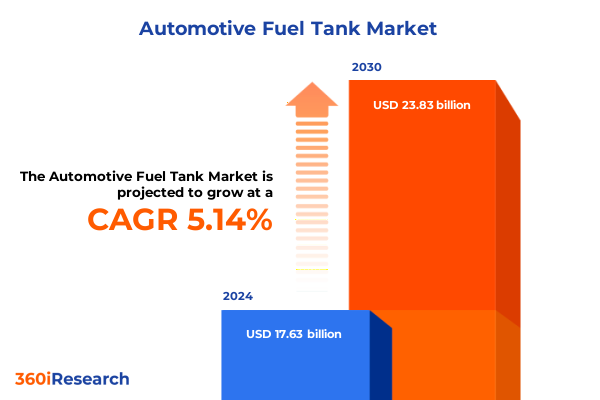

The Automotive Fuel Tank Market size was estimated at USD 17.63 billion in 2024 and expected to reach USD 18.51 billion in 2025, at a CAGR of 5.14% to reach USD 23.83 billion by 2030.

Unveiling the Critical Role of Automotive Fuel Tanks in Driving the Future of Vehicle Efficiency and Safety Across Global Markets

Automotive fuel tanks serve as more than reservoirs for vehicle propulsion; they represent a pivotal intersection of safety engineering, regulatory compliance, and design innovation. Recent emphasis on reducing vehicular emissions and improving crashworthiness has elevated the fuel tank from a passive component to a strategic enabler of performance goals. In this context, stakeholders across OEMs, component suppliers, and regulatory bodies recognize the necessity of integrating advanced materials, digital monitoring systems, and streamlined manufacturing processes to meet evolving consumer expectations and stringent safety standards.

As the global push toward electrification coexists with ongoing demand for internal combustion engines, the fuel tank sector finds itself navigating a complex balance between legacy requirements and future-proofing initiatives. Emerging markets, particularly where two-wheelers and commercial vehicles dominate transportation, present unique challenges for cost-effective tank solutions that still adhere to safety and emission norms. Meanwhile, advanced economies adopt more sophisticated designs that incorporate real-time diagnostics and lighter, corrosion-resistant alloys. This introductory section sets the stage for a comprehensive analysis of the forces reshaping the automotive fuel tank domain, laying the groundwork for deeper exploration of transformative shifts, tariff impacts, and segmentation insights.

Exploring Innovations in Materials Digitalization and Regulatory Standards Are Transforming Longevity Sustainability and Efficiency of Automotive Fuel Tanks

The automotive fuel tank landscape is undergoing a renaissance driven by breakthroughs in materials and digital integration alongside evolving regulatory mandates. Lightweight composites and advanced polymers are challenging traditional steel and aluminum constructs by offering exceptional corrosion resistance and weight reduction, thereby improving overall vehicle efficiency. Simultaneously, the integration of sensor networks and Internet of Things connectivity has enabled real-time monitoring of fuel levels, pressure anomalies, and leak detection, enhancing predictive maintenance capabilities and elevating safety benchmarks.

Regulatory bodies across North America, Europe, and Asia are tightening emission and crash-test criteria, compelling manufacturers to innovate in both design and production. New standards require fuel containment systems that endure higher impact forces and extreme environmental conditions, triggering collaboration between material scientists, component engineers, and certification experts. Moreover, additive manufacturing and robotics are reshaping production lines by allowing complex geometries and rapid prototyping, which accelerates time to market while maintaining quality consistency. Together, these innovations underscore how the industry is pivoting toward more resilient, efficient, and connected fuel tank architectures.

Assessing the Widespread Effects of 2025 US Tariff Policies on Raw Material Costs Supply Chain Resilience and Competitive Dynamics in the Fuel Tank Sector

In 2025, the United States implemented revised tariff policies that have rippled through the automotive supply chain, particularly affecting raw material acquisition and component imports. Steel and aluminum levies have elevated input costs, prompting manufacturers to explore alternative sourcing strategies and negotiate long-term contracts to mitigate price volatility. This has intensified partnerships with domestic mill operators and driven interest in lower-cost polymer blends and composite materials as viable substitutes.

These tariff-induced dynamics have also underscored the critical importance of supply chain resilience. Manufacturers are diversifying supplier portfolios across multiple geographies and investing in near-shoring to reduce lead times and logistical uncertainties. As a result, production footprints are adapting to balance cost pressures with the need for consistent material quality and regulatory compliance. In response, competitive dynamics within the fuel tank sector are shifting, with agile players capitalizing on efficient sourcing and process innovations to maintain margin stability and market presence.

Uncovering Deep Market Dynamics Through Material Component Fuel Type Production Method Capacity Vehicle Classification and Distribution Channel Perspectives

A nuanced understanding of market segmentation reveals critical insights into where value is created and latent opportunities reside. Material type segmentation highlights a shift toward plastic tanks that leverage blow molding processes for cost-effective production, while metal variants continue to rely on stamping and welding techniques to meet durability and safety thresholds. Among metal options, aluminum stands out for its weight advantage and corrosion resistance, whereas steel retains appeal for heavy-duty applications where strength is paramount.

Component analysis sheds light on where revenue streams diverge. Baffles, filler necks, and fuel caps demand precision engineering to prevent leaks and manage pressure changes, while integrated fuel pumps and gauges emphasize digital accuracy. Fuel line variants further reflect a spectrum of polymer and metal choices influenced by the targeted vehicle configuration. When considering fuel type, gasoline and diesel tanks dominate established markets, yet CNG and hydrogen segments are accelerating development to support alternative fuel initiatives. Capacity-based classification illustrates distinct design requirements for sub-45-liter systems in compact vehicles, standard ranges between 45 to 70 liters in passenger cars, and larger capacities beyond 70 liters in commercial fleets.

Manufacturing process insights underscore the prevalence of blow molding in plastic tank production, contrasted with traditional stamping and welding methods for metal structures. Vehicle-type segmentation differentiates requirements for passenger vehicles-spanning hatchbacks, sedans, and SUVs-from the robust demands of heavy and light commercial vehicles, and the compact form factors required by two-wheelers. Finally, end-use analysis contrasts original equipment manufacturers, who prioritize integration and regulatory adherence, with aftermarket providers emphasizing retrofit versatility, while sales channel breakdown examines offline distribution networks alongside online brand portals and e-commerce platforms.

This comprehensive research report categorizes the Automotive Fuel Tank market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Component

- Fuel Type

- Manufacturing Process

- Capacity

- Vehicle Type

- End Use

- Sales Channel

Analyzing Regional Growth Drivers and Challenges Across Americas Europe Middle East Africa and Asia Pacific Fuel Tank Markets with Strategic Implications

Regional patterns illuminate varied growth trajectories and competitive landscapes. In the Americas, the confluence of mature automotive hubs and policy incentives for emissions reduction has fostered rapid adoption of lightweight tank materials and telematics-enabled monitoring solutions. OEMs in this region are investing heavily in sustainable manufacturing and exploring collaborations with tech providers to integrate advanced diagnostics into fuel containment systems.

Europe, Middle East & Africa present a mosaic of regulatory regimes and infrastructure readiness that shape divergent pathways. Stringent European standards around crash safety and recyclability are accelerating uptake of aluminum and innovative polymer composites. In contrast, emerging economies in the Middle East and Africa prioritize cost-effective production and depend on established steel tank technologies, while pilot projects for CNG and hydrogen applications are gaining traction in regions with supportive energy policies.

Asia-Pacific stands out for its dual role as both a manufacturing powerhouse and a rapidly expanding end-use market. High-volume production centers in Southeast Asia leverage efficient stamping and welding lines, while Northeast Asia leads in advanced material R&D and digital integration. Consumer demand for both two-wheelers and passenger vehicles continues to drive capacity optimization, prompting localized design adaptations and the expansion of aftermarket channels.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fuel Tank market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Positioning Competitive Advantages and Collaborative Innovations Among Leading Automotive Fuel Tank Manufacturers and Suppliers

Leading manufacturers and suppliers have distinguished themselves through strategic partnerships, technology licensing agreements, and cross-industry alliances. Some global players leverage vertical integration models that encompass raw material production, component manufacturing, and in-house testing facilities, ensuring stringent quality controls and rapid innovation cycles. Other firms focus on modular platform approaches that enable seamless adaptation of tank designs across multiple vehicle segments, enhancing economies of scale.

Collaborative ventures between material science specialists and OEM research centers are propelling the adoption of next-generation composite blends and embedded sensor arrays. Marketing strategies emphasize turnkey solutions that bundle design, validation, and aftermarket support, creating value propositions that extend beyond basic tank supply. Additionally, a wave of industry consolidation has strengthened the market positions of mid-tier suppliers, enabling them to invest in advanced tooling and digital simulation capabilities. Overall, competitive differentiation increasingly hinges on the ability to deliver end-to-end engineering expertise and turnkey system integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fuel Tank market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Boyd Welding LLC

- Continental AG

- Crefact Co., Ltd.

- DALI & SAMIR ENGINEERING PVT. LTD.

- ELSA LLC

- FORVIA

- Fuel Total Systems

- ILJIN Hysolus CO., LTD.

- Kautex Textron GmbH & Co. KG

- LyondellBasell Industries Holdings B.V.

- Magna International Inc.

- Motherson Yachiyo Automotive Systems Co., Ltd.

- NovaNox

- POSCO

- Rotovia

- Röchling SE & Co. KG

- SKH by Krishna Group

- SMA Serbatoi S.p.A.

- SMTR Group

- Spectra Premium

- Tata Autocomp Systems Limited

- The Plastic Omnium Group

- TI Automotive by ABC Technologies

- Time Technoplast Ltd.

- Toyoda Gosei Co., Ltd.

- YAPP Automotive Systems Co., Ltd.

- Z.P.H.U. ARHEN Andrzej and Adam Pawelec

Actionable Strategies for Industry Leaders to Enhance Innovation Drive Operational Efficiency and Navigate Market Disruptions in the Automotive Fuel Tank Domain

Industry leaders must adopt a proactive approach to drive continuous innovation while safeguarding operational resilience. Prioritizing investment in advanced material research, particularly in high-strength polymers and hybrid composites, will unlock weight reduction and enhanced safety performance. Simultaneously, forging alliances with telematics providers and artificial intelligence specialists can accelerate the integration of predictive diagnostics and real-time monitoring into fuel tank systems.

To navigate tariff volatility and supply chain disruptions, executives should diversify sourcing strategies by establishing regional procurement hubs and engaging with a network of certified secondary suppliers. Furthermore, embracing digital twin technologies and virtual testing platforms can streamline validation cycles, reduce physical prototyping costs, and expedite new product introductions. Finally, aligning sustainability goals with end-to-end life cycle management-encompassing recyclable materials and modular design principles-will resonate with both regulatory bodies and eco-conscious consumers, securing long-term market relevance.

Detailing Rigorous Research Approaches Data Collection Techniques and Analytical Frameworks Underpinning the Comprehensive Automotive Fuel Tank Market Study

This research draws on a multi-tiered methodology that integrates primary interviews with OEM engineers, material scientists, and regulatory officials, supplemented by secondary insights from industry publications and technical standards. Field data on material performance and production processes were gathered through plant visits and virtual workshops, ensuring a grounded understanding of real-world applications. Simultaneously, expert panels provided qualitative validation of emerging trends and technology adoption barriers.

Quantitative analyses leveraged cost-benchmarking exercises and comparative studies across manufacturing geographies, assessing factors such as yield rates, scrap reduction, and line efficiency. Advanced analytics techniques-including cluster mapping and scenario modeling-were employed to explore the interplay between tariff policies and supply chain configurations. Finally, cross-sectional reviews of regional regulatory frameworks informed the assessment of compliance requirements and their impact on design criteria, resulting in a comprehensive and balanced market study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fuel Tank market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fuel Tank Market, by Material Type

- Automotive Fuel Tank Market, by Component

- Automotive Fuel Tank Market, by Fuel Type

- Automotive Fuel Tank Market, by Manufacturing Process

- Automotive Fuel Tank Market, by Capacity

- Automotive Fuel Tank Market, by Vehicle Type

- Automotive Fuel Tank Market, by End Use

- Automotive Fuel Tank Market, by Sales Channel

- Automotive Fuel Tank Market, by Region

- Automotive Fuel Tank Market, by Group

- Automotive Fuel Tank Market, by Country

- United States Automotive Fuel Tank Market

- China Automotive Fuel Tank Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings and Strategic Perspectives to Inform Decision Making and Foster Growth in the Evolving Automotive Fuel Tank Landscape

The automotive fuel tank sector stands at a crossroads where technological innovation converges with regulatory stringency and evolving end-user expectations. Critical findings highlight the ascendancy of lightweight composites, the imperative of digital integration for safety and maintenance, and the strategic responsiveness required to navigate tariff-induced supply chain shifts. Segmentation insights reveal clear value drivers within material choices, component integrations, and vehicle-specific design considerations, while regional analysis underscores the need for localized strategies that align with divergent market conditions.

Going forward, stakeholders who harness advanced materials, leverage digital diagnostics, and cultivate adaptable supply networks will secure a decisive advantage. The evidence points toward a future in which modular, sensor-enabled fuel tank systems will become standard, and where sustainability commitments will shape both design and aftersales engagements. Organizations that act on these insights will not only mitigate risks but also capture growth opportunities in a dynamic and competitive landscape.

Secure Key Insight into the Automotive Fuel Tank Market with Associate Director Ketan Rohom to Accelerate Strategic Planning and Competitive Advantage

To gain unparalleled clarity on the shifting dynamics and emerging opportunities within the automotive fuel tank landscape, reach out to Associate Director Ketan Rohom to purchase your complete market research report. His expertise in sales and marketing strategy will guide you through tailored insights that empower decision-makers to develop robust strategic plans and secure a competitive edge. Unlock detailed analysis of material innovations, regulatory impacts, supply chain resilience, and regional growth drivers that will enable your organization to stay ahead of industry disruptions. Engage directly with Ketan Rohom to customize your research package, receive expert consultation on application to your business objectives, and ensure your team benefits from actionable intelligence that drives sustainable growth. Secure your access today and transform data into decisive action with the support of Ketan Rohom’s informed perspective and strategic acumen.

- How big is the Automotive Fuel Tank Market?

- What is the Automotive Fuel Tank Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?