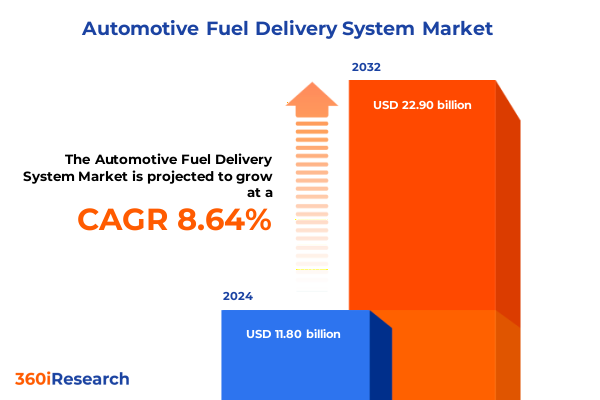

The Automotive Fuel Delivery System Market size was estimated at USD 12.60 billion in 2025 and expected to reach USD 13.47 billion in 2026, at a CAGR of 8.89% to reach USD 22.90 billion by 2032.

Exploring the Multifaceted Dynamics of Automotive Fuel Delivery Systems and Setting the Stage for Strategic Analysis and Informed Decision-Making

The automotive industry’s relentless quest for improved performance, reduced emissions, and enhanced fuel efficiency has thrust fuel delivery systems into the spotlight as critical enablers of powertrain optimization. With engine technologies growing ever more sophisticated, the interplay between fuel filters, injectors, pumps, rails, and tanks must be meticulously engineered to meet stringent environmental regulations and evolving consumer expectations. This executive summary sets the foundation by framing the intricate network of mechanical, electronic, and regulatory forces that shape the current landscape of fuel delivery systems.

In addition to the technical complexities, the ecosystem is influenced by shifting global supply chains, tariff evolutions, and regional policy initiatives that collectively redefine market dynamics. Stakeholders ranging from OEMs to aftermarket distributors are increasingly leveraging integrated strategies to navigate these multifaceted challenges. Against this backdrop, the following insights unpack the transformative trends, tariff impacts, segmentation intricacies, and regional nuances that will guide stakeholders in making informed strategic decisions.

By establishing a clear understanding of the forces at play, this introduction primes readers for a deeper dive into the critical factors driving innovation, competitive advantage, and sustainable growth in the automotive fuel delivery domain. Through a balanced examination of technological advancements, policy influences, and market segmentation, decision-makers will be equipped with the contextual clarity necessary to chart a course toward long-term success.

Uncovering Pivotal Technological and Regulatory Shifts Revolutionizing the Automotive Fuel Delivery Landscape and Industry Competitive Dynamics

Automotive fuel delivery has undergone seismic shifts driven by a confluence of technological innovation and regulatory evolution. As internal combustion engines increasingly integrate electronic controls and advanced materials, conventional fuel pumps and injectors are giving way to high-precision piezoelectric injectors and electric pumps that enable finer fuel metering and faster response times. Moreover, the adoption of gasoline direct injection and common rail systems has accelerated in response to stringent emissions standards, prompting manufacturers to embrace novel designs that balance power output with environmental stewardship.

In parallel, digitalization has permeated the supply chain, with predictive maintenance and telematics solutions enabling real-time diagnostics of fuel delivery components. The infusion of data analytics into manufacturing and servicing procedures has enhanced operational efficiency, shortened development cycles, and reduced unplanned downtime. Furthermore, additive manufacturing is emerging as a viable method for prototyping complex manifolds and custom fittings, thereby fostering agility in component development and aftermarket customization.

Transitioning from legacy system architectures to these advanced platforms also entails comprehensive regulatory compliance efforts. Global emissions targets, particularly Euro 7 regulations and forthcoming national standards in North America and Asia, are compelling stakeholders to reevaluate their technology roadmaps. As a result, the industry is witnessing a paradigm shift toward modular, scalable fuel delivery architectures that can be rapidly adapted to diverse powertrain configurations and alternative fuels.

Analyzing the Ripple Effects of 2025 United States Tariff Adjustments on Automotive Fuel Delivery Supply Chains, Costs, and Market Strategies

The introduction of new tariff measures in 2025 has generated a cascading effect across the automotive fuel delivery ecosystem. Components imported under previously favorable trade agreements now face additional duties that elevate production costs and compress supplier margins. Consequently, many original equipment suppliers and aftermarket distributors are accelerating efforts to localize manufacturing or renegotiate procurement contracts to mitigate the fiscal burden posed by the updated United States tariff framework.

Moreover, the tariff revisions have prompted notable shifts in cross-border logistics. Companies are increasingly exploring nearshoring strategies, relocating key assembly operations to Mexico and Canada to leverage North American Free Trade Agreement provisions and reduce exposure to punitive duties. Simultaneously, the reclassification of certain fuel delivery parts under revised Harmonized System codes has triggered uncertainties in customs valuations, compelling stakeholders to pursue enhanced tariff engineering and compliance protocols.

In this context, strategic alliances and joint ventures have become instrumental in sharing the cost impact and fostering innovation. By collaborating with regional partners, leading suppliers can distribute risk, capitalize on local incentives, and maintain uninterrupted supply of critical components such as solenoid injectors and electric fuel pumps. Ultimately, the cumulative impact of the 2025 tariff adjustments underscores the necessity of a resilient, adaptive supply chain architecture that aligns with broader corporate objectives.

Delving into Component, Fuel, System, Vehicle, and Channel Segmentation to Reveal Granular Insights in Automotive Fuel Delivery Markets

A component-level lens reveals that fuel injectors-particularly piezo injector variants-are at the forefront of precision fueling trends, driven by the need for ultra-fine atomization and rapid injection events. Simultaneously, solenoid injectors maintain a strong position within legacy platforms that prioritize cost-efficiency over peak performance. Fuel pumps exhibit a bifurcation between electric and mechanical designs, with electric pumps gaining traction in hybrid and mild-hybrid applications, while mechanical pumps remain integral to conventional engine architectures.

When viewed through the prism of fuel type segmentation, gasoline systems continue to dominate passenger car portfolios, yet diesel applications sustain their relevance in commercial vehicles and heavy-duty segments. The advent of CNG-powered fleets, albeit modest in volume, signals a growing segment that caters to urban transit and fleet operators aiming to reduce carbon footprints. Shifting to system-type analysis, gas-electric direct injection platforms are poised to outpace carburetor-based setups, while common rail systems assert their indispensability in delivering high-pressure diesel injection for both commercial and passenger segments.

Evaluating vehicle type segmentation underscores divergent requirements: passenger cars seek compact, lightweight fuel delivery architectures optimized for packaging constraints and consumer efficiency demands, whereas commercial vehicles demand robust, high-capacity pumps and filters designed for sustained high-mileage operations. Distribution channel dynamics further complicate the landscape, as original equipment manufacturers emphasize stringent quality protocols and integration standards, while aftermarket channels focus on compatibility, cost-effectiveness, and rapid availability to meet service market needs.

This comprehensive research report categorizes the Automotive Fuel Delivery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Fuel Type

- System Type

- Vehicle Type

- Distribution Channel

Assessing Regional Dynamics across Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Distinct Trends in Fuel Delivery System Markets

Regional dynamics underscore the nuanced interplay between regulatory environments, infrastructure maturity, and consumer preferences. In the Americas, stringent emissions regulations in the United States and Canada have catalyzed development of advanced fuel delivery modules that meet both EPA Tier 3 and Canadian Airshed requirements. Moreover, Mexico’s evolving manufacturing landscape supports a growing ecosystem of component suppliers aiming to serve both North American and Latin American markets with competitively priced systems.

Turning to Europe, the Middle East, and Africa, the European Union’s imminent Euro 7 standards are driving rapid adoption of high-pressure injection systems and rigorous durability testing protocols. In the Middle East, fleet operators increasingly adopt diesel and CNG technologies to optimize operating costs, creating opportunities for robust composite fuel tanks and advanced filter systems. Meanwhile, Africa’s market is characterized by a blend of legacy carburetor-based platforms and emerging demand for aftermarket electric pump upgrades to enhance reliability on challenging road conditions.

In Asia-Pacific, dynamic growth in India and Southeast Asia is underpinned by expanding passenger car ownership and government incentives for cleaner fuels. China’s pivot toward gasoline direct injection and port fuel injection technologies has stimulated local R&D investments, while Japan’s established OEM base continues to drive incremental innovations in piezo injector performance and fuel rail materials. Across the region, the convergence of urbanization, regulatory tightening, and infrastructure enhancements is shaping a multifaceted market evolution.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fuel Delivery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Fuel Delivery Innovators and Market Players to Highlight Strategic Positioning and Competitive Advantages

Industry leaders have responded to these market forces through targeted innovation, strategic collaborations, and portfolio optimization. A prominent global supplier has invested heavily in piezoelectric injector technology, securing patents for high-speed actuation mechanisms that promise reduced emissions and enhanced fuel economy. Another leading player has expanded its electric pump offerings by acquiring a specialized micro-motor manufacturer, thereby integrating mechatronic expertise into its core portfolio to accelerate time-to-market for hybrid applications.

Furthermore, key OEM partnerships underscore the value of co-development frameworks, where fuel pump and fuel rail integrators collaborate with automakers on bespoke solutions tailored for next-generation powertrains. Joint ventures focused on additive manufacturing capabilities have also emerged, enabling select manufacturers to produce complex manifolds and test prototypes in compressed timeframes. These alliances not only share development risks but also facilitate knowledge transfer and supply chain synergies.

Finally, aftermarket specialists have refined their distribution strategies, leveraging digital platforms to offer enhanced part traceability and compatibility verification tools. By fostering closer relationships with service networks and independent workshops, these companies ensure rapid adoption of premium filter and pump assemblies that meet or exceed OEM performance standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fuel Delivery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Continental AG

- Delphi Technologies plc

- Denso Corporation

- Hitachi Astemo, Ltd.

- Landi Renzo S.p.A.

- Marelli Holdings Co., Ltd.

- Mikuni Corporation

- Robert Bosch GmbH

- Stanadyne LLC

- TI Fluid Systems plc

- Toyoda Gosei Co., Ltd.

- Valeo SA

- Vitesco Technologies Group AG

Empowering Industry Leaders with Strategic Recommendations to Navigate Technological Change, Regulatory Complexities, and Competitive Pressures in Fuel Delivery Systems

Industry leaders should prioritize end-to-end digital integration to harness predictive analytics for maintenance forecasting and production yield optimization. By deploying connected sensors on fuel delivery components, companies can collect real-time performance data, enabling rapid root-cause analysis and facilitating condition-based servicing models that reduce lifecycle costs.

Moreover, establishing collaborative platforms with regulatory authorities and standards bodies can streamline compliance efforts for forthcoming emissions regulations. Engaging early in the regulatory development process allows suppliers to influence technical parameters and align R&D investments with policy trajectories. This proactive stance not only minimizes time-to-market risks but also positions companies as industry thought leaders.

In parallel, diversifying supply chains through strategic nearshoring partnerships and dual sourcing strategies will bolster resilience against tariff shocks and geopolitical disruptions. Engaging local manufacturing hubs and forging alliances with regional component specialists can secure preferential trade treatment and mitigate currency and logistic vulnerabilities. Ultimately, a multifaceted approach that integrates technological innovation, regulatory collaboration, and supply chain agility will serve as the cornerstone for sustainable competitive advantage.

Outlining a Comprehensive Research Framework Combining Qualitative and Quantitative Analyses, Data Triangulation, and Industry Expert Insights

The research methodology underpinning this analysis combines rigorous qualitative and quantitative approaches to ensure robust, actionable insights. Primary data collection involved in-depth interviews with OEM engineers, Tier 1 supplier executives, and aftermarket distributors, complemented by surveys of maintenance professionals to capture end-user performance feedback. Secondary research included a comprehensive review of industry technical standards, patent filings, and regional regulations to establish a solid contextual framework.

Data triangulation was employed to validate market observations, cross-referencing supplier financial disclosures with customs import-export records and manufacturing output statistics. This multi-dimensional approach ensures that strategic trends identified in component adoption, system preferences, and fuel types are corroborated by both proprietary and publicly available datasets. Expert panel discussions further refined these findings, enabling calibration of insights against real-world operational challenges.

Finally, the segmentation model was rigorously tested through case studies spanning diverse vehicle platforms and distribution channels, ensuring that the resulting strategic recommendations are grounded in practical applicability. This comprehensive methodology guarantees that decision-makers receive a well-rounded, evidence-based perspective on the complexities of the automotive fuel delivery ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fuel Delivery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fuel Delivery System Market, by Component Type

- Automotive Fuel Delivery System Market, by Fuel Type

- Automotive Fuel Delivery System Market, by System Type

- Automotive Fuel Delivery System Market, by Vehicle Type

- Automotive Fuel Delivery System Market, by Distribution Channel

- Automotive Fuel Delivery System Market, by Region

- Automotive Fuel Delivery System Market, by Group

- Automotive Fuel Delivery System Market, by Country

- United States Automotive Fuel Delivery System Market

- China Automotive Fuel Delivery System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Strategic Findings and Future Perspectives to Guide Stakeholders in Making Informed Decisions about Automotive Fuel Delivery Investments

Drawing together the multifaceted findings, it is evident that the automotive fuel delivery sector stands at an inflection point shaped by electrification, regulatory stringency, and evolving supply chain paradigms. The ascent of piezo injectors, electric pumps, and advanced rail architectures signals a departure from legacy designs toward systems that deliver both performance and environmental compliance. Yet, the full realization of these technologies hinges on adaptive strategies that address the ripple effects of new tariff regimes and regional policy shifts.

Moreover, granular segmentation insights underscore that a one-size-fits-all approach is untenable; component selection, fuel type compatibility, system integration, vehicle application, and distribution channel requirements must be harmonized to optimize outcomes. Regional dynamics further complicate this picture, demanding bespoke strategies for the Americas, EMEA, and Asia-Pacific markets based on regulatory demands and infrastructure maturity.

Ultimately, companies that proactively invest in digital integration, regulatory collaboration, and supply chain resilience will be best positioned to capture the opportunities presented by this transformative era. The insights presented herein equip stakeholders with the contextual intelligence necessary to craft forward-looking roadmaps that align innovation with market realities.

Connect with Ketan Rohom to Secure Comprehensive Automotive Fuel Delivery Market Insights and Drive Business Growth with Expertly Curated Research

Engaging with Ketan Rohom unlocks a direct pathway to leverage the comprehensive market research insights tailored for stakeholders navigating the complex landscape of automotive fuel delivery systems. Partnering with an Associate Director focused on sales and marketing provides unparalleled access to in-depth analyses across components, technologies, and regional dynamics. Prospective clients will benefit from customized consultations that align strategic objectives with the latest industry intelligence on tariffs, segmentation nuances, and emerging disruptive trends.

By reaching out to Ketan Rohom, organizations can accelerate their decision-making processes with a reliable point of contact committed to delivering actionable recommendations and supporting bespoke research needs. This collaborative opportunity ensures that critical insights on supply chain resilience, regulatory shifts, and competitive positioning are readily available. Initiating this dialogue empowers industry leaders to secure the vital data and expert guidance necessary to drive growth, mitigate risks, and maintain a competitive edge in the evolving fuel delivery market.

Seize the moment to connect with a seasoned expert who bridges the gap between comprehensive research and strategic execution. Contact Ketan Rohom today to explore how the full report can inform your next wave of innovation, investment planning, and market expansion strategies in the dynamic automotive fuel delivery sector

- How big is the Automotive Fuel Delivery System Market?

- What is the Automotive Fuel Delivery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?