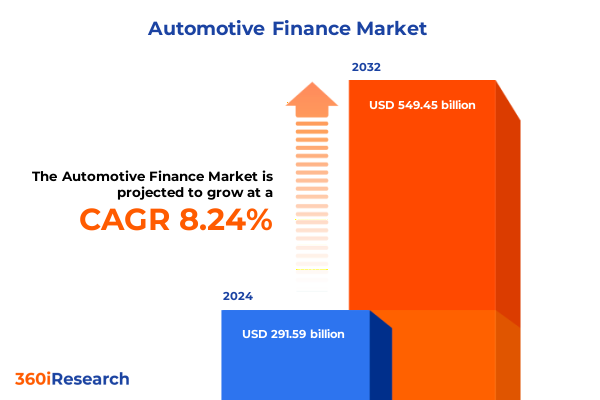

The Automotive Finance Market size was estimated at USD 315.45 billion in 2025 and expected to reach USD 338.36 billion in 2026, at a CAGR of 8.24% to reach USD 549.45 billion by 2032.

Automotive financing at the cusp of a new era demands adaptive strategies to drive growth and resilience in evolving market conditions

The automotive finance sector is undergoing a pivotal transformation as macroeconomic conditions, technological advancements, and evolving consumer behaviors converge to redefine how vehicles are acquired and financed. Against a backdrop of historically low interest rates giving way to a tightening monetary environment, lending institutions and original equipment manufacturers are compelled to revisit their underwriting criteria, pricing models, and risk management approaches. Simultaneously, emerging retail channels, from digital marketplaces to subscription services, are challenging legacy distribution frameworks, stimulating competition and innovation.

In this context, the interplay between electrification mandates and consumer demand for sustainability is reshaping product offerings, while regulatory pressures on data privacy and environmental standards are influencing compliance priorities. The resulting landscape demands a holistic perspective that encompasses the supply chain, capital structure, and aftermarket value propositions. This executive summary synthesizes the salient market shifts, policy impacts, and competitive dynamics that stakeholders must address to thrive in today’s automotive financing environment.

Drawing upon extensive primary interviews with industry executives, proprietary data analyses, and a thorough review of regulatory developments, the subsequent sections unpack key transformative shifts, quantify tariff implications, elucidate granular segmentation and regional nuances, highlight major market players, and propose actionable recommendations. The depth and breadth of this analysis are designed to equip decision-makers with the insights needed to forge resilient strategies and capture emerging opportunities.

The rise of electrification digital platforms and diversified financing models is reshaping how consumers and fleets access vehicles in the United States

The electrification of vehicle portfolios has emerged as a fundamental driver of change in automotive finance. As manufacturers accelerate the rollout of electric models, financing products must adapt to account for distinct residual value profiles, battery lease structures, and potential government incentives. This shift is not isolated; it reverberates through risk assessment frameworks, necessitating new methodologies to quantify the impact of battery degradation, charging infrastructure availability, and evolving consumer preferences.

Parallel to these product shifts, digital retail experiences have gained unprecedented traction. A growing share of buyers now complete financing approvals, trade-in valuations, and contract signings through online platforms, often integrated with e-commerce ecosystems. This migration toward digital origination demands robust data security protocols, seamless user interfaces, and real-time credit adjudication engines capable of scaling across diverse customer segments.

Moreover, the proliferation of alternative financing models-ranging from flexible subscription services to peer-to-peer lending arrangements-has introduced new competition and disintermediation risks. Traditional lenders are challenged to refine their value propositions by layering in benefits such as maintenance bundles, usage-based insurance, and loyalty incentives, thereby fostering deeper customer engagement.

Lastly, regulatory developments around consumer protection, fair lending practices, and ecosystem interoperability are influencing the strategic choices of finance providers. The need to reconcile growth ambitions with compliance obligations underscores the importance of agile operational frameworks and proactive stakeholder collaboration across industry, government, and consumer advocacy groups.

New tariff measures in twenty twenty five are exerting pressure on supply chains manufacturing costs and financing structures across automotive segments

In twenty twenty five, new and enduring tariff measures continue to exert significant influence on automotive supply chains and financing structures. The extension of steel and aluminum tariffs, coupled with targeted levies on imported electric vehicle components, is elevating production costs and prompting manufacturers to recalibrate sourcing strategies. These cost pressures inevitably cascade to financing programs, as higher vehicle prices affect loan-to-value ratios and residual value projections.

From a credit risk standpoint, the inflationary impact of tariffs is contributing to increased monthly payment obligations for consumers and fleet operators alike. Lenders are responding by tightening underwriting criteria, requiring higher down payments, or adjusting interest spreads to preserve margin integrity. In some cases, captive finance organizations are absorbing a greater share of cost increases to maintain competitive lease rates, which in turn affects residual value guarantees at contract end.

Beyond immediate pricing effects, the unpredictability surrounding future trade policy adds a layer of volatility to long-term strategic planning. Financing providers are enhancing scenario modeling to assess the potential ramifications of expanded tariff scopes or retaliatory measures. This includes stress-testing credit portfolios under divergent cost and residual value sensitivities, as well as reexamining the risk-return calculus for emerging segments such as electric commercial fleets.

Furthermore, the tariff environment has underscored the strategic importance of regional production footprints. Companies with flexible manufacturing networks are better positioned to mitigate cross-border tariff impacts, which also influences financing partnerships and channel priorities. As the trade landscape continues to evolve, the capacity to swiftly adapt financing schemes in alignment with supply chain resilience will determine which providers sustain competitive advantages.

Deep segmentation based on customer type vehicle type financing models credit tiers and distribution channels reveals strategic pockets of growth and risk

Delving into customer type segmentation, the market’s dual pillars of Consumer and Fleet financing reveal distinct growth trajectories. First-time buyers, buoyed by digital onboarding tools and targeted incentive programs, exhibit appetite for flexible financing structures, whereas returning buyers demonstrate brand loyalty and lower credit risk, giving rise to differentiated pricing strategies. Corporate fleet financing, driven by efficiency mandates and total cost of ownership analyses, demands larger ticket sizes and integrated telematics offerings, while rental fleets prioritize rapid vehicle turnover and residual value optimization.

Examining vehicle type segmentation, new electric vehicles command bespoke financing solutions that account for government rebates, specialized insurance, and battery maintenance. In contrast, internal combustion engine models benefit from well-established risk models and residual benchmarks. Among used vehicles, certified pre-owned programs leverage factory-backed warranties to instill confidence and often align with captive finance promotions, whereas non-certified pre-owned vehicles follow broader retail and wholesale loan criteria, reflecting a wider variance in credit quality.

Turning to financing type, closed-end leases offer fixed end-of-term obligations appealing to consumers seeking payment predictability, whereas open-end leases attract commercial operators willing to assume residual value risk in exchange for contract flexibility. Retail loans cater to individual ownership aspirations with amortization schedules tied to credit profiles, while wholesale loans underpin dealer floor planning and inventory financing, sustaining the retail pipeline.

Credit tier segmentation further refines market dynamics, as prime borrowers benefit from preferential rates and streamlined approvals, while deep subprime applicants face rigorous collateral requirements and alternative underwriting pathways. Within the subprime bracket, near-prime customers are transitioning toward standard loan products, whereas true subprime segments rely heavily on specialized lenders that accommodate higher risk premiums. This layered understanding enables precision targeting and risk calibration across the credit spectrum.

Assessing distribution channels, captive finance divisions leverage brand affinity and dealer networks to secure preferential rate structures and integrated service offerings, while commercial banks, spanning large institutions and regional banks, provide broad-based lending capabilities with scalable underwriting platforms. Community credit unions cultivate member-centric financing propositions, benefiting from local market insights, whereas large credit unions balance competitive rates with operational scale. Independent finance companies, including fintech lenders and traditional independents, drive innovation through streamlined digital processes, alternative data usage, and niche market focus, reshaping customer acquisition and retention pathways.

This comprehensive research report categorizes the Automotive Finance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Customer Type

- Financing Type

- Credit Tier

- Vehicle Type

- Distribution Channel

Regional dynamics across the Americas Europe Middle East Africa and Asia Pacific underline distinct economic drivers and financing behaviors

Across the Americas, the United States remains the epicenter of automotive finance innovation, propelled by a diverse consumer base and robust dealer network. Latin American markets, while growth-oriented, present varied regulatory and currency risk considerations that influence cross-border financing partnerships. Canadian finance providers, operating within a more centralized banking structure, benefit from stable interest rates and harmonized consumer protection standards.

In Europe, Middle East, and Africa, divergent economic cycles and regulatory regimes create a mosaic of financing practices. Western European markets emphasize green lending initiatives and robust credit bureau integration, whereas emerging markets in Eastern Europe and Africa are characterized by higher interest rate environments, informal distribution channels, and shifting collateral norms. In the Middle East, sovereign wealth fund participation and government-supported leasing programs are driving fleet growth in commercial and public sectors.

The Asia-Pacific region encompasses mature markets like Japan and Australia, where aging vehicle populations and digital adoption spur targeted refinancing products, alongside frontier markets in Southeast Asia that offer high-growth potential but face infrastructural and regulatory hurdles. China’s dual focus on electrification and shared mobility has fostered innovative captive finance models, while India’s evolving credit ecosystem is expanding access through digital lending platforms and alternative data solutions. Regional dynamics underscore the necessity for finance providers to tailor product designs, partnership strategies, and compliance frameworks to local market realities.

This comprehensive research report examines key regions that drive the evolution of the Automotive Finance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading automotive finance providers and emerging fintech disruptors are jockeying for market share through innovation partnerships and strategic alliances

Legacy captive finance entities affiliated with major automakers continue to dominate volume, leveraging integrated dealer networks and brand-specific loyalty programs to secure repeat business. Their scale enables competitive lease residuals and captive-backed incentives that influence consumer choice. Meanwhile, national commercial banks draw upon diversified balance sheets to offer comprehensive loan portfolios, bundling financing with insurance and ancillary products to drive share of wallet.

Credit unions, particularly community-based institutions, are carving out niches by emphasizing member relationships, flexible underwriting, and lower fee structures. Their proximity to local markets affords them insights into community credit dynamics and emerging consumer trends. Conversely, large credit unions utilize digital platforms and strategic partnerships to extend their reach and maintain cost efficiency, positioning themselves as credible alternatives to traditional banks.

Independent finance companies and fintech disruptors are reshaping the competitive landscape through technology-driven origination, risk-based pricing, and alternative data incorporation. By streamlining application processes and offering instant credit decisions, they appeal to digitally native consumers and underserved subprime segments. Strategic alliances between fintechs and established lenders are gaining traction, combining technological agility with regulatory compliance and capital access.

Emerging players from adjacent sectors, including mobility service providers and telematics specialists, are entering the financing arena via white-label solutions and joint ventures. Their data-rich platforms enable usage-based lending models and pay-per-mile financial products, introducing new revenue streams while challenging conventional underwriting paradigms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Finance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ally Financial Inc.

- American Honda Finance Corporation

- Bank of America Corporation

- BMW Financial Services NA, LLC

- Capital One Financial Corporation

- CarMax Auto Finance

- Credit Acceptance Corporation

- Exeter Finance Corp

- Ford Motor Credit Company LLC

- GM Financial Company, Inc.

- Hyundai Capital America, Inc.

- JPMorgan Chase & Co.

- Mercedes-Benz Financial Services USA LLC

- Nissan Motor Acceptance Corporation

- PNC Financial Services Group, Inc.

- Santander Consumer USA Inc.

- TD Auto Finance

- Toyota Financial Services Corporation

- Truist Financial Corporation

- USAA Federal Savings Bank

- Volkswagen Credit, Inc.

- Wells Fargo & Company

- Westlake Financial Services

- World Omni Financial Corp

Pragmatic steps for industry leaders to optimize lending frameworks embrace technological innovation and navigate regulatory headwinds effectively

Industry leaders should prioritize the integration of advanced data analytics into underwriting frameworks to refine risk assessment for electrified and shared mobility segments. By leveraging machine learning models that incorporate telematics, payment behavior, and alternative credit indicators, finance providers can optimize pricing and expand access to underbanked populations. Strategic investments in predictive analytics platforms will be pivotal in maintaining competitive positioning.

Strengthening digital retail ecosystems is equally critical. Finance organizations must collaborate with OEMs and dealer networks to deliver end-to-end online experiences that seamlessly connect prequalification, trade appraisal, financing approval, and document execution. User-centric design, robust cybersecurity measures, and personalized financial offers will enhance conversion rates and foster long-term loyalty.

To address tariff-related cost pressures, companies should explore dynamic pricing strategies and hedging mechanisms that absorb or mitigate input cost volatility. Establishing captive purchasing teams or joint procurement consortia can help finance arms secure more favorable terms on vehicles and components, indirectly preserving residual values and lease rate competitiveness.

Finally, cultivating cross-channel synergies by forging partnerships with fintech innovators, mobility service providers, and insurance carriers will unlock new revenue streams. Collaborative pilots around subscription models, usage-based insurance, and pay-as-you-go financing can diversify portfolios and capture evolving consumer preferences, ensuring that finance providers are well-positioned for sustained growth.

Robust research methodology combining qualitative interviews quantitative analysis and comprehensive market triangulation ensures data accuracy and strategic relevance

This research leverages a multi-faceted methodology that combines in-depth interviews with senior executives across OEM captive finance divisions, commercial banking institutions, credit unions, and independent finance providers. These qualitative insights are complemented by extensive secondary research, including regulatory filings, industry white papers, and investor presentations, to ensure a comprehensive understanding of market dynamics.

Quantitative analysis spans loan origination data, residual value performance, pricing trends, and macroeconomic indicators to identify correlations and outliers. Advanced statistical techniques, such as regression modeling and scenario analysis, underpin key findings on credit risk shifts, absorption of tariff impacts, and the adoption rates of alternative finance solutions. This approach facilitates robust triangulation and validation of market intelligence.

Additionally, a series of consumer and fleet operator surveys were conducted to capture evolving preferences, digital engagement behaviors, and financing challenges. The insights derived from these surveys inform the segmentation deep dive and regional breakdowns, enabling nuanced differentiation across customer cohorts and geographies.

The combination of primary and secondary sources, enriched by proprietary data sets and rigorous analytical frameworks, provides an authoritative foundation for strategic decision-making. The research lifecycle also included iterative reviews with industry advisory panels to refine assumptions and contextualize emerging trends against real-world operational constraints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Finance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Finance Market, by Customer Type

- Automotive Finance Market, by Financing Type

- Automotive Finance Market, by Credit Tier

- Automotive Finance Market, by Vehicle Type

- Automotive Finance Market, by Distribution Channel

- Automotive Finance Market, by Region

- Automotive Finance Market, by Group

- Automotive Finance Market, by Country

- United States Automotive Finance Market

- China Automotive Finance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing the evolving financing landscape highlights critical inflection points for stakeholders to capitalize on transformative trends and mitigate emerging risks

As the automotive finance landscape evolves at an accelerated pace, stakeholders must remain vigilant in monitoring technological, regulatory, and geopolitical developments. Electrification, digital transformation, and trade policy shifts represent converging currents that will reshape credit risk, distribution channels, and customer expectations.

The interdependencies among segmentation categories-from consumer credit tiers to distribution channels-highlight the importance of cross-functional coordination and data-driven strategy formulation. Leveraging detailed segmentation insights and regional nuances will be essential for designing resilient financing programs that balance growth objectives with risk mitigation.

Ultimately, the capacity to translate this analytical depth into decisive actions will separate market leaders from laggards. By aligning organizational structures, technology investments, and partnership ecosystems with the insights surfaced in this report, finance providers can unlock sustainable competitive advantages and deliver value across the evolving vehicle ownership and mobility continuum.

Engage directly with Associate Director Ketan Rohom to unlock comprehensive insights in the automotive finance market report tailored to your strategic objectives

To explore how these findings can be tailored to your organization’s roadmap, connect with Associate Director Ketan Rohom who brings deep domain expertise and a strategic lens to automotive finance narratives. His guidance will help you navigate complex market dynamics, from credit structuring and channel optimization to tariff risk mitigation. By engaging directly, you will gain personalized insights, exclusive data deep dives, and targeted advisory support to fortify your competitive positioning. Seize this opportunity to acquire the comprehensive market research report that empowers your team to make informed, data-driven decisions and accelerate growth in an increasingly dynamic landscape.

- How big is the Automotive Finance Market?

- What is the Automotive Finance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?