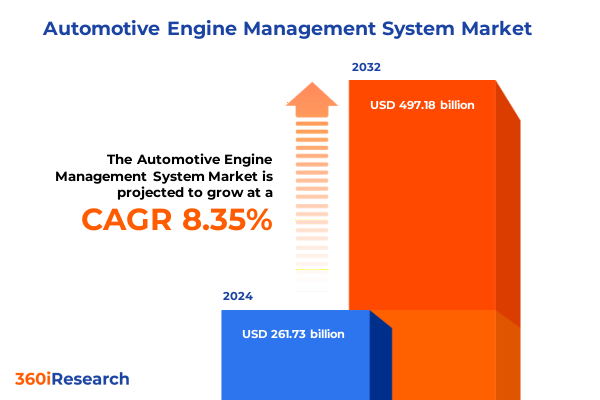

The Automotive Engine Management System Market size was estimated at USD 281.05 billion in 2025 and expected to reach USD 301.81 billion in 2026, at a CAGR of 8.48% to reach USD 497.18 billion by 2032.

Engaging Overview of Automotive Engine Management Systems Illuminating Their Strategic Role in Modern Powertrain Efficiency

In today’s rapidly evolving automotive landscape, engine management systems serve as the cornerstone for optimizing efficiency, reducing emissions, and delivering superior performance. These sophisticated electronic control architectures harness real-time sensor data, advanced calibration algorithms, and adaptive control strategies to ensure precise air-fuel ratios, ignition timing, and emission aftertreatment management. As regulatory bodies worldwide tighten emissions standards and consumer demand shifts toward electrification and connectivity, engine management systems have transcended their traditional role, emerging as pivotal enablers of smarter, greener mobility solutions.

From turbocharged gasoline powertrains to diesel-powered heavy-duty applications and electrified hybrid drivetrains, the integration of next-generation control units, sensors, actuators, and calibration software has become imperative. This introduction outlines the strategic importance of modern engine management architectures and sets the stage for exploring how technological advancement, policy shifts, and market dynamics collectively shape the future of powertrain control.

Disruptive Paradigm Shifts Driving Innovation, Connectivity, and Decarbonization in Engine Management Landscapes Transforming Industry Standards

The automotive engine management landscape has undergone transformative shifts driven by the convergence of digitalization, decarbonization imperatives, and data-centric innovation. The proliferation of connected vehicles now enables continuous remote monitoring, predictive maintenance algorithms, and over-the-air calibration updates, thereby reshaping service models and extending product lifecycles. Moreover, the integration of artificial intelligence and machine learning into control units empowers adaptive combustion strategies that optimize performance under diverse operating conditions, reducing fuel consumption while maintaining dynamic responsiveness.

Alongside these technological advances, regulatory frameworks worldwide have accelerated the transition toward lower emissions. Stricter CO2 targets and real-driving emission (RDE) protocols have incentivized the adoption of advanced sensor arrays, precise fuel management actuators, and sophisticated calibration software. At the same time, the advent of modular hardware platforms and software-defined vehicle architectures has facilitated greater scalability and functional safety compliance. These disruptive paradigm shifts collectively redefine the strategic priorities for OEMs and suppliers alike, placing engine management systems at the forefront of next-generation powertrain innovation.

Assessing the Comprehensive Cumulative Consequences of Newly Imposed United States Tariffs on Critical Engine Management Components Throughout 2025

In 2025, the United States implemented a series of tariffs targeting imported automotive components, including those integral to engine management systems, in response to broader trade policy objectives. By imposing levies on control modules, sensors, and precision actuators sourced primarily from key international suppliers, these measures have intensified cost pressures across the supply chain. As a result, many Tier 1 manufacturers have re-evaluated sourcing strategies, accelerating initiatives to diversify their supplier bases and explore nearshore production capabilities.

Consequently, the imposition of tariffs has catalyzed a two-pronged shift in procurement and product strategy. First, OEMs are negotiating long-term agreements with domestic and regional suppliers to secure favorable cost structures and mitigate tariff exposure. Second, suppliers are investing in automated manufacturing and digital twin simulations to optimize production layouts within tariff-free jurisdictions. These adjustments have amplified focus on total lifecycle costs and driven collaborative engagements to co-develop localized solutions, thereby reshaping competitive dynamics across the engine management ecosystem throughout 2025.

Unveiling Intricate Segmentation Insights That Illuminate Diverse End User, Application, Fuel Type, and Product Type Dynamics

A nuanced understanding of the engine management market emerges when considering multiple segmentation dimensions, each revealing distinct adoption patterns and value drivers. From an end-user perspective, original equipment manufacturers invest heavily in next-generation control units, leveraging integrated software architectures to meet OEM performance and reliability targets, while the aftermarket benefits from growing demand for calibration updates and replacement sensors, particularly in independent and franchise workshops seeking to enhance vehicle diagnostics and reduce downtime.

When examining application segments, commercial vehicles, including both heavy-duty and light-duty fleets, drive demand for robust, high-precision sensor arrays and actuators capable of enduring rigorous duty cycles. Off-highway sectors, such as agriculture and construction, prioritize ruggedized engine ECUs and calibration software that can adapt to variable load profiles, whereas passenger cars-spanning hatchbacks, sedans, and SUVs-emphasize seamless integration of driving modes, emission control strategies, and connectivity features that enrich user experience and comply with stringent urban emission norms.

Fuel type intricacies introduce further differentiation: diesel platforms continue to dominate heavy-duty and off-highway applications due to superior torque characteristics, while gasoline engines maintain prevalence in passenger segments. The surge in electric vehicles underscores growing investment in control electronics for hybrid systems-ranging from mild hybrids to full and plug-in hybrids-where sophisticated powertrain management and seamless transition between energy sources are paramount.

Finally, product type segmentation reveals that actuators-such as fuel injectors and idle control valves-remain critical for precise fuel metering, while manifold absolute pressure, mass air flow, and oxygen sensors deliver the essential feedback loops for real-time calibration. Engine and transmission ECUs serve as the central processing hubs, orchestrating combustion, turbocharging, and gearshift logic, complemented by calibration and diagnostic software that enable over-the-air updates and granular fault analysis. This layered segmentation provides comprehensive insights into the varied drivers influencing design choices, procurement strategies, and aftermarket offerings across the engine management systems market.

This comprehensive research report categorizes the Automotive Engine Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fuel Type

- Application

- End User

Highlighting Critical Regional Trends and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia Pacific Engine Management Markets

Regional dynamics highlight divergent growth pathways shaped by regulatory priorities, infrastructure development, and end-user preferences. In the Americas, stringent emissions standards enforced by the Environmental Protection Agency and burgeoning state-level zero-emission vehicle mandates drive continuous innovation in software calibration and advanced sensor fusion techniques. Meanwhile, fleet electrification incentives in Canada and robust aftermarket services in Latin America underscore a balanced focus on both new vehicle technologies and legacy powertrain support.

In Europe, Middle East, and Africa, the enactment of Euro 7 and Fit for 55 initiatives compels OEMs to implement enhanced diagnostic capabilities and integrated particulate filters, especially in luxury and high-performance segments. Within the Middle East, rising demand for premium SUVs and performance optimization solutions creates fertile ground for sophisticated ECU offerings, while Africa’s agricultural mechanization trends fuel adoption of ruggedized engine management modules capable of operating in extreme environmental conditions.

Across Asia-Pacific, government mandates in China continue to bolster new energy vehicle production, prompting a surge in control unit variants designed for hybrid and fully electric drivetrains. India’s progressive Bharat Stage 6 Plus emission regulations accelerate the rollout of high-precision sensors and calibration software, whereas Japan’s leadership in hybrid powertrains sustains demand for integrated control solutions. Simultaneously, ASEAN nations witness expansion in off-highway engine management technologies, driven by growth in construction and agricultural infrastructure projects. These regional nuances inform tailored strategies for product development, localization efforts, and strategic partnerships.

This comprehensive research report examines key regions that drive the evolution of the Automotive Engine Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Companies Shaping Innovations, Strategic Partnerships, and Technological Leadership Driving Future Growth in Engine Management Ecosystem

Leading players in the engine management domain leverage differentiated strategies to maintain technological edge and foster collaborative ecosystems. One major supplier has prioritized the development of cloud-connected ECUs that support real-time diagnostics, enabling OEMs and aftermarket service providers to implement predictive maintenance programs. Another industry stalwart focuses on modular hardware platforms paired with open-architecture software, facilitating rapid customization across diverse vehicle applications, from heavy commercial fleets to urban passenger cars.

A third prominent company has expanded its footprint through strategic acquisitions of sensor specialists, integrating high-precision manifold absolute pressure and mass air flow sensors into comprehensive engine management suites. Meanwhile, a key competitor has formed joint development agreements with automotive software firms to co-create advanced calibration and diagnostic tools, reinforcing its position in electric and hybrid powertrain segments. Across these leading entities, common themes emerge: accelerated investment in R&D for next-generation actuators, the pursuit of functional safety certifications, and the cultivation of end-to-end solution portfolios that span hardware, software, and services. Such strategic initiatives drive competitive differentiation and set the stage for future collaboration with OEMs, technology partners, and regulatory bodies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Engine Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- BorgWarner Inc.

- Continental AG

- DENSO Corporation

- Dover Corporation

- Hella KGaA Hueck & Co.

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Keihin Corporation

- Melexis N.V.

- Mitsubishi Heavy Industries Ltd.

- NGK Spark Plug Co., Ltd.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- ROHM Semiconductor K.K.

- Sanken Electric Co., Ltd.

- Sensata Technologies Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Valeo SA

- Visteon Corporation

- ZF Friedrichshafen AG

Deploying Actionable Strategic Recommendations to Navigate Emerging Technological Advances and Market Volatility in Engine Management

To maintain a competitive stance amid evolving regulatory mandates and technological disruption, industry leaders should prioritize a software-defined vehicle approach that decouples hardware constraints from functional capabilities, enabling rapid deployment of emission control updates and performance enhancements. Investments in digital twin simulations can streamline development cycles, reduce time-to-market, and enhance cross-functional collaboration between ECU design, calibration, and validation teams.

Furthermore, strengthening supply chain resilience through dual-sourcing strategies and regional production hubs can mitigate tariff exposure and geopolitical risks. Establishing localized manufacturing and calibration centers will also improve responsiveness to end-market requirements. Leaders should deepen collaborations with OEMs and mobility service providers to co-create customized engine management packages that address unique application profiles, whether in heavy-duty transport, off-highway equipment, or electrified passenger vehicles.

Finally, strategic partnerships with software developers and cloud platform providers can unlock new revenue streams via data-driven services such as over-the-air updates, predictive maintenance subscriptions, and remote diagnostics. By embracing these actionable recommendations, companies can navigate market volatility, reduce total lifecycle costs, and seize emerging opportunities in decarbonization and connected mobility.

Detailing Rigorous Research Methodology and Data Collection Framework Ensuring Robustness and Reliability of Engine Management Analysis

This analysis employs a rigorous, multi-method research framework designed to ensure data integrity and comprehensive insight generation. Primary data collection involved in-depth interviews with OEM powertrain engineers, Tier 1 supplier executives, and independent workshop operators, providing firsthand perspectives on product design trade-offs, regulatory compliance challenges, and end-user requirements. Secondary research encompassed a systematic review of regulatory documents, technical white papers, patent filings, and academic publications, ensuring alignment with the latest emission standards and control system innovations.

Quantitative module performance metrics and qualitative stakeholder feedback were triangulated to validate key findings, while a layered segmentation approach-spanning end user, application, fuel type, and product type-facilitated nuanced analysis across over a dozen powertrain configurations. Regional insights were derived from localized policy assessments and region-specific technology adoption rates. Throughout the process, peer review and cross-functional workshops reinforced analytical rigor and mitigated potential biases, ensuring that the final report delivers robust, actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Engine Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Engine Management System Market, by Product Type

- Automotive Engine Management System Market, by Fuel Type

- Automotive Engine Management System Market, by Application

- Automotive Engine Management System Market, by End User

- Automotive Engine Management System Market, by Region

- Automotive Engine Management System Market, by Group

- Automotive Engine Management System Market, by Country

- United States Automotive Engine Management System Market

- China Automotive Engine Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Key Conclusions That Illuminate Strategic Imperatives and Future Opportunities in the Engine Management Landscape

The evolution of automotive engine management systems represents a critical inflection point for achieving sustainable mobility, operational efficiency, and regulatory compliance. As connectivity, electrification, and advanced analytics converge, control architectures are shifting from isolated electronic modules to integrated software ecosystems that support real-time updates and remote diagnostics. Tariff-induced supply chain adjustments underscore the importance of resilient sourcing strategies and local manufacturing footprints, while segmentation insights highlight distinct growth vectors across end-user markets, fuel types, and vehicle applications.

Regional variances in regulatory frameworks and infrastructure development further accentuate the need for agile product development and strategic partnerships. Leading companies that leverage modular platforms, open-architecture software, and cloud connectivity are best positioned to capture the next wave of market transformation. By synthesizing these strategic imperatives and technological trends, decision-makers can prioritize investments, align R&D roadmaps, and craft differentiated value propositions that resonate with both OEMs and aftermarket stakeholders. The insights presented in this executive summary affirm that engine management systems will remain central to future powertrain innovation and market leadership.

Engage with Associate Director Sales Marketing to Secure Comprehensive Engine Management Insights by Purchasing the In-Depth Market Research Report

Engage directly with Associate Director of Sales & Marketing at 360iResearch, Ketan Rohom, to unlock unparalleled access to comprehensive insights and strategic intelligence on the automotive engine management system landscape. Ketan Rohom offers personalized guidance to align the report findings with your organization’s unique challenges, ensuring you can leverage emerging technologies and regulatory trends for maximum competitive advantage. By reaching out, you will gain priority access to tailored data sets, proprietary analysis, and exclusive intelligence on supplier innovation roadmaps.

Secure the full research report today to explore detailed evaluations of technology roadmaps, supplier benchmarking, and region-specific developments that will inform critical investment and partnership decisions. Whether you seek to optimize product portfolios, refine R&D priorities, or reinforce supply chain resilience, Ketan Rohom provides the strategic support and negotiating leverage you need. Don’t miss this opportunity to transform the way you approach engine management system strategies; contact Ketan Rohom and propel your organization toward leadership in performance, efficiency, and compliance.

- How big is the Automotive Engine Management System Market?

- What is the Automotive Engine Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?