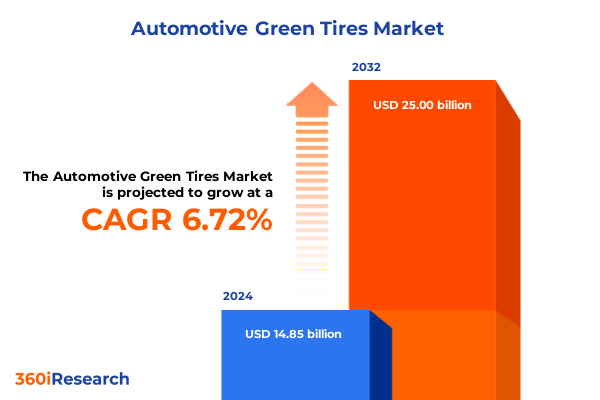

The Automotive Green Tires Market size was estimated at USD 15.87 billion in 2025 and expected to reach USD 16.72 billion in 2026, at a CAGR of 6.70% to reach USD 25.00 billion by 2032.

Setting the Stage for Sustainable Mobility Through a Comprehensive Overview of the Green Tire Revolution and Its Far-Reaching Implications

The rapid acceleration of environmental regulations coupled with evolving consumer preferences has ushered in a new era for automotive tire design, one defined by sustainability, innovation, and performance. Green tires, engineered to reduce rolling resistance and enhance fuel efficiency, have emerged as a pivotal element in the broader drive toward decarbonization of road transport. This report begins by tracing the origins of the green tire concept, highlighting how emergent polymers and tread formulations have advanced the pursuit of reduced carbon emissions without sacrificing durability or safety.

As regulatory bodies across the globe tighten emissions standards and incentivize eco-friendly mobility solutions, vehicle manufacturers and tire suppliers are aligning their research and development efforts to meet these demands. From the incorporation of high-silica compounds to the adoption of airless designs, the evolution of green tire technologies reflects a multifaceted response to environmental imperatives. By weaving together scientific breakthroughs, legislative milestones, and shifting customer expectations, this section lays the foundation for understanding why green tires represent both a technical marvel and a strategic imperative for industry stakeholders.

Unveiling the Groundbreaking Technological Advancements and Regulatory Interventions Reshaping the Automotive Green Tire Landscape Across Global Markets

The landscape of automotive green tires is in the midst of profound transformation as emerging materials, digital innovation, and policy initiatives converge to redefine market boundaries. Advanced polymer composites and bio-based rubbers are pushing the limits of tread performance, enabling reductions in rolling resistance that translate directly into lower greenhouse gas emissions. Meanwhile, digital tire monitoring systems and predictive wear algorithms are integrating with vehicle platforms to optimize tire life cycles and resource utilization in real time.

On the regulatory front, emissions targets in key markets have precipitated a wave of incentives and penalties designed to accelerate adoption of energy-efficient tires. Governments are introducing labeling requirements that rate tires based on fuel efficiency, wet braking, and noise levels, creating clear visibility into performance trade-offs. In parallel, collaborations among industry consortia are standardizing testing protocols and material specifications, ensuring interoperability and reliability. Together, these technological and policy shifts are not merely incremental; they represent a paradigm shift that will reshape supply chains, investment priorities, and competitive dynamics in the automotive green tire sector.

Analyzing the Far-Reaching Consequences of 2025 Tariff Adjustments on the United States Automotive Green Tire Sector Amid Trade Dynamics

The tariff landscape in the United States underwent significant adjustments in 2025, introducing new cost structures that have reverberated across the automotive green tire supply chain. Tariffs on key raw materials such as specialized silica and synthetic polymers have driven up input costs for domestic tire producers, compelling many to reevaluate sourcing strategies or absorb higher manufacturing expenses. This environment has intensified pressure on original equipment manufacturers and independent tire retailers alike, as cost pass-through to end users becomes increasingly constrained by competitive and regulatory considerations.

Conversely, these tariff measures have presented opportunities for domestic innovation, encouraging investment in alternative materials and localized compound blending facilities. Some manufacturers have accelerated their research into high-performance natural rubber substitutes and advanced recycling methodologies to mitigate exposure to import levies. The net effect of these dynamics has been a recalibration of production footprints, with select players expanding capacity in North America to capitalize on favorable trade conditions once domestic raw material alternatives are validated. As a result, companies that adopt agile supply chain management and material diversification will be best positioned to navigate the evolving tariff regime and maintain cost competitiveness.

Illuminating the Multifaceted Segmentation Drivers Underpinning the Automotive Green Tire Market Spectrum Across Type Technology Material Distribution Vehicle and Usage

A comprehensive understanding of the green tire market requires an exploration of multiple intersecting dimensions of segmentation. The differentiation by tire type lays the groundwork, contrasting time-tested bias ply constructions with the increasingly dominant radial designs that offer superior flexibility and fuel economy. Advancements in core technologies further diversify the landscape: airless solutions, split between composite and polyurethane variants, coexist alongside low rolling resistance options that employ either high silica or standard silica compounds. The quest for uninterrupted mobility has given rise to run-flat technologies, with self-supporting designs and support rings, as well as self-sealing treads available in latex-based and polymer-based formulations.

Material selection remains integral to performance and sustainability objectives, with natural rubber sourced from renewable plantations working in concert with synthetic rubbers engineered for consistent quality and resilience. Distribution strategies reflect shifting buyer behaviors, where traditional offline channels compete with growing online platforms that offer direct-to-consumer accessibility and enhanced product transparency. Vehicle segmentation highlights tailored requirements for heavy commercial vehicles, light commercial vehicles, and passenger cars, each demanding specific performance characteristics and durability profiles. Finally, the distinction between original equipment manufacturer offerings and replacement tires underscores divergent expectations regarding supply consistency, pricing models, and aftermarket services, illuminating the multifaceted nature of decision-criteria across stakeholders.

This comprehensive research report categorizes the Automotive Green Tires market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Tire Type

- Technology

- Material Type

- Distribution Channel

- Vehicle Type

- End Use

Deciphering the Regional Nuances and Growth Trajectories for Automotive Green Tires Within the Americas Europe Middle East Africa and Asia-Pacific Landscapes

Regional dynamics in the automotive green tire industry are shaped by a complex interplay of infrastructure maturity, regulatory intensity, and consumer adoption patterns. In the Americas, a combination of stringent fuel economy standards and growing fleet electrification initiatives has spurred demand for low rolling resistance and run-flat technologies, prompting manufacturers to localize production closer to major automotive hubs. Collaboration among supply chain partners in North America and South America is fostering material innovation and streamlined logistics networks to meet rising sustainability benchmarks.

Across Europe, the Middle East and Africa, diverse regulatory frameworks create both challenges and opportunities. The European Union’s rigorous tire labeling system and carbon trading mechanisms drive rapid innovation, while emerging markets in the Middle East and Africa require tailored approaches that balance performance with affordability. Partnership models that integrate financing solutions and technical training are helping to accelerate market penetration in these regions. Meanwhile, the Asia-Pacific region continues to lead in production capacity, leveraging advanced manufacturing platforms in countries with established tire manufacturing legacies. Simultaneously, rising environmental awareness and government incentives across major Asian economies are increasing adoption of green tire variants among passenger car and commercial fleet operators.

This comprehensive research report examines key regions that drive the evolution of the Automotive Green Tires market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Leadership Among Key Players Steering the Evolution of the Automotive Green Tire Industry Toward Sustainability

Key players in the automotive green tire arena are deploying a range of strategies to secure competitive advantage and capital investment. Leading manufacturers have originated collaborative research partnerships with chemical suppliers to refine high-silica compounds and bio-based elastomers, accelerating the translation of laboratory breakthroughs into mass-production processes. Several industry titans have also leveraged digital platforms to integrate tire performance data with vehicle telematics, enabling predictive maintenance services that bolster brand loyalty and reduce total cost of ownership for fleet operators.

In parallel, mid-tier and emerging suppliers are carving niche positions by specializing in modular compound blending and customizable tread designs that address regional climatic conditions and road surface challenges. These agile contenders are forging alliances with aftermarket networks to deliver rapid order fulfillment, while strategic joint ventures are enhancing distribution reach in underserved markets. Established research centers of excellence are extending material sciences capabilities into advanced recycling and pyrolysis techniques, ensuring circularity goals are met without compromising tire integrity or performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Green Tires market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apollo Tyres Ltd

- Balkrishna Industries Limited

- Bridgestone Corporation

- CEAT Limited

- Cheng Shin Rubber Ind. Co., Ltd.

- Compagnie Générale des Établissements Michelin S.C.A.

- Continental AG

- Cooper Tire & Rubber Company LLC

- Giti Tire Pte Ltd

- Hankook Tire & Technology Co., Ltd.

- Kumho Tire Co., Inc.

- MRF Limited

- Nokian Tyres plc

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire & Rubber Company

- Tianjin Linglong Tire Co., Ltd.

- Toyo Tire Corporation

- Yokohama Rubber Co., Ltd.

- Zhongce Rubber Group Co., Ltd.

Empowering Industry Leaders with Targeted Strategies to Accelerate Sustainable Growth and Competitive Edge in the Automotive Green Tire Arena

To capitalize on the momentum in green tire adoption, industry leaders should elevate collaboration across the value chain, from raw material suppliers to end-of-life recyclers, creating integrated ecosystems that optimize resource efficiency. Investing in advanced analytics and digital twin models will enable real-time performance monitoring, guiding continuous product refinement and predictive maintenance offerings. Moreover, cultivating partnerships with automotive OEMs to co-develop bespoke solutions will solidify long-term supply agreements and reinforce mutual commitments to emission reduction targets.

Companies should also prioritize scalable production platforms that can pivot rapidly between compound formulations and tread architectures in response to regulatory updates, ensuring minimal time to market. Parallel initiatives in sustainable sourcing-such as certified natural rubber plantations and closed-loop synthetic polymer recovery-will enhance brand credibility and mitigate raw material risk exposure. Lastly, embedding circular economy principles in product design, from modular tread replacement systems to tire retreading programs, will unlock new revenue streams and reinforce environmental stewardship credentials.

Articulating a Robust Research Framework Combining Primary and Secondary Data Collection and Advanced Analytical Techniques for Comprehensive Market Insights

The research process commenced with an exhaustive secondary review of legislative databases, patent filings, academic journals, and technical whitepapers to identify prevailing trends in tire materials and performance metrics. Building on this foundation, primary interviews were conducted with R&D executives, sustainability officers, supply chain specialists, and fleet managers across multiple geographies to gather qualitative insights on innovation roadmaps and adoption barriers. Quantitative data was triangulated through proprietary databases tracking production volumes, raw material pricing indices, and aftermarket sales channels.

Advanced analytical techniques, including scenario modeling and regression analysis, were applied to understand the sensitivity of tire performance parameters to material composition and process variables. Validation workshops with industry experts were held to test the robustness of assumptions and data interpretations, ensuring that the final analysis reflects real-world operational dynamics. This multi-method approach guarantees depth of insight, methodological rigor, and actionable clarity for stakeholders seeking to navigate the evolving landscape of automotive green tires.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Green Tires market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Green Tires Market, by Tire Type

- Automotive Green Tires Market, by Technology

- Automotive Green Tires Market, by Material Type

- Automotive Green Tires Market, by Distribution Channel

- Automotive Green Tires Market, by Vehicle Type

- Automotive Green Tires Market, by End Use

- Automotive Green Tires Market, by Region

- Automotive Green Tires Market, by Group

- Automotive Green Tires Market, by Country

- United States Automotive Green Tires Market

- China Automotive Green Tires Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Transformative Journey of Automotive Green Tires Evidencing the Pathway to Long-Term Industry Resilience and Eco-Innovation

The journey of automotive green tire innovation underscores a broader industry transformation, one where ecological imperatives and performance aspirations converge to redefine mobility. Through advances in materials science, digital integration, and circular economy practices, green tires have transcended niche status to become essential components of sustainable vehicle platforms. In synthesizing regulatory trajectories, tariff implications, segmentation drivers, and regional patterns, this report reveals a dynamic marketplace shaped by technological ambition and strategic agility.

Looking ahead, the automotive green tire sector is poised to benefit from continued investment in bio-sourced compounds, smart monitoring systems, and closed-loop manufacturing models. Stakeholders who embrace cross-industry collaboration, material diversification, and data-driven decision-making will not only mitigate risk but also capture substantial opportunities for growth. The narrative of green tire evolution thus serves as both a testament to industry resilience and a roadmap for the next wave of eco-innovation in transportation.

Initiate collaboration with Ketan Rohom to secure essential intelligence and drive strategic decisions in the automotive green tire sector

Embark on a strategic partnership that will elevate your market intelligence and empower your decision-making in the automotive green tire domain. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore the comprehensive insights and in-depth analysis contained within the full market research report. Unlock detailed evaluations of technological breakthroughs, regional dynamics, and competitive benchmarks, all designed to inform your next steps toward sustainable growth. Engage directly with Ketan to tailor your report package to the priorities and scale of your organization and gain immediate access to the critical data and actionable recommendations you need. Invest in the definitive resource that will position you at the forefront of the automotive green tire revolution and drive your business forward with confidence.

- How big is the Automotive Green Tires Market?

- What is the Automotive Green Tires Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?