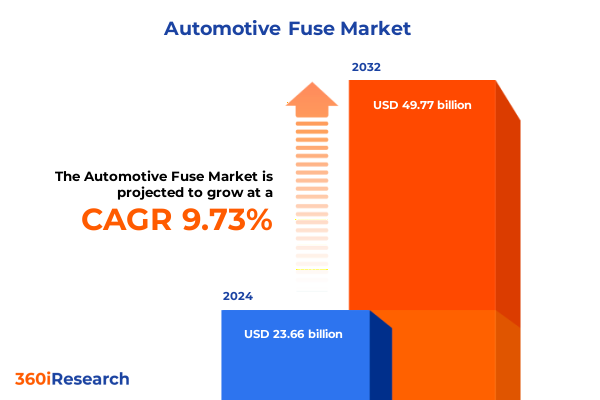

The Automotive Fuse Market size was estimated at USD 25.66 billion in 2025 and expected to reach USD 27.83 billion in 2026, at a CAGR of 9.92% to reach USD 49.77 billion by 2032.

Exploring the Critical Role of Automotive Fuses in Evolving Vehicle Architectures and Safety Frameworks in the Modern 2025 Landscape

Automotive fuses serve as the foundational safeguard for modern vehicle electrical systems, interrupting fault currents to prevent component damage, electrical fires, and system malfunctions. In a landscape where vehicle architectures encompass everything from traditional internal combustion engines to complex hybrid and battery electric drivetrains, circuit protection solutions have become more critical than ever. With global electric vehicle sales expected to exceed 20 million units in 2025, representing over 25% of new car registrations, demand for both low-voltage and high-voltage fuses has surged to ensure safe operation of high-power battery systems and auxiliary electronics.

Simultaneously, the proliferation of advanced driver assistance systems (ADAS), infotainment suites, and vehicle electrification has exponentially increased the number of electrical circuits onboard. This complexity demands fuses that not only offer precise time-current characteristics but also integrate real-time diagnostic capabilities. Emerging smart fuse technologies leverage Internet of Things (IoT) connectivity to monitor load conditions, temperature, and operational health, enabling predictive maintenance and reducing downtime in fleet applications.

Moreover, stringent international safety standards underpin fuse design and application practices across regions to foster global interoperability. Standards such as ISO 8820 for automotive fuse-link user guidelines and IEC 60269 for low-voltage power fuses harmonize time-current characteristics, ensuring that fuses deliver consistent performance in diverse vehicle platforms. These regulatory frameworks serve as the cornerstone for manufacturers seeking to align product innovation with robust safety and reliability requirements.

Uncovering the Transformative Technological and Regulatory Shifts Reshaping the Automotive Fuse Industry Amidst Electrification and Smart Mobility

The acceleration of vehicle electrification has driven a profound transformation in circuit protection requirements. Modern hybrid and battery electric vehicles now deploy dual voltage architectures, necessitating both low-voltage fuses for auxiliary systems and high-voltage fuses for propulsion components. In response to the ongoing build-out of fast-charging infrastructure, fuse manufacturers have introduced high-performance DC hybrid and photovoltaic fuse solutions capable of handling up to 2000 VDC and currents exceeding 1250 A. These innovations mark a decisive shift from legacy fuse designs toward specialized components engineered for demanding energy applications in electrified powertrains.

Concurrently, the integration of smart technologies has elevated fuses from passive protection elements to active system guardians. IoT-enabled fuses and fuse holders now incorporate onboard sensors and communication modules that transmit load, temperature, and fault-event data to vehicle control units and cloud platforms. This real-time visibility enhances diagnostic accuracy, accelerates fault resolution, and underpins advanced safety strategies such as coordinated overcurrent response across networked subsystems. As a result, smart fuses are rapidly emerging as indispensable components in next-generation vehicle electronic architectures.

Material science and miniaturization trends have further reshaped the industry landscape. The advent of electronic fuses (eFuses) utilizing semiconductor switching technologies is increasingly attractive for cloud and autonomous driving applications, where space constraints and rapid fault interruption are paramount. Compared to thermal fuses, eFuses offer reduced form factors, precise current limiting, and programmable trip characteristics, aligning with the demands of high-density automotive electronics. These advances underscore a broader move toward intelligent energy management and highlight the fuse industry’s role in facilitating the transition to connected, autonomous, and electrified mobility solutions.

Examining the Cumulative Impact of 2025 United States Tariffs on Supply Chain Dynamics, Cost Structures, and Manufacturer Strategies in the Fuse Sector

United States trade policy in 2025 introduced significant tariff measures impacting imported vehicles and auto parts, including fuses and raw materials integral to circuit protection components. Under the existing framework, a 25% tariff on foreign automotive imports created a cost premium on products reliant on cross-border supply chains. The subsequent U.S.–Japan deal, which reduced tariffs on Japanese vehicles and parts from 27.5% to 15%, introduced a complex dynamic where U.S.-assembled vehicles continued to incur higher duties, raising concerns about competitive neutrality among domestic manufacturers.

The financial impact on original equipment manufacturers has been substantial. In Q2 2025, General Motors reported a $1.1 billion hit to net income directly attributable to tariff expenses, resulting in a 35% year-over-year decline in net profits. Despite maintaining full-year guidance, GM and other Detroit-based automakers are absorbing elevated production costs rather than passing them on fully to consumers, seeking mitigation through strategic plant re-allocation and incremental investments in U.S.-based capacity expansion.

Automotive fuse suppliers also encountered supply-chain disruptions and input cost increases. Companies with vertically integrated operations or diversified sourcing strategies demonstrated greater resilience, as they could shift procurement to domestic or tariff-exempt regions. In contrast, firms heavily reliant on specific foreign suppliers faced margin compression and were compelled to localize production facilities, forge strategic partnerships with U.S.-based component manufacturers, and restructure pricing mechanisms. These adjustments underscore the urgency for agile supply-chain management and strategic foresight in navigating evolving trade landscapes.

Revealing Key Segmentation Insights to Illuminate Diverse Automotive Fuse Market Niches Based on Technical, Application, and Commercial Criteria

Market segmentation by fuse type reveals three primary categories: blade fuses, cartridge fuses, and micro fuses. Blade fuses are further distinguished into maxi and standard variants, providing high- and medium-current protections for diverse power distribution needs. Cartridge fuses offer both cylindrical and rectangular profiles, serving applications from under-hood battery safety to high-power fuse blocks. Micro fuses, encompassing APM and ATM micro formats, deliver compact protection solutions for sensitive control circuits in infotainment and advanced electronic modules.

Vehicle type segmentation underscores the dual markets of passenger vehicles and commercial vehicles, each demanding tailored fuse specifications. Passenger cars and light trucks prioritize miniaturized fuse designs to optimize under-hood package space for electric and conventional configurations. Meanwhile, commercial vehicles leverage robust high-current fuse types to safeguard heavy-duty power distribution systems operating under extended duty cycles and higher ambient temperatures.

Application segmentation spans engine compartment, exterior, and interior domains. Engine compartment fuses must tolerate elevated thermal stresses and vibration, whereas exterior fuses, such as in lighting and telematics modules, require ingress protection. Interior fuses focus on cabin electronics, including infotainment, climate control, and safety sensor networks, driving the proliferation of low-profile micro fuse solutions.

Current rating segmentation delineates three bands: up to 10 A, 10 to 50 A, and above 50 A, reflecting the wide spectrum of circuit protection requirements. Lower-current fuses support signal and control circuits, while mid-range ratings address intermediate loads such as lighting, pumps, and motors, and high-current fuses protect main power feeds and high-voltage battery systems.

End use classification into OEM and aftermarket segments highlights the differing quality and certification expectations. OEM fuses undergo rigorous qualification to meet vehicle manufacturer specifications and compliance mandates, whereas aftermarket fuses emphasize interchangeability and cost-effectiveness for repair and maintenance applications.

Mounting type segmentation includes inline, panel mount, and PCB mount configurations. Inline fuses offer in-line cable protection, panel mounts facilitate fuse block integration, and PCB mounts integrate directly onto circuit boards, catering to emerging compact electronic control units.

Distribution channel segmentation covers OEM supply, aftermarket distributors, and e-commerce platforms. OEM supply chains prioritize long-term agreements and just-in-time logistics, aftermarket distributors focus on broad product portfolios for repair networks, and e-commerce channels offer rapid procurement for specialty and emergency applications.

This comprehensive research report categorizes the Automotive Fuse market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuse Type

- Vehicle Type

- Current Rating

- Mounting Type

- Application

- End Use

- Distribution Channel

Analyzing Key Regional Insights Demonstrating Pan-Regional Trends and Opportunities across the Americas, EMEA, and Asia-Pacific Fuse Markets

The Americas region is characterized by a mature automotive ecosystem encompassing North, Central, and South America. The United States leads with robust vehicle production and electrification momentum, evidenced by a 10% EV sales share in the first quarter of 2025. However, ongoing tariff uncertainties have introduced cost volatility into supply chains, prompting manufacturers to prioritize regional sourcing and domestic capacity expansion to mitigate duty impacts and support local job creation.

Europe, Middle East & Africa (EMEA) combines developed markets in Western Europe with emerging markets across the Middle East and Africa. Western European countries continue to enforce stringent CO₂ reduction targets under EU regulations, driving up EV adoption to around 25% of new car sales in 2025. This regulatory environment stimulates demand for high-voltage fuse solutions tailored to electric drivetrains. In parallel, Middle Eastern countries are investing in infrastructure modernization, while African markets present nascent opportunities for cost-effective aftermarket and commercial vehicle fuse applications. Trade negotiations with the EU have also influenced duty structures, underscoring the complexity of cross-border component flows.

Asia-Pacific remains the fastest-growing region, led by China’s dominant position in both EV production and battery manufacturing. With China’s EV sales projected to reach 60% of total new vehicle sales in 2025, demand for high-capacity fuses and battery system protections is unparalleled. Japan and South Korea also maintain strong automotive manufacturing bases, benefiting from reduced tariffs under recent trade agreements and fueling requirements for both low- and high-voltage fuse innovations. The diverse regulatory landscapes and rapidly evolving electrification strategies across Asia-Pacific create a dynamic environment for fuse suppliers to capture growth through localized solutions and strategic partnerships.

This comprehensive research report examines key regions that drive the evolution of the Automotive Fuse market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Initiatives and Competitive Positioning of Leading Automotive Fuse Suppliers Driving Market Innovation and Resilience

TE Connectivity has solidified its position as a leading supplier of automotive circuit protection components through a diversified product portfolio and robust R&D investment. In its fiscal first quarter of 2025, TE reported adjusted earnings per share of $1.95 on $3.84 billion in sales, driven in part by growing demand from EV manufacturers. The company’s transportation solutions unit delivered $404 million in operating profit, underpinned by strengthening orders in high-voltage connector and fuse applications. With new orders totaling $4 billion, TE is strategically aligning its production footprint to capitalize on anticipated shifts in EV assembly across Asia and North America.

Littelfuse continues to leverage its diversified end-market exposure and flexible operating model to navigate trade uncertainties and economic headwinds. In the first quarter of 2025, the company achieved net sales of $554 million, representing a 3.5% year-over-year increase, with adjusted diluted EPS of $2.19, up 24%. Littelfuse’s leadership in developing ultra-high amperage surface-mount and photovoltaic fuse solutions, coupled with a strong free cash flow conversion rate of 98%, underscores its capacity to invest in innovation and sustain growth across automotive, industrial, and electronics segments.

Mersen, a specialist in electrical power and advanced materials, has positioned itself at the forefront of high-voltage and DC fuse technologies. Although the company has deferred its growth targets by two years due to a temporary slowdown in EV and silicon carbide semiconductor demand, it remains committed to expanding its product portfolio for battery energy storage and renewable energy applications. Mersen’s first-to-market photovoltaic and DC hybrid fuse series, combined with a global footprint of R&D centers and manufacturing facilities, provide a strong platform for capitalizing on the electrification and renewable energy trends shaping the fuse market landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Fuse market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bel Fuse Inc.

- Blue Sea Systems, Inc.

- Bourns, Inc.

- Eaton Corporation plc

- Littelfuse, Inc.

- Mersen S.A.

- Nihon Fuse Co., Ltd.

- Schurter AG

- SIBA GmbH

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- Würth Elektronik GmbH & Co. KG

- Yazaki Corporation

Strategic Recommendations for Automotive Fuse Industry Leaders to Enhance Supply Chain Agility, Innovation Roadmaps, and Market Penetration Strategies

Industry leaders must prioritize supply chain diversification to mitigate the impacts of evolving tariff regimes and geopolitical uncertainties. By cultivating relationships with multiple regional suppliers and investing in localized production capacity, companies can reduce exposure to single-source dependencies and optimize total landed costs in an increasingly protectionist trade environment.

Investing in advanced fuse technologies, including smart sensor integration and eFuse architectures, will differentiate market offerings and address the growing demand for real-time diagnostic data and rapid fault isolation. Collaborations with vehicle OEMs to standardize smart fuse communication protocols and validation processes will expedite adoption and embed fuses as integral elements of next-generation electronic control strategies.

Embracing modular design principles and scalable manufacturing processes will enable rapid customization across diverse vehicle platforms. Modular fuse blocks and standardized interface modules can streamline product development cycles, allowing suppliers to respond swiftly to shifting segment requirements-from compact passenger cars to heavy-duty commercial vehicles-while maintaining cost efficiencies.

Strengthening technical partnerships with automotive industry consortia and standards bodies, such as ISO and SAE, will ensure alignment with emerging safety and functional requirements. Active participation in functional safety working groups and contributions to time-current characteristic harmonization will enhance product credibility and accelerate market acceptance in both established and emerging regions.

Unveiling a Robust Research Methodology That Combines Extensive Primary Stakeholder Engagement with Comprehensive Secondary Data Triangulation Techniques

This research integrates a rigorous dual-phase methodology combining primary stakeholder engagement with comprehensive secondary data analysis. Initially, in-depth interviews were conducted with senior executives, design engineers, and procurement specialists across OEM and supplier organizations to gather firsthand insights on evolving product requirements, regulatory influences, and supply chain dynamics.

Complementing primary research, an extensive review of technical standards, trade policy documents, and industry publications-including ISO, IEC, and tariff regulation records-was undertaken to establish a robust contextual framework. Secondary data sources were critically evaluated for validity and triangulated with primary findings to enhance reliability and mitigate biases inherent to individual data sets.

Quantitative analyses were applied to segment and regional dynamics, leveraging proprietary transaction databases and customs trade data. Qualitative thematic coding of interview transcripts facilitated the identification of key innovation drivers and strategic imperatives, which were then synthesized into actionable recommendations.

Throughout the research process, strategic validation workshops were convened with cross-functional stakeholders to refine insights and ensure that conclusions reflect both market realities and forward-looking perspectives. This holistic approach underpins the credibility of the report’s findings and provides a clear roadmap for decision-makers navigating the complex automotive fuse landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Fuse market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Fuse Market, by Fuse Type

- Automotive Fuse Market, by Vehicle Type

- Automotive Fuse Market, by Current Rating

- Automotive Fuse Market, by Mounting Type

- Automotive Fuse Market, by Application

- Automotive Fuse Market, by End Use

- Automotive Fuse Market, by Distribution Channel

- Automotive Fuse Market, by Region

- Automotive Fuse Market, by Group

- Automotive Fuse Market, by Country

- United States Automotive Fuse Market

- China Automotive Fuse Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing the Critical Role of Automotive Fuse Innovation and Strategic Foresight in Navigating Industry Transformation

The automotive fuse market stands at a critical inflection point driven by rapid electrification, heightened safety regulations, and advanced connectivity demands. As vehicle architectures evolve, the role of fuses has transcended basic overcurrent protection to become a strategic enabler of system reliability, energy efficiency, and diagnostic intelligence.

Trade policy shifts in 2025 have reinforced the necessity for agile supply-chain strategies and localized production footprints, compelling both OEMs and suppliers to reevaluate sourcing, manufacturing, and logistics models. Simultaneously, technological innovations-from high-voltage DC hybrid fuses to smart IoT-enabled eFuse solutions-are redefining component value propositions and opening new avenues for differentiation.

Key regional variations underscore the importance of tailored approaches: mature markets in the Americas and EMEA are governed by stringent safety and emissions standards, while Asia-Pacific offers high-growth potential anchored by China’s dominant EV production. Leading suppliers such as TE Connectivity, Littelfuse, and Mersen have demonstrated resilience through diversified portfolios, strategic investments, and effective cost management.

Moving forward, industry success will hinge on the ability to integrate advanced fuse technologies within modular vehicle platforms, optimize global supply chains, and actively shape emerging standards. Organizations that embrace these imperatives will be well-positioned to deliver robust circuit protection solutions and capitalize on the transformative trends reshaping the automotive landscape.

Seize the Opportunity by Engaging Ketan Rohom for Tailored Automotive Fuse Market Intelligence and Secure Your Comprehensive Report Today

To secure the full suite of in-depth analysis, strategic insights, and future-proof recommendations tailored to your organization’s needs, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a collaborative discussion to explore how this comprehensive research can inform your critical decisions, de-risk your investments, and catalyze growth. Act now to obtain your copy of the complete automotive fuse market report and empower your team with the actionable intelligence required to lead in an evolving industry landscape.

- How big is the Automotive Fuse Market?

- What is the Automotive Fuse Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?