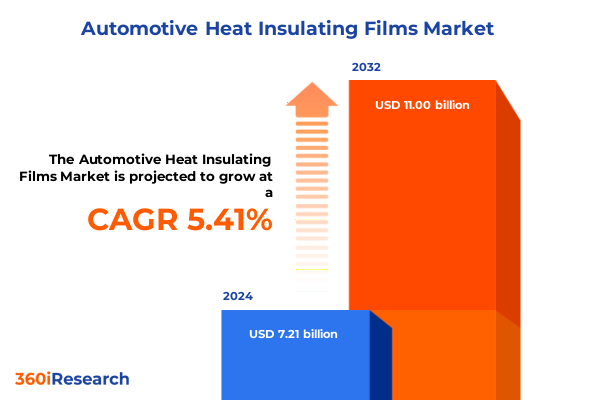

The Automotive Heat Insulating Films Market size was estimated at USD 7.57 billion in 2025 and expected to reach USD 7.95 billion in 2026, at a CAGR of 5.48% to reach USD 11.00 billion by 2032.

Setting the Stage for Growth and Innovation in Automotive Heat Insulating Films with a Focus on Emerging Opportunities and Market Drivers

The automotive heat insulating films market is experiencing a pivotal moment driven by an increasing emphasis on passenger comfort, energy efficiency, and stringent regulatory frameworks. In recent years, rising awareness of cabin thermal management and the desire for reduced HVAC energy consumption have propelled these films into the spotlight. As automotive OEMs and aftermarkets intensify their focus on lightweight solutions that contribute to fuel economy and electric vehicle range extension, heat insulating films have transitioned from optional accessories to fundamental components of automotive design.

Against this backdrop, consumer preferences are evolving in tandem with technological innovations. Modern consumers demand enhanced UV protection to guard against interior degradation, glare reduction for improved driving safety, and increased privacy for personal and commercial transport. In response, manufacturers have accelerated research into advanced materials that deliver multifaceted performance without compromising optical clarity. As a result, nano-ceramic compounds and high-performance PET substrates are emerging alongside traditional metallic layers, catalyzing a new era of product differentiation.

Moreover, government initiatives aimed at reducing vehicular emissions and encouraging the adoption of electric vehicles have created a favorable policy environment for the expansion of heat insulating film applications. Incentives, tax benefits, and evolving safety standards collectively underscore the strategic importance of these materials in the broader push for sustainable mobility.

Navigating the Convergence of Nanotechnology Advances and Digital Manufacturing to Redefine Thermal Management in Modern Vehicles

The automotive heat insulating films landscape is undergoing transformative shifts fueled by breakthroughs in nanotechnology, material science, and digital manufacturing processes. Nano-ceramic formulations now enable films to reject infrared radiation with unprecedented efficiency without resorting to metallic additives, thus preserving signal transparency for onboard electronics and satellite-based communication. Concurrently, the advent of laser patterning and precision coating techniques has streamlined production, allowing for tighter tolerances and uniformity across large-format substrates.

In addition, the proliferation of connected vehicles and autonomous driving prototypes has heightened the need for sophisticated thermal management systems. As sensors and cameras proliferate on exterior surfaces, heat insulating films must maintain consistent performance under prolonged exposure to varying environmental conditions. This has spawned hybrid films that combine multiple functionalities-glare reduction, UV blocking, and thermal reflection-into consolidated layers. Manufacturers are increasingly leveraging proprietary polymer blends and molecular bonding strategies to meet these complex requirements.

Finally, the convergence of online distribution platforms with traditional dealer networks is reshaping go-to-market strategies. Direct-to-consumer channels now offer customization options, enabling end users to select specialized tints and performance levels. Meanwhile, OEM partnerships are driving integration of films into original window assemblies, reinforcing the strategic role of heat insulating films in next-generation vehicle architecture.

Assessing How Revised United States Tariffs in 2025 Have Catalyzed Supply Chain Localization and Material Innovation Across the Sector

In early 2025, the United States implemented a revised tariff schedule targeting specialty automotive components, including heat insulating films. The cumulative effect of increased duties has compelled both domestic suppliers and foreign exporters to reevaluate procurement strategies and supply chain configurations. While higher tariffs marginally increased unit production costs for imported metallic layered films, producers swiftly responded by intensifying domestic material sourcing and integrating alternative substrates such as polyethylene terephthalate and polyvinyl butyral.

These strategic adjustments have not only mitigated cost pressures but also accelerated the adoption of localized manufacturing hubs. Regional coating facilities have expanded capacity to serve commercial and passenger vehicle OEMs more directly, thereby reducing lead times and inventory carrying costs. Moreover, partnerships between polymer compounders and film converters have strengthened, driving joint development agreements to optimize material formulations tailored to U.S. regulatory requirements.

Despite initial concerns over price fluctuations, the market has displayed remarkable resilience. End users benefitted from diversified supplier portfolios and phased tariff implementation schedules, which allowed for gradual pricing adjustments. Consequently, aftermarket channels continued to flourish, buoyed by a strong consumer appetite for retrofit installations that promise enhanced thermal comfort and UV protection.

Illuminating Critical Insights across Material Types Technologies Functionalities and Vehicle Applications Fueling Product Differentiation

In analyzing the market through the lens of material composition, films comprising metallic layers remain valued for their superior infrared reflectivity, yet nano-ceramic compounds have carved a strong niche by offering enhanced durability and optical neutrality. Polyethylene terephthalate substrates deliver cost-effective solutions with robust tensile strength, while polyvinyl butyral films provide exceptional adhesion and safety benefits in shatter-prone applications. Polyvinyl chloride options continue to serve budget-sensitive segments, delivering adequate performance under moderate temperature differentials.

From a technological standpoint, metalized films exhibit unmatched heat rejection capabilities, which appeal to high-end OEM applications and luxury vehicle customizations. In contrast, non-metalized films have gained traction in aftermarket channels thanks to their radio frequency transparency and compatibility with advanced driver assistance systems. Function-driven differentiation is evident as glare reduction films become standard in sunroof and windshield applications, heat rejection variants dominate midsize passenger vehicles, privacy and security films increasingly protect valuables in urban environments, and UV blocking layers address health-conscious consumer segments.

Moreover, vehicle type segmentation highlights significant dynamics: passenger vehicles account for the majority of retrofit volumes, while heavy and light commercial vehicles demand specialized films for fleet operations, including logistics and public transportation. Distribution channels remain bifurcated between offline installers offering professional fitment services and online platforms providing DIY kits. Meanwhile, the aftermarket continues to drive volume, but automotive OEMs maintain a strategic foothold by integrating films during original window fabrication, signaling an enduring symbiosis between retrofitting and factory-installed solutions.

This comprehensive research report categorizes the Automotive Heat Insulating Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Technology

- Functionality

- Vehicle Type

- Distribution Channel

- End User

Exploring How Regional Regulations Consumer Behaviors and Manufacturing Capacities Shape Demand across Key Global Markets

Regional dynamics underscore a complex interplay of regulatory frameworks, consumer preferences, and manufacturing landscapes. In the Americas, stringent fuel efficiency regulations and a robust automotive aftermarket ecosystem have fostered a high demand for both retrofit and OEM-integrated films. With the United States leading policy reforms and Canada advancing emission reduction targets, North American stakeholders emphasize energy-saving innovations and professional installation networks.

Across Europe, the Middle East, and Africa, heterogeneous market conditions present both challenges and opportunities. Western Europe’s rigorous safety and environmental standards drive adoption of advanced nano-ceramic and multi-layered films, while emerging markets in Eastern Europe and North Africa hinge on cost-effective solutions adaptable to variable climate extremes. The Gulf Cooperation Council region sees growing interest in high-performance heat rejection films to combat intense solar exposure, and South Africa gravitates toward privacy and security films amid urbanization trends.

In the Asia-Pacific region, rapid vehicle production and the ascent of electric mobility create fertile ground for innovative thermal management strategies. Key automotive hubs in China, Japan, South Korea, and India are investing heavily in local coating technologies and material R&D. Simultaneously, Southeast Asian markets display a rising aftermarket culture, leveraging online distribution to meet diverse consumer needs across tropical climates.

This comprehensive research report examines key regions that drive the evolution of the Automotive Heat Insulating Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Understanding the Strategic Positioning of Established Manufacturers Emerging Innovators and Specialized Service Providers in a Competitive Ecosystem

A competitive landscape characterized by global leaders and nimble specialized entities defines the automotive heat insulating films sector. Legacy manufacturers with integrated polymer compounding and coating capabilities continue to hold significant OEM contracts, leveraging deep R&D investment and scale economies. These players maintain robust portfolios that span metalized and non-metalized offerings, accompanied by advanced testing facilities that ensure compliance with international safety and performance standards.

At the same time, emerging firms harness cutting-edge materials science to introduce proprietary nano-ceramic coatings and hybrid multilayer architectures. These innovators frequently collaborate with research institutions to accelerate product validation, securing patents that underscore their technological leadership. Partnerships between suppliers and vehicle manufacturers are intensifying, focusing on co-development of next-generation films tailor-made for electric and autonomous vehicle platforms.

In parallel, specialized converters and installation networks support aftermarket growth through value-added services such as mobile fitment units and digital configurators. Their agility in responding to local consumer trends and climate-specific requirements gives them a competitive edge, particularly in markets where professional installation remains critical to performance assurance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Heat Insulating Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- American Standard Window Films

- Avery Dennison Corporation

- CarzSpa Autofresh Private Limited

- Chenxin Group Co., Limited

- Compagnie de Saint-Gobain S.A.

- Cosmo Sunshield

- Covestro AG

- Eastman Chemical Company

- FILIRIKO s.r.o.

- Garware Hi-Tech Films Ltd.

- Guangzhou Annhao Auto Accessories Co., Ltd.

- Guangzhou Xinglan New Material Technology Co., Ltd

- HAVERKAMP GmbH

- HEXIS SAS

- Johnson Window Films, Inc.

- Lintec Corporation

- Luxfil

- Madico, Inc.

- NEXFIL Co.,Ltd

- ORAFOL Europe GmbH

- RIKEN TECHNOS CORP

- SICAN CO., LTD

- Toray Industries, Inc.

- XPEL, Inc.

Implementing Strategic Partnerships and Supply Chain Diversification to Accelerate Innovation and Ensure Resilient Market Access

To capitalize on evolving market dynamics, industry leaders should prioritize collaborative R&D initiatives that align material innovation with vehicle electrification and autonomy roadmaps. By establishing joint testing centers with OEM partners, stakeholders can validate performance under real-world conditions, accelerating time to market and reducing integration barriers. Concurrently, enhancing digital platforms to provide configurators and virtual demonstrations will engage end users and streamline the purchasing process across offline and online channels.

Furthermore, organizations must adopt a dual-sourcing strategy for critical polymers to mitigate tariff-induced risks and ensure supply chain agility. Investing in regional production hubs near key automotive clusters can reduce lead times and transportation costs while reinforcing sustainability goals through localized operations. Embracing modular manufacturing techniques will also allow for flexible production volumes and rapid adaptation to shifting consumer preferences.

Lastly, a focused approach to market education is essential. Providing transparent data on energy savings, UV protection benefits, and long-term cost advantages will empower both OEM engineers and aftermarket installers to advocate for premium film solutions. Workshops, certification programs, and thought leadership content should be employed to elevate the perceived value proposition and foster enduring customer loyalty.

Detailing a Rigorous Mixed-Methods Approach Combining Expert Interviews Primary Installment Data and Robust Secondary Source Analysis

The research methodology underpinning this analysis combines qualitative expert interviews, primary data collection with OEM procurement teams and aftermarket installers, and secondary research from publicly available technical journals and regulatory filings. In-depth discussions with material scientists and polymer engineers provided critical insights into emerging formulation trends and performance benchmarks. Simultaneously, consultations with logistics specialists and distribution channel managers illuminated the impact of tariff changes and supply chain realignments.

Secondary sources encompassing industry white papers, peer-reviewed publications, and government policy documents were triangulated to validate findings and ensure methodological rigor. Key performance metrics, such as infrared rejection efficiency and optical clarity indices, were assessed through published laboratory studies. Market structure analyses incorporated mapping of regional manufacturing capacities and distribution footprints to contextualize strategic positioning across global hubs.

This blended approach ensures a holistic understanding of the automotive heat insulating films landscape, capturing the technological, economic, and regulatory dimensions that inform strategic decision-making for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Heat Insulating Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Heat Insulating Films Market, by Material Type

- Automotive Heat Insulating Films Market, by Technology

- Automotive Heat Insulating Films Market, by Functionality

- Automotive Heat Insulating Films Market, by Vehicle Type

- Automotive Heat Insulating Films Market, by Distribution Channel

- Automotive Heat Insulating Films Market, by End User

- Automotive Heat Insulating Films Market, by Region

- Automotive Heat Insulating Films Market, by Group

- Automotive Heat Insulating Films Market, by Country

- United States Automotive Heat Insulating Films Market

- China Automotive Heat Insulating Films Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Insights on How Material Innovation and Strategic Agility Will Define the Next Era of Thermal Management in Vehicles

As automotive ecosystems evolve toward electrification and autonomy, the role of heat insulating films will become increasingly integral to vehicle design and user experience. Advanced materials that deliver multi-functional performance-balancing thermal regulation, UV protection, and signal transparency-will redefine cabin comfort standards. Moreover, the convergence of digital sales channels with professional installation services will expand market reach and customer engagement.

The cumulative impact of regulatory pressures, tariff dynamics, and consumer expectations underscores the necessity for agile innovation and strategic foresight. Industry participants who embrace collaborative development, supply chain resilience, and transparent value communication will be best positioned to capture emerging opportunities. In this dynamic environment, a deep understanding of material science, coupled with operational flexibility, remains the cornerstone of sustained competitive advantage.

Ultimately, the automotive heat insulating films market is poised for transformative growth as vehicles transition to cleaner, smarter, and more connected platforms. By aligning product development with broader mobility trends and regional market nuances, stakeholders can drive meaningful differentiation and long-term success.

Unlock Comprehensive Market Intelligence and Personalized Guidance by Connecting with Ketan Rohom to Acquire the Full Automotive Heat Insulating Films Report

For additional insights or to secure the full market research report covering in-depth analysis, strategic forecasting, and bespoke data on the automotive heat insulating films sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Leverage expert guidance to inform procurement decisions and unlock tailored market intelligence that aligns with your organizational goals and competitive positioning. Connect today to obtain comprehensive deliverables and embark on a data-driven path to sustainable growth and innovation.

- How big is the Automotive Heat Insulating Films Market?

- What is the Automotive Heat Insulating Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?