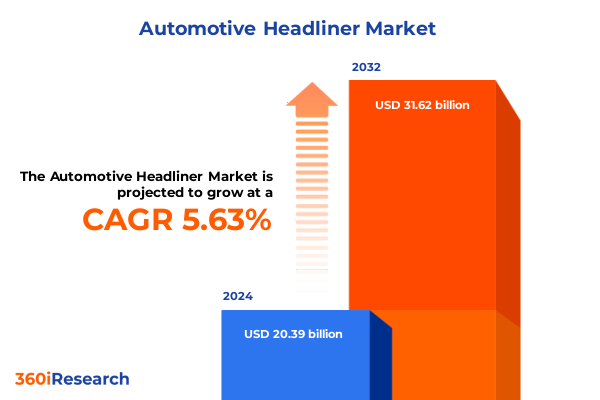

The Automotive Headliner Market size was estimated at USD 21.47 billion in 2025 and expected to reach USD 22.64 billion in 2026, at a CAGR of 5.68% to reach USD 31.62 billion by 2032.

Unveiling the Transformative Significance of Automotive Headliners Amid Evolving Vehicle Technologies and Consumer Expectations in a Dynamic Market Landscape

The automotive headliner segment has emerged from its historical role as a simple cabin finish to become a strategic component of vehicle design, performance, and brand differentiation. Once considered merely a cosmetic or acoustic trim, headliners now deliver multifunctional benefits that span from advanced thermal management to integrated safety features. This evolution reflects broader shifts in automobile manufacturing, where materials science innovations and consumer appetite for high-end cabin experiences converge to elevate the headliner from an afterthought to a core competitive frontier.

Against the backdrop of heightened electrification and growing sustainability mandates, headliner solutions must align with stringent weight, safety, and environmental criteria. At the same time, consumers continue demanding cabins that deliver superior acoustic comfort, refined aesthetics, and customizable design elements. As a result, automotive OEMs and suppliers face mounting pressure to strike a balance between performance attributes and cost efficiencies. This introduction outlines the strategic underpinnings of the headliner landscape, setting the stage for an in-depth exploration of transformative forces, tariff impacts, segmentation nuance, regional dynamics, and competitive imperatives.

Exploring the Revolutionary Technological and Sustainable Material Advancements Reshaping Headliner Design and Performance in Modern Automotive Manufacturing

The past few years have witnessed a paradigm shift in headliner architecture driven by the imperative to reduce vehicle mass while enhancing cabin functionality. Cutting-edge composite systems now leverage carbon fiber and fiberglass reinforcements to deliver exceptional rigidity at a fraction of the weight of traditional substrates. Simultaneously, emerging bio-based and recycled polymers are carving out new avenues for sustainable product life cycles without compromising thermal and acoustic performance. This confluence of lightweighting and eco-innovation underscores a broader industry pivot toward materials that satisfy both corporate sustainability goals and regulatory emissions targets.

In parallel, digital smart-cabin integration has emerged as a critical vector of innovation. Embedded sensors within foam-backed assemblies now monitor humidity, cabin temperature, and occupant comfort, seamlessly interfacing with vehicle software platforms. Fabrics and thermoplastic overlays are also being engineered to support capacitive touch controls and ambient lighting systems, elevating the headliner into an interactive interface rather than a passive panel. These technological leaps reflect a relentless drive toward greater personalization, connectivity, and occupant well-being.

Looking ahead, the industry is poised to embrace additive manufacturing and nanotechnology to push the envelope on design freedom and functional layering. These advances promise to reshape cost structures and supplier ecosystems, making adaptability and rapid prototyping key competitive advantages. The result is a headliner landscape undergoing continuous reinvention, where technological prowess and material ingenuity are rewriting expectations of cabin performance and design sophistication.

Assessing the Comprehensive Effects of 2025 United States Tariff Policies on Automotive Headliner Supply Chains Costs and Competitive Dynamics in North America

The implementation of 2025 United States tariff adjustments has introduced a new layer of complexity into global headliner supply chains. With levies applied on specific polymer imports and composite assemblies, manufacturers are reassessing their sourcing strategies to mitigate cost escalations. Some tier-one suppliers have already relocated portions of their production footprint to countries outside the tariff scope, while others are renegotiating long-term raw material contracts to secure more favorable terms. These maneuvers underscore the critical need for flexibility in procurement strategies amid a fluid trade policy environment.

Financial pressures stemming from tariffs are also accelerating the adoption of domestic feedstock alternatives. North American resin producers, for instance, are intensifying capacity expansions and R&D efforts to provide locally sourced thermoplastics that match the performance of imported materials. At the same time, collaborative ventures between OEMs and material innovators are emerging to co-develop tariff-compliant solutions. These partnerships not only serve to bypass tariff constraints but also foster greater transparency and integration across the value chain.

Beyond direct cost implications, the tariff regime has ripple effects on competitive positioning and time-to-market dynamics. Suppliers unable to swiftly adapt face margin compression, while agile players stand to capture incremental share by marketing tariff-resistant headliner platforms. As headliner components continue to represent a significant percentage of total interior trim costs, navigating the 2025 tariff landscape effectively will be crucial for stakeholders seeking to maintain profitability and uphold product innovation pipelines.

Gaining Strategic Clarity Through In-Depth Analysis of Automotive Headliner Market Segmentation Across Materials Functions Vehicle Categories and End Users

Understanding the headliner market’s segmentation illuminates where growth opportunities and risks are concentrated. When viewed through the lens of material type, composites lead the drive toward lightweight performance by harnessing carbon fiber reinforced and fiberglass reinforced constructions. Meanwhile, fabric-based solutions employing acrylic, nylon, polyester, and wool blends continue to captivate interior stylists seeking refined textures and customizable color palettes. Foam-backed substrates deliver cost-effective acoustic and thermal management, and thermoplastics such as polycarbonate and polyethylene are increasingly leveraged for integrated lighting and sensor applications.

Shifting focus to functionality, aesthetic enhancement remains a cornerstone of differentiation, as headliner surfaces evolve into expression zones that support ambient lighting, branded stitch patterns, and tactile finishes. Simultaneously, sound insulation demands persist, driving innovations in multilayer foams and barrier fabrics that attenuate powertrain and road noise. Thermal insulation also commands significant attention, with advanced mineral-filled composites and phase-change materials emerging to optimize cabin temperature regulation and reduce HVAC energy loads.

Examining the market through vehicle type reveals distinct requirements. Heavy commercial vehicles such as buses and trucks prioritize durability and ease of maintenance, whereas light commercial pickups and vans emphasize cost efficiency and modularity. Passenger vehicles, including hatchbacks, sedans, and SUVs, demand higher degrees of personalization, premium tactile quality, and integration with infotainment systems. Finally, end-user segmentation between aftermarket channels and OEMs highlights divergent value drivers: aftermarket participants focus on retrofit simplicity and price sensitivity, whereas OEMs seek design integration, scalability, and long-term performance assurances.

This comprehensive research report categorizes the Automotive Headliner market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Functionality

- Vehicle Type

- End-User

Uncovering Regional Dynamics in Automotive Headliner Demand Highlighting Divergent Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific

Regional landscapes are shaping the competitive dynamics of headliner deployments worldwide. In the Americas, strong demand is anchored by North American OEMs accelerating vehicle electrification, which in turn amplifies focus on lightweight headliner composites and acoustic comfort. This trend is bolstered by robust aftermarket channels that cater to consumers upgrading cabin aesthetics and thermal insulation, especially in high-end electric SUVs.

Across Europe, the Middle East, and Africa, stringent emissions regulations and growing consumer emphasis on circular economy principles have spurred investments in bio-based and recycled polymers. Local OEMs are integrating headliner platforms designed to meet EU sustainability criteria, while emerging markets in the Middle East and Africa are adopting cost-effective solutions that address extreme temperature differentials and dust infiltration concerns.

In Asia-Pacific, rapid urbanization and rising per-capita incomes are driving an insatiable appetite for premium passenger vehicles, thus elevating headliner features such as integrated ambient lighting and noise mitigation. Regional suppliers are also capitalizing on expansive manufacturing ecosystems, offering competitive pricing on foam-backed and thermoplastic headliners. This dynamic has positioned Asia-Pacific as a hotbed for innovation, as local and global players alike co-invest in R&D hubs across China, India, and Southeast Asia to refine next-generation cabin solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Headliner market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Innovation Portfolios Driving Market Leadership Among Leading Automotive Headliner Manufacturers Globally

Leading innovators and established incumbents are jockeying for market leadership through distinct competitive strategies. A handful of global chemical giants are leveraging their deep material science portfolios to co-develop custom resin and fabric blends for headliner applications, positioning themselves as end-to-end solution providers. At the same time, automotive systems integrators are forging partnerships with emerging composites specialists, enabling rapid prototyping and seamless integration of smart cabin features.

Strategic M&A transactions have also reshaped the competitive landscape, as larger suppliers acquire niche technology firms to bolster lightweighting and acoustic expertise. Meanwhile, regional players are differentiating through cost-focused manufacturing footprints, serving local OEMs with flexible order quantities and expedited delivery cycles. These varied approaches underscore a market in which technical differentiation, scale economics, and supply chain agility each play a pivotal role in defining industry leadership.

Innovation pipelines further distinguish the leading companies. Firms that successfully leverage additive manufacturing and digital twin simulations gain early mover advantage by accelerating design iterations and reducing time-to-market. Simultaneously, those investing in circular economy processes-such as post-consumer fabric recycling and renewable feedstock utilization-are building resilient brands that resonate with increasingly eco-conscious automakers and consumers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Headliner market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adler Pelzer Holding GmbH

- Atlas Roofing Corporation

- AUNDE Group

- Daehan Solution

- Glen Raven, Inc.

- Grupo Antolin Irausa, S.A.

- Howa USA Holdings, Inc.

- Kasai Group

- Kolon Industries, Inc.

- Lear Corporation

- Motus Integrated Solutions

- SA Automotive

- Sage Automotive Interiors, Inc.

- Shanghai Daimay Automotive Interior Co., Ltd.

- Shigeru Co., Ltd.

- Sika AG

- SMS Auto Fabrics

- Toray Industries, Inc.

- Toyota Boshoku Corporation

- UGN, Inc.

- Freudenberg SE

Strategic Roadmap for Industry Leaders to Enhance Innovation Supply Chain Resilience and Sustainability in Automotive Headliner Production and Adoption

Industry leaders should prioritize the integration of multifunctional material systems that balance lightweighting, acoustic comfort, and sustainability. Establishing strategic alliances with resin producers and fabric innovators can unlock co-development opportunities, accelerating the launch of tariff-resilient headliner platforms. Early adoption of bio-based polymers and recycled composites will not only mitigate future regulatory risks but also resonate with OEMs targeting ambitious carbon-neutral goals.

Supply chain resilience remains paramount. Executives must conduct scenario planning to assess the impact of potential future tariff adjustments and trade disruptions. Diversifying sourcing across multiple geographies, coupled with dual-sourcing agreements for critical feedstocks, will safeguard against shocks. Additionally, investment in digital supply chain visibility tools can provide real-time performance tracking, enabling rapid adjustments and cost containment.

Finally, embracing advanced manufacturing technologies such as additive fabrication, automated layup robotics, and digital quality inspection will deliver faster design cycles and lower scrap rates. By embedding data analytics within R&D processes, firms can optimize headliner performance through predictive modeling of acoustic and thermal properties. Collectively, these recommendations offer a strategic roadmap to consolidate market position, foster innovation, and deliver cabin experiences that align with evolving consumer expectations.

Detailing Rigorous Qualitative and Quantitative Research Frameworks and Validation Processes Employed to Deliver Insightful Automotive Headliner Market Analysis

This analysis is grounded in a multidisciplinary research methodology that blends qualitative insights with robust quantitative validation. Primary research comprised in-depth interviews with senior executives at OEMs, tier-one suppliers, and materials innovators, capturing firsthand perspectives on design priorities, procurement challenges, and emerging technology roadmaps. These dialogues were supplemented by field visits to advanced manufacturing facilities and materials testing laboratories, ensuring a direct line of sight into process capabilities and innovation pipelines.

Secondary sources included peer-reviewed journals, industry whitepapers, and regulatory filings to contextualize technological trajectories and policy impacts. Market participants’ patent databases were systematically analyzed to identify nascent material formulations and proprietary manufacturing processes. Concurrently, financial statements and investor presentations provided a window into companies’ strategic investments and capital allocations within headliner segments.

Data triangulation and rigorous validation were achieved through cross-referencing primary interview findings with secondary data points, ensuring consistency and accuracy. Statistical analyses of trade flow databases and tariff schedules further enriched the assessment of supply chain dynamics. The result is a transparent, credible framework that delivers actionable insights into automotive headliner market evolution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Headliner market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Headliner Market, by Material Type

- Automotive Headliner Market, by Functionality

- Automotive Headliner Market, by Vehicle Type

- Automotive Headliner Market, by End-User

- Automotive Headliner Market, by Region

- Automotive Headliner Market, by Group

- Automotive Headliner Market, by Country

- United States Automotive Headliner Market

- China Automotive Headliner Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Insights and Emerging Opportunities to Inform Strategic Decision Making in Automotive Headliner Development Manufacturing and Market Engagement

In synthesizing the market landscape, several key imperatives emerge for stakeholders in the automotive headliner domain. Material innovation, driven by composites and sustainable polymers, will continue to define competitive advantage, particularly as regulators and consumers demand lighter, greener cabin solutions. Concurrently, the integration of acoustic, thermal, and interactive functionalities within headliner assemblies underscores the transition from passive trim to active system components.

Regional dynamics further elucidate differentiated value pools: North America’s tariff-influenced supply chains, EMEA’s sustainability-driven policy frameworks, and Asia-Pacific’s agile manufacturing prowess. Companies that adeptly navigate these regional nuances-through flexible sourcing, strategic partnerships, and localized R&D-will gain outsized market share. Moreover, the interplay between global incumbent mergers and emerging niche innovators will shape the technology trajectory and cost structures of future headliner platforms.

Ultimately, those who marry advanced manufacturing techniques with data-driven design optimization and resilient procurement strategies will unlock the full potential of the headliner as a multifunctional, revenue-enhancing element. The market is poised for continued expansion, provided stakeholders remain adaptive, collaborative, and forward-looking in their approach.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Strategic Insights That Propel Informed Decisions in Automotive Headliner Investments

To gain unfettered access to comprehensive insights and stay ahead of industry curves, engage directly with Ketan Rohom. His expertise in automotive headliner market dynamics ensures you receive arms-length analysis tailored to your strategic needs. Reaching out will empower your team to navigate complex supply chain challenges, optimize material selections, and harness emerging technologies with data-driven confidence.

Ketan’s personalized support extends beyond standard market overviews to include bespoke scenario planning, risk mitigation guidance, and competitive benchmarking. By partnering with him, you’ll transform research into actionable roadmaps, aligning investment decisions with the latest regulatory shifts and consumer expectations. Contacting Ketan is your first step toward making informed strategic investments and securing a leadership position in tomorrow’s automotive headliner landscape.

- How big is the Automotive Headliner Market?

- What is the Automotive Headliner Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?