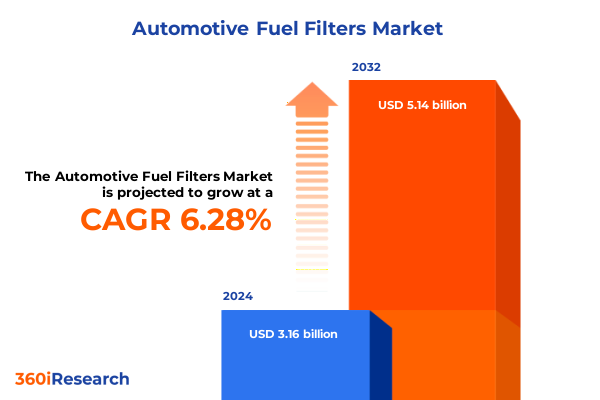

The Automotive Fuel Filters Market size was estimated at USD 4.93 billion in 2025 and expected to reach USD 5.25 billion in 2026, at a CAGR of 6.44% to reach USD 7.64 billion by 2032.

Exploring the Critical Role of Fuel Filters in Evolving Automotive Technologies and Market Dynamics Across Global Supply Chains

Fuel filtration remains an indispensable pillar in automotive powertrain architectures, ensuring that engines operate within optimal performance parameters while safeguarding critical system components. At the core of every internal combustion powertrain, fuel filters serve as the frontline defense against particulate matter, microbial contamination, and water intrusion. They protect fuel injectors, pumps, and high-pressure common rails from abrasive wear and corrosion, directly influencing engine longevity and fuel efficiency.

As the automotive sector evolves, the role of the fuel filter extends beyond simple contaminant removal. Manufacturers increasingly integrate multi-stage filtration media to address emerging challenges posed by biofuel blends and ultra-low sulfur diesel. Concurrently, polymer housing innovations have improved filter module durability and reduced overall weight, aligning with lightweighting initiatives. These advancements, coupled with stringent in-line monitoring and sensor integration, allow predictive maintenance strategies that minimize unplanned downtimes.

Consequently, the fuel filter market is characterized by continuous material science innovations and cross-functional collaboration among OEM powertrain teams, aftermarket service providers, and specialty media manufacturers. This report delves into these dynamics, setting the stage for a comprehensive analysis of how evolving technology, regulatory trajectories, and end-user requirements are reshaping the global fuel filter landscape.

Navigating Transformative Shifts in Fuel Filtration Amid Electrification, Stringent Emissions Standards, and Digital Integration in Automotive Ecosystems

The automotive fuel filter landscape is undergoing profound transformation driven by macro trends in powertrain electrification, regulatory pressure on emissions, and digitization across vehicle platforms. First, as hybrid powertrains gain traction alongside battery-electric and fuel-cell vehicles, fuel filters must adapt to intermittent combustion cycles and varied fuel chemistries, prompting the development of hybrid-compatible filtration solutions.

Moreover, tightening global emissions standards have catalyzed the adoption of ultra-fine media capable of capturing particles below 5 microns, thereby reducing deposit formation in injectors and catalytic systems. In parallel, the integration of digital sensors within filter housings provides real-time differential pressure data, enabling connected vehicles to predict maintenance intervals and optimize filter replacement schedules.

Furthermore, supply chain disruptions have accelerated localization efforts for critical filtration components, while additive manufacturing techniques are being explored for rapid prototyping of new filter geometries. These shifts underscore the strategic importance of securing resilient sourcing networks, investing in advanced materials research, and fostering collaborations that span technology startups and established OEM engineering teams. Together, these forces are redefining what it means to deliver reliable, high-performance fuel filtration in the modern automotive ecosystem.

Assessing the Cumulative Impact of 2025 United States Tariffs on Automotive Fuel Filters Supply Chains Costs and Manufacturer Strategies

In 2025, a complex tapestry of U.S. tariff measures is exerting cumulative pressure on the automotive fuel filter supply chain and manufacturing costs. Remaining in force from the landmark Section 301 investigation of 2018-2019 are 25% duties on Chinese-origin automotive parts, including filter media and polymer housings, which contribute to elevated landed costs for importers. In addition, a new 20% tariff under the International Emergency Economic Powers Act took effect on March 4, 2025 for certain components, further intensifying input cost volatility.

Simultaneously, Section 232 tariffs on steel and aluminum continue to impose 25% and 10% duties, respectively, on metallic filter canisters and centrifuge elements. According to industry analysis, these levies add approximately $45 per vehicle in steel-related expenses and an additional $75 per vehicle for aluminum-intensive components, exerting upward pressure on overall system pricing. The Vehicle Suppliers Association has publicly warned that such duties threaten long-term competitiveness by complicating supply chain planning and heightening procurement risk across both OEM and aftermarket channels.

Moreover, reciprocal tariffs and recent trade agreements have created asymmetric cost structures; for instance, the U.S.-Japan auto trade pact lowers duties on Japanese-assembled vehicles to 15%, while domestically produced systems continue to face higher U.S. tariffs. Leading automakers, including General Motors and Hyundai, have disclosed multi-hundred-million-dollar impacts on quarterly earnings attributable to these duties, prompting strategies to mitigate exposure through near-shoring, alternative sourcing, and localized production ramps. As such, the layered tariff environment demands dynamic cost-management approaches and collaborative dialogue with policymakers to sustain fuel filter affordability and supply stability.

Unveiling Comprehensive Segmentation Insights by Fuel Type, Application, Vehicle Type, Filter Design, Material Composition, and Distribution Channels

Market segmentation in the fuel filter arena reflects the diversity of contemporary automotive propulsion systems, with distinct requirements across alternative and conventional energy vectors. Passenger vehicles and light commercial platforms draw upon gasoline and diesel filter technologies, whereas heavier-duty truck segments often confront more severe contamination profiles, necessitating reinforced cartridge and spin-on solutions. Concurrently, the expanding fleet of CNG, LPG, and hybrid vehicles has spurred the rise of specialized media formulations resistant to gaseous fuel permeation and moisture accumulation.

From an application perspective, original equipment channels demand rigorous qualification processes and compliance with OEM specifications, while the aftermarket relies on both authorized service centers and independent workshops to serve end users. This dual-path channel structure influences filter design lifecycles, packaging strategies, and warranty frameworks. In terms of distribution, traditional dealer networks and aftermarket retail remain the primary conduits for offline sales, but e-commerce platforms and automaker portals are accelerating adoption of direct-to-consumer deliveries.

Filter architecture itself is bifurcated among module designs-integrated or standalone-and conventional spin-on housings, each tailored to specific powertrain layouts. Underlying media composition further divides offerings into cellulose-based, synthetic microglass, and activated-carbon blends, with subvariants engineered for pressboard durability or nanofiber permeability. Through these interlocking dimensions-fuel type, vehicle class, application route, filter configuration, material science, and distribution channel-the market exhibits nuanced purchasing behaviors and technology-adoption rates that reflect broader shifts in vehicle electrification and aftermarket digitization.

This comprehensive research report categorizes the Automotive Fuel Filters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Filter Type

- Fuel Type

- Material

- Application

- Vehicle Type

- Distribution Channel

Examining Regional Dynamics Shaping Automotive Fuel Filter Demand and Supply Across the Americas, EMEA, and Asia-Pacific Landscapes

Regional dynamics play an instrumental role in shaping the competitive intensity and technology adoption curves of fuel filters worldwide. In the Americas, stringent federal and state emissions mandates, coupled with widespread diesel adoption in commercial fleets, drive demand for high-performance particulate retention and water-separation capabilities. Meanwhile, the United States’ heavy reliance on long-distance trucking networks underscores the critical need for robust filter modules that withstand elevated flow rates and pressure cycles.

Across Europe, the Middle East, and Africa, a heterogeneous regulatory landscape prizes both low carbon footprints and lifecycle sustainability. European passenger car markets are pioneering biofuel-compatible filters, while Middle Eastern commercial operators seek modules designed for high ambient temperatures and abrasive desert particulates. The aftermarket is equally dynamic, with online channels growing rapidly as mobile service providers leverage digital diagnostics to recommend timely filter replacements.

In the Asia-Pacific region, rapid vehicle park expansion and government incentives for cleaner-burning fuels catalyze mass adoption of advanced filtration media. Emerging markets in Southeast Asia and India emphasize cost-effective spin-on solutions to serve small-displacement engine fleets, whereas Australia and Japan focus on integrated module designs optimized for hybrid and LPG systems. Supply chain localization initiatives and free-trade agreements further influence pricing structures and supplier ecosystems, reinforcing the need for adaptive regional strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fuel Filters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Global and Regional Players Driving Innovation and Competitive Differentiation in the Automotive Fuel Filter Market

Leading players in the fuel filter market blend heritage filtration expertise with forward-looking technology investments. Traditional Tier 1 manufacturers leverage decades of collaboration with major OEMs to refine proprietary media formulations, enabling ultra-fine contaminant capture and extended service intervals. These incumbents continually expand their patent portfolios to incorporate novel nanofiber and microglass blends capable of meeting evolving emissions standards.

In parallel, specialized component suppliers focus on modular housing designs, integrating sensors for differential pressure monitoring and constructing polymer canisters with high chemical resistance. Their agility in delivering application-specific prototypes accelerates time-to-market for emerging powertrain platforms. Complementing these dynamics, aftermarket leaders have fortified distribution networks, implementing digital ordering systems and remanufacturing processes to support sustainability goals and circular-economy initiatives.

Collaboration across the ecosystem remains pivotal: OEM alliances with media innovators, joint ventures between filtration specialists and material scientists, and partnerships with service-network operators ensure that product portfolios remain aligned with vehicle architecture shifts. Collectively, these strategic configurations underscore a competitive landscape where technological differentiation and supply chain resilience are equally valued.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fuel Filters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affinia Group, LLC

- Champion Laboratories Inc.

- Cummins Inc.

- Denso Corporation

- Donaldson Company, Inc.

- FAA Filters LLC

- Fildex Filters Canada Corporation

- Hengst SE

- MAHLE GmbH

- MANN+HUMMEL GmbH

- Parker-Hannifin Corporation

- Robert Bosch GmbH

- Tenneco Inc.

Strategic Roadmap for Industry Leaders to Enhance Value Chains, Optimize Operations, and Capitalize on Emerging Fuel Filter Market Opportunities

Industry leaders should adopt a multidimensional strategy to thrive amid evolving market dynamics. First, investing in advanced media research and co-development partnerships can yield next-generation filtration materials that address biofuel compatibility, micro-contaminant capture, and sensor integration for predictive maintenance. Concurrently, strengthening relationships with OEM powertrain teams through joint qualification programs reduces time to certification for novel filter designs.

Moreover, optimizing the supply chain via near-shoring of critical components and flexible sourcing agreements can mitigate tariff exposure and logistic disruptions. In this context, utilizing digital platforms for real-time inventory management and demand forecasting enhances responsiveness to regional demand shifts. Expanding distribution footprints by bolstering e-commerce capabilities and integrating with connected-vehicle maintenance ecosystems can capture incremental aftermarket share.

Finally, aligning product portfolios with sustainability imperatives-through the introduction of recyclable media, remanufacturing programs, and carbon-neutral manufacturing processes-resonates with regulatory requirements and end-customer preferences. By blending technology leadership, supply chain agility, and sustainability credentials, companies can secure long-term competitive advantages in the global fuel filter arena.

Implementing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Triangulation for Market Insights

This research study employs a rigorous, multi-tiered methodology to ensure validity and reliability of insights. Primary data collection involved in-depth interviews with senior R&D and procurement executives at leading OEMs, Tier 1 suppliers, and aftermarket service providers, providing firsthand perspectives on evolving filtration requirements and supply chain strategies. Secondary data was sourced from industry journals, regulatory publications, customs databases, and patent filings, enabling comprehensive coverage of media innovations and trade-policy changes.

Quantitative analysis incorporated triangulation techniques, cross-verifying shipment data, regional production volumes, and component import-export records to map supply-chain flows. Additionally, technology roadmaps and standards documentation were reviewed to align filter specifications with global emissions mandates. The combined approach of expert consultations, data triangulation, and systematic literature review underpins the credibility of the report’s conclusions and recommendations.

Throughout the process, quality assurance measures-such as data validation workshops and peer reviews by subject-matter experts-were conducted to eliminate bias and verify interpretative consistency. The resulting framework provides robust, actionable intelligence tailored to strategic decision-makers in the automotive filtration sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fuel Filters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fuel Filters Market, by Filter Type

- Automotive Fuel Filters Market, by Fuel Type

- Automotive Fuel Filters Market, by Material

- Automotive Fuel Filters Market, by Application

- Automotive Fuel Filters Market, by Vehicle Type

- Automotive Fuel Filters Market, by Distribution Channel

- Automotive Fuel Filters Market, by Region

- Automotive Fuel Filters Market, by Group

- Automotive Fuel Filters Market, by Country

- United States Automotive Fuel Filters Market

- China Automotive Fuel Filters Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Critical Insights and Strategic Imperatives to Navigate the Complex Automotive Fuel Filter Ecosystem

In summary, the automotive fuel filter landscape stands at the intersection of technological innovation, regulatory complexity, and dynamic consumer demands. Advanced materials research, digital integration for predictive maintenance, and segmentation strategies underscore the market’s evolution, while layered tariff structures and regional supply chain considerations present both challenges and opportunities.

Stakeholders that embrace co-development alliances, agile sourcing frameworks, and sustainability-driven manufacturing will be best positioned to navigate uncertainties and capture value. As electrification and alternative fuel adoption continue to expand, the role of fuel filtration evolves in tandem, necessitating continuous product differentiation and operational resilience.

Collectively, the insights and recommendations presented in this report offer a strategic compass for decision-makers seeking to align product portfolios, optimize supply networks, and drive profitable growth in the global fuel filter sector.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Automotive Fuel Filter Market Research and Drive Informed Strategic Decisions

To explore in-depth strategic insights and secure your comprehensive market research report on the global automotive fuel filter industry, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan opens the door to tailored advisory sessions, enterprise licensing options, and exclusive briefings. Leverage this opportunity to inform your sourcing decisions, refine your product development roadmap, and strengthen your competitive positioning. Contact Ketan Rohom today to discuss customized research packages, volume licensing discounts, and collaborative consulting engagements geared to accelerate your growth trajectory.

- How big is the Automotive Fuel Filters Market?

- What is the Automotive Fuel Filters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?