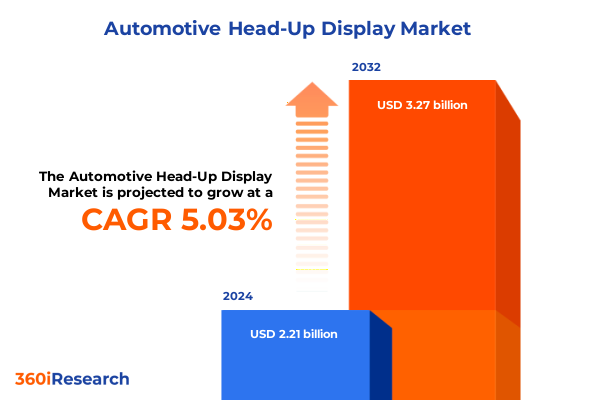

The Automotive Head-Up Display Market size was estimated at USD 2.30 billion in 2025 and expected to reach USD 2.39 billion in 2026, at a CAGR of 5.18% to reach USD 3.27 billion by 2032.

Motor vehicles are undergoing a paradigm shift as head-up displays emerge as critical interfaces blending safety enhancements and user experience improvements

Head-up displays have transitioned from niche electronic accessories to integrated cockpit features that project critical driving information directly into the driver’s line of sight. By combining speed, navigation, safety alerts, and vehicle status indicators into a single transparent display, these systems minimize distractions and allow drivers to stay focused on the road. In doing so, head-up displays are reshaping the in-vehicle experience and accelerating the evolution of digital cockpits.

Moreover, stricter safety regulations and growing consumer demand for enhanced connectivity are propelling wider adoption of head-up display technologies. Automakers and tier-one suppliers are collaborating to integrate advanced optics and software solutions that support seamless integration with ADAS and infotainment systems. As a result, head-up displays are no longer optional extras but strategic differentiators that elevate brand perception and driver satisfaction.

Consequently, this executive summary offers a concise roadmap through the multifaceted head-up display landscape. It synthesizes transformative trends, regulatory impacts, in-depth segmentation insights, and regional dynamics, while spotlighting leading industry players and actionable recommendations. The aim is to provide decision-makers with a clear, authoritative overview of the opportunities and challenges defining the current and future state of automotive head-up display solutions.

Advancements in augmented reality integration electric mobility and autonomous systems are transforming the future trajectory of head-up display adoption in automotive

Integration of augmented reality elements is redefining how drivers interact with their vehicles. By overlaying navigational cues, hazard warnings, and contextual annotations onto the real-world environment, head-up displays are evolving from static projection devices into dynamic situational awareness platforms. Meanwhile, electric vehicle adoption is surging, prompting suppliers to optimize HUD architectures for high-voltage environments and power-efficient operation. These parallel advancements in AR integration and electric mobility are fostering novel use cases and intensifying competition among technology providers.

Furthermore, the rise of autonomous driving systems is reshaping the requirements for in-vehicle displays. As vehicles advance toward higher levels of automation, head-up displays will need to support transitional driving modes and passenger-focused applications. In addition, the convergence of infotainment, connectivity, and safety functions is driving development of unified digital cockpits that leverage head-up projection as a central interface. Collectively, these technological shifts are unlocking new growth vectors and setting the stage for widespread adoption of next-generation head-up display solutions.

Recent shifts in US trade policy including 2025 tariffs on automotive components have introduced supply chain volatility and cost implications for head-up display manufacturers

In early 2025, changes in United States trade policy introduced new tariffs on imported automotive components, affecting head-up display supply chains across multiple regions. As a result, manufacturers that relied on overseas production for critical modules experienced immediate cost pressure, prompting strategic adjustments to sourcing and procurement strategies. Consequently, some suppliers have accelerated shifts toward near-shoring and diversified manufacturing footprints to mitigate the impact of increased duties.

In addition, the cumulative effect of these tariffs has reverberated through logistics networks and supplier agreements. Inflationary concerns and contract renegotiations have slowed product rollouts in certain markets, while encouraging investments in localized assembly operations. Meanwhile, tier-one suppliers are evaluating hybrid sourcing models that balance cost efficiency with supply security. Ultimately, the 2025 tariff measures have underscored the importance of resilient supply chains and flexible manufacturing architectures in sustaining head-up display innovation.

Incorporating comprehensive segmentation from projection methods to end-use applications illuminates nuanced adoption patterns in the head-up display market

Analysis by type reveals distinct adoption trajectories for combiner-projected HUDs and windshield-projected HUDs. Combiner units, with their lower cost and modular integration, continue to appeal to value-oriented segments, whereas windshield-projected HUDs offer refined image quality and expanded display real estate favored by premium OEMs. In parallel, component breakdown highlights divergent investment priorities: Control & Power Supply Units, which encompass control consoles and HUD power management, remain critical for maintaining energy efficiency and system reliability; Projectors & Display Units, ranging from laser projectors to mirror displays, are commanding increased R&D focus for brightness and contrast improvements; and Software Solutions-spanning HUD operating systems and navigation software-are becoming central to differentiating user experiences.

Moreover, display type further segments the market across DLP, LCD, and LED technologies, with each approach offering specific trade-offs in resolution, color fidelity, and cost constraints. Distribution channels also influence market dynamics: legacy offline sales networks continue to dominate traditional OEM pipelines, while online sales platforms are facilitating aftermarket upgrades and software-driven feature enhancements. Additionally, head-up display applications span driver assistance, entertainment display, navigation assistance, and safety & warning systems, underscoring the versatility of this technology across diverse use cases.

Finally, end-use distinctions between aftermarket and original equipment manufacturers reflect different purchasing triggers and integration timelines, and vehicle type segmentation-commercial vehicles versus passenger vehicles-illuminates how usage patterns and regulatory demands vary across fleet operations and consumer markets.

This comprehensive research report categorizes the Automotive Head-Up Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Display Type

- Distribution Channel

- Application

- End-Use

- Vehicle Type

Regional dynamics spanning the Americas EMEA and Asia-Pacific reveal distinct regulatory technology and consumer adoption trends shaping head-up display deployment

The Americas region exhibits a strong focus on safety and regulatory compliance, with the United States leading adoption through stringent collision-avoidance mandates that encourage integration of head-up structures with advanced driver assistance systems. Meanwhile, Canada and Mexico are showing growing interest in retrofit solutions, driven by fleet operators aiming to leverage HUD technology for logistics and last-mile delivery efficiency. Overall, collaborative efforts between automakers and technology startups in the Americas are accelerating deployment through pilot programs and certification pathways.

Across Europe, the Middle East, and Africa, standardization efforts and regulatory alignment are shaping localized demand profiles. European nations are prioritizing head-up display integration to meet EU Vision Zero targets, resulting in heightened interest from mainstream OEMs. In the Middle East, luxury brands are exploring bespoke HUD features to differentiate premium models, while African markets remain selective, focusing primarily on durable combiner devices suited to infrastructure constraints. These regional nuances underscore the importance of tailoring product roadmaps to diverse regulatory landscapes and consumer expectations.

In Asia-Pacific, rapid automotive electrification and digital cockpit initiatives are driving unprecedented growth in head-up display adoption. China remains the single largest market, with both domestic and international suppliers investing heavily in state-of-the-art windshield-projected systems. Japan’s established electronics ecosystem continues to foster innovation around micro-display technologies, while emerging markets such as India and Southeast Asia are gradually embracing aftermarket upgrades to enhance driver safety in congested urban environments.

This comprehensive research report examines key regions that drive the evolution of the Automotive Head-Up Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading tier one suppliers and technology innovators are driving competitive differentiation through partnerships product launches and software centric strategies in head-up display development

Several tier-one suppliers have emerged as innovation leaders by forging strategic partnerships with semiconductor firms and optics specialists. These alliances enable co-development of integrated HUD modules that combine high-performance projection engines with scalable software platforms. In addition, select technology vendors have introduced modular architectures that allow OEMs to tailor display size, brightness, and content overlays to specific vehicle lines, thereby accelerating time to market and reducing development complexity.

Furthermore, established automotive electronics companies are leveraging proprietary software stacks and cloud connectivity to offer over-the-air updates, expanding HUD capabilities post-deployment. This shift toward software-centric strategies empowers end-customers to unlock new functionalities-such as enhanced navigation graphics and driver-health monitoring-without extensive hardware modifications. As a result, competitive differentiation increasingly hinges on continuous software enhancements and data security provisions.

Meanwhile, smaller disruptors are distinguishing themselves through specialized offerings, including micro-LED optics and ultra-compact laser projector modules tailored for electric and autonomous vehicles. By focusing on niche performance metrics such as contrast ratio and color gamut, these innovators are capturing attention from premium OEMs seeking to elevate brand perception. Collectively, these competitive moves are intensifying pressure across the value chain and pushing head-up display capabilities to new performance thresholds.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Head-Up Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alps Alpine Co., Ltd.

- BAE Systems Plc

- Continental AG

- DENSO Corporation

- Foryou Corporation

- Garmin Ltd.

- HARMAN International Industries, Inc. by Samsung Electronics Co., Ltd.

- HUDWAY, LLC

- Hyundai Mobis Co Ltd

- LG Corporation

- MicroVision, Inc.

- Nippon Seiki Co., Ltd.

- Panasonic Corporation

- Pioneer Corporation

- Raythink Technology Co., Ltd.

- Robert Bosch GmbH

- ROHM CO., LTD.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Thales Group

- Toshiba Corporation

- VALEO SA

- Visteon Corporation

- YAZAKI Corporation

Industry leaders should pursue targeted investments in advanced optics software integration and localized manufacturing to capitalize on emerging head-up display market opportunities

Industry leaders should prioritize investments in advanced optics and projection modules to stay ahead of evolving performance benchmarks. By channeling resources into R&D initiatives that enhance luminance, field of view, and image stability, suppliers can deliver superior user experiences that meet stringent safety and ergonomic requirements. In addition, integrating artificial intelligence and machine learning algorithms into software frameworks can provide contextual insights-such as predictive hazard warnings-further solidifying head-up displays as indispensable cockpit elements.

Moreover, organizations must consider localized manufacturing and assembly strategies to mitigate the impact of trade policy shifts and supply chain disruptions. Establishing regional production hubs and forging strategic alliances with contract manufacturers will enable more flexible sourcing and faster response times. Simultaneously, embracing modular display architectures and common component platforms can streamline product variants, reduce inventory complexity, and improve overall operational agility.

Finally, collaborative engagement with regulatory authorities and industry consortia will help shape emerging standards and certification processes. By participating in working groups, companies can influence mandates for performance criteria, interoperability protocols, and cybersecurity guidelines, ensuring head-up display solutions align with the highest safety and regulatory benchmarks.

This research combines primary interviews and secondary data triangulation with rigorous segmentation and validation methodologies to ensure comprehensive market insights

This study draws upon extensive primary research, including in-depth interviews with senior executives at OEMs, tier-one suppliers, and technology innovators. These discussions provided nuanced perspectives on strategic priorities, technology roadmaps, and emerging use cases for head-up display systems. Qualitative insights were further enriched by consulting with regulatory experts to understand the evolving requirements that shape design and deployment decisions.

In addition, a comprehensive secondary research phase examined technical publications, patent filings, and industry white papers to establish a robust foundation of market intelligence. Data triangulation techniques were employed to validate reported trends and identify potential discrepancies, ensuring a balanced and objective view of competitive dynamics. Detailed segmentation analyses and regional assessments were conducted to capture the full spectrum of market variables, including projection methods, component types, display technologies, distribution channels, applications, end-use categories, and vehicle types.

Methodological rigor was maintained through iterative review cycles with cross-functional experts, enabling refinement of assumptions and verification of findings. The outcome is a thoroughly vetted research framework that delivers actionable insights and strategic clarity for stakeholders navigating the complex automotive head-up display ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Head-Up Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Head-Up Display Market, by Type

- Automotive Head-Up Display Market, by Component

- Automotive Head-Up Display Market, by Display Type

- Automotive Head-Up Display Market, by Distribution Channel

- Automotive Head-Up Display Market, by Application

- Automotive Head-Up Display Market, by End-Use

- Automotive Head-Up Display Market, by Vehicle Type

- Automotive Head-Up Display Market, by Region

- Automotive Head-Up Display Market, by Group

- Automotive Head-Up Display Market, by Country

- United States Automotive Head-Up Display Market

- China Automotive Head-Up Display Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Robust analysis underscores the pivotal role of regulatory alignment safety enhancements and software innovation in steering the automotive head-up display market forward

Through meticulous analysis, this report underscores the critical interplay between regulatory frameworks and technological innovation in advancing head-up display adoption. Safety mandates worldwide are progressively raising performance benchmarks, prompting suppliers to engineer display systems that deliver optimal visibility under diverse environmental conditions. Simultaneously, advances in software algorithms and connectivity are expanding HUD functionalities beyond traditional speed and navigation overlays, transforming them into intelligent driver assistance tools.

Furthermore, the convergence of electric and autonomous vehicle development is accelerating demand for more sophisticated HUD solutions. As vehicles assume greater control functions, head-up displays will need to adapt and support both driver and passenger experiences, necessitating flexible system architectures and adaptive content management. This transition highlights the importance of end-to-end system integration and the need for cross-domain collaboration across optics, electronics, software, and user-experience design.

Ultimately, the automotive head-up display market is entering a phase of rapid evolution, in which competitive advantage will accrue to organizations that can seamlessly integrate cutting-edge optics, software, and supply chain resilience. By aligning strategic investments with emerging regulatory and technological trends, stakeholders can unlock new growth avenues and deliver next-generation cockpit experiences.

Unlock unparalleled strategic guidance and expert market intelligence on automotive head-up displays by contacting Ketan Rohom Associate Director of Sales & Marketing

To unlock the full depth of our comprehensive market research report on automotive head-up displays and position your organization at the forefront of cockpit innovation, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He delivers personalized guidance on leveraging the latest insights, enabling you to make informed decisions about strategic partnerships, product roadmaps, and channel development.

Engaging with Ketan provides you with exclusive access to detailed competitive benchmarks, region-specific assessments, and segmentation analyses that will sharpen your market strategies and accelerate your time to value. Discover how your organization can differentiate its offerings and capture emerging opportunities in the rapid-growth head-up display market.

- How big is the Automotive Head-Up Display Market?

- What is the Automotive Head-Up Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?