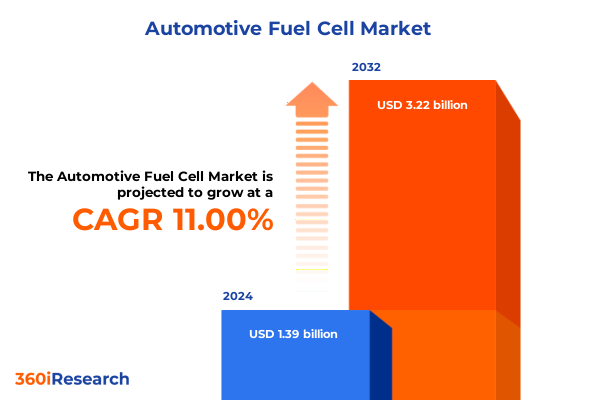

The Automotive Fuel Cell Market size was estimated at USD 1.55 billion in 2025 and expected to reach USD 1.70 billion in 2026, at a CAGR of 11.01% to reach USD 3.22 billion by 2032.

Setting the Stage for a Hydrogen-Driven Future in Automotive Powertrains by Uncovering Key Drivers and Challenges in Fuel Cell Innovation

Hydrogen’s allure as an automotive power source rests on its potential to decarbonize transport by emitting only water vapor when generated using low-carbon processes. Renewable hydrogen production technologies, including electrolysis powered by wind and solar, continue to advance, yet cost and infrastructure challenges persist. Federal incentives such as the production tax credits established under the Inflation Reduction Act have garnered bipartisan Congressional support, preserving and expanding up to $3 per kilogram subsidies for clean hydrogen, thereby reinforcing investor confidence in the emerging hydrogen economy. Despite headwinds, these policy measures are catalyzing the integration of hydrogen as a strategic component of broader decarbonization roadmaps in both public and private sectors.

Revolutionary Technological and Market Dynamics Reshaping the Competitive Terrain of Automotive Fuel Cells Towards Sustainable Mobility

Over the past year, technological maturation in proton exchange membrane fuel cells (PEMFC) has accelerated, driven by breakthroughs in catalyst and membrane durability. Innovations in platinum group metal loadings and nanostructuring techniques have reduced precious metal requirements while extending stack lifetimes, making PEMFC increasingly viable for passenger vehicles and light commercial applications. At the same time, solid oxide fuel cell (SOFC) architectures have gained traction for stationary and heavy-duty use cases due to their fuel flexibility and high-temperature efficiency. Concurrently, digital control systems leveraging predictive maintenance algorithms and real-time performance monitoring are enhancing reliability and lowering lifecycle costs.

Assessing How Escalating U.S. Tariff Measures Have Altered Supply Chains, Cost Structures, and Strategic Sourcing in the Fuel Cell Automotive Sector

Since 2024, U.S. Section 301 tariff actions have imposed steep duties on strategic imports, raising semiconductor tariffs from 25% to 50% by January 2025 and elevating battery parts and other critical mineral imports to 25%. These measures, aimed at countering state-supported foreign competition, now encompass certain platinum group metals used in fuel cell catalysts, as well as key electronic components for fuel cell control units.

In-Depth Examination of Market Segmentation Revealing Niche Opportunities Across Fuel Cell Technologies, Power Ranges, Applications, End Uses, and Sales Channels

Analyzing the market through the lens of fuel cell type reveals proton exchange membrane systems dominating automotive applications due to their rapid start-up and power density advantages, while alkaline, phosphoric acid, and solid oxide variants find niche roles in stationary and heavy-duty contexts. Viewing by power output highlights that sub-100 kW modules serve mobility prototypes and emerging light-duty models, mid-range 100–200 kW systems align with most passenger vehicles, and outputs beyond 200 kW cater to buses and long-haul trucks. Application-based segmentation underscores how portable energy solutions support medical and military use cases, stationary units secure remote or backup power needs, and transportation applications span from personal cars to mass transit fleets. When considering end-use, the distinction between commercial vehicles and passenger cars surfaces differing requirements for range, refueling infrastructure, and performance, with heavy and light commercial segments focusing on logistics and fleet reliability and passenger cars emphasizing weight savings and cabin space. Finally, channel dynamics differentiate aftersales services and retrofit opportunities from original equipment manufacturer collaborations, shaping how OEMs and service providers align distribution, service networks, and warranty offerings.

This comprehensive research report categorizes the Automotive Fuel Cell market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Cell Type

- Power Output

- Application

- End Use

- Sales Channel

Evaluating Regional Disparities and Growth Catalysts Driving Automotive Fuel Cell Adoption Across the Americas, EMEA, and Asia-Pacific

In the Americas, the policy environment has become more favorable to hydrogen, with federal support bolstered by bipartisan legislation preserving credits for production and fueling infrastructure. While the Biden administration’s tariff strategy has introduced cost volatility in imported components, states such as California continue to lead deployment, with incentives under the Low Carbon Fuel Standard and Advanced Clean Trucks rule driving early adoption of fuel cell buses and trucks. Canada advances in parallel, leveraging its platinum resources and emerging hydrogen hubs in Alberta and Quebec to support both mobility and industrial decarbonization.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fuel Cell market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Shaping the Competitive Landscape of the Automotive Fuel Cell Ecosystem Worldwide

Toyota remains a pioneer in passenger car fuel cell deployment, recently unveiling third-generation stack technology designed for cost reduction and improved durability. After initial Mirai volumes underperformed projections, the company has pivoted to heavy commercial applications, collaborating with SinoHytec in China and other partners to scale cost-effective fuel cell modules. Hyundai continues to refine its Nexo SUV platform but faces headwinds from safety recalls and declining volumes, prompting the automaker to explore next-generation designs and modular stack architectures to rebuild consumer trust. Ballard Power Systems has solidified its position in commercial transit, securing multi-megawatt engine orders from global bus manufacturers, demonstrating over 200 million service miles and 99% fleet availability as evidence of the technology’s reliability. Plug Power’s vertically integrated approach has achieved record liquid hydrogen output of 300 metric tons in April 2025 at its Georgia facility, underscoring the scalability of PEM electrolyzer systems and fueling the company’s downstream fuel cell deployments. Cummins’ complete acquisition of Hydrogenics has deepened its fuel cell stack and electrolyzer portfolio, positioning the company to offer end-to-end hydrogen solutions as it integrates electrolytic and fuel cell capabilities into its Electrified Power segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fuel Cell market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Audi AG

- Ballard Power Systems Inc.

- Bloom Energy Corporation

- BMW AG

- Cummins Inc.

- Denso Corporation

- Doosan Fuel Cell Co. Ltd.

- Ford Motor Company

- General Motors Company

- Honda Motor Co. Ltd.

- Hyundai Motor Company

- Intelligent Energy Limited

- Mercedes-Benz Group AG

- Mitsubishi Heavy Industries Ltd.

- Nikola Corporation

- Nissan Motor Co. Ltd.

- Nuvera Fuel Cells LLC

- Panasonic Holdings Corporation

- Plug Power Inc.

- Robert Bosch GmbH

- SFC Energy AG

- Toshiba Corporation

- Toyota Motor Corporation

- Volkswagen AG

Strategic Imperatives for Industry Leaders to Capitalize on Fuel Cell Innovations, Forge Alliances, and Navigate Policy Challenges in a Decarbonizing Market

Stakeholders should consider localizing critical component production to mitigate the impact of tariff escalations, thereby securing more predictable supply chains and cost structures in light of recent Section 301 duties. It is imperative to collaborate with regional infrastructure initiatives and engage policymakers to refine regulatory frameworks-such as the EU’s AFIR requirements for hydrogen stations-to ensure alignment between deployment targets and commercial rollout plans. Investing in modular stack designs and scalable platform architectures will enable rapid adaptation across diverse power output requirements, from sub-100 kW passenger modules to megawatt-level commercial systems, unlocking new market segments while optimizing R&D resource allocations to accelerate time to market.

Transparent Overview of the Rigorous Research Methods and Data Validation Approaches Underpinning the Automotive Fuel Cell Market Analysis

This report integrates insights from comprehensive primary research, including interviews with automaker and supplier executives, technology developers, and regulatory stakeholders, to capture firsthand perspectives on innovation trends and market drivers. Secondary data sources encompass government policy publications, company filings, patent analyses, and regulatory notices-such as USTR Section 301 determinations-to ensure coverage of the latest tariff and subsidy frameworks. A rigorous triangulation process cross-verifies quantitative data and qualitative inputs, while validation panels of technical experts and end-user representatives provide critical review to refine findings and conclusions. Advanced data analytics and scenario modeling techniques further contextualize strategic implications under varying policy and pricing scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fuel Cell market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fuel Cell Market, by Fuel Cell Type

- Automotive Fuel Cell Market, by Power Output

- Automotive Fuel Cell Market, by Application

- Automotive Fuel Cell Market, by End Use

- Automotive Fuel Cell Market, by Sales Channel

- Automotive Fuel Cell Market, by Region

- Automotive Fuel Cell Market, by Group

- Automotive Fuel Cell Market, by Country

- United States Automotive Fuel Cell Market

- China Automotive Fuel Cell Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Critical Insights and Future Directions Highlighted in This Comprehensive Review of Automotive Fuel Cell Advancements

The convergence of maturing fuel cell technologies, advancing electrolyzer capabilities, and expanding policy support has set the stage for hydrogen to play an increasingly strategic role in decarbonizing automotive applications. While cost and infrastructure challenges persist, targeted innovations in PEMFC durability, modular design, and digital control systems are unlocking new use cases across power ranges and vehicle classes. Regional dynamics-shaped by tariffs, regulatory frameworks, and resource endowments-will determine the pace of adoption, requiring stakeholders to adapt sourcing strategies, forge cross-segment partnerships, and align with evolving standards. These strategic imperatives will define the trajectory of the automotive fuel cell sector over the next decade, as collaboration between industry, government, and research institutions accelerates the shift toward sustainable mobility.

Contact Our Associate Director of Sales & Marketing to Unlock Detailed Automotive Fuel Cell Insights and Secure Your Exclusive Market Research Report Today

For further insights into detailed market dynamics, in-depth data analyses, and tailored strategic guidance, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He can help you obtain the full automotive fuel cell market research report and explore customized options to meet your organization’s specific needs. Connect now to secure your exclusive access and empower your strategic decision-making with comprehensive, actionable intelligence.

- How big is the Automotive Fuel Cell Market?

- What is the Automotive Fuel Cell Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?