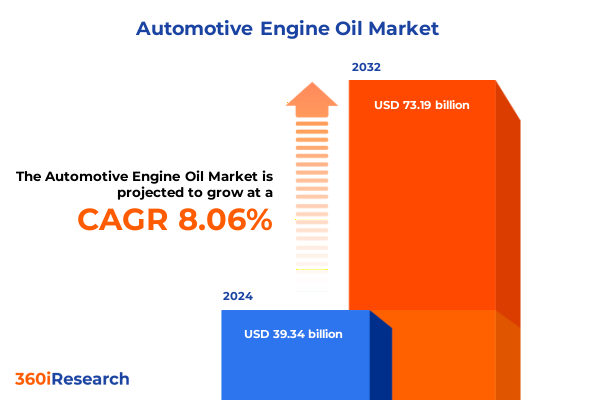

The Automotive Engine Oil Market size was estimated at USD 41.77 billion in 2025 and expected to reach USD 44.36 billion in 2026, at a CAGR of 8.34% to reach USD 73.19 billion by 2032.

Unlocking Engine Oil’s Pivotal Role in Enhancing Internal Combustion Engine Performance, Durability, and Regulatory Compliance in a Dynamic Market

Engine lubricants serve as the lifeblood of internal combustion engines, performing the critical functions of reducing friction, mitigating wear, and facilitating heat dissipation under extreme operating conditions. These oils enable optimal engine performance and longevity, contributing directly to improved fuel economy and reduced greenhouse gas emissions through decreased mechanical losses. The introduction of the ILSAC GF-6 and API SP standards underscores the industry’s commitment to advancing lubricant formulations, delivering enhanced low-speed pre-ignition protection, superior oxidation stability, and cleaner engine internals across a diverse range of gasoline engine platforms.

Advancements in base oil technologies have further propelled the transition from conventional mineral oils to semi-synthetic and fully synthetic formulations. Ultra-low viscosity grades such as SAE 0W-16 and SAE 0W-8 are engineered to minimize hydrodynamic friction, supporting cold-start performance and stop-start driving applications without compromising wear protection. As emission regulations become more stringent and consumer demand for efficiency intensifies, engine oil manufacturers are investing heavily in additive packages and molecularly engineered base oils to meet these evolving requirements.

Navigating Transformative Shifts in Automotive Lubricants Driven by Electrification, Sustainability Mandates, and Advanced Engine Technologies Shaping Demand

The automotive lubrication landscape is undergoing transformative shifts driven by the rapid adoption of electrified powertrains, heightened sustainability mandates, and the proliferation of advanced engine technologies. While electric vehicles are poised to displace a growing share of internal combustion engines-contributing to a projected one-quarter of global car sales in 2025 according to the IEA-ICE vehicles will remain integral to mixed fleets for years to come. This duality has spurred lubricant developers to innovate formulations that cater simultaneously to high-efficiency turbocharged engines and hybrid systems requiring specialized low-viscosity oils.

Concurrently, environmental regulations such as Euro 5+ for motorcycles and more rigorous particulate filter protection requirements have elevated the importance of low-ash and high-cleanliness oils. Industry participants are responding with proprietary technologies that exceed baseline API SQ thresholds, enabling up to 70% greater LSPI control and cleaner engine performance beyond standard limits. Moreover, the integration of connectivity and predictive maintenance tools in modern vehicles is reshaping aftermarket service models, as real-time data on oil condition and engine health informs optimized drain intervals and tailored lubrication strategies.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Automotive Lubricants Supply Chains, Input Costs, and Market Dynamics Across the Value Chain

In 2025, comprehensive U.S. tariff measures have introduced significant cost pressures and uncertainty across automotive lubricant supply chains. A blanket 25% tariff on imported passenger vehicles and light trucks took effect on April 2, 2025, followed by a 25% levy on core auto parts-including engines and powertrain components-implemented on May 3, 2025. Although base oils under the universal trade order were exempted from the initial 10% ad valorem rates, the broader impact of steel and aluminum tariffs on vehicle production has dampened growth forecasts for finished lubricant demand, as vehicle assembly slowdowns typically translate to reduced oil consumption.

Marketers of Group III base oils, which the U.S. imports predominantly from Canada, South Korea, and the Middle East, have voiced concerns over 10% energy product surcharges. However, declining crude oil prices and stabilizing base oil costs have partially mitigated immediate price fluctuations in lubricant blends. Nonetheless, domestic producers are recalibrating their sourcing strategies and expanding local blending capacity to insulate against continued tariff uncertainties and maintain supply continuity.

Understanding Key Segmentation Insights to Drive Strategic Positioning in the Engine Oil Market Amid Product, Application, Vehicle, End User, and Distribution Variances

Diverse segmentation in the engine oil market reveals nuanced demand drivers across product type, application, vehicle category, end user, and distribution channel. Conventional mineral oils remain cost-effective for legacy fleets, yet semi-synthetic blends offer balanced performance improvements in oxidation stability and wear control, while fully synthetic formulations are increasingly mandated by high-pressure turbocharged gasoline engines requiring ultra-low friction and resistance to low-speed pre-ignition. Each formulation tier commands distinct customer expectations and performance benchmarks.

Application segmentation highlights the varied requirements of diesel engines, gasoline engines, and motorcycles, with the latter further differentiated between off-road models demanding robust high-temperature protection and street bikes prioritizing deposit control. Vehicle type segmentation spans commercial vehicles, where extended oil drain intervals and high viscosity grades are paramount, through passenger cars that leverage mid-grade multigrade oils for everyday efficiency, to two-wheelers subdivided into motorcycles and scooters, each with unique viscosity and additive needs. End-user segmentation distinguishes between OEM fill-forwards, which demand manufacturer-approved lubricants aligned with warranty requirements, and aftermarket channels where consumer choice and peel-back packaging drive brand loyalty. Distribution segmentation encompasses traditional retail outlets, service centers, and workshops, alongside burgeoning online sales via e-commerce platforms and manufacturer websites, which facilitate direct-to-consumer engagement and subscription-based service models.

This comprehensive research report categorizes the Automotive Engine Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Application

- End User

- Distribution Channel

Evaluating Regional Variations in Automotive Engine Oil Demand and Growth Patterns Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics in the automotive engine oil market are shaped by distinct regulatory frameworks, fleet compositions, and industrial growth trajectories. In the Americas, stringent U.S. emissions standards and tariff policies have catalyzed the adoption of synthetic and semi-synthetic oils, while investment in domestic blending and base oil production projects aims to bolster supply chain resilience. Canada and Mexico, as critical trade partners, navigate North American Forum agreements and localized formulation requirements to support cross-border vehicle assembly operations.

In Europe, the Middle East, and Africa, European Union regulations such as ACEA C5 and low-SAPS engine oils drive demand for specialized formulations that protect particulate filters and catalytic converters, with Eastern European markets emerging as growth hubs due to fleet renewal programs. Middle Eastern countries leverage expanding logistics and commercial vehicle sectors, boosted by infrastructure investments and rising freight transport activity. In the Asia-Pacific region, rapid urbanization and two-wheeler proliferation in India, Southeast Asia, and Latin America fuel robust demand for motorcycle and scooter lubricants, while China’s transition to new energy vehicles is gradually tempering ICE lubricant consumption even as base oil refining expansions aim to serve both domestic and export markets.

This comprehensive research report examines key regions that drive the evolution of the Automotive Engine Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Engine Oil Manufacturers’ Strategic Moves, Innovation Pipelines, and Competitive Strategies Transforming the Global Lubricant Arena

Leading engine oil manufacturers have deployed multifaceted strategies to maintain competitive advantage and capture evolving market share. Shell has committed to converting its Wesseling facility in Germany into a Group III base oil hub, leveraging electrification and renewable hydrogen integration to cut emissions by approximately 620,000 tonnes of CO₂ annually and secure a premium basestock supply for high-performance lubricants. Similarly, ExxonMobil’s Specialty Products division is progressing its Singapore Resid Upgrade Project, which will expand Group II base oil capacity and enhance supply for its Mobil 1™ and ESP x2 0W-20 formulations, supporting industrial and automotive lubricant growth in Asia-Pacific markets.

Beyond capacity expansions, these integrated oil majors are innovating at the product level. ExxonMobil’s Product Solutions business is on track to grow high-value product sales by 80% versus 2024, reflecting demand for advanced formulations that deliver up to 4% fuel economy improvements and extended oil life. Meanwhile, offshore and regional players are forging OEM partnerships to co-develop tailored lubricants that align with next-generation emission control systems and hybrid powertrains, strengthening their foothold in both aftermarket and factory-fill segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Engine Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BP p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Eni S.p.A.

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- PetroChina Company Limited

- Royal Dutch Shell plc

- SK ZIC

- TotalEnergies SE

- Valvoline Inc.

Formulating Actionable Recommendations to Strengthen Market Positioning, Optimize Supply Chains, and Embrace Innovation in the Engine Oil Sector

To navigate the complex and rapidly evolving engine oil market, industry leaders should prioritize diversification of raw material sourcing and invest in localized blending capabilities to mitigate tariff risks and supply disruptions. Strategic alliances with additive providers and OEMs can accelerate co-development of next-generation formulations that meet increasingly stringent environmental regulations and performance benchmarks. Additionally, embracing digitalization across the value chain-from predictive maintenance platforms to direct-to-consumer e-commerce models-will unlock new avenues for customer engagement and recurring revenue streams.

R&D investments should focus on ultra-low viscosity technologies, bio-based and recyclable additives, and advanced molecular engineering techniques to reduce parasitic engine losses and extend drain intervals. In parallel, companies must refine their sustainability trajectories by setting clear decarbonization targets for their production facilities and aligning with science-based climate frameworks. Finally, executing targeted acquisitions or joint ventures in high-growth regions such as Southeast Asia or Eastern Europe can accelerate market penetration, while structured cost reduction programs will preserve margins in a cost-inflationary environment.

Detailing a Robust Research Methodology Incorporating Secondary Intelligence, Primary Expert Validation, and Rigorous Data Triangulation Protocols

This report’s findings are underpinned by a rigorous, multi-stage research methodology combining comprehensive secondary intelligence with primary expert validation. The secondary phase included analysis of regulatory filings, industry association publications, technical standards documents, and specialized trade media to map current product specifications, tariff developments, and macroeconomic indicators. Proprietary databases were leveraged to benchmark global base oil capacities and lubricant formulation trends across key geographies.

During the primary phase, in-depth interviews were conducted with senior executives from global lubricant manufacturers, additive suppliers, OEM technical teams, and leading aftermarket distributors. These qualitative insights were triangulated with quantitative data obtained from public company disclosures, trade reports, and customs statistics to ensure accuracy and consistency. All data sets underwent thorough vetting and cross-referencing, with iterative feedback loops engaging industry experts to refine interpretations and validate emerging trends. The methodology adheres to best-practice research standards, ensuring transparent, actionable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Engine Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Engine Oil Market, by Product Type

- Automotive Engine Oil Market, by Vehicle Type

- Automotive Engine Oil Market, by Application

- Automotive Engine Oil Market, by End User

- Automotive Engine Oil Market, by Distribution Channel

- Automotive Engine Oil Market, by Region

- Automotive Engine Oil Market, by Group

- Automotive Engine Oil Market, by Country

- United States Automotive Engine Oil Market

- China Automotive Engine Oil Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights on the Future Trajectory of Automotive Engine Oils in Light of Technological Innovations, Regulatory Pressures, and Market Disruptions

As the automotive industry confronts unprecedented technological, regulatory, and trade pressures, engine lubricants remain an essential enabler of performance, efficiency, and environmental compliance. The shift toward synthetic and low-viscosity formulations underscores the sector’s adaptability amid the growing prevalence of turbocharged engines, hybrid drivetrains, and emerging electrification trends. Concurrently, regional variations in demand dynamics and tariff regimes necessitate agile supply chain strategies and localized production footprints.

Major players have demonstrated resilience through strategic capacity expansions, product innovation, and digital engagement models. However, the cumulative impact of global tariff actions and evolving emission standards highlights the need for continuous investment in advanced additive chemistries, sustainable base oils, and collaborative OEM partnerships. By embracing a proactive approach to segmentation, regional diversification, and R&D excellence, industry stakeholders can position themselves to thrive in a market defined by both disruption and opportunity.

Engage with Ketan Rohom to Secure Your Comprehensive Automotive Engine Oil Market Research Report Tailored to Your Strategic Needs and Empower Data-Driven Decisions Today

Embrace the opportunity to gain exclusive insights, data, and expert analysis tailored to the automotive engine oil industry by engaging Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the detailed findings of our comprehensive report, ensuring you have the strategic intelligence needed to navigate evolving market conditions, anticipate regulatory changes, and capitalize on technological advancements in lubrication.

Contact Ketan today to discuss your specific research requirements and discover how our market intelligence can inform product development, optimize distribution strategies, and strengthen your competitive position. Don’t miss this chance to empower your decision-making with granular data and actionable foresight that will drive growth and resilience in a rapidly transforming industry.

- How big is the Automotive Engine Oil Market?

- What is the Automotive Engine Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?