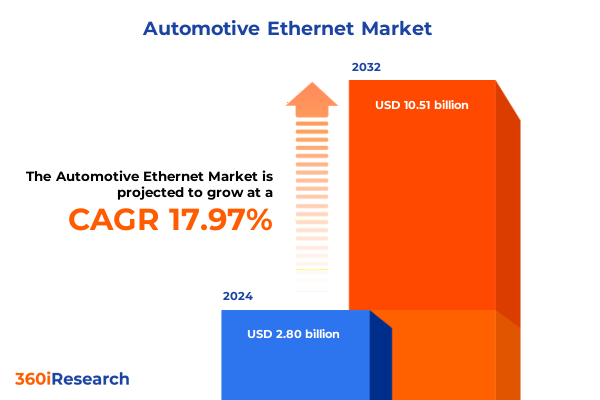

The Automotive Ethernet Market size was estimated at USD 3.27 billion in 2025 and expected to reach USD 3.84 billion in 2026, at a CAGR of 18.11% to reach USD 10.51 billion by 2032.

Introduction to Automotive Ethernet Market Executive Summary Providing Rapid Overview of Innovation Shaping Connected Mobility Landscape

The automotive Ethernet arena is rapidly redefining the in-vehicle network paradigm, transitioning from legacy bus architectures to a unified high-bandwidth backbone that supports the future of connected mobility. As data volumes escalate with the advent of advanced driver assistance systems and next-generation infotainment features, Ethernet emerges as the enabling fabric, effortlessly scaling from megabits to gigabits per second. Stakeholders across the automotive supply chain are recognizing that this shift is more than incremental; it represents a fundamental reimagination of vehicle electronics, offering unprecedented flexibility and system integration potential.

This executive summary provides a concise yet comprehensive orientation to the forces propelling automotive Ethernet adoption. It underscores the synergies between vehicle electrification, autonomous driving ambitions, and cybersecurity mandates, positioning Ethernet as the universal enabler. Moreover, by contextualizing recent standardization milestones and evolving ecosystem dynamics, this introduction sets the foundation for deeper analysis of market transformations, policy impacts, segmentation nuances, regional differentiation, and strategic imperatives.

Exploring Transformative Shifts Driving Automotive Ethernet Evolution From Bandwidth Expansion to Time Sensitive Networking Revolutionizing Vehicle Connectivity

Automotive Ethernet is in the midst of an evolutionary leap, driven by the imperative to accommodate exponential data growth and emerging use cases such as over-the-air updates and vehicle-to-everything communication. The transition from 100BASE-T1 to 10GBASE-T and beyond signifies more than increased throughput; it heralds the integration of time-sensitive networking capabilities that ensure deterministic performance for safety-critical applications. Meanwhile, the proliferation of zone-based architectures is simplifying harness complexity and reducing vehicle weight, further underscoring Ethernet’s role as the foundational network layer.

Concurrently, the industry is witnessing a convergence of IT and automotive testing paradigms, compelling test and validation approaches to evolve. Test coverage must now encompass interoperability, EMC compliance, and cybersecurity resilience alongside traditional performance metrics. This convergence is catalyzing the growth of specialized testing tools and services, enabling suppliers and manufacturers to accelerate development cycles while ensuring functional safety and regulatory adherence. Together, these transformative shifts are reshaping competitive dynamics and elevating value creation across the automotive ecosystem.

Assessing Cumulative Impact of 2025 United States Tariffs on Automotive Ethernet Supply Chain and Cost Structures Influencing Industry Strategies

In 2025, the United States government refined its tariff schedule to address supply chain vulnerabilities in critical automotive components, encompassing semiconductor interfaces, connectors, and test equipment integral to automotive Ethernet deployments. These levies have introduced additional cost pressures, compelling OEMs and tier-1 suppliers to reevaluate sourcing strategies. Many organizations are now prioritizing localized production or qualifying secondary suppliers to mitigate upward cost trajectories and ensure continuity of supply.

The cumulative effect of these tariffs extends beyond direct component pricing, influencing inventory management, lead-time buffers, and contract negotiations. Engineering and procurement teams are collaborating closely to redesign harness architectures for component flexibility and to identify modular solutions that can accommodate alternative vendors without extensive revalidation. This strategic realignment is accelerating investment in regional manufacturing hubs and bolstering collaborative ventures, thereby enhancing supply-chain resilience and cost transparency in a rapidly shifting trade policy environment.

Unveiling Key Segmentation Insights Illuminating How Type Components Transmission Application Vehicle Type and End User Shape Automotive Ethernet Markets

An in-depth examination of market segmentation reveals that the automotive Ethernet domain is defined by network infrastructure offerings and specialized testing solutions, each addressing distinct phases of the vehicle development lifecycle. Hardware, services, and software components form the core ecosystem, with connectors, network switches, and physical layer transmitters providing the tangible links that carry high-speed signals across the vehicle. Meanwhile, installation and maintenance services are foundational to long-term performance, complementing the rapid integration of software-defined networking tools that facilitate diagnostics and remote updates.

Data transmission modalities further refine the competitive landscape, where 100BASE-T1 has served as the workhorse for mid-range bandwidth needs, even as demand for 1000BASE-T1 and 10GBASE-T accelerates to support the densest sensor arrays and immersive cabin experiences. Across applications, advanced driver assistance systems, chassis control networks, and body and comfort modules are leveraging Ethernet to unify disparate subsystems, while infotainment platforms and powertrain control units increasingly rely on Ethernet’s quality-of-service mechanisms to meet stringent latency and reliability requirements.

Vehicle segmentation underscores divergent adoption dynamics within commercial fleets and passenger car portfolios. Commercial vehicles such as buses, heavy trucks, and light commercial transports are adopting Ethernet to enable fleet telematics, predictive maintenance, and enhanced safety features, whereas hatchbacks, sedans, and SUVs are integrating Ethernet to support high-definition displays, audio streaming, and over-the-air updates. Finally, aftermarket channels and original equipment manufacturers are co-evolving, with aftermarket service providers leveraging portable testing suites to service aging vehicle fleets and OEMs embedding diagnostics capabilities directly into the vehicle platform.

This comprehensive research report categorizes the Automotive Ethernet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Type

- Transmission Type

- Application

- Vehicle Type

- End-User

Navigating Key Regional Insights Revealing Distinct Adoption Trends and Competitive Dynamics Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the automotive Ethernet market are shaped by distinct regulatory frameworks, industrial capabilities, and adoption velocities. In the Americas, North American automakers and technology hubs in the United States and Mexico have accelerated investments in high-volume Ethernet switch manufacturing and partner with local tier-1 suppliers to ensure compliance with reshoring incentives. The presence of leading OEM R&D centers drives innovation toward zonal architectures and high-speed data aggregation, simultaneously fostering robust aftermarket ecosystems to support connected vehicle service infrastructures.

Europe, Middle East, and Africa encompass a diverse spectrum of adoption patterns. European nations are pioneering Time-Sensitive Networking standards and functional safety benchmarks that set global precedents, while Middle East markets are increasingly integrating advanced telematics into commercial transport fleets. Africa, though nascent, shows promise in selected corridors where mining and logistics operations prioritize ruggedized networking solutions that leverage Ethernet for diagnostic telemetry and remote monitoring.

Asia-Pacific remains a pivotal growth frontier, with China’s large-scale EV mandates and Japan’s focus on autonomous mobility applications spurring sterling demand for both Ethernet hardware and sophisticated validation services. South Korea’s semiconductor ecosystem integrates deeply with vehicle networking, enabling domestic suppliers to offer vertically integrated SoC solutions. Meanwhile, ASEAN economies are cultivating joint ventures to upskill local workforces and establish assembly capabilities tailored to region-specific regulatory and infrastructural requirements.

This comprehensive research report examines key regions that drive the evolution of the Automotive Ethernet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Companies Driving Innovation and Strategic Partnerships Shaping the Future of Automotive Ethernet Ecosystem and Market Competition

The competitive landscape of automotive Ethernet is characterized by a blend of semiconductor leaders, connectivity specialists, and test equipment innovators. Prominent integrated circuit providers are driving the development of robust physical layer transceivers, embedded switches, and chipset platforms optimized for low power consumption and high reliability. Connectivity and harness manufacturers complement these offerings with advanced connector designs, shielding solutions, and zone-based distribution modules that reduce vehicle weight and simplify assembly.

Parallel to hardware evolution, software and test equipment vendors are forging new pathways for in-field diagnostics and continuous integration testing. Test solution providers are expanding their portfolios to include emulation of complex network topologies, cybersecurity penetration testing, and compliance validation against evolving standards. Ecosystem alliances and strategic partnerships between chipset vendors, OEMs, and test houses are proliferating, collectively accelerating interoperability initiatives and harmonizing certification processes to streamline time to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Ethernet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AllGo Embedded Systems Pvt. Ltd.

- Analog Devices, Inc.

- Aukua Systems, Inc.

- Broadcom Inc.

- Cadence Design Systems, Inc.

- Excelfore Corporation

- Infineon Technologies AG

- Marvell Technology Group Ltd.

- Microchip Technology Inc.

- Molex, LLC

- NEXCOM International Co., Ltd.

- NVIDIA Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qualcomm Incorporated

- Realtek Semiconductor Corp.

- Rohde & Schwarz GmbH & Co. KG

- RUETZ SYSTEM SOLUTIONS GmbH

- Spirent Communications plc

- System‑on‑Chip Engineering S.L.

- Texas Instruments Incorporated

- TE Connectivity Ltd.

- TSN Systems GmbH

- TTTech Auto AG

- Vector Informatik GmbH

Actionable Recommendations for Industry Leaders to Optimize Automotive Ethernet Strategies and Navigate Emerging Technological and Regulatory Challenges

Industry leaders can capitalize on automotive Ethernet’s momentum by embracing a multipronged strategy that balances technological differentiation with supply-chain resilience. First, prioritizing investment in time-sensitive networking and deterministic Ethernet profiles will enable integration of safety-critical functions without compromise. Concurrently, establishing partnerships with regional hardware suppliers and contract manufacturers will mitigate exposure to tariff-induced cost fluctuations and delivery disruptions.

Moreover, accelerating the development of modular network architectures that decouple application layers from physical topologies can foster reuse across multiple vehicle programs and support incremental feature upgrades. Companies should also expand their service offerings to include comprehensive testing and validation workflows that address cybersecurity, functional safety, and electromagnetic compatibility under one umbrella. Finally, engaging proactively in standards bodies and industry consortia will position organizations to influence specification roadmaps and ensure alignment with emerging regulatory requirements, underpinning a sustainable competitive advantage.

Comprehensive Research Methodology Outlining Primary Interviews Secondary Analysis and Data Triangulation to Deliver Robust Automotive Ethernet Insights

This research synthesizes insights gathered through a meticulous combination of primary and secondary methodologies. Primary research involved in-depth interviews with senior executives and technical leads at OEMs, tier-1 suppliers, and test equipment manufacturers, as well as expert panels composed of automotive network architects and validation engineers. Structured questionnaires and workshop sessions provided qualitative nuances on design priorities, supplier selection criteria, and evolving use cases.

Complementing the primary outreach, secondary research encompassed a thorough review of technical standards documents, peer-reviewed journal articles, white papers from industry cooperatives, and product literature from leading chipset and connectivity vendors. Patent landscapes and conference proceedings were analyzed to identify technology trajectories, while regulatory filings and trade policy publications informed the assessment of tariff impacts. Data triangulation ensured consistency across sources, with iterative validation by an advisory board of automotive Ethernet subject-matter experts to guarantee the fidelity and relevance of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Ethernet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Ethernet Market, by Components

- Automotive Ethernet Market, by Type

- Automotive Ethernet Market, by Transmission Type

- Automotive Ethernet Market, by Application

- Automotive Ethernet Market, by Vehicle Type

- Automotive Ethernet Market, by End-User

- Automotive Ethernet Market, by Region

- Automotive Ethernet Market, by Group

- Automotive Ethernet Market, by Country

- United States Automotive Ethernet Market

- China Automotive Ethernet Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Conclusion Summarizing Critical Insights and Strategic Imperatives for Stakeholders to Capitalize on Automotive Ethernet Advancements and Market Opportunities

In conclusion, automotive Ethernet has emerged as the indispensable backbone for next-generation vehicle architectures, uniting disparate subsystems under a common high-bandwidth framework. Transformative trends such as time-sensitive networking, zonal topologies, and integrated cybersecurity are catalyzing new competitive dynamics and redefining value propositions across the supply chain. At the same time, policy shifts and evolving tariffs in the United States are compelling stakeholders to reconsider sourcing strategies and invest in regional manufacturing capabilities.

Segment-specific insights reveal abundant opportunities in both network infrastructure and testing services, with differentiated demand curves across transmission types, applications, vehicle segments, and end-user channels. Regional variations underscore the importance of localized approaches, while a competitive landscape characterized by chipset innovators, connectivity specialists, and test equipment providers points to robust ecosystem collaboration. By aligning technology roadmaps with market realities and engaging proactively in standards development, stakeholders can unlock sustainable growth and leadership in the automotive Ethernet domain.

Access the Complete Automotive Ethernet Market Research Report and Engage with Associate Director of Sales Marketing Ketan Rohom for Purchase Guidance

Unlocking an in-depth exploration of the automotive Ethernet landscape begins here with unparalleled access to comprehensive market insights. Engage directly with the Associate Director of Sales & Marketing, Ketan Rohom, to receive personalized guidance on how this report can support your strategic decision making. Whether you represent an OEM, tier-1 supplier, test equipment provider, or investor, you will gain clarity on transformative technology trends, regional adoption patterns, and competitive strategies. By partnering with Ketan Rohom, you will benefit from a tailored discussion on licensing, delivery timelines, and bespoke advisory services designed to accelerate your market entry or expansion plan. Don’t miss this opportunity to elevate your understanding of automotive Ethernet and drive future-ready innovation within your organization; contact Ketan Rohom today to secure your copy of the definitive research report and chart your path to competitive advantage.

- How big is the Automotive Ethernet Market?

- What is the Automotive Ethernet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?