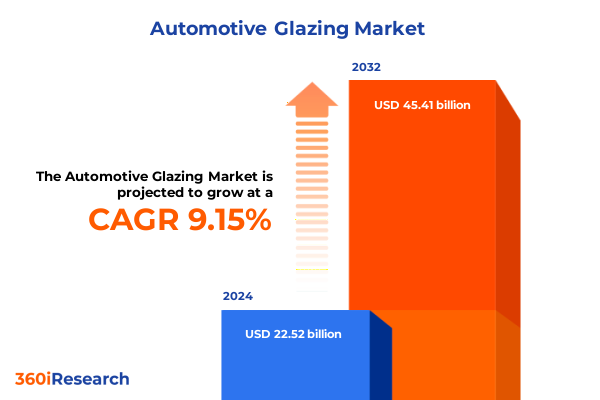

The Automotive Glazing Market size was estimated at USD 24.46 billion in 2025 and expected to reach USD 26.61 billion in 2026, at a CAGR of 9.23% to reach USD 45.41 billion by 2032.

Understanding the Transformative Importance of Advanced Automotive Glazing as a Cornerstone of Vehicle Safety Comfort Efficiency and Aesthetic Appeal

Automotive glazing has evolved beyond simple transparent panels to become an integral component that influences safety, comfort, energy efficiency, and overall vehicle design. As vehicles incorporate advanced driver assistance systems, head-up displays, and increasing levels of autonomy, glazing solutions now serve multiple functions including structural support, noise insulation, thermal management, and optical clarity for interactive user interfaces. Moreover, regulatory requirements for safety standards and visibility have become more stringent, elevating the role of glazing in crash performance and occupant protection.

Recent shifts in consumer expectations have further underscored the demand for enhanced acoustic comfort and solar control within cabin environments. Electric and hybrid vehicles, with their lower noise footprints, place greater emphasis on glazing technologies that can reduce wind and road noise to preserve the perceived quality of premium interiors. Consequently, the glazing sector is witnessing a surge of interest in advanced materials, coatings, and integrated display technologies that enable both functional performance and aesthetic versatility. Transitioning from traditional glass to hybrid solutions, the landscape now demands a balance between transparency, strength, weight optimization, and digital integration to meet the evolving standards of modern mobility.

Identifying the Pivotal Shifts Driving Innovation and Disruption in the Automotive Glazing Ecosystem Amidst Emerging Mobility Trends

The automotive glazing ecosystem is undergoing profound transformation driven by emerging mobility patterns and technological breakthroughs. Electrification has accelerated the need for materials with superior thermal insulation to maximize battery efficiency, while lightweighting initiatives across powertrains and chassis have redirected focus onto glazing solutions that reduce overall vehicle mass without compromising structural integrity. At the same time, advanced driver assistance systems rely on specialized glass surfaces for camera and sensor integration, requiring optical precision and surface durability under diverse environmental conditions.

In parallel, head-up display adoption is reshaping windshield design, as manufacturers incorporate transparent planar surfaces capable of projecting critical driving information directly into the driver’s line of sight. This convergence of glass engineering and digital display technologies has spurred collaborations between glass suppliers, electronics firms, and automotive OEMs. Furthermore, sustainable mobility goals have led to increased exploration of recyclable polymers and bio-based coatings that lower the industry’s carbon footprint. As consumer demand for personalization rises, interactive tinting and variable light transmission coatings are also gaining traction, reflecting the interplay between design innovation and functional performance.

Assessing the Cumulative Economic and Strategic Consequences of United States Tariff Measures on Automotive Glazing Supply Chains in 2025

United States tariffs enacted in recent years continue to shape the strategic calculus for glazing suppliers and vehicle manufacturers alike. Section 301 duties initially imposed on certain imported components from China have persisted through 2025, maintaining an added cost burden on laminated and tempered glass sourced from key Asian suppliers. Additionally, broader steel and aluminum tariffs under Section 232 have indirectly affected glazing production lines, as raw material price volatility and supply chain realignments increase lead times and logistical complexity.

This cumulative impact has prompted stakeholders to reassess sourcing strategies, with many electing to localize production or diversify their supplier base across lower-tariff markets. Investment in regional manufacturing hubs has accelerated, enabling quicker response times to OEM requirements and reducing exposure to sudden policy shifts. Simultaneously, companies are renegotiating long-term contracts to include tariff mitigation clauses and exploring free trade zones to optimize duty relief. In doing so, the industry is gradually realigning toward a more resilient and geographically balanced supply network capable of weathering ongoing trade tensions.

Revealing the Essential Segmentation Framework Guiding Product and Material Choices Across Diverse Automotive Glazing Applications

Insights into the automotive glazing market reveal that product differentiation is increasingly defined by the choice between laminated and tempered glass, each offering distinct safety and acoustic properties. Material innovation extends beyond conventional soda-lime and borosilicate glass to include polymers such as polycarbonate, which provides impact resistance, and thermoplastic elastomers that enhance flexibility and formability under complex geometries.

The vehicle type segmentation underscores divergent glazing requirements for commercial and passenger applications. Heavy and light commercial vehicles prioritize durability and scratch resistance to withstand harsh operating environments, whereas passenger cars demand a blend of optical clarity and comfort features across hatchback, sedan, and SUV architectures. Application-level analysis highlights the windshield’s critical role in windshield-integrated HUDs, while side windows and sunroofs are evolving to feature switchable tint technologies that improve cabin ergonomics. Distribution channel dynamics show that OEM partnerships drive innovation pipelines, whereas the aftermarket segment focuses on replacement efficiency and cost effectiveness, catering to repair networks and independent service providers.

This comprehensive research report categorizes the Automotive Glazing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Vehicle Type

- Application

- Distribution Channel

Examining Key Regional Dynamics Shaping Demand for Automotive Glazing Solutions Across the Americas EMEA and Asia Pacific Markets

Regional market dynamics demonstrate that the Americas region benefits from a robust automotive manufacturing base and well-established aftermarket channels. North American OEMs are at the forefront of integrating driver assistance hardware, resulting in higher demand for precision-engineered laminated windshields and specialized side glazing. South American markets, while smaller in scale, are witnessing gradual uptake of premium glazing features driven by growing consumer awareness of safety standards.

Within Europe, Middle East, and Africa, stringent safety regulations and environmental directives propel innovation in lightweight glass composites and solar-control coatings. European manufacturers collaborate closely with coating technology firms to meet Euro NCAP requirements, while Middle Eastern markets favor high-performance solar reflective glazing to address extreme climatic conditions. Africa’s emerging vehicle fleets are gradually adopting glazed headlight and rear window upgrades as repair and retrofit costs become more accessible.

Asia-Pacific emerges as the fastest-paced arena, with China and India leading capacity expansion and local glass production. Government incentives for electric vehicles are catalyzing adoption of advanced glazing solutions that enhance thermal management and cabin comfort. Southeast Asian markets are likewise integrating aftermarket tinting and protective film services, reflecting a maturing consumer preference for vehicle customization.

This comprehensive research report examines key regions that drive the evolution of the Automotive Glazing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations Adopted by Leading Global Players in the Automotive Glazing Sector

Leading global players in the automotive glazing space are deploying a suite of strategies to reinforce market positions. Major glass producers are investing in cutting-edge R&D initiatives to develop ultra-thin laminated products that meet evolving vehicle design requirements. Strategic acquisitions of technology startups have provided access to innovative coatings and smart glass capabilities, enhancing product portfolios with digital functionality.

Partnerships with automotive OEMs enable early integration of proprietary glazing modules into concept vehicles, granting suppliers a competitive edge in formulation and manufacturing standards. Capacity expansions in key geographies ensure proximity to assembly plants, while joint ventures with local fabricators support compliance with regional trade policies and sustainability mandates. Commitment to circular economy principles has led to material recycling programs that reclaim glass and polymer byproducts, reinforcing commitments to environmental targets and reducing lifecycle emissions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Glazing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- AGP Group

- Apex Auto Glass Company Limited

- Carlex Glass America, LLC

- Central Glass Co., Ltd.

- Compagnie de Saint-Gobain

- Corning Incorporated

- Covestro AG

- FUSO Glass India Private Limited

- Fuyao Glass Industry Group Co., Ltd.

- Gentex Corporation

- Glavista Autoglas GmbH

- Koch Industries, Inc.

- Kochhar Glass (India) Pvt. Ltd.

- Magna International Inc.

- Marvel Glass Pvt. Ltd.

- Nippon Sheet Glass Co., Ltd.

- Olimpia Auto Glass Inc.

- PG Group

- PGW Auto Glass, LLC

- Schott AG

- Tyneside Safety Glass

- Vitro, S.A.B de C.V

- Webasto SE

- Xinyi Glass Holdings Limited

- Şişecam

Delivering Actionable Strategic Recommendations to Help Industry Leaders Navigate Market Complexities and Capitalize on Automotive Glazing Opportunities

To thrive in a market shaped by rapid technological progress and evolving policy landscapes, industry leaders should prioritize the development of multifunctional glazing systems that seamlessly integrate sensor arrays and augmented reality displays. Establishing modular manufacturing cells near OEM hubs will mitigate tariff exposure and reduce logistic bottlenecks, while collaborative R&D partnerships can accelerate the commercialization of lightweight composite materials.

Diversification of the supplier base across lower-tariff regions will enhance resilience against geopolitical disruptions. Simultaneously, embedding sustainability into product roadmaps through closed-loop recycling and low-emission production processes will address tightening regulatory mandates and growing consumer demand for eco-friendly solutions. Investing in digital sales channels and aftermarket service platforms will bolster customer engagement, enabling real-time performance monitoring and predictive maintenance offerings. By aligning strategic priorities with emerging mobility trends, glazing providers can capture incremental value and reinforce long-term competitiveness.

Outlining the Robust Research Methodology and Analytical Approach Underpinning This Comprehensive Automotive Glazing Market Study

This analysis combines extensive secondary research with primary inputs from industry veterans, including senior engineers, supply chain directors, and OEM purchasing managers. Data sources span regulatory filings, customs databases, technical white papers, and coatings and materials association publications. Primary research interviews were designed to validate emerging trends, assess innovation pipelines, and understand procurement strategies across global regions.

Quantitative data underwent rigorous triangulation to ensure consistency across diverse sources. Segment definitions were cross-verified with vendor disclosures and government classification standards, while regional demand projections were aligned with vehicle production forecasts. Quality control measures included peer reviews by an advisory panel of glazing and automotive specialists, ensuring both methodological robustness and actionable relevance. This multifaceted approach underpins the credibility of the insights presented and supports informed decision-making throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Glazing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Glazing Market, by Product Type

- Automotive Glazing Market, by Material Type

- Automotive Glazing Market, by Vehicle Type

- Automotive Glazing Market, by Application

- Automotive Glazing Market, by Distribution Channel

- Automotive Glazing Market, by Region

- Automotive Glazing Market, by Group

- Automotive Glazing Market, by Country

- United States Automotive Glazing Market

- China Automotive Glazing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights to Illuminate the Future Trajectory of the Automotive Glazing Industry in a Rapidly Evolving Landscape

The automotive glazing sector stands at the intersection of safety regulation, material science, and digital innovation. Electrification, autonomous functionalities, and climate imperatives are collectively redefining glazing requirements, demanding solutions that balance transparency, structural performance, and interactive capabilities. Concurrently, persistent tariff measures and evolving trade policies underscore the strategic importance of diversified supply chains and regional manufacturing footprints.

Segmentation across product types, materials, vehicle classes, applications, and distribution channels provides a structured lens through which stakeholders can identify targeted growth avenues and optimize portfolio strategies. Regional nuances-from the established OEM landscapes of the Americas and EMEA to the expansion-driven dynamics of Asia-Pacific-highlight the need for localized approaches in product development and go-to-market execution. By synthesizing competitive benchmarks, technological trajectories, and regulatory factors, this research illuminates a clear path forward for stakeholders looking to navigate complexities and harness emerging opportunities within the evolving automotive glazing landscape.

Taking the Next Step Toward Informed Decision Making with Expert Guidance and a Detailed Automotive Glazing Market Research Report

To acquire comprehensive insights and gain a competitive edge in the automotive glazing market, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to discuss customized access options and secure the complete market research report today. Our dedicated team will guide you through the depth of analysis on technological innovations, regional dynamics, tariff impacts, segmentation strategies, and company benchmarks, ensuring you have the strategic intelligence required to make confident, informed decisions.

- How big is the Automotive Glazing Market?

- What is the Automotive Glazing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?