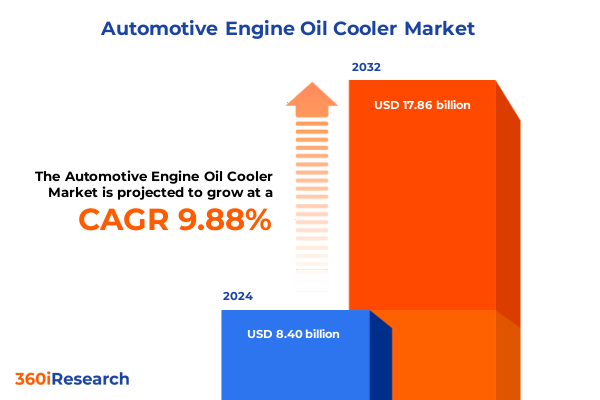

The Automotive Engine Oil Cooler Market size was estimated at USD 9.22 billion in 2025 and expected to reach USD 10.13 billion in 2026, at a CAGR of 9.89% to reach USD 17.86 billion by 2032.

Fueling Future Mobility with Precision Thermal Management for Engine Oil Cooling Solutions to Meet Unprecedented Efficiency and Performance Demands

Engine oil coolers play a pivotal role in maintaining optimal lubricant temperature, ensuring reliable engine performance and extending component longevity. As internal combustion engines work under increasingly demanding conditions-driven by higher power densities, turbocharging, and downsized architectures-effective oil cooling systems have become indispensable for thermal regulation. At the same time, hybrid and electric vehicle platforms are introducing new thermal management challenges, where oil coolers must adapt to support electric motors, inverters, and transmission assemblies while preserving compact design footprints. In these hybrid systems, the integration of oil cooling directly into electric motor housings enables more efficient heat exchange, contributing to the pursuit of higher power density without sacrificing reliability. Oil cooling technology recently became the dominant thermal strategy in electric motor applications, capturing an estimated 50 percent share of market cooled motor types in the first half of 2022, underscoring its importance for future powertrain architectures.

Subsequently, manufacturers have refined delivery systems to minimize coolant volumes, optimize nozzle placement, and reduce energy consumption, while retaining precise temperature control. These design advancements reflect a broader industry focus on enhancing thermal performance through targeted cooling, where oil spray nozzles deliver lubrication and thermal dissipation to critical hotspots. The next generation of oil coolers will increasingly leverage advanced fluids and direct-oil cooling architectures to drive both performance and efficiency, supporting rapid innovation cycles and the global transition toward electrified mobility.

Looking ahead, the confluence of stringent emissions regulations, growing electrification, and consumer demand for fuel efficiency is elevating oil cooler functionality from a support component to a core enabler of powertrain advancement. This introduction sets the stage for examining how transformative shifts, policy actions, and strategic segmentation insights will shape the engine oil cooler market in 2025 and beyond.

Harnessing Electrification, Intelligent Controls, Advanced Materials and Connected Technologies to Shape the Next Generation Automotive Engine Oil Cooling Landscape

In recent years, the automotive thermal management domain has undergone a profound transformation, driven by the proliferation of electrified powertrains, digital integration, and stringent environmental mandates. Electrification has particularly catalyzed innovation, as hybrid and electric vehicles demand more sophisticated cooling architectures that reconcile the dual needs of lubrication and thermal dissipation. For instance, direct-oil cooling approaches have emerged to address the limitations of conventional water jackets, delivering heat removal directly at the stator windings and other critical motor components. Advanced coolants infused with nanoparticles and enhanced thermally conductive composites are being developed to further improve heat transfer without unduly increasing system complexity or weight.

Concurrently, the adoption of intelligent control mechanisms has elevated oil coolers from passive devices to adaptive systems capable of real-time response. Modern temperature management controllers leverage thermistor feedback, pulse-width modulation, and CAN-based communications to modulate fan speeds and flow rates, optimizing cooling performance under diverse operating scenarios. These capabilities align with broader Industry 4.0 trends, where digital twins and predictive analytics are increasingly integral to both product development and maintenance. Digital twin frameworks now enable virtual replication of thermal subsystems, facilitating rapid design iterations, predictive maintenance, and system optimization. Manufacturing leaders like Volkswagen Group and BMW are deploying cloud-based digital twin platforms to simulate thermal dynamics and refine cooling architectures before prototyping, accelerating time-to-market and reducing development costs.

Moreover, oil coolers equipped with intelligent temperature control modules can dynamically adjust cooling parameters in response to real-time engine load data, integrating features such as PWM and CAN bus communication for precise temperature regulation while minimizing parasitic power losses. At the materials frontier, nanocoatings and hybrid composite structures are enabling heat exchanger surfaces that resist fouling and enhance convective heat transfer, offering both durability and high performance in extreme conditions. As these trends converge, the engine oil cooler landscape will continue to evolve toward smarter, lighter, and more sustainable solutions, driving the next era of thermal management excellence.

Assessing the Multibillion Dollar Burden of Comprehensive Section 232 Tariffs on Automobile Parts and Vehicles Enacted in 2025 for Thermal Management Components

In March 2025, the U.S. government invoked Section 232 of the Trade Expansion Act of 1962 to impose a 25 percent tariff on imported passenger vehicles and a later rollout extended an equivalent 25 percent duty to critical automobile parts, including engines and thermal management components, effective on April 3 and May 3, respectively, in order to safeguard national security interests and domestic production capabilities. These sweeping measures have introduced unprecedented cost pressures on both original equipment manufacturers and tier-one suppliers of engine oil coolers, which often rely on cross-border supply chains and specialized materials.

Major automakers have reported multi-billion-dollar impacts in their quarterly earnings as a result of these levies. For example, General Motors disclosed a $1.1 billion tariff hit in the second quarter, attributing nearly a fifth of its profit decline to Section 232 duties and projecting potential annual costs upward of $5 billion as the tariff regime persists. Similarly, Stellantis indicated a $350 million expense load during the first half of 2025, underscoring the widespread financial ramifications across leading automotive portfolios.

While some manufacturers have absorbed these costs to maintain price stability for consumers, the feasibility of this approach is waning. Supply chain realignment and production repatriation initiatives are estimated to yield multi-year operational benefits, while ongoing USMCA certification processes and bilateral trade negotiations offer potential pathways to reduce the effective tariff base over time. Nonetheless, even with ambitious localization efforts, the tariff landscape has disrupted inventory planning, dealer margin structures, and aftermarket service channels. Dealer groups and repair networks anticipate higher parts prices and constrained inventories, which could dampen aftermarket maintenance volumes and alter long-term consumer behavior. As a result, stakeholders across the oil cooler value chain must navigate this evolving tariff environment with robust mitigation frameworks and scenario planning to preserve both profitability and market share.

Deciphering Market Dynamics Through Application-Driven, Product-Oriented, Channel-Focused, Material-Based and Fuel-Type-Centric Segmentation Insights for Holistic Analysis

A nuanced understanding of market segmentation is critical for stakeholders seeking to align product portfolios and distribution strategies with evolving industry requirements. In terms of application, oil cooler solutions serve a spectrum of end users including commercial vehicles, off-highway machinery, industrial equipment, and mainstream passenger cars, while future application segments such as electric and hybrid vehicles are reshaping thermal management requirements and spurring dedicated product innovations. Product type analysis reveals distinct performance trade-offs between air-cooled systems, which offer simplicity and weight advantages, and water-cooled architectures, which support higher heat rejection rates; within water-cooled systems, integrated modular coolers and smart control coolers represent advanced future product types that deliver tighter temperature regulation and modular deployment potential.

Examining distribution channels uncovers differentiated go-to-market approaches, where established original equipment manufacturer contracts coexist with a growing aftermarket segment that demands rapid fulfillment and retrofit adaptability. Emerging future channels such as direct-to-consumer and e-commerce platforms are also evolving to address the needs of fleet operators and specialty enthusiast communities. Equally, material-centric insights highlight the predominance of aluminum and copper-brass constructions for their proven thermal conductivity and manufacturability, while next-generation materials like composite assemblies and nanocoating enhancements promise improved heat transfer efficiency and corrosion resistance. Finally, segmentation by fuel type underscores the diverse operating environments that oil coolers must withstand-from diesel and gasoline powertrains to alternative fuels-and spotlights the forthcoming integration of hydrogen fuel cell systems as a future fuel type, which demands bespoke cooling strategies due to their high energy density and unique thermal profiles. Combining these segmentation dimensions uncovers crossover opportunities, such as aluminum composite coolers that blend lightweight design with robust performance for racing and high-performance passenger car applications.

This comprehensive research report categorizes the Automotive Engine Oil Cooler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Fuel Type

- Application

- Distribution Channel

Navigating Regional Nuances Across Americas, Europe Middle East & Africa, and Asia-Pacific to Understand Diverse Thermal Management Adoption Patterns

Regional dynamics play a pivotal role in shaping engine oil cooler demand, with market drivers and technological priorities varying across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust automotive production volumes and a mature aftermarket network sustain steady demand, supported by regulatory incentives for domestic manufacturing and a significant commercial vehicle fleet requiring high-durability thermal solutions. North America’s emphasis on supply chain resilience has prompted leading OEMs and suppliers to invest in local manufacturing facilities, thereby reducing exposure to overseas tariff volatility and logistical disruptions.

Across Europe Middle East & Africa, stringent emissions standards and ambitious decarbonization targets are accelerating the adoption of electrified and hybrid vehicle platforms, necessitating oil cooler designs optimized for compact packaging and multi-system integration. Regulatory frameworks such as Euro 7 emissions norms and Middle Eastern fleet renewal programs are fostering innovation in lightweight materials and smart cooling controls, while African markets present opportunities for ruggedized models capable of withstanding extreme ambient conditions and limited service infrastructure. The mature aftermarket in EMEA also drives demand for reliable retrofit solutions that can be installed across a wide range of vehicle platforms.

The Asia-Pacific region commands a dominant share of global engine oil cooler consumption, fueled by the scale of vehicle production in markets like China and India and extensive growth in electric mobility adoption. High-volume passenger car assembly lines, alongside rapid expansion of two-and three-wheeler networks, have created a dynamic environment for cost-efficient, scalable cooling solutions. Asia-Pacific’s material suppliers and thermal management specialists are leveraging advanced manufacturing techniques and digital automation to meet rising throughput demands, further solidifying the region’s status as the epicenter of future thermal management innovation.

This comprehensive research report examines key regions that drive the evolution of the Automotive Engine Oil Cooler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives of Leading Thermal Management Innovators and Tier-One Suppliers Driving Advancement in Engine Oil Cooler Technologies

Key players continue to invest heavily in R&D, partnerships, and capacity expansion to fortify their competitive positions. Denso Corporation, renowned for its advanced thermal management systems, has broadened its oil cooler portfolio to include solutions tailored for battery electric and hybrid vehicles, integrating lightweight materials and high-efficiency fin geometries that reduce overall system weight. Mahle GmbH has leveraged its extensive engineering expertise to develop modular oil cooler platforms with built-in diagnostics and adaptive control features, enabling seamless integration with next-generation powertrains.

Modine Manufacturing Company has expanded production capacity in Asia-Pacific and North America, focusing on precision brazing techniques and enhanced heat exchanger designs to support increasing global demand. BorgWarner Inc. has recently completed a significant expansion of its dedicated oil cooler manufacturing facility, positioning itself to address surging demand from both conventional internal combustion and electrified vehicle segments. Valeo SA’s breakthrough in ultra-thin oil cooler technology has demonstrated a 15 percent reduction in component weight while improving thermal performance, aligning with stringent commercial vehicle efficiency targets.

Aisin Seiki leverages its deep integration with the Toyota Group to develop compact, high-flow oil cooler modules for mid-size sedans, emphasizing reliability under aggressive driving profiles, while Calsonic Kansei focuses on integrated thermal assemblies that combine oil cooling with transmission cooling circuits for packaging efficiency. Emerging specialists like PWR Advanced Cooling Technology and Setrab AB are challenging incumbents through rapid prototyping, additive manufacturing deployments, and bespoke solutions for high-performance and specialty off-highway applications. These strategic initiatives underscore a market where technological differentiation, regional agility, and close OEM relationships are pivotal for long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Engine Oil Cooler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Radiators

- AKG Verwaltungsgesellschaft mbH

- BAR-TEK Motorsport GmbH

- Bell Intercoolers

- Cardone Industries, Inc.

- Chang Zhou ADV Heat Exchanger Co., Ltd.

- Dana Incorporated

- Derale Performance

- Fluidyne Control Systems

- HKS Co. Ltd.

- Mahle GmbH

- Marelli Holdings Co., Ltd.

- Mishimoto Automotive

- Modine Manufacturing Company

- Motorpro Cooling

- Nissens Automotive A/S

- OSC Automotive

- PWR Holdings Limited

- Quality Stamping & Tube Corp.

- Sanhua Automotive

- Setrab AB

- Standard Motor Products, Inc

- Tata Sons Pvt. Ltd.

- Thermex Ltd.

Implementing Forward-Looking Strategies for Technology Adoption, Supply Chain Resilience, Tariff Mitigation and Collaborative Innovation in Thermal Management

Industry leaders can capitalize on emerging opportunities by aligning strategic roadmaps with transformative market forces. First, embracing modular oil cooler designs and integrated smart control systems will facilitate product differentiation while addressing the performance and sustainability imperatives of electrified powertrains. Developing partnerships with semiconductor and sensor providers can accelerate the rollout of advanced thermal controllers, enabling real-time monitoring and predictive maintenance capabilities that enhance reliability and reduce downtime. Second, to mitigate the impact of Section 232 tariffs and evolving trade policies, organizations should pursue a multi-pronged supply chain strategy that includes reshoring critical production steps, qualifying additional regional suppliers, and certifying content under USMCA or equivalent trade agreements. This will safeguard against future tariff escalations and foster operational continuity under shifting geopolitical conditions.

Third, committing to materials innovation-such as nanocoating treatments, composite heat exchangers, and lightweight aluminum-copper hybrids-will yield efficiency gains and open pathways to meet increasingly stringent emissions and fuel economy standards. Collaborating with academic institutions and materials science centers can facilitate early access to disruptive technologies and expedite commercialization. Finally, adopting a data-centric approach to product development and lifecycle management-leveraging digital twin simulations, machine learning algorithms, and real-world operation data-will optimize thermal system architectures and anticipate design constraints before they arise. By integrating these recommendations into cohesive innovation frameworks, industry stakeholders will be well-positioned to drive growth, enhance resilience, and lead the shift toward a cooler, smarter automotive future.

Employing Rigorous Mixed-Method Research Protocols Incorporating Expert Interviews, Industry Data Triangulation and Robust Validation Procedures

This research report is built upon a multi-layered methodology that synthesizes both primary and secondary data sources through systematic processes. Secondary research involved an exhaustive review of technical standards, patent filings, regulatory announcements, and peer-reviewed academic literature, complemented by insights from industry white papers, trade publications, and reputable online databases. Primary research constituted in-depth interviews with senior executives, thermal system engineers, materials specialists, and supply chain experts across key global markets. These interviews were conducted via structured questionnaires, enabling consistent benchmarking of qualitative insights.

Data triangulation was achieved by cross-referencing primary interview findings with secondary market data points and published corporate disclosures, ensuring high-fidelity validation of emerging trends and strategic initiatives. Where possible, quantitative datasets were normalized against publicly available sales and production figures to maintain alignment with real-world market conditions. Advanced analytical techniques-including thematic coding for qualitative inputs and scenario modeling for policy impact analysis-were applied to identify critical drivers, challenges, and growth enablers. Finally, the research underwent multiple rounds of peer review by domain specialists to verify the accuracy and relevance of conclusions, guaranteeing a robust and transparent foundation for actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Engine Oil Cooler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Engine Oil Cooler Market, by Product Type

- Automotive Engine Oil Cooler Market, by Material

- Automotive Engine Oil Cooler Market, by Fuel Type

- Automotive Engine Oil Cooler Market, by Application

- Automotive Engine Oil Cooler Market, by Distribution Channel

- Automotive Engine Oil Cooler Market, by Region

- Automotive Engine Oil Cooler Market, by Group

- Automotive Engine Oil Cooler Market, by Country

- United States Automotive Engine Oil Cooler Market

- China Automotive Engine Oil Cooler Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings on Technological Trends, Regulatory Impacts and Strategic Imperatives Shaping the Automotive Engine Oil Cooling Sector

Through detailed analysis of transformative shifts, tariff developments, segmentation dynamics, and regional nuances, this report underscores the evolving nature of engine oil cooler technology. Electrified powertrains have redefined the scope and complexity of thermal management, necessitating the convergence of advanced materials, smart control systems, and digital simulation technologies. At the same time, global trade policies-particularly Section 232 tariffs-have introduced tangible cost pressures, prompting supply chain restructuring and regional production realignment to preserve competitive advantage.

Segmentation insights reveal that tailored solutions across applications, product types, distribution channels, materials, and fuel types are essential to capture emerging opportunities, from hybrid electric vehicles to hydrogen fuel cell applications. Regional analysis emphasizes the need for differentiated strategies in the Americas, Europe Middle East & Africa, and Asia-Pacific, reflecting distinct regulatory frameworks, manufacturing capabilities, and market maturities. Leading companies are responding through strategic capacity expansions, technological collaborations, and focused R&D investments, demonstrating that innovation and agility will be central to long-term success. These collective findings provide a strategic blueprint for stakeholders aiming to advance their thermal management portfolios and navigate a rapidly evolving automotive landscape.

Engage with Associate Director of Sales & Marketing to Unlock Exclusive Research Insights and Drive Strategic Growth in Engine Oil Cooler Market Intelligence

Elevate your strategic planning and competitive positioning with access to the full research report. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to explore how tailored market intelligence and expert analysis can inform your product development, supply chain initiatives, and go-to-market strategies. Secure your copy today and gain a comprehensive understanding of emerging trends, tariff impacts, and regional dynamics that will shape the future of automotive engine oil cooling technologies. Partner with a seasoned market specialist to translate in-depth insights into growth opportunities, drive innovation agendas, and maintain a differentiated edge in an increasingly complex thermal management landscape.

- How big is the Automotive Engine Oil Cooler Market?

- What is the Automotive Engine Oil Cooler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?