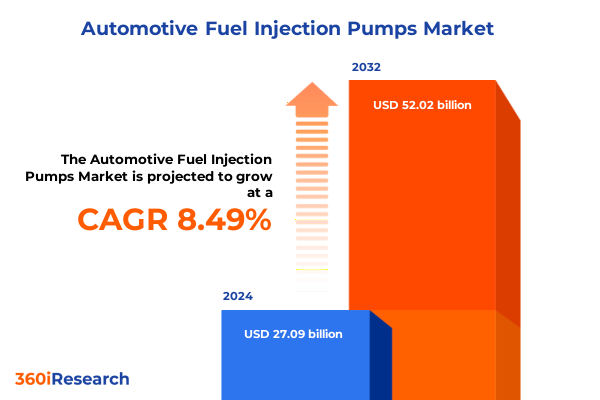

The Automotive Fuel Injection Pumps Market size was estimated at USD 28.92 billion in 2025 and expected to reach USD 30.88 billion in 2026, at a CAGR of 8.74% to reach USD 52.02 billion by 2032.

Unveiling the Core Dynamics Shaping the Automotive Fuel Injection Pump Market Through Advanced Technological Innovation Regulatory Evolution and Evolving Demand Drivers

The automotive fuel injection pump market stands at the nexus of rapid technological innovation, evolving regulatory landscapes, and shifting consumer expectations. Over the past decade, rising demands for fuel efficiency and lower emissions have propelled fuel injection pumps from traditional mechanical devices to sophisticated, electronically controlled systems. As engines become more complex and environmental regulations more stringent, these critical components increasingly serve as the linchpin between powertrain performance and compliance objectives.

Stakeholders across the value chain-from original equipment manufacturers (OEMs) to specialized tier-one suppliers-must navigate a complex web of technological compatibility, materials sourcing, and quality assurance processes. At the same time, the transition toward hybrid and battery electric vehicles exerts pressure on conventional fuel injection pump providers to diversify their offerings or optimize their existing portfolios. Competition has intensified not only through innovation but also via strategic alliances and emerging players leveraging additive manufacturing and advanced materials science.

In this dynamic environment, decision-makers require a clear, concise panorama of market forces, emerging applications, and potential disruptions. This executive summary presents an integrated overview of the prevailing dynamics shaping the fuel injection pump industry, setting the stage for detailed analysis of pivotal shifts, tariff impacts, segmentation insights, and regional variances.

Examining the Transformative Shifts Driving the Fuel Injection Pump Ecosystem From Electrification Integration to Data-Driven Maintenance and Sustainability Focus

Industry stakeholders are witnessing transformative shifts across the entire fuel injection pump landscape, driven by the imperative to reduce environmental footprints while enhancing engine performance. First, digital integration has emerged as a game-changer: the convergence of sensors, real-time diagnostics, and over-the-air calibration updates enables continuous optimization of injection timing and pressure profiles. These capabilities not only prolong component lifecycles but also empower predictive maintenance strategies, thereby reducing unplanned downtimes.

Second, the push toward sustainability has accelerated material innovation. Lightweight composite housings and corrosion-resistant alloys now complement traditional steel pump bodies, delivering both performance gains and fuel consumption reductions. Meanwhile, advanced manufacturing techniques-such as laser sintering for internal geometries-unlock unprecedented precision in pump tolerances and flow consistency.

Third, the advancing adoption of mild-hybrid systems introduces new requirements for injection pump integration. Pumps must operate seamlessly alongside electric boost systems and energy recuperation modules, demanding enhanced control algorithms and fail-safe redundancies. This trend has compelled suppliers to forge partnerships with software developers and controls specialists, creating multidisciplinary teams capable of delivering holistic powertrain solutions.

Collectively, these developments signal a paradigm shift toward smarter, lighter, and more connected injection pumps-positioning them as pivotal enablers in the ongoing evolution of automotive propulsion.

Analyzing the Cumulative Impact of Recent United States Tariffs on Automotive Fuel Injection Pump Supply Chains Manufacturing Costs and Market Strategies

In 2025, the United States implemented targeted tariffs aimed at bolstering domestic manufacturing of key automotive components. These measures, primarily affecting steel and aluminum inputs as well as certain precision-machined assemblies, have had a pronounced cumulative impact on the fuel injection pump supply chain. Manufacturers reliant on imported high-grade alloy components faced cost escalations that reverberated through pricing negotiations with OEM clients.

To mitigate rising input costs, several tier-one suppliers accelerated nearshoring initiatives, establishing secondary machining facilities in Mexico and the southeastern U.S. states. This shift not only reduced tariff exposure but also shortened lead times and improved responsiveness to OEM production schedules. Nonetheless, capacity constraints and labor availability challenges in these new locations introduced additional hurdles, prompting collaborative workforce development programs and incentives at local and state levels.

The net effect has been a reconfiguration of global sourcing strategies: while some suppliers opted to absorb a portion of the tariff burden to maintain established relationships, others rebalanced their portfolios by increasing domestic procurement of raw materials. This rebalancing has led to long-term agreements with American steelmakers and alloy specialists, reshaping contractual frameworks and driving innovation in locally produced, high-strength materials tailored for injection pump applications.

Deriving Actionable Insights from Comprehensive Market Segmentation Across Technology Application Fuel Type and Distribution Channel Variations

A nuanced examination of market segmentation reveals distinct trajectories across technology, application, fuel type, and distribution channels. Technologically, common rail systems-available in high pressure and ultra high pressure variants-continue to dominate due to their exceptional injection precision, emissions control, and compatibility with advanced engine architectures. Distributor rotary models retain relevance in cost-sensitive segments, while inline and unit pumps find niche applications in legacy and small-displacement engines, respectively.

When viewed through the lens of application, heavy commercial vehicles demonstrate stable demand for robust bus and truck pumps capable of enduring high-load cycles. Light commercial vehicles have experienced an uptick in pickups and vans, driven by last-mile delivery requirements and construction sector growth. Meanwhile, passenger cars have seen SUVs outpace hatchbacks and sedans, as consumer preferences align with higher ground clearance and integration of sophisticated driver assistance systems.

Fuel type segmentation highlights the enduring strength of diesel-powered pumps in heavy-duty contexts, whereas gasoline pumps-split between direct injection and port fuel injection varieties-gain traction within performance and economy-focused passenger models. Direct injection variants are particularly prized for their superior thermodynamic efficiency and engine downsizing potential.

Finally, distribution channels bifurcate between OEM ties and aftermarket opportunities. While original equipment networks ensure seamless integration and warranty coverage, the aftermarket channel-spanning authorized dealers and independent workshops-has leveraged digital ordering platforms and rapid diagnostics to capture a growing share of maintenance and replacement volume.

This comprehensive research report categorizes the Automotive Fuel Injection Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Fuel Type

- Application

- Distribution Channel

Capturing Vital Regional Distinctions Influencing Automotive Fuel Injection Pump Adoption Across Americas Europe Middle East Africa and Asia Pacific

The regional landscape for fuel injection pumps is characterized by divergent growth rates, regulatory frameworks, and adoption patterns. In the Americas, strong light vehicle production hubs in the United States and Mexico benefit from nearshoring trends, while Brazil’s commercial vehicle sector remains a reliable source of diesel pump demand. North American OEMs continue to prioritize localized manufacturing, spurred by policy incentives and streamlined logistics.

Across Europe, stringent CO2 limits have catalyzed the integration of ultra high pressure common rail systems in both passenger and commercial vehicles, with Germany, France, and Italy at the forefront of R&D and test-bed validation. The Middle East’s reliance on legacy diesel fleets has fostered aftermarket modernization initiatives, whereas Africa’s markets are gradually opening to newer pump technologies through infrastructure investments and urban transit upgrades.

In the Asia-Pacific region, China dominates both production and consumption, driven by massive vehicle assembly volumes and government programs emphasizing fuel economy. India’s rising commercial fleet has spurred demand for reliable inline and distributor rotary pumps, particularly in the bus and small truck segments. Southeast Asian markets are concurrently balancing cost constraints with environmental mandates, creating opportunities for mid-pressure common rail systems and selective diesel-gasoline hybrids.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fuel Injection Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company-Level Perspectives Including Innovations Partnerships and Competitive Dynamics Among Leading Fuel Injection Pump Manufacturers

Leading industry participants have strategically positioned themselves to capitalize on emerging trends by investing heavily in technological differentiation, global footprints, and collaborative ventures. One prominent supplier has deepened its portfolio with advanced common rail modules featuring integrated pressure control valves and real-time monitoring, while another has pursued joint ventures to expand its manufacturing capacity across North America and Asia.

An established Japanese manufacturer leverages its strengths in materials science to introduce pump components with ultra-low wear coatings, thereby extending service intervals in heavy-duty applications. Simultaneously, a European player has consolidated aftermarket and OEM channels through a unified digital platform, achieving seamless data exchange between workshops and assembly lines.

Mid‐tier suppliers, meanwhile, are forging alliances with controls software specialists to co-develop electronic control units that interface directly with emerging hybrid powertrains. New entrants, especially those backed by venture funding in advanced materials and additive manufacturing, are securing strategic partnerships with major OEMs, accelerating proof-of-concept projects under stringent validation protocols.

These strategic maneuvers collectively underscore the critical role of innovation partnerships, footprint expansion, and digital integration in maintaining competitive advantage within the fuel injection pump sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fuel Injection Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BorgWarner Inc.

- Continental AG

- Cummins Inc.

- Denso Corporation

- Devendra Autocom Pvt. Ltd.

- HEARTMAN Co., Ltd

- Heinzmann GmbH & Co. KG

- Hitachi Ltd.

- HR Rück + Köhler

- KKR GROUP

- MAHLE Group

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- NICO Precision Co., Inc.

- NiYo Engineers

- Noguchi Seiki Co.,Ltd.

- Phinia Inc.

- Robert Bosch GmbH

- Robert Bosch GmbH

- Schaeffler Technologies AG & Co. KG

- Sealand Turbo-Diesel Asia Pte Ltd.

- Stanadyne LLC

- Standard Motor Products, Inc.

- VALEO

Formulating Actionable Recommendations to Propel Industry Leaders Toward Sustainable Growth Operational Excellence and Market Differentiation

Industry leaders should prioritize the integration of advanced sensor and control technologies to support predictive maintenance frameworks and reduce unexpected downtimes. By embedding real-time diagnostics into pump assemblies and leveraging cloud-based analytics, suppliers can offer value-added services that reinforce long-term OEM partnerships and generate recurring revenue streams.

Diversifying regional manufacturing footprints through selective nearshoring can mitigate tariff-related expenditures and supply chain disruptions. Targeted investments in secondary production hubs, complemented by local workforce upskilling programs, will ensure capacity resilience while aligning with evolving trade policies.

Collaborations with software developers and hybrid powertrain integrators are essential to capture opportunities at the intersection of electrification and combustion systems. Co-development agreements that focus on seamless interoperability and robust fail-safe mechanisms will differentiate offerings in increasingly complex vehicle architectures.

Finally, engaging proactively with regulatory bodies and materials suppliers to co-create next-generation high-strength alloys can shorten development cycles and secure preferential sourcing terms. Such coordinated efforts will not only enhance pump durability and performance but also drive sustainability objectives through lighter, more efficient component designs.

Detailing the Robust Research Methodology Employed to Ensure Data Integrity Comprehensive Analysis and Industry-Relevant Market Intelligence

This research employed a rigorous, multi-tiered methodology to ensure the validity, reliability, and relevance of its findings. Primary data collection included structured interviews with OEM powertrain engineers, tier-one supplier executives, and aftermarket distribution managers, providing first-hand insights into technological priorities, cost pressures, and integration challenges.

Secondary research encompassed an extensive review of technical white papers, industry journals, patent filings, and regulatory filings to map historical trends and emerging best practices. Publicly available databases were cross-referenced with proprietary subscription sources to triangulate shipment volumes, material inputs, and regional trade flows.

Quantitative analysis leveraged a bottom-up approach, aggregating individual plant capacities, average component lifecycles, and vehicle production schedules to model relative demand patterns. Qualitative validation sessions with independent powertrain consultants and academic researchers were convened to test hypotheses and refine segment definitions.

The study’s structured data-validation framework incorporated discrepancy checks, plausibility assessments, and iterative feedback loops, ensuring that conclusions reflect both market realities and forward-looking scenarios. This robust methodology underpins the strategic insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fuel Injection Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fuel Injection Pumps Market, by Technology

- Automotive Fuel Injection Pumps Market, by Fuel Type

- Automotive Fuel Injection Pumps Market, by Application

- Automotive Fuel Injection Pumps Market, by Distribution Channel

- Automotive Fuel Injection Pumps Market, by Region

- Automotive Fuel Injection Pumps Market, by Group

- Automotive Fuel Injection Pumps Market, by Country

- United States Automotive Fuel Injection Pumps Market

- China Automotive Fuel Injection Pumps Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding with Key Takeaways on Market Trajectories Strategic Imperatives and Future Outlook for the Automotive Fuel Injection Pump Sector

In summation, the automotive fuel injection pump sector is undergoing a profound transformation driven by digitalization, material innovation, and evolving regulatory frameworks. High-pressure common rail systems are setting new benchmarks for performance and emissions compliance, while distributor, inline, and unit pump technologies continue to serve niche applications and legacy platforms.

Tariff-induced shifts in global supply chains have underscored the importance of manufacturing agility, strategic nearshoring, and supplier diversification. Detailed segmentation analysis reveals divergent growth pathways across commercial and passenger vehicle applications, fuel types, and distribution channels, highlighting where value can be captured most effectively.

Regionally, North America’s localized production strategies, Europe’s stringent emissions programs, and Asia-Pacific’s scale economies collectively shape a complex, interdependent market dynamic. Leading manufacturers are responding through innovation partnerships, digital platform integration, and materials advancements to preserve competitive edge.

The actionable recommendations outlined herein provide a clear roadmap for industry participants seeking to harness emerging opportunities, from predictive maintenance services to collaborative alloy development. These insights form the foundation for strategic decision-making in a market that remains critical to the future of automotive propulsion.

Engaging Directly with an Associate Director to Access Exclusive In-Depth Market Insights and Secure Your Advanced Automotive Fuel Injection Pump Report Today

To obtain a comprehensive, precise analysis of the automotive fuel injection pump sector-including in-depth segmentation studies, regional developments, and strategic company profiles-reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the rich insights uncovered in this extensive research, help tailor the findings to your unique business challenges, and facilitate immediate access to the full report. His expertise ensures you receive unparalleled support in leveraging data-driven intelligence to fortify your market positioning, optimize supply chains, and drive innovation.

Secure the critical knowledge your team needs to stay ahead in a rapidly evolving landscape. Connect with Ketan Rohom today to explore bespoke licensing options, customized data extracts, and consultancy services that transform insights into actionable plans tailored for your organizational goals.

- How big is the Automotive Fuel Injection Pumps Market?

- What is the Automotive Fuel Injection Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?