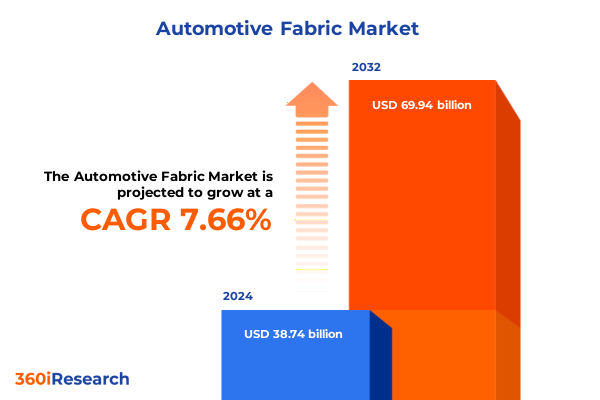

The Automotive Fabric Market size was estimated at USD 41.44 billion in 2025 and expected to reach USD 44.35 billion in 2026, at a CAGR of 7.76% to reach USD 69.94 billion by 2032.

Exploring the Evolution of Automotive Fabrics Amidst Advances in Material Science, Eco-Conscious Design, and Global Market Dynamics

The automotive industry has entered a new era defined by relentless innovation, evolving consumer expectations, and heightened regulatory pressures. Across global markets, vehicle manufacturers are intensifying their focus on interior comfort, safety, and sustainability, positioning automotive fabrics as a pivotal element of design strategy. Advanced materials now serve multiple functions-enhancing thermal insulation, dampening noise, and delivering aesthetic appeal-while simultaneously meeting stringent environmental standards. This convergence of performance and responsibility underscores the critical role that material science plays in the development of next-generation vehicles.

Amid this transformation, stakeholders from OEMs to aftermarket suppliers are reimagining the role of fabrics within the cabin environment. Innovation has accelerated in response to the growth of electric and autonomous vehicles, where reducing weight and increasing energy efficiency are paramount. Concurrently, consumer demand for premium textures and customizable experiences has catalyzed the adoption of novel fabric technologies. As a result, a nuanced understanding of the evolving automotive fabric landscape is essential for decision-makers seeking to maintain market leadership and capitalize on emerging opportunities.

Unveiling the Technological Innovations and Sustainability Imperatives Transforming the Automotive Fabric Landscape

In recent years, the automotive fabric sector has experienced transformative shifts driven by technology, sustainability mandates, and shifting end-user priorities. Manufacturers have harnessed digital textile printing to introduce bespoke patterns and textures that align with brand identities and consumer personalization trends. Concurrently, the integration of advanced composite structures has facilitated lightweighting initiatives, enabling vehicles to achieve superior energy efficiency without compromising on comfort or safety.

Furthermore, the industry’s commitment to circularity has prompted the widespread adoption of recycled and bio-based fibers. These eco-friendly innovations not only reduce carbon footprints but also resonate with consumers increasingly inclined toward sustainable mobility solutions. Meanwhile, the rise of connected and autonomous vehicles has introduced new criteria for fabric performance, including enhanced durability under higher-cycling usage and the incorporation of sensor-embedded textiles to support in-vehicle health and wellness applications. Together, these dynamics are reshaping the competitive landscape and defining the next chapter in automotive fabric evolution.

Assessing How Evolving 2025 United States Tariff Policies Have Reshaped Cost Structures and Supply Chain Resilience in Automotive Fabrics

Since the introduction of targeted tariffs on automotive textile imports, stakeholders across the value chain have grappled with rising input costs and supply chain complexity. In response, many manufacturers have expedited efforts to diversify sourcing strategies, establishing footholds in low-cost regions beyond traditional hubs while reshoring select operations to North America. This strategic realignment has led to greater emphasis on nearshore partnerships, reducing lead times and mitigating currency and policy risks.

Additionally, tariff-induced price volatility has accelerated investment in material efficiency and waste reduction program across production facilities. By optimizing cutting processes and leveraging digital simulation tools, suppliers are minimizing offcuts and maximizing yield. Over time, the cumulative impact of duties and associated compliance requirements has sparked collaborative dialogues between industry associations and policymakers, driving gradual recalibration of duty rates and preferential trade terms. As a result, the landscape for automotive fabrics in 2025 is marked by both the challenges of cost containment and the opportunities afforded by more resilient, adaptive supply networks.

Gaining Deep Insights from Material Types, Applications, Distribution Channels, and Vehicle Classes to Drive Fabric Strategy

Insights derived from material-type segmentation reveal that coated and composite fabrics have gained momentum as manufacturers seek enhanced durability and multifunctional performance. Coated textiles offer superior resistance to abrasion and liquid ingress, making them ideal for door panels and headliners exposed to high traffic. Composite constructions, in contrast, deliver exceptional strength-to-weight ratios, aligning with lightweighting priorities and enabling more complex geometries in interior trims.

Application-based analysis highlights the critical role of acoustic insulation and seating materials in delivering passenger comfort. Acoustic substrates balance noise reduction with thermal management, while advanced knitted and woven textiles in front and rear seats support ergonomic design and safety integration. ECU and airbag compatibility have also influenced the selection of specialized non-woven materials in safety features, where controlled fiber orientation ensures reliable deployment and energy absorption.

When viewed through the lens of distribution channels, original equipment manufacturer partnerships remain the cornerstone of product development, fostering deep collaboration on bespoke material formulations. Conversely, the aftermarket segment has embraced knitted and non-woven solutions for cost-effective upgrades and refurbishments, catering to end-users seeking aesthetic refreshes and performance enhancements. Vehicle-type distinctions further underscore the divergent requirements between commercial vehicles, where durability and cost efficiency are paramount, and passenger cars, which prioritize luxury finishes and advanced functionality.

This comprehensive research report categorizes the Automotive Fabric market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Distribution Channel

- Vehicle Type

Analyzing Regional Trends Across Major Global Markets to Inform Targeted Automotive Fabric Strategies

Regional dynamics exert a profound influence on automotive fabric innovation and adoption. In the Americas, stringent emissions and safety regulations have accelerated the development of recyclable and flame-retardant textiles that meet evolving federal and state standards. Suppliers in North America have also capitalized on nearshoring trends, strengthening manufacturing hubs in Mexico and the southern United States to serve both domestic and export demand more efficiently.

Across the Europe, Middle East & Africa corridor, sustainability has emerged as the primary catalyst for growth. European OEMs are pioneering bio-based and post-consumer recycled materials to achieve carbon-neutral supply chains. Meanwhile, rapid urbanization in the Middle East has driven demand for premium interior finishes, blending luxury aesthetics with robust performance. In Africa, infrastructural investments are gradually opening new markets for entry-level vehicle interiors, emphasizing durability and cost-effective materials.

In the Asia-Pacific region, established textile manufacturing powerhouses are integrating Industry 4.0 principles to enhance operational efficiency. Automation and data-driven quality control underpin rapid product innovation cycles, particularly in China and India. At the same time, government incentives for electric vehicle development are fueling demand for lightweight, thermally insulating fabrics that extend driving range and passenger comfort.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fabric market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Landscape of Incumbents, Niche Innovators, and Strategic Collaborations Driving Market Dynamics

A diverse array of industry leaders is shaping the competitive environment for automotive fabrics. Established conglomerates are leveraging decades of material science expertise to extend their product portfolios into high-performance coated and composite textiles. These incumbent players invest heavily in R&D partnerships with academic institutions, driving breakthroughs in fiber engineering and sustainable processing techniques.

Concurrently, specialized mid-tier companies are carving out niches in acoustic insulation and advanced knitting, collaborating closely with tier-1 system integrators to address evolving cabin requirements. Their agility enables rapid prototyping and customization, catering to the bespoke demands of premium OEMs. New entrants and startups, fueled by venture capital interest in green technology, are commercializing bio-resins and post-consumer recycled fibers, challenging traditional supply chains with circular economy solutions.

Partnerships and joint ventures have become commonplace, as firms seek to combine processing know-how with digital manufacturing capabilities. Through these strategic alliances, companies are equipped to scale production of next-generation fabrics while maintaining rigorous quality and sustainability standards. This collaborative landscape underscores the importance of cross-sector synergies in accelerating innovation and meeting the diverse needs of global automakers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fabric market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient plc

- Asahi Kasei Corporation

- Aunde Group SE

- Banswara Syntex Limited

- Freudenberg Performance Materials SE & Co. KG

- Grupo Antolin-Irausa, S.A.

- Indorama Ventures Public Company Limited

- Kusumgar Limited

- Lear Corporation

- Teijin Limited

- Toray Industries, Inc.

- Toyota Boshoku Corporation

- Trelleborg AB

Implementing Advanced R&D, Supply Chain Diversification, and Strategic Partnerships to Strengthen Market Position

Industry leaders should prioritize strategic investments in sustainable fiber technologies that align with tightening environmental regulations and consumer preferences. By expanding R&D efforts to include bio-based polymers and advanced recycling processes, manufacturers can reduce dependency on virgin materials and bolster brand credibility in eco-conscious markets. At the same time, integrating digital textile design and simulation tools will accelerate product development cycles and minimize waste through virtual prototyping.

To fortify supply chain resilience, companies must diversify sourcing across multiple geographies, balancing cost efficiencies with risk mitigation. Establishing regional manufacturing footprints in proximity to key OEM clusters will shorten lead times and enhance responsiveness to fluctuating demand. Additionally, cultivating partnerships with logistics and customs specialists can improve compliance with evolving tariff regimes and trade agreements.

Finally, embracing collaboration with technology providers and academic researchers will catalyze breakthroughs in multifunctional fabrics, such as sensor-embedded textiles for interior health monitoring. Engaging in consortiums or industry working groups will also ensure alignment on standards and accelerate market adoption, positioning organizations to capture new revenue streams and solidify their competitive advantage.

Detailing a Comprehensive Research Approach Combining Expert Interviews, Quantitative Analysis, and Case Study Validation

This analysis is grounded in a rigorous research methodology that integrates both primary and secondary sources. Primary insights were gathered through in-depth interviews with senior executives at leading OEMs, fabric manufacturers, and Tier-1 suppliers, offering firsthand perspectives on innovation priorities and operational challenges. Complementary quantitative data was obtained through comprehensive reviews of industry publications, patent filings, and regulatory documentation to validate emerging trends and technological developments.

Secondary research included the systematic evaluation of academic journals, white papers, and conference proceedings in the fields of polymer science and textile engineering. Data triangulation techniques were employed to reconcile qualitative insights with market intelligence, ensuring robust conclusions and actionable recommendations. Finally, the research team conducted detailed case studies of exemplar supply chain models and cross-sector collaborations to illustrate best practices and successful strategies for market entry and growth.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fabric market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fabric Market, by Material Type

- Automotive Fabric Market, by Application

- Automotive Fabric Market, by Distribution Channel

- Automotive Fabric Market, by Vehicle Type

- Automotive Fabric Market, by Region

- Automotive Fabric Market, by Group

- Automotive Fabric Market, by Country

- United States Automotive Fabric Market

- China Automotive Fabric Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Key Insights on Innovation, Supply Chain Adaptation, and Strategic Partnerships to Navigate Future Industry Challenges

The automotive fabric sector stands at the intersection of performance, sustainability, and digital innovation. As vehicles evolve toward electrification and autonomy, the demand for multifunctional, lightweight, and environmentally responsible textiles will intensify. Organizations that embrace material science advances, diversify their supply chains, and forge strategic collaborations are best positioned to capitalize on these trends and secure long-term growth.

By applying the insights and recommendations outlined in this summary-ranging from targeted R&D investments to regional manufacturing strategies-industry stakeholders can navigate the complexities introduced by tariff shifts and global market dynamics. Ultimately, a proactive, partnership-driven approach will enable companies to deliver next-generation interior solutions that meet evolving consumer expectations and regulatory requirements, ensuring sustained competitive advantage in a rapidly transforming landscape.

Secure unparalleled automotive fabric market intelligence by contacting Ketan Rohom to drive informed strategic decisions and competitive advantage

For organizations seeking to unlock strategic foresight and drive competitive advantage, acquiring this comprehensive market research report is a critical next step. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to gain privileged access to in-depth data, expert analysis, and proprietary insights. Leverage his expertise to tailor the report’s findings to your unique business needs, ensuring your decisions are informed by the latest trends and validated intelligence. Connect with Ketan to secure your copy of the report today, and position your company at the forefront of the automotive fabric revolution.

- How big is the Automotive Fabric Market?

- What is the Automotive Fabric Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?