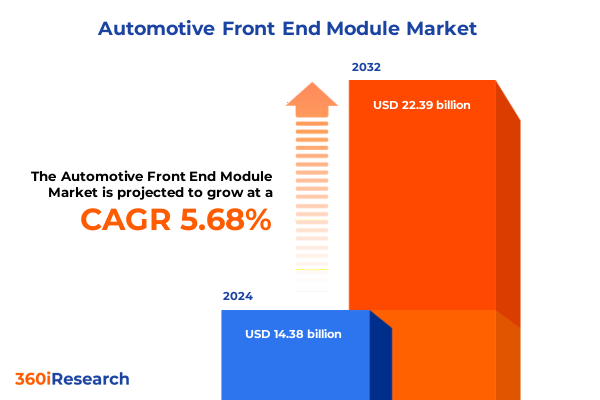

The Automotive Front End Module Market size was estimated at USD 15.08 billion in 2025 and expected to reach USD 15.82 billion in 2026, at a CAGR of 5.80% to reach USD 22.39 billion by 2032.

Understanding the pivotal role of the modern automotive front end module in vehicle safety structural design and electrification integration

The automotive front end module has evolved into a pivotal assembly within modern vehicle architecture, underpinning safety systems, thermal management, and the integration of advanced driver assistance technologies. Over the past decade, this component has transcended its original bumper and radiator support function to become a multidisciplinary convergence point where structural integrity, pedestrian protection, and aerodynamic efficiency intersect. As vehicle platforms become increasingly modular, the front end module remains a cornerstone element that shapes vehicle crashworthiness and influences the package layout for powertrain and electrification subsystems.

Against a backdrop of stringent global regulations regarding pedestrian safety and CO₂ emissions, leading OEMs and tier-one suppliers have intensified their focus on optimizing front end modules for lightweight performance and manufacturability. Innovations in composite materials, adaptive grille shutters, and integrated sensor mounts demonstrate the expanding role of this module as an enabler of next-generation mobility solutions. This section introduces the reader to the complex interplay of engineering, regulatory pressures, and market dynamics that define today’s front end module landscape, setting the stage for the transformative shifts explored in the following chapters.

Exploring the convergence of electrification advanced driver assistance and digital manufacturing that is redefining front end module engineering

The automotive industry is experiencing paradigm-shifting transformations that are redefining front end module design and functionality. Electrification has emerged as a primary driver, compelling suppliers to reengineer modules to accommodate electric motors, high-voltage cables, and optimized cooling circuits. As a result, thermal management features such as active shutters and integrated heat exchangers have migrated from downstream subassemblies into the front module itself, delivering greater packaging efficiency while reducing drag and improving range.

Concurrently, the proliferation of advanced driver assistance systems (ADAS) demands seamless integration of radar, lidar, and camera sensors into the module’s aesthetic and structural framework. This convergence has propelled the adoption of novel materials capable of withstanding signal attenuation while preserving crash performance. Moreover, digital manufacturing techniques such as additive manufacturing and closed-loop injection molding are streamlining development cycles and enabling rapid customization for diverse vehicle platforms. Collectively, these shifts are transforming the front end module from a static assembly into a dynamic platform that supports electrification, autonomy, and connectivity.

Analyzing how 2025 US steel aluminum and composite tariffs have spurred material innovation and regional production realignment in front end module supply chains

Since the introduction of new tariff measures in early 2025, the cost dynamics of automotive component manufacturing have been notably affected. Tariff increases on imported steel and aluminum, as well as on select polymer composites, have driven suppliers to reassess material strategies and regional sourcing footprints. In response, several tier-one companies have diversified their supply chains by qualifying alternative material grades and relocating production closer to key vehicle assembly plants.

These tariff-induced adjustments have catalyzed greater collaboration between OEMs and material suppliers to co-develop proprietary alloys and thermoplastic blends that mitigate cost pressures without sacrificing crash performance. At the same time, localized manufacturing hubs in the United States and Mexico have gained traction as suppliers seek to minimize cross-border duties. Although initial retooling and validation efforts have required capital investment, the longer-term outcome has been enhanced supply chain resilience and reduced exposure to future trade disputes. Ultimately, these developments underscore the cumulative impact of tariffs in accelerating material innovation and regional production realignment within the front end module ecosystem.

Uncovering how material choices technology tiers distribution channels and vehicle categories shape differentiated opportunities in front end modules

Insights across material, technology, distribution channel, and vehicle type segmentation reveal nuanced growth opportunities and risk considerations for market participants. When exploring material preferences, composite assemblies are gaining traction in higher-end and electric vehicle segments due to their exceptional strength-to-weight ratios, while metal modules continue to dominate mass-market platforms with proven manufacturing economies. Plastic components offer design flexibility and cost advantages, particularly in regions where polymer import duties are comparatively low.

From a technology perspective, active front end modules-equipped with mechanisms such as variable shutters and electronically controlled vents-are capturing share in performance and efficiency-focused vehicle programs. Passive modules remain prevalent in entry-level and budget models, providing a stable baseline for crash management without the complexity or cost of active actuation. Distribution channels also exhibit distinct patterns: the aftermarket segment is characterized by modular replacement solutions designed for rapid repair, whereas original equipment manufacturer channels demand highly integrated, vehicle-specific designs aligned with OEM validation protocols.

Finally, examining vehicle type segmentation highlights the divergent requirements across heavy commercial vehicles, which prioritize durability and ease of service, light commercial vehicles, where payload optimization is critical, and passenger cars, which balance aesthetics, pedestrian safety, and fuel efficiency. Together, these segmentation insights furnish decision-makers with a comprehensive view of where to focus R&D and deployment efforts to align with evolving vehicle program requirements.

This comprehensive research report categorizes the Automotive Front End Module market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Technology

- Distribution Channel

- Vehicle Type

Examining the diverse regional regulatory market and manufacturing forces driving front end module innovation across global geographies

Regional dynamics play a pivotal role in shaping front end module strategies, as varying regulatory frameworks, manufacturing capacities, and consumer preferences influence product requirements and supplier positioning. In the Americas, robust demand for pickup trucks and SUVs propels the adoption of durable metal modules, while there is a growing shift toward composites in electric truck programs. The continental free trade agreements and proximity to key component manufacturers offer cost advantages, yet recent tariff implementations have prompted increased nearshoring efforts within the United States and Mexico.

Europe, the Middle East, and Africa present a complex mosaic of regulatory stringency and market heterogeneity. Stringent pedestrian safety regulations in the European Union mandate enhanced bumper energy absorption structures, which has driven the integration of multi-material modules combining aluminum and composite reinforcements. The Middle East’s high-temperature environments require front modules engineered for thermal stability, particularly for commercial fleets operating in desert regions. In Africa, burgeoning urbanization fuels demand for aftermarket replacement modules that balance affordability with regulatory compliance.

Asia-Pacific remains the largest production and consumption hub, led by China and India’s vast passenger car markets. Rapid electrification targets in China have accelerated the deployment of active thermal management solutions within front end modules, while cost sensitivity in India encourages high-volume plastic solutions with simplified validations. Japan and South Korea continue to innovate through advanced materials research and precision manufacturing, reinforcing the region’s role as a global technology leader in front end module development.

This comprehensive research report examines key regions that drive the evolution of the Automotive Front End Module market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how leading suppliers and OEMs are driving collaborative innovation in materials sensor integration and modular manufacturing

Key industry players have been instrumental in advancing front end module technologies through strategic collaborations, targeted R&D investments, and integrated supply chain capabilities. Leading tier-one suppliers have differentiated themselves by forging partnerships with material science companies to develop next-generation composites that deliver unmatched crash energy management. Others have invested significantly in sensor integration platforms, positioning themselves as one-stop providers for ADAS-ready modules.

Original equipment manufacturers are also playing a proactive role by involving module suppliers early in vehicle platform development cycles, ensuring seamless electrical and structural integration. Several global OEMs have established co-innovation centers to pilot additive manufacturing for rapidly customizable module prototypes, thereby reducing lead times and aligning product iterations with evolving safety standards. Meanwhile, aftermarket specialists have focused on creating universal retrofit kits, expanding their service network reach to capture replacement demand in mature vehicle populations.

Through platforms such as industry consortia and standards bodies, these companies are collectively shaping the future roadmap for front end module specifications. By maintaining a balance between proprietary innovations and open architecture designs, they are enabling broader adoption of advanced materials and digital manufacturing processes across the automotive value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Front End Module market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Continental AG

- DENSO Corporation

- Faurecia SA

- Gestamp Automoción S.A.

- HELLA GmbH & Co. KGaA

- Hyundai Mobis Co., Ltd.

- Magna International Inc.

- Mahle GmbH

- Marelli Corporation

- Montaplast GmbH

- Plastic Omnium SE

- Samvardhana Motherson Automotive Systems Group BV

- Valeo SA

Strategic blueprint for blending hybrid materials regional agility and digital supply chains to future-proof front end module leadership

Industry leaders should adopt a multi-pronged approach that balances innovation investment with operational agility. Companies must prioritize the development of hybrid material platforms that combine the lightweight advantages of composites with the cost-effectiveness of metals and polymers. At the same time, early integration of thermal and sensor management into module design will be critical to meet upcoming ADAS and electrification requirements.

Furthermore, establishing regional development centers in tariff-sensitive markets can reduce duty burdens while enhancing responsiveness to local regulatory changes. Collaborative partnerships with raw material suppliers and technology startups can accelerate co-creation of proprietary alloys and smart component architectures, ensuring a continuous pipeline of innovation. Digitizing the module supply chain through real-time data analytics and predictive maintenance tools will also help mitigate production disruptions and improve quality yields.

Lastly, aligning front end module roadmaps with vehicle platform strategies by engaging OEMs at the conceptual stage will secure long-term program awards. By executing these recommendations, industry players can position themselves at the forefront of front end module advancement, driving both commercial success and technological leadership.

Overview of a rigorous research framework combining secondary analysis primary interviews and data triangulation for comprehensive front end module insights

This research leveraged a robust methodology combining extensive secondary research with targeted primary interviews to ensure accuracy and depth. Secondary data sources included regulatory filings, OEM technical briefs, industry journals, and patent databases to map technological developments and material innovations. These inputs provided a foundational understanding of global market dynamics, tariff frameworks, and regional manufacturing landscapes.

Complementing this, primary research was conducted through interviews with senior executives from leading tier-one suppliers, OEM powertrain and chassis engineers, and material science experts. These discussions yielded critical insights into real-world design challenges, validation protocols, and supply chain strategies. The data was then triangulated using cross-verification techniques to resolve discrepancies and corroborate trends across disparate information streams.

Finally, analytical models were employed to contextualize the qualitative findings within the broader industry landscape, focusing on segmentation variables of material, technology, distribution channel, and vehicle type, as well as regional considerations. Rigorous quality checks were applied throughout the process to ensure consistency, relevance, and impartiality of the conclusions presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Front End Module market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Front End Module Market, by Material

- Automotive Front End Module Market, by Technology

- Automotive Front End Module Market, by Distribution Channel

- Automotive Front End Module Market, by Vehicle Type

- Automotive Front End Module Market, by Region

- Automotive Front End Module Market, by Group

- Automotive Front End Module Market, by Country

- United States Automotive Front End Module Market

- China Automotive Front End Module Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of key findings on material innovation regulatory trends and strategic levers shaping the future of front end module development

In an era defined by electrification, stringent safety mandates, and heightened trade complexities, the automotive front end module stands at the nexus of innovation and regulation. As this report illustrates, successful market participants are those that proactively harness advanced materials, digital manufacturing, and early-stage OEM collaboration to deliver modules that meet tomorrow’s performance requirements.

The cumulative effect of 2025 tariff shifts, regional regulatory variations, and evolving ADAS integration demands underscores the importance of supply chain adaptability and cross-functional alignment. By synthesizing segmentation insights and regional considerations, decision-makers can prioritize investments in high-impact areas such as composite development, active thermal management, and integrated sensor platforms. Ultimately, the strategies outlined here provide a clear roadmap for navigating an increasingly complex landscape-positioning companies to lead in front end module innovation and capture new growth opportunities worldwide.

Engage with Ketan Rohom to secure the definitive automotive front end module research report and unlock actionable insights for strategic market leadership

To explore the depth and practical implications of this comprehensive front end module research report, connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Through a personalized consultation, Ketan can guide you through the report highlights, answer any detailed queries about methodology and findings, and help you understand how these insights apply to your strategic objectives. Whether you seek to benchmark your existing product portfolio, identify partnership opportunities, or anticipate market shifts, Ketan is poised to assist you in leveraging these findings for measurable competitive advantage. Reach out today to secure your copy of the full report and embark on data-driven decision-making that propels your organization’s leadership in automotive front end module innovation.

- How big is the Automotive Front End Module Market?

- What is the Automotive Front End Module Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?