Friedrichshafen AG

Crafting Actionable Strategies for Industry Stakeholders to Capitalize on Emerging Trends, Optimize Supply Chains, and Unlock Competitive Advantages in the Powertrain Ecosystem

To thrive amid shifting powertrain dynamics and evolving trade policies, industry leaders should adopt a proactive posture across product development, supply chain configuration, and customer engagement. First, organizations must prioritize modular design frameworks that accommodate multiple engine types-including diesel, gasoline, hybrid, and electric-while enabling rapid reconfiguration of mount stiffness, damping characteristics, and material compositions. This approach reduces time to market for new powertrain architectures and supports cost-efficient customization at scale.

Moreover, cultivating strategic supplier ecosystems with diversified geographic footprints will mitigate the risks introduced by tariffs and geopolitical volatility. By establishing dual sourcing arrangements and nearshoring select component processes, companies can preserve margin integrity and maintain inventory agility. In addition, investment in automation and advanced robotics within local production facilities can offset labor cost differentials and accelerate throughput.

In parallel, embedding digital capabilities into mount assemblies through sensor integration and predictive analytics will create new revenue streams in aftermarket and fleet services. By offering subscription-based monitoring platforms, manufacturers can differentiate their value proposition and foster long-term customer relationships. Cross-functional teams should collaborate to define data standards, establish secure connectivity protocols, and develop intuitive user interfaces for service alerts and performance benchmarking.

Finally, leaders must align their sustainability agendas with circular economy principles by exploring recyclable materials and closed-loop supply models. Lifecycle assessments should inform design decisions, guiding the selection of low-carbon elastomers and hydraulic fluids compatible with remanufacturing workflows. Through these strategic initiatives, stakeholders can bolster competitive resilience and unlock sustained growth in an automotive landscape defined by rapid transformation.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Comprehensive Market Intelligence Accuracy

This study integrates a multi-pronged research framework designed to deliver reliable, actionable insights into the engine and mount markets. The foundation consists of primary research conducted through in-depth interviews with more than 50 senior executives across original equipment manufacturers, tier-1 suppliers, and aftermarket distributors. These conversations explored technical challenges, procurement dynamics, and growth priorities, providing firsthand perspectives on emerging trends and competitive strategies.

Complementing primary findings, secondary research encompassed the analysis of industry journals, patent filings, regulatory documents, and trade association publications. This intensive review enabled the identification of technological breakthroughs, policy shifts, and macroeconomic drivers influencing market behavior. Data triangulation techniques were applied to cross-verify information, ensuring content accuracy and reducing bias.

Quantitative analyses employed advanced statistical modeling and scenario planning tools to examine segmentation impacts, tariff sensitivities, and regional demand trajectories. Supply chain mapping exercises traced the flow of raw materials and finished components across global nodes, yielding insights into bottleneck risks and resilience measures. The research was further validated through peer reviews by independent subject matter experts who assessed methodological rigor and substantiated key findings.

By combining these qualitative and quantitative methods within a structured validation process, this research delivers a robust intelligence platform. Stakeholders can trust the integrity of the insights to inform product roadmaps, strategic investments, and risk management frameworks in the highly dynamic automotive powertrain domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Engine & Engine Mounts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Engine & Engine Mounts Market, by Engine Type

- Automotive Engine & Engine Mounts Market, by Mount Type

- Automotive Engine & Engine Mounts Market, by Vehicle Type

- Automotive Engine & Engine Mounts Market, by End User

- Automotive Engine & Engine Mounts Market, by Sales Channel

- Automotive Engine & Engine Mounts Market, by Region

- Automotive Engine & Engine Mounts Market, by Group

- Automotive Engine & Engine Mounts Market, by Country

- United States Automotive Engine & Engine Mounts Market

- China Automotive Engine & Engine Mounts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Core Findings and Strategic Implications from Comprehensive Analysis of Engine and Mount Markets to Guide Informed Decision Making for Stakeholders

The cumulative analysis of engine and mount sectors underscores a pivotal industry inflection point shaped by rapid electrification, advanced materials integration, and shifting trade landscapes. As traditional combustion platforms transition toward hybrid and electric configurations, the role of mounts has evolved beyond simple vibration dampers into intelligent enablers of performance, comfort, and asset health. Regulatory pressures and tariff policies further compound the strategic calculus, rewarding agility and local production capabilities.

Segmentation insights reveal that powertrain type, mount design, vehicle class, end user distinctions, and sales channel preferences collectively dictate product development pathways and go-to-market tactics. Regional variations in regulatory regimes and consumer demands require tailored approaches for the Americas, Europe, Middle East & Africa, and Asia-Pacific territories. In parallel, leading companies are competing through vertical integration, digital service offerings, and collaborative innovation models that blend mechanical expertise with software intelligence.

Looking ahead, industry leaders must embrace modular engineering architectures, diversified sourcing frameworks, and sustainability-driven material selections to navigate uncertainty. Embedding sensor technologies and leveraging predictive analytics will unlock aftermarket value and strengthen customer loyalty. Crucially, strategic scenario planning should remain at the forefront of decision making as tariff landscapes and regulatory mandates continue to evolve.

In essence, the future of automotive engine and mount markets hinges on the ability to marry technical excellence with responsive business models. By operationalizing the insights presented herein, stakeholders can secure competitive advantage, drive profitable growth, and shape the next generation of mobility solutions.

Encouraging Engagement with Our Associate Director to Secure In-Depth Market Intelligence and Drive Strategic Success through a Tailored Automotive Powertrain Research Investment

As you navigate the complexities of modern automotive powertrain markets, take the next step toward unlocking impactful intelligence by connecting with Ketan Rohom, Associate Director of Sales & Marketing at our research firm. Engaging with Ketan ensures you receive tailored guidance on leveraging our comprehensive market study to drive strategic initiatives, whether you aim to refine product roadmaps, optimize supply chains, or secure competitive positioning in a rapidly evolving landscape.

Our Associate Director will work closely with your team to understand your specific needs, recommend the most relevant insights, and facilitate access to proprietary data, expert interviews, and in-depth analyses that go beyond public domain reports. By collaborating directly with Ketan, you will gain clarity on how to transform high-level findings into actionable business strategies and accelerate your time to market with confidence.

Don’t miss the opportunity to harness premium market intelligence that can shape your strategic decisions for the coming years. Reach out today to schedule a personalized consultation and explore how our automotive engine and engine mount research can empower your organization to capitalize on emerging trends and navigate regulatory headwinds effectively. Secure your copy of the report and embark on a journey toward informed decision making and sustained industry leadership.

- How big is the Automotive Engine & Engine Mounts Market?

- What is the Automotive Engine & Engine Mounts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?