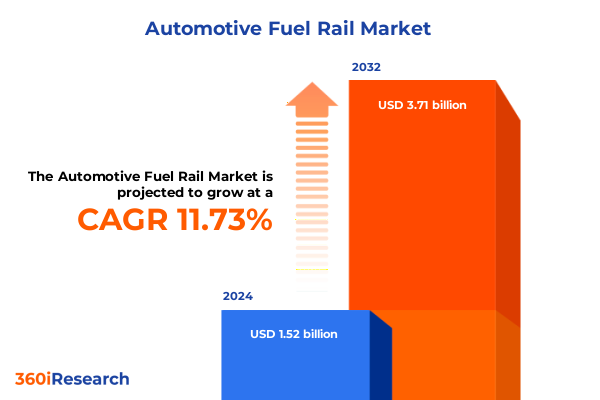

The Automotive Fuel Rail Market size was estimated at USD 1.70 billion in 2025 and expected to reach USD 1.89 billion in 2026, at a CAGR of 11.79% to reach USD 3.71 billion by 2032.

Unveiling the Critical Role of Fuel Rails in Modern Automotive Powertrains Amid Evolving Regulatory and Technological Demands

Across modern automotive powertrains the fuel rail functions as a critical conduit, delivering precisely metered fuel doses to the engine while maintaining system integrity under varying pressure regimes. This component’s performance directly influences engine efficiency, emissions compliance, and overall powertrain responsiveness in both passenger and commercial vehicle applications. As global regulatory bodies tighten emissions standards and consumer demand shifts toward improved fuel economy, the design and material composition of fuel rails have risen to the forefront of OEM priorities.

Over the past decade, fuel rails have evolved from legacy low-pressure systems to advanced common rail networks capable of sustaining pressures in excess of 2,000 bar. This evolution has been driven by the pursuit of optimized combustion, lower particulate output, and tighter control over injection timing. In parallel, alternative powertrain architectures, including hydrogen fuel cell systems, have introduced new pressure and material requirements, prompting suppliers to expand their technology portfolios.

Material selection has become equally pivotal, as manufacturers balance the thermomechanical demands of high-pressure operation with the mass reduction goals that underpin modern fuel efficiency targets. Meanwhile, distribution channels have bifurcated: OEM procurement strategies focus on high-volume scalability and integrated supply chain solutions, while aftermarket providers emphasize rapid availability, standardized specifications, and repairability. Transitioning between these channels requires nuanced strategies that account for regulatory variations, supply chain resiliency, and evolving end-user expectations.

This executive summary lays the foundation for understanding the transformative shifts, tariff-driven supply chain reconfigurations, segmentation insights, regional dynamics, competitive landscapes, and strategic recommendations shaping the automotive fuel rail market today.

Examining the Major Technological, Regulatory, and Material Innovations Redefining the Automotive Fuel Rail Landscape in Recent Years

Recent years have witnessed a series of transformative shifts redefining the automotive fuel rail landscape. Technological innovation has accelerated the transition from conventional low-pressure manifolds to sophisticated common rail systems, capable of supporting ultra-high injection pressures and enabling precise volumetric control. These advancements facilitate cleaner combustion and lower emissions, aligning with the strict requirements of Euro 7 and emerging global regulatory frameworks.

Concurrently, material science breakthroughs have introduced new possibilities for weight reduction and durability enhancement. Suppliers are moving beyond traditional steel constructs to leverage die-cast and extruded aluminum variants or composite solutions that offer corrosion resistance and simplified manufacturing processes. Additive manufacturing techniques are beginning to enable rapid prototyping of complex geometries, shortening development cycles and facilitating design customization for alternative fuel platforms.

Moreover, the rise of hydrogen powertrains has spurred demand for fuel rails capable of handling both gaseous hydrogen and liquid hydrogen feed, each demanding unique sealing and pressure containment strategies. In parallel, electric vehicles have shifted the focus of some manufacturers toward integrated modular fuel systems that can coexist alongside battery packs in hybrid configurations.

Regulations focused on lifecycle carbon footprints have prompted OEMs and suppliers to adopt circular economy practices, including material recycling and remanufacturing of fuel rail assemblies. Digital twin technologies and advanced simulation tools are streamlining design validation processes and reducing the time-to-market for new variants. These interlinked shifts underscore the dynamic interplay between regulatory imperatives, technological ingenuity, and market demands reshaping the fuel rail sector.

Assessing How Ongoing U.S. Steel and Aluminum Tariffs Have Altered Supply Chains, Cost Structures, and Strategic Sourcing Decisions in 2025

Since the introduction of Section 232 tariffs on imported steel and aluminum in 2018, U.S. automotive component suppliers have navigated a complex landscape of increased input costs and supply chain realignment. As of 2025, the 25 percent steel duty and 10 percent aluminum duty remain in effect, amplifying raw material expenses for fuel rail manufacturers reliant on carbon steel, stainless steel, and aluminum variants. These duties have prompted many Tier 1 and Tier 2 suppliers to reevaluate their global sourcing footprints and engage in supplier diversification strategies.

In response, some manufacturers have pursued regional nearshoring initiatives, relocating press and extrusion operations closer to North American automotive clusters. This realignment not only mitigates tariff exposure but also shortens lead times and enhances responsiveness to production schedule fluctuations. At the same time, collaborative agreements with upstream recyclers have emerged, enabling the use of reclaimed alloys that fall below tariff thresholds and comply with stringent quality standards required for high-pressure fuel delivery.

To counterbalance higher material costs, R&D teams are intensifying efforts to qualify alternative composite materials and hybrid structures, blending polymeric sleeves with metallic inserts for critical sealing interfaces. Additionally, long-term contracts and hedging instruments are increasingly utilized to lock in metal prices and protect margins against further tariff escalation. These collective measures reflect the industry’s adaptability, as manufacturers strive to maintain competitive cost structures without compromising performance or compliance in a tariff-impacted environment.

Deriving Strategic Implications from Multifaceted Market Segmentation Based on System Type, Material, Fuel, Pressure, Vehicle Application, and Distribution Channel

Based on fuel system type, the market distinguishes between common rail and conventional rail architectures, revealing that common rail solutions dominate powertrains requiring high-pressure atomization, while legacy conventional rails continue to serve budget-sensitive vehicle segments. When viewed through the lens of material type, aluminum and steel emerge as the cornerstone metals, with die-cast aluminum preferred for its weight savings and extrusion lines yielding highly consistent cross-sections. Within the aluminum category, manufacturers further differentiate offerings into die-cast and extruded aluminum variants, each optimized for distinct machining and heat treatment protocols, while the steel continuum bifurcates into carbon steel and stainless steel, targeting applications where corrosion resistance or mechanical strength is paramount.

Examining fuel type segmentation, diesel continues to leverage high-pressure rails engineered for robust particulate filtration, whereas gasoline powertrains capitalize on precision-engineered passages to meet stringent vapor recovery regulations. Concurrently, the alternative fuel segment is gaining momentum through modular architectures tailored for electric range extenders and hydrogen injection systems, each demanding unique sealing compounds and manifold layouts. Turning to pressure rating, high-pressure rails support direct injection systems across modern engines, whereas low-pressure rails remain relevant for port injection and return-type fuel supply loops in cost-driven applications.

Vehicle type further influences design criteria, with commercial vehicles often requiring reinforced fittings and extended service intervals to endure rigorous duty cycles, while passenger vehicles prioritize packaging flexibility and noise-vibration-harshness (NVH) performance. Finally, distribution channel dynamics differentiate between aftermarket and original equipment manufacturer pathways, where aftermarket offerings emphasize interchangeability and ease of installation, and OEM channels prioritize tailored specifications, long-term supply agreements, and integrated inventory management. Each segmentation dimension interacts to form a comprehensive mosaic of market requirements and innovation imperatives.

This comprehensive research report categorizes the Automotive Fuel Rail market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel System Type

- Material Type

- Fuel Type

- Pressure Rating

- Vehicle Type

- Distribution Channel

Comparing Regional Dynamics Driving Demand and Innovation in the Americas, EMEA, and Asia-Pacific Fuel Rail Markets

In the Americas, automotive production hubs in the United States and Mexico drive sustained demand for high-pressure common rail systems, bolstered by continued investment in diesel commercial vehicles and a growing focus on hydrogen fuel cell prototypes. Regional trade agreements facilitate material flow across borders, while local incentives for advanced manufacturing encourage the adoption of lightweight aluminum components. In contrast, Europe, Middle East & Africa exhibits a pronounced emphasis on emissions reduction and circularity, pushing OEMs to refine stainless steel rails for durability and recyclability and to adopt modular designs suited for hybrid powertrains across passenger fleets.

Meanwhile, the Asia-Pacific region, led by China, Japan, and India, accounts for the largest volume of vehicle output globally, underpinning robust demand for both conventional and common rail architectures. Chinese manufacturers are rapidly scaling extrusion capabilities to supply domestic OEMs, while Japanese and Indian firms focus on incremental innovations in material coatings to enhance fuel compatibility and extend service lifecycles. Australia and Southeast Asian markets, though smaller, serve as proving grounds for alternative fuel systems, with pilot programs for hydrogen-powered buses and electric hybrid retrofits influencing regional suppliers.

Across all regions, the interplay between local regulations, infrastructure readiness for alternative fuels, and shifting consumer preferences shapes the strategic priorities of fuel rail manufacturers. Companies that tailor their product portfolios to regional nuances in powertrain technology, material sourcing, and distribution partnerships are best positioned to capture growth opportunities in this geographically diverse market landscape.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fuel Rail market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Automotive Component Manufacturers Shaping Fuel Rail Development through Innovation, Partnerships, and Global Expansion Strategies

Leading component manufacturers are at the forefront of fuel rail innovation, each leveraging unique capabilities to capture market share and address evolving automotive requirements. A global technology powerhouse has advanced its additive manufacturing processes to produce complex manifold geometries that optimize flow dynamics and reduce weight. Another major tier supplier has solidified its position through strategic joint ventures with alloy producers, ensuring preferential access to high-grade aluminum and stainless steel feedstocks that meet stringent OEM specifications.

Several established automotive electronics firms have integrated digital sensing modules into fuel rail assemblies, enabling real-time monitoring of pressure, temperature, and flow rates. This shift toward smart rails facilitates predictive maintenance and enhances engine calibration strategies. In parallel, traditional rubber hose and connector specialists have expanded into rigid rail systems by acquiring material science startups, broadening their portfolios to include high-pressure polymeric inserts and advanced sealing compounds suitable for hydrogen and alternative fuel delivery.

Meanwhile, mid-tier suppliers are differentiating through regional manufacturing footprints, establishing localized extrusion and machining centers to serve key automotive clusters in North America, Europe, and Asia-Pacific. These facilities not only circumvent tariff barriers but also foster collaborative development with local engine OEMs, accelerating the validation of next-generation common rail platforms. Collectively, these leading players exemplify how integrated R&D, supply chain optimization, and cross-sector partnerships underpin success in the competitive fuel rail market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fuel Rail market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Bharat Forge Limited

- Bosal International N.V.

- Calsonic Kansei Corporation

- Continental AG

- Cooper Standard Holdings Inc.

- DENSO Corporation

- Dura Automotive Systems, LLC

- Hitachi Astemo, Ltd.

- Kautex Textron GmbH & Co. KG

- Keihin Corporation

- Landi Renzo S.p.A.

- Linamar Corporation

- MAHLE GmbH

- Marelli Holdings Co., Ltd.

- Nikki Co., Ltd.

- Ningbo Gaofa Automotive Control System Co., Ltd.

- Robert Bosch GmbH

- Sanoh America, Inc.

- Sanoh Industrial Co., Ltd.

- SMP Deutschland GmbH

- TI Fluid Systems plc

- USUI Co., Ltd.

- Valeo SA

- Yasunaga Corporation

Outlining Targeted Strategies for Industry Leaders to Mitigate Risk, Capitalize on Emerging Technologies, and Drive Competitive Advantage in Fuel Rail Markets

Industry leaders should prioritize diversification of raw material sources to mitigate the ongoing effects of tariff volatility and supply chain disruptions. Establishing dual-sourcing agreements with geographically dispersed suppliers can reduce exposure to localized bottlenecks and ensure continuity of high-grade steel and aluminum inputs. Additionally, investing in research programs focused on polymer-metal hybrid structures and composite materials can unlock further weight reduction and corrosion resistance, driving improvements in fuel efficiency and component longevity.

Collaborative development with established powertrain OEMs and emerging hydrogen technology providers can accelerate the qualification of next-generation fuel rail systems. By co-investing in pilot production lines and shared validation facilities, suppliers can achieve faster time-to-market for high-pressure hydrogen-compatible rails and modular platforms tailored to both traditional and alternative fuel applications. Furthermore, integrating digital twin methodologies into design workflows can streamline prototyping cycles and enhance performance predictions under diverse operational conditions.

Finally, companies should reinforce aftermarket engagement through value-added services such as condition monitoring solutions and extended warranty programs. By leveraging smart sensor data embedded within fuel rail systems, suppliers can offer predictive maintenance platforms that reduce downtime and foster long-term customer relationships. These targeted strategies will enable industry participants to maintain cost competitiveness, drive technological differentiation, and secure strategic advantage in an increasingly complex market.

Detailing a Robust Multi-Source Research Framework Incorporating Primary Interviews, Secondary Data Evaluation, and Rigorous Validation Protocols

This analysis is underpinned by a rigorous research framework that combines qualitative insights from in-depth interviews with industry executives, technical experts, and procurement specialists. These primary discussions have illuminated real-world challenges in raw material sourcing, design validation, and aftermarket support. To supplement these findings, a comprehensive review of secondary data sources-such as regulatory filings, patent disclosures, trade association reports, and peer-reviewed studies-has been conducted to ensure a holistic perspective.

Quantitative data, including production volumes, import-export statistics, and material pricing trends, were collected from publicly available government databases and industry consortia publications. These datasets underwent cross-validation against proprietary supply chain records and expert feedback to identify anomalies and ensure consistency. Advanced analytical tools were applied to model tariff impact scenarios, sensitivity analyses, and segmentation overlays, providing a robust foundation for strategic recommendations.

Throughout the research process, stringent quality controls were maintained via iterative peer reviews, data triangulation methods, and adherence to established market research standards. This methodology ensures that conclusions are both reliable and actionable, offering stakeholders a transparent view of assumptions, data sources, and analytical techniques employed in deriving key market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fuel Rail market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fuel Rail Market, by Fuel System Type

- Automotive Fuel Rail Market, by Material Type

- Automotive Fuel Rail Market, by Fuel Type

- Automotive Fuel Rail Market, by Pressure Rating

- Automotive Fuel Rail Market, by Vehicle Type

- Automotive Fuel Rail Market, by Distribution Channel

- Automotive Fuel Rail Market, by Region

- Automotive Fuel Rail Market, by Group

- Automotive Fuel Rail Market, by Country

- United States Automotive Fuel Rail Market

- China Automotive Fuel Rail Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Strategic Imperatives to Propel Data-Informed Decision-Making for Stakeholders in Automotive Fuel Rail Ecosystem

The analysis reveals that the convergence of advanced high-pressure common rail technology, material innovation, and supply chain adaptation in response to U.S. tariffs is reshaping the fuel rail sector. Material diversification efforts and strategic nearshoring mitigate cost pressures, while digital integration and additive manufacturing accelerate product development timelines. In regional markets, tailored approaches to emissions regulations, fuel infrastructure readiness, and consumer preferences drive differentiated demand patterns.

Segmentation insights underscore the importance of aligning product portfolios with specific system types, material requirements, fuel applications, pressure ratings, vehicle classes, and distribution channels. Leading manufacturers leverage collaborative partnerships, proprietary sensing solutions, and localized production to maintain competitive positioning. For industry decision-makers, the imperative is clear: proactively invest in emerging material sciences, deepen supplier relationships, and adopt digital tools to enhance design and operational resilience.

By synthesizing these findings, stakeholders are equipped to navigate the complexities of the automotive fuel rail landscape, capitalize on emerging trends, and execute informed strategies that secure long-term growth and innovation.

Engaging with Ketan Rohom to Access Comprehensive In-Depth Analysis and Unlock Actionable Intelligence through the Full Market Research Report

To access the full breadth of detailed analyses covering material performance comparisons, tariff impact assessments, and competitive positioning, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Through a personalized consultation, Ketan will outline how each chapter of the report addresses your organization’s strategic needs, ranging from custom segmentation deep dives to regional outlooks and technology roadmaps. You will gain clarity on fuel system innovations, material substitution opportunities, and adaptive sourcing strategies for both aftermarket and OEM applications. Engaging with Ketan also provides an early view of upcoming report updates as industry conditions evolve, including subscription options for continual intelligence delivery. By partnering with Ketan, you will ensure your team has the comprehensive data and expert guidance required to make timely, informed decisions in the automotive fuel rail ecosystem. Secure your copy today to turn insights into actionable outcomes and maintain a competitive edge.

- How big is the Automotive Fuel Rail Market?

- What is the Automotive Fuel Rail Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?