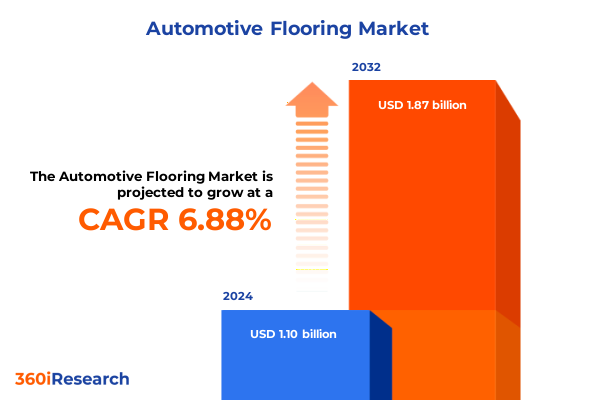

The Automotive Flooring Market size was estimated at USD 1.16 billion in 2025 and expected to reach USD 1.23 billion in 2026, at a CAGR of 7.09% to reach USD 1.87 billion by 2032.

Setting the Stage for Automotive Flooring Excellence With Clarity on Industry Context, Stakeholder Dynamics, and Emerging Opportunities

The automotive flooring segment occupies a pivotal position within the broader interior components ecosystem, serving as the interface between passengers, operators, and the vehicle architecture. With rising consumer expectations around noise insulation, comfort, and aesthetics, flooring materials have evolved from purely functional rubber mats to advanced composite and biobased surfaces. In parallel, regulatory regimes around flammability, volatile organic compound emissions, and recyclability have compelled manufacturers to innovate in both design and materials selection.

At the heart of this market, stakeholders span global original equipment manufacturers, tier 1 and tier 2 suppliers, aftermarket specialists, and distribution channels ranging from traditional dealerships to online platforms. OEM design teams are prioritizing lightweight and sustainable solutions to align with vehicle electrification strategies, while aftermarket providers must balance cost efficiency with enhanced features in a highly price-sensitive environment. Emerging technologies such as digital printing and integrated IoT sensor modules further blur the lines between utility and personalization.

Emerging opportunities center on leveraging advanced materials such as thermoplastic elastomers and recycled polymers, coupled with modular construction approaches that reduce assembly complexity and facilitate circularity. As consumer demand shifts toward bespoke interior experiences, the automotive flooring landscape is poised for transformation, underscoring the need for a comprehensive overview of current drivers, challenges, and future trajectories.

Beyond these developments, the automotive flooring segment is increasingly recognized as a differentiator in brand positioning and occupant experience. High-end automakers are investing in tactile, premium flooring modules that harmonize with seat materials and trim accents, reinforcing cohesive interior design themes. At the same time, aftermarket innovators are capitalizing on customization platforms that allow drivers to select bespoke color patterns, logos, and textures, underscoring the dual importance of form and function in this maturing category.

Unveiling Revolutionary Trends Reshaping Automotive Flooring: From Technological Innovations to Sustainability Imperatives Driving Market Evolution

Over the past decade, the automotive flooring landscape has witnessed a profound metamorphosis driven by technological breakthroughs and mounting sustainability imperatives. Thermoplastic elastomers, once reserved for niche applications, have emerged as surrogates for traditional vinyl and rubber, offering significant weight savings and enhanced recyclability. Concurrently, advancements in natural fiber composites and bio-based polymers are gaining traction among OEMs seeking to align cabin materials with circular economy objectives. These material shifts not only reduce environmental impact but also contribute to overall vehicle mass reduction, which plays a critical role in extending the range of battery electric vehicles.

Alongside material innovations, digital manufacturing techniques such as laser-guided trimming, 3D printing for rapid prototyping, and digital printing for customizable aesthetics are redefining production flexibility. Manufacturers now can produce small-batch, model-specific flooring modules without prohibitive tooling investments, enabling a higher degree of personalization that resonates with premium automakers and aftermarket enthusiasts alike. The integration of IoT-enabled floor sensors adds another layer of functionality, facilitating occupant detection, weight distribution analysis, and predictive maintenance alerts.

Regulatory frameworks around indoor air quality and chemical emissions have tightened, forcing suppliers to reformulate adhesives and backings to comply with stringent volatile organic compound thresholds. Acoustic performance requirements, particularly for electric powertrains that accentuate interior soundscapes, have fostered the adoption of specialized sound-deadening underlays and multi-layer composite constructions. As a result, tier 1 flooring systems now encompass a blend of foam substrates, polymeric barriers, and textile coverings engineered to attenuate noise while maintaining durability.

Furthermore, the aftermarket landscape has been reshaped by direct-to-consumer models, where subscription-based floor mat replacement services and virtual showrooms offer consumers unparalleled convenience. This trend is supported by advanced logistics and drop-shipping partnerships that minimize lead times. As a result, aftermarket providers are integrating digital experience platforms to engage end users with interactive configurators, enabling tailored recommendations based on vehicle model, climate region, and lifestyle preferences.

The convergence of these forces has set the stage for a new era in automotive flooring where functionality, sustainability, and digital capabilities intersect. Stakeholders who strategically invest in these transformative trends will be best positioned to navigate the shifting market landscape and capture emerging value pools.

Analyzing the Far Reaching Consequences of 2025 United States Tariffs on Automotive Flooring Supply Chains Production Costs and Competitiveness

In 2025, the United States government implemented revised tariff schedules targeting a broad range of imported automotive components, including flooring modules, raw polymer compounds, and textile laminates. Tariff rates on key inputs originating from select regions rose by an incremental 15 to 25 percentage points, compelling OEMs and tier 1 suppliers to reassess their procurement footprints. The sudden escalation in duties has amplified landed costs for imported carpet backing materials and high-performance rubbers, exerting upward pressure on production budgets across North America.

Confronted with these heightened import levies, manufacturers have pursued a multipronged response. Some have accelerated nearshoring initiatives, shifting sourcing to domestic compounders and nontraditional jurisdictions to mitigate exposure to punitive duties. Others have initiated collaborative ventures with local material suppliers to secure lower-cost equivalents and strengthen supply chain resilience. Inventory build strategies have been revisited, with entities opting to stockpile critical polymer beads and textile rolls prior to tariff adjustments, thereby reducing immediate cost volatility but raising storage and working capital considerations.

From a competitiveness standpoint, the tariffs have created differential impacts across vehicle segments. Heavy commercial vehicle flooring assemblies, which rely on high-grade rubbers to withstand severe operating conditions, have faced more pronounced cost escalations compared to passenger car carpet systems that can more readily substitute toward lower-tier materials. Off-road and agricultural vehicle segments, characterized by fluctuating demand cycles, have exhibited a more cautious investment posture, delaying flooring upgrades and focusing on lifecycle cost optimization to offset the impact of tariff-induced price shifts.

Moreover, tariff-induced cost pressures have spurred a wave of material substitution trials, with companies experimenting with domestically produced recycled PET fibers and bio-based rubber analogues. Pilot programs in North America have demonstrated that these alternative materials can achieve comparable wear resistance and acoustic performance at moderate cost premiums. For OEMs and tier 1 suppliers willing to invest in qualification processes, these innovations present a pathway to circumvent import duties while advancing sustainability agendas.

Moreover, tariff-induced cost pressures have spurred a wave of material substitution trials, with companies experimenting with domestically produced recycled PET fibers and bio-based rubber analogues. Pilot programs in North America have demonstrated that these alternative materials can achieve comparable wear resistance and acoustic performance at moderate cost premiums. For OEMs and tier 1 suppliers willing to invest in qualification processes, these innovations present a pathway to circumvent import duties while advancing sustainability agendas.

Ultimately, the 2025 tariff revisions have underscored the strategic imperative of supply diversification, vertical integration for critical polymer processing, and dynamic cost management. Firms that proactively recalibrate their sourcing strategies stand to preserve margin integrity and maintain competitive positioning in a more protectionist trade environment.

Unlocking Strategic Perspectives Through In Depth Segmentation Insights Across Vehicle Type Material Composition and Distribution Channel Dynamics

Understanding the automotive flooring market through the prism of vehicle type reveals distinct demand patterns and performance requirements. Commercial vehicles, bifurcated into heavy and light classes, prioritize durability and chemical resistance to endure intensive duty cycles and frequent cleaning regimens. In contrast, off-road vehicles-spanning agricultural equipment and construction machinery-call for robust, abrasion-resistant surfaces designed to repel mud, debris, and hydraulic fluids. Passenger cars further fragment into hatchback, sedan, and sport utility vehicle categories, with hatchbacks often favoring lightweight, cost-effective carpet modules, sedans demanding enhanced acoustic damping, and SUVs leveraging textured rubber or vinyl for all-weather versatility.

Material type segmentation adds another layer of granularity, highlighting opportunities for differentiation. Traditional carpet options, including chenille, cut pile, and loop pile constructions, continue to serve upper-tier consumer preferences for refined tactile comfort and upscale aesthetics. However, natural and synthetic rubber formulations have grown in prominence for applications that demand moisture resistance and ease of cleaning, while thermoplastic elastomer blends strike a balance between flexibility and recyclability. Vinyl flooring modules have maintained their foothold in cost-sensitive segments due to straightforward molding processes and scalable production.

Distribution channel insights further shape engagement strategies across the value chain. Dealerships remain critical for bespoke, model-specific interior upgrades, leveraging factory-fit accessory programs to capture aftermarket sales. E-commerce platforms have disrupted conventional retail dynamics by providing consumers with on-demand access to custom-fit mat kits, digital configurators, and subscription replacement services. Original equipment manufacturers increasingly exert influence through direct sourcing agreements and co-development partnerships, while retail outlets continue to cater to high-volume replacement demand with economy-focused product lines.

Delving into these segmentation dimensions equips stakeholders to align product roadmaps, investment priorities, and marketing initiatives with the nuanced expectations of each category, thereby unlocking targeted growth avenues and driving more efficient resource allocation.

An integrated view across the three segmentation axes illuminates cross-functional growth levers. For instance, heavy commercial vehicle operators in the Americas region often require robust vinyl modules with loop pile carpet inserts, which can be distributed through OEM channels to optimize fitment accuracy. Similarly, e-commerce platforms targeting passenger vehicle owners may bundle thermoplastic elastomer floor liners with custom graphic overlays, capturing premium pricing through value-added customization. By orchestrating segmentation insights holistically, companies can design modular product suites that resonate with precise customer needs.

This comprehensive research report categorizes the Automotive Flooring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Material Type

- Distribution Channel

Dissecting Regional Nuances and Growth Drivers in Automotive Flooring Across Americas EMEA and Asia Pacific Markets Impacting Strategic Direction

The Americas region, led by the United States, demonstrates a robust appetite for premium automotive flooring solutions that enhance cabin comfort and durability. Climatic extremes spanning frigid northern winters to scorching southern summers drive demand for materials with superior thermal insulation and UV resistance. Meanwhile, Latin American markets emphasize cost efficiency and resilience against rough road conditions, prompting a tilt toward multifunctional rubber blends and simplified carpet underlays. Across North America, rising electric vehicle adoption has ushered in renewed focus on lightweight materials and low-emission adhesives that comply with stricter environmental regulations.

In Europe, Middle East, and Africa, stringent regulatory landscapes around chemical emissions and recyclability have spurred widespread adoption of bio-based and recyclable polymers. Luxury carmakers headquartered in Western Europe often specify high-performance acoustic mats incorporating foamed polymer substrates to meet elevated expectations for noise reduction. The Middle East market, with its unique ambient temperature challenges, favors heat-stable vinyl and thermoplastic elastomer surfaces that resist distortion. Sub-Saharan African markets prioritize basic functionality and cost competitiveness, leading to continued reliance on traditional rubber flooring and textile-backed vinyl systems.

The Asia-Pacific region remains the largest manufacturing hub for automotive interiors, driving significant demand for cost-effective flooring components. Rapid growth in countries such as China and India has elevated passenger car production, creating parallel growth in aftersales demand for replacement mats. Localized production of thermoplastic elastomer compounds has increased capacity to serve high-volume domestic OEMs, while Southeast Asian nations are emerging as key exporters of bio-composite materials. Moreover, Japan and South Korea continue to lead in material innovation, integrating nano-enhanced formulations and self-cleaning surface treatments that cater to advanced mobility segments.

Recognizing these regional nuances enables market participants to tailor their product development, procurement strategies, and marketing approaches in accordance with distinct regulatory, climatic, and consumer preferences, ultimately strengthening their global footprint and competitive edge.

Across all regions, the shift toward electrification and shared mobility is converging to reshape flooring requirements. In ride-hailing fleets within the Americas and Asia-Pacific, durable, easy-clean flooring surfaces with rapid installation and serviceability are becoming essential. In Europe, the integration of autonomous shuttle services emphasizes modular flooring that accommodates sensor arrays and flexible seating layouts. Recognizing these cross-regional mobility trends allows stakeholders to anticipate future demands and develop globally scalable yet locally adaptable flooring solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Flooring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Flooring Suppliers Showcasing Their Strategic Positioning Innovation Portfolios and Partnerships Driving Market Direction

Trelleborg, a pioneer in polymer-based mobility solutions, has solidified its foothold in the automotive flooring space through a combination of process innovation and strategic acquisitions. Leveraging its expertise in elastomer compounding and vibration management, the company offers high-performance mat systems that encompass integrated acoustic damping layers and thermally optimized backings. Recent collaborations with European OEMs have yielded next-generation materials that feature enhanced recyclability and reduced volatile organic compound emissions.

Faurecia, known predominantly for seating and interior modules, has expanded its materials portfolio to include advanced textile carpets and modular flooring units for electric vehicle platforms. By forging partnerships with specialty yarn producers and leveraging digital printing capabilities, Faurecia can deliver bespoke graphic designs and palpable brand differentiation. Its turnkey approach combines material science, process engineering, and in-vehicle integration, appealing to OEMs seeking a unified supply chain partner.

Magna International maintains a competitive edge through its vertically integrated manufacturing network spanning North America, Europe, and Asia-Pacific. The company’s interior division synchronizes flooring systems with adjacent panels, creating cohesive assemblies that simplify final installation while ensuring stringent fit-and-finish standards. Magna’s R&D centers in Germany and Canada have recently unveiled lightweight sandwich structures that marry recycled PET textiles with thin-film thermoplastic layers, delivering both weight savings and acoustic performance.

Continental AG and Lear Corporation round out the set of industry frontrunners by emphasizing digital transformation and sustainability. Continental’s material development roadmaps prioritize bio-based polymers and closed-loop recycling, whereas Lear focuses on data-driven process optimization and predictive quality analytics. Both firms have inked joint research agreements with material science institutes to explore next-gen flooring substrates featuring self-healing surface treatments and integrated sensor arrays for occupant monitoring.

Looking ahead, these leading suppliers are poised to confront emerging challenges by leveraging digital twins, additive manufacturing and collaborative ecosystems. Smaller innovators are forming consortia with established players to co-develop closed-loop recycling channels, while AI-driven simulation tools are streamlining product development cycles. As the competitive landscape continues to fragment between traditional elastomer giants and agile material tech startups, the ability to navigate partnerships and accelerate product validation will determine long-term success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Flooring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Acme Mills

- Adler Pelzer Holding GmbH

- Apache Mills

- AstenJohnson

- Auria Solutions

- Auto Custom Carpets, Inc.

- Autoneum Holding Ltd.

- Autotech Nonwovens Pvt. Ltd.

- Corry Rubber Corporation,

- Feltex Automotive,

- Freudenberg SE

- GAHH, LLC

- Hayashi Telempu Corporation

- HP Pelzer Automotive System Inc.,

- Hyosung Advanced Materials

- IDEAL Automotive GmbH

- Kotobukiya Fronte Co., Ltd.

- Pharaoh Automotive

- Shandong Exceeding Auto Interior Parts Co.,Ltd.

- Shanghai Shenda Co., Ltd.

- Suminoe Textile Co., Ltd.

- Toyota Boshoku Corporation,

- Vaccess India Pvt. Ltd.

- WALSER GmbH

Charting the Course for Automotive Flooring Leaders With Actionable Recommendations to Capitalize on Emerging Trends and Bolster Competitive Advantage

Automotive flooring manufacturers must prioritize sustainable materials development to align with tightening environmental standards and growing consumer demand for green solutions. Investing in bio-based polymer research and closed-loop recycling infrastructure will not only reduce regulatory risk but also open new avenues for premium product positioning. At the same time, collaborating with chemical suppliers and academic institutions can accelerate innovation cycles, enabling first-mover advantage in emerging compounds and composites.

Supply chain resilience should be elevated as a strategic imperative by diversifying sourcing footprints across multiple geographies and by exploring nearshoring or onshoring opportunities. Building strategic alliances with local compounders and textile mills can mitigate the impact of protectionist trade policies such as the 2025 tariff revisions. In parallel, digital inventory management systems and predictive analytics will allow for just-in-time replenishment, reducing the need for costly stockpiling while ensuring uninterrupted operations.

Embracing digital manufacturing and customization tools is essential for capturing value in both OEM and aftermarket channels. Implementing modular design principles, digital printing, and rapid prototyping capabilities provides the agility to meet bespoke consumer demands at scale. Furthermore, integrating IoT-enabled sensors within flooring modules will create data-rich interfaces that support emerging mobility use cases in shared vehicles and fleet management.

Finally, organizations should adopt a customer-centric go-to-market strategy that harmonizes direct e-commerce offerings with traditional dealership networks. Tailored marketing narratives, value-added service packages, and subscription-based replacement models can drive incremental revenue streams while fostering long-term customer engagement.

Building internal capabilities through cross-functional teams and talent development programs will be critical to sustain the recommended strategic initiatives. By fostering a culture of continuous improvement and investing in workforce training on advanced material processing and data analytics, companies can ensure they have the human capital necessary to translate strategic plans into operational excellence.

Illuminating Research Methodology Employed to Analyze Automotive Flooring Market Drivers Data Collection Techniques and Analytical Frameworks

Our methodology commenced with a comprehensive secondary research phase, drawing on industry white papers, trade journals, and material supplier publications to establish a broad understanding of automotive flooring market drivers. This phase included rigorous review of technical standards related to chemical emissions, acoustic performance, and flammability across major markets. It also involved evaluating policy documents and tariff schedules to assess the evolving trade landscape impacting raw material flows.

To validate and enrich these insights, a series of primary interviews was conducted with design engineers, procurement managers, and aftermarket distributors across North America, Europe, and Asia-Pacific. These conversations yielded qualitative perspectives on emerging material preferences, supply chain bottlenecks, and customer expectations. Key informants were selected based on their direct involvement in flooring module specification, manufacturing process optimization, and channel management.

Quantitative data collection encompassed pricing benchmarks for raw polymers, textile substrates, and finished mat assemblies, obtained from proprietary supplier databases and corroborated through public customs records. Data triangulation techniques were applied to harmonize disparate sources, ensuring consistency and accuracy in the analysis. Advanced statistical tools were then used to identify correlations between material choices, vehicle segments, and distribution channels.

Finally, an iterative validation workshop with senior sector experts was held to refine the findings, reconcile any conflicting data points, and validate the strategic recommendations. The resulting framework integrates segmentation analysis, regional dynamics, and company profiling into a cohesive roadmap for automotive flooring stakeholders.

While our research encompasses a broad spectrum of industry inputs, it is bounded by the availability of proprietary pricing data and the rapidly evolving nature of trade policies. Analyses are based on current tariff schedules and anticipated regulatory trajectories, but emerging trade agreements or material breakthroughs could influence near-term dynamics. Readers are encouraged to consider these parameters when applying the findings to specific strategic contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Flooring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Flooring Market, by Vehicle Type

- Automotive Flooring Market, by Material Type

- Automotive Flooring Market, by Distribution Channel

- Automotive Flooring Market, by Region

- Automotive Flooring Market, by Group

- Automotive Flooring Market, by Country

- United States Automotive Flooring Market

- China Automotive Flooring Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights on Automotive Flooring Market Dynamics and Strategic Imperatives to Guide Stakeholders Through an Evolving Landscape

The automotive flooring market stands at a nexus of material innovation, regulatory influence, and shifting customer expectations, demanding a sophisticated response from industry participants. Advanced polymers, biobased composites, and digital manufacturing techniques are reconfiguring the value proposition of flooring modules, offering opportunities to enhance sustainability, reduce mass, and elevate interior comfort.

The 2025 tariff adjustments in the United States have underscored the strategic importance of supply chain agility and cost management, compelling businesses to diversify sourcing and strengthen local partnerships. Meanwhile, segmentation insights reveal that demand patterns vary significantly across vehicle types, material preferences, and distribution channels, highlighting the need for tailored product strategies rather than one-size-fits-all offerings.

Regional nuances further complicate the competitive landscape, as climate, regulation, and consumer behavior differ markedly between the Americas, EMEA, and Asia-Pacific regions. Leading suppliers have responded by forging collaborative R&D agreements, streamlining manufacturing footprints, and integrating digital solutions to meet localized requirements while capturing scale efficiencies.

As the market evolves, organizations that embrace sustainability, leverage data-driven decision-making, and cultivate partnerships across the value chain will solidify their market positioning. By aligning strategic investments with the transformative shifts described herein, stakeholders can navigate complexity and unlock new sources of value in the automotive flooring domain.

Ultimately, the automotive flooring market presents a multifaceted opportunity space where agility, technological prowess, and strategic foresight converge. Stakeholders equipped with the insights and action plans articulated in this report will be well positioned to navigate shifting paradigms and drive sustainable value creation across the automotive interior ecosystem.

Empowering Decision Makers to Access the Automotive Flooring Research Report and Collaborate With Ketan Rohom to Drive Strategic Growth

For industry leaders seeking a deeper, actionable understanding of the evolving automotive flooring landscape, the comprehensive research report offers a structured analysis of transformative trends, tariff impacts, segmentation insights, and regional dynamics. This report equips decision makers with the clarity required to craft informed strategies that balance innovation aspirations with operational realities.

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, provides an opportunity to explore bespoke consulting packages, tailor the research findings to specific organizational needs, and discuss potential partnerships. By leveraging this expertise, stakeholders can accelerate go-to-market initiatives, optimize supply chain configurations, and identify high-potential growth corridors.

To secure your copy of the report and arrange a strategic briefing with Ketan Rohom, visit the purchase portal or reach out through the designated contact channels. Unlock the insights that will shape the future of automotive flooring solutions and gain a competitive edge in an increasingly dynamic market.

- How big is the Automotive Flooring Market?

- What is the Automotive Flooring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?