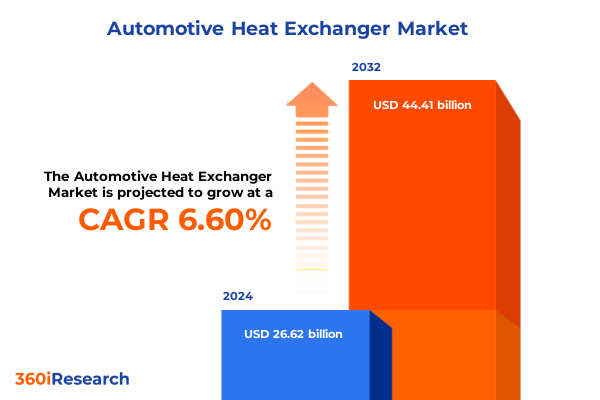

The Automotive Heat Exchanger Market size was estimated at USD 28.29 billion in 2025 and expected to reach USD 30.07 billion in 2026, at a CAGR of 6.65% to reach USD 44.41 billion by 2032.

Unveiling the Critical Role of Advanced Heat Exchangers in Driving Automotive Thermal Management Innovation and Ensuring Operational Efficiency

The automotive industry’s relentless pursuit of enhanced performance and efficiency has elevated thermal management to a critical strategic priority. As vehicles become more electrified and power-dense, the demands placed on heat exchangers have intensified, driving both innovation and complexity. These components not only regulate engine and battery temperatures but also influence overall vehicle weight, fuel economy, and emission profiles. Consequently, advanced heat exchanger technologies are at the forefront of engineering efforts to balance thermal efficiencies with the stringent regulatory and consumer-driven requirements of modern mobility.

In parallel, the shift toward electric vehicles has prompted a redefinition of thermal management architectures. Traditional engine cooling solutions are now complemented by battery thermal management systems, requiring novel materials and design approaches that can handle wide temperature fluctuations and maintain system integrity. Moreover, advancements in computational fluid dynamics and additive manufacturing have accelerated prototyping cycles, empowering designers to explore intricate geometries and microchannel networks that were previously unfeasible.

Taken together, these trends illustrate a market in transition-one where the interplay between regulatory pressure, material science breakthroughs, and digital engineering underscores the vital role of heat exchangers in supporting the next generation of automotive solutions. This introduction sets the stage for a deeper examination of the transformative shifts, tariff implications, segmentation insights, and strategic imperatives that define the current landscape.

Recognizing Pivotal Transformations Shaping the Future of Automotive Heat Exchange Driven by Electrification Sustainability and Digitalization

The automotive heat exchanger market has experienced a series of transformative shifts driven by the convergence of electrification, sustainability, and digitalization. Electrified powertrains introduce unique thermal profiles, necessitating heat exchanger designs that are compact, lightweight, and capable of handling dual thermal loads-battery packs and power electronics. At the same time, sustainability goals are reshaping material selection and manufacturing processes, with a growing emphasis on recyclable metals, bio-based refrigerants, and reduced carbon footprints across the supply chain.

Digital tools are also playing an increasingly prominent role. The integration of simulation-driven development and digital twin technologies enables manufacturers to optimize thermal performance virtually, reducing physical prototyping cycles and accelerating time to market. Additionally, smart sensors embedded within heat exchanger units facilitate real-time monitoring, predictive maintenance, and adaptive thermal management strategies. These capabilities help ensure peak operating conditions, minimize unplanned downtime, and support over-the-air updates to thermal control algorithms.

Consequently, the landscape of automotive thermal management is shifting from traditional component manufacturing to holistic systems engineering. In this environment, collaborations between OEMs, material specialists, and software providers are essential to achieving synergies that deliver not only superior thermal control but also reduced total cost of ownership and enhanced vehicle reliability.

Assessing the Far-Reaching Consequences of United States Tariffs on Automotive Heat Exchanger Supply Chains Production Costs and Global Competitiveness

Recent tariff adjustments imposed by the United States have reverberated throughout global automotive heat exchanger supply chains, prompting manufacturers to reevaluate sourcing strategies, production footprints, and cost structures. Raw materials such as aluminum and copper-essential for high-efficiency heat transfer-have seen price volatility influenced by import duties. As a result, suppliers are increasingly exploring nearshoring options and regionalized production to mitigate tariff exposure and reduce lead times.

In response, several Tier 1 and Tier 2 manufacturers have diversified their supplier bases, securing alternative alloy sources from markets outside traditional import pipelines. This supply chain resilience effort extends to forging partnerships with local foundries and extrusion specialists, thereby containing input costs and ensuring continuity of supply. Concurrently, production costs have edged upward, driving a renewed focus on design for manufacturability. Innovations in modular assembly, extrusion-based architectures, and simplified brazing methods enable cost-effective scaling while preserving thermal performance.

Moreover, the competitive landscape has adjusted as OEMs seek to optimize their cost positions without compromising quality or compliance. Some have implemented value engineering initiatives that streamline heat exchanger designs, reducing material usage and assembly complexity. Collectively, these strategic shifts underscore the criticality of tariff-aware planning and agile manufacturing practices to sustain competitiveness under evolving trade regimes.

Delving into Comprehensive Segmentation Insights Revealing Material Type Fin Configuration Vehicle Application and Channel Dynamics Underpinning Market Shifts

A nuanced understanding of market segmentation reveals how diverse technological and end-use requirements shape thermal management strategies. When categorized by type, the market spans air cooled heat exchangers with both forced draft and induced draft models, plate exchangers in brazed, gasketed, and welded plate variants, and tube exchangers comprising double tube, finned tube, and shell-and-tube configurations. Material preferences range from high-performance alloys to aluminum, copper, and stainless steel, each offering distinct thermal conductivity, weight, and corrosion resistance profiles.

Fin treatments further differentiate product offerings, with corrugated, louvered, and plain geometries optimized for specific heat transfer coefficients, airflow characteristics, and fouling conditions. In terms of vehicle platforms, the market addresses conventional internal combustion systems as well as rapidly growing electric and hybrid architectures. Application areas span air conditioning circuits, condensers, engine cooling loops, evaporators, and radiators, reflecting the multifaceted thermal regulation demands of modern vehicles.

End-user segmentation clarifies downstream dynamics: commercial transport such as buses, coaches, heavy trucks, and light commercial vehicles require robust thermal solutions under high duty cycles, while passenger segments-hatchbacks, sedans, and SUVs-prioritize comfort, packaging efficiency, and noise, vibration, and harshness (NVH) considerations. Distribution channels are divided between original equipment manufacturers and aftermarket suppliers, addressing OEM integration as well as retrofit and replacement demands. Furthermore, specialized applications in intercoolers, oil coolers, and residential or industrial air conditioners underscore the extensive scope of heat exchange technologies across mobility and beyond.

This comprehensive research report categorizes the Automotive Heat Exchanger market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Fin Type

- Vehicle

- Application

- End User

- Application

- Sales Channel

Exploring Regional Market Dynamics Across the Americas Europe Middle East Africa and Asia-Pacific to Uncover Strategic Growth Hotspots

Regional analysis illuminates distinct growth drivers and competitive landscapes across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, increasing light-vehicle production and a resurgence in commercial truck fleets are fueling demand for advanced heat exchange solutions. Regulatory emphasis on emissions and fuel economy incentivizes the adoption of lightweight alloys and high-efficiency microchannel designs.

Across Europe, the Middle East, and Africa, stringent CO₂ targets and the expansion of electric mobility programs are accelerating investments in battery thermal management systems. Collaborative research initiatives between automotive OEMs and material technology providers are prevalent in this region, driving rapid iterations in design and manufacturing processes. Meanwhile, the Middle East’s emerging electric bus deployments highlight growing diversification beyond oil-driven transport.

The Asia-Pacific region, home to the largest vehicle manufacturing base, exhibits robust uptake of electric and hybrid platforms, particularly in China, India, and Southeast Asia. Supply chain integration, supported by dense clusters of foundries and extrusion specialists, enables rapid scaling. Additionally, government incentives for localized production and R&D are promoting the development of next-generation heat exchanger architectures, spanning novel material composites and additive manufacturing techniques.

This comprehensive research report examines key regions that drive the evolution of the Automotive Heat Exchanger market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Influential Industry Players Shaping the Competitive Automotive Heat Exchanger Sector Through Innovation and Strategic Partnerships

Leading companies in the automotive heat exchanger sector are driving differentiation through technological innovation, strategic partnerships, and capacity expansion. Major tier-one suppliers leverage global footprints to offer integrated thermal management systems, combining core exchanger platforms with sensors and controls. These suppliers invest heavily in R&D centers that focus on material science breakthroughs-such as nano-coatings and composite fin structures-to enhance heat transfer rates while reducing weight.

Additionally, collaborative ventures between OEMs and specialized component manufacturers are becoming increasingly common. Such alliances facilitate co-development of modular, plug-and-play solutions tailored for electric vehicle architectures, reducing integration complexity and accelerating commercialization. Furthermore, several key players are expanding their regional presence by establishing new manufacturing plants in tariff-friendly jurisdictions, thereby optimizing cost structures and lead times.

Innovation extends beyond hardware: some companies are integrating digital monitoring platforms that capture operational data, enabling predictive maintenance services and performance benchmarking. This shift toward value-added services underscores a broader trend in which heat exchanger providers evolve into strategic partners, offering holistic thermal management packages that encompass design, manufacturing, and lifecycle support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Heat Exchanger market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AKG Group

- ARES PHE

- Changzhou Bingrui Heat Transfer Technology Co., Ltd

- COMCO EUROPE s.r.o

- Conflux Technology Pty. Ltd.

- Constellium SE

- DENSO Corporation

- Estra Automotive

- Hanon Systems

- HISAKAWORKS S.E.A SDN BHD

- HRS Process Systems Ltd.

- Hulamin

- MAHLE GmbH

- Modine Manufacturing Company

- Saaswad Heat Transfer And Engineering Pvt. Ltd.

- SACOME

- Sai Engineering

- SANDEN CORPORATION

- Serck Motorsport

- SM Auto Engineering Pvt. Ltd.

- Subros Limited

- SWEP International AB

- T.RAD Co., Ltd.

- Thermex Ltd.

- Vibrant Power Inc.

Proposing Strategic Actions for Industry Leaders to Accelerate Technological Adoption Strengthen Supply Resilience and Capitalize on Emerging Opportunities

Industry leaders must adopt a multifaceted strategy to capitalize on emerging opportunities and mitigate risks in the evolving heat exchanger landscape. First, accelerating the adoption of lightweight, high-conductivity materials-such as aluminum-alloy composites and advanced stainless steel grades-will improve vehicle performance while addressing regulatory efficiency targets. Concurrently, investing in digital design tools and additive manufacturing capabilities can streamline development cycles and enable rapid prototyping of complex geometries.

Furthermore, supply chain resilience remains paramount in light of shifting tariff environments. Diversifying supplier networks across multiple regions and forging long-term partnerships with local extrusion and brazing specialists can buffer against import duties and logistical disruptions. In parallel, companies should explore strategic joint ventures with software providers to integrate smart sensors and predictive analytics directly into heat exchange assemblies, unlocking data-driven maintenance and optimization services.

Finally, aligning product roadmaps with the transition to electrified powertrains will be critical. Tailoring thermal solutions for battery cooling, inverter heat rejection, and cabin conditioning in electric and hybrid vehicles demands a systems-level perspective. By combining materials expertise, digital capabilities, and collaborative innovation models, industry leaders can elevate thermal management from a component-centric approach to a holistic enabler of next-generation mobility.

Outlining Rigorous Research Methodology Combining Primary Insights Secondary Data Triangulation and Analytical Frameworks for Robust Market Analysis

This research synthesizes insights from a robust, multi-stage methodology designed to ensure data integrity and analytical rigor. The process began with extensive secondary research, which involved reviewing technical publications, regulatory filings, patent databases, and supplier documentation to establish foundational market understanding and emerging technology trends. These findings guided the development of detailed discussion guides for primary interviews.

In the second phase, primary research encompassed in-depth conversations with senior decision-makers across OEMs, tier-one and tier-two suppliers, material specialists, and industry consultants. These interviews validated secondary data, uncovered real-world innovation drivers, and provided perspective on regional dynamics, tariff impacts, and R&D priorities. Responses were systematically coded and cross-referenced to ensure consistency and mitigate potential biases.

Finally, analytical frameworks, including SWOT analyses, value chain mapping, and competitive benchmarking, were employed to triangulate findings and derive actionable insights. This layered approach ensures that conclusions are grounded in empirical evidence and reflect the nuanced interplay of technological, regulatory, and commercial factors shaping the global heat exchanger market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Heat Exchanger market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Heat Exchanger Market, by Type

- Automotive Heat Exchanger Market, by Material

- Automotive Heat Exchanger Market, by Fin Type

- Automotive Heat Exchanger Market, by Vehicle

- Automotive Heat Exchanger Market, by Application

- Automotive Heat Exchanger Market, by End User

- Automotive Heat Exchanger Market, by Application

- Automotive Heat Exchanger Market, by Sales Channel

- Automotive Heat Exchanger Market, by Region

- Automotive Heat Exchanger Market, by Group

- Automotive Heat Exchanger Market, by Country

- United States Automotive Heat Exchanger Market

- China Automotive Heat Exchanger Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings to Illuminate the Future Trajectory of Automotive Heat Exchanger Advances and Strategic Imperatives for Stakeholders

The analysis of automotive heat exchangers underscores their pivotal role in meeting contemporary mobility challenges, from electrification to sustainability mandates. Advanced materials, innovative manufacturing methods, and digital integration are converging to deliver solutions that enhance thermal efficiency, reduce weight, and support rigorous emission standards. At the same time, evolving trade policies necessitate agile supply chain strategies to preserve cost competitiveness and ensure uninterrupted production.

Segmentation insights reveal that no single technology or material dominates; rather, market participants must tailor offerings across types, fin configurations, and application areas to meet diverse performance and packaging requirements. Regional dynamics further emphasize the importance of localized R&D and manufacturing, particularly in areas where regulatory pressures and EV adoption are most pronounced.

Ultimately, success in this sector hinges on the ability to blend engineering excellence with strategic foresight. By embracing collaborative innovation, optimizing material selection, and leveraging data-driven maintenance platforms, stakeholders can position themselves at the forefront of automotive thermal management evolution. The resulting advancements promise improved vehicle performance, enhanced sustainability credentials, and new avenues for growth.

Empowering Strategic Action Connect with Ketan Rohom for Exclusive Access to the Complete Automotive Heat Exchanger Market Report and Accelerate Your Next Move

The transition from insight to action is crucial for organizations seeking to maintain a competitive edge in the heat exchanger market. To that end, connect with our Associate Director of Sales & Marketing, Ketan Rohom, who brings deep domain expertise and a comprehensive understanding of market nuances. Engaging with Ketan ensures personalized guidance tailored to your strategic objectives, whether you are exploring new material innovations, assessing tariff impacts, or optimizing regional supply chains.

By reaching out, you gain exclusive access to the complete market research report, which synthesizes rigorous primary interviews with industry leaders, secondary data triangulation, and advanced analytical frameworks. This report equips decision-makers with actionable intelligence on segmentation dynamics, transformative market shifts, and competitive positioning. Ketan will help you navigate the report’s insights to formulate bespoke strategies that drive operational efficiency and sustainable growth.

Initiating this dialogue is the first step toward unlocking critical opportunities within the automotive thermal management ecosystem. Schedule a consultation with Ketan Rohom today to secure your copy of the report and accelerate your next strategic move in the heat exchanger landscape. Propel your business forward with data-driven decisions supported by expert counsel and make informed investments in innovation and supply resilience.

- How big is the Automotive Heat Exchanger Market?

- What is the Automotive Heat Exchanger Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?