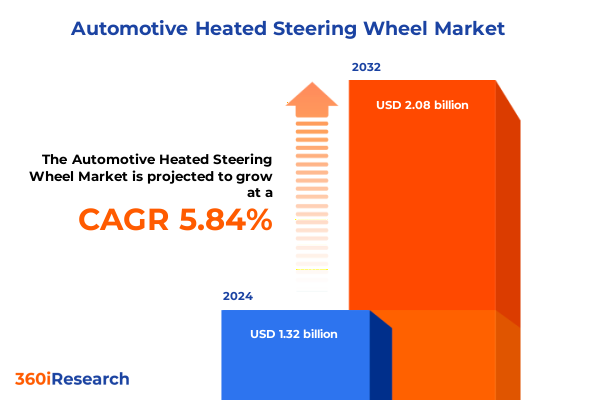

The Automotive Heated Steering Wheel Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.47 billion in 2026, at a CAGR of 5.88% to reach USD 2.08 billion by 2032.

Unveiling the Transformative Power of Heated Steering Wheels in Enhancing Driver Comfort Safety and Competitive Edge Across Global Automotive Segments

When the crisp chill of winter takes hold, the simple yet sophisticated heated steering wheel emerges as a defining element of driver comfort and safety. More than a luxury add-on, this feature has become integral to modern automotive design, offering reliable warmth and ergonomic grip that enhance control and reduce distraction in cold conditions. As vehicle interiors evolve, the heated steering wheel has transcended basic functionality to embody a fusion of advanced materials, embedded sensors, and intelligent control systems. In parallel with the industry’s shift toward electrification, this component’s role has expanded beyond aftermarket retrofits to a core element in next-generation electric and hybrid vehicles.

Furthermore, the growing consumer demand for premium in-cabin experiences has spurred OEMs to integrate heated steering options even in mid-range segments. Notably, electric vehicle sales exceeded 17 million globally in 2024, representing over 20% of total car sales and underscoring the accelerated electrification trend shaping feature adoption across all price tiers. In the United States, EV sales grew by about 10% year-on-year, with more than one in ten cars sold now electric. Consequently, manufacturers regard heated steering wheels as a strategic differentiator that aligns with broader trends in sustainable mobility and enhanced user experience. As we delve into the subsequent sections, we will explore the dynamic landscape, regulatory impacts, segmentation nuances, regional variations, leading companies, and targeted recommendations necessary to navigate this sophisticated market.

Exploring the Radical Shifts in Vehicle Electrification Sensor Integration and Comfort Trends Reshaping the Heated Steering Wheel Landscape

The landscape of the heated steering wheel market is undergoing radical transformation driven by vehicle electrification, sensor integration, and discerning consumer expectations. Electrification has elevated in-cabin thermal management from a luxury feature to a standard comfort attribute, as electric and hybrid vehicles place a premium on energy-efficient climate control systems. In addition, embedded sensor technologies-ranging from infrared proximity detectors to precise thermistors-enable rapid response heating, optimizing energy usage while ensuring consistent warmth at the wheel surface. Moreover, the convergence of smart control systems has introduced app-based and voice-activated interfaces, empowering drivers to precondition their steering wheels remotely or adjust temperatures on the fly through in-car voice assistants.

At the material level, innovations in eco-friendly composites and advanced insulation materials have enhanced heater performance while supporting OEM sustainability objectives. Consequently, wood, synthetic leathers, and next-generation ergonomic polymers now coexist with traditional leather in heated steering wheel constructions. This material diversity reflects broader trends in personalized vehicle interiors, where tactile quality and thermal conduction characteristics must harmonize with design aesthetics and weight targets. Concurrently, the aftermarket sector is evolving to offer retrofit solutions and standalone covers that leverage plug-and-play integration and modular sensor control modules. As the market matures, the interplay between integrated steering assemblies and retrofit covers highlights a dual pathway of innovation-challenging suppliers to balance cost, performance, and compatibility across a fragmented vehicle parc.

Assessing the Far-reaching Economic and Operational Consequences of the 2025 United States Tariff Measures on Automotive Heated Steering Wheel Components

In early 2025, the U.S. government enacted sweeping Section 232 tariffs under the Trade Expansion Act of 1962, imposing a 25% duty on imported passenger vehicles, light trucks, and key automotive parts, including electrical and powertrain components. The first phase took effect on April 3, 2025 for complete vehicles, while engines, transmissions, and electrical modules came under the 25% levy on May 3, 2025. Although U.S. content certification under USMCA temporarily shields compliant parts, automakers face a complex matrix of compliance processes and shifting effective rates.

These tariff measures have reverberated throughout the heated steering wheel ecosystem, elevating input costs for heater cores, wiring harnesses, and temperature sensors sourced from global suppliers. Manufacturers have reported multi-million–dollar impacts to operating income, with leading automakers like General Motors absorbing a $1.1 billion tariff hit in Q2 2025. Stellantis disclosed $350 million in first-half costs, foreshadowing persistent margin compression if duties persist through 2026. In response, several suppliers are evaluating production relocation and expanded domestic assembly to mitigate tariff exposure, although capacity constraints and capital lead times present near-term challenges. Consequently, industry players are advancing supply chain diversification, accelerating the adoption of U.S.-based tier-one partnerships, and exploring duty-drawback programs. As a result, cost volatility will likely remain a prominent factor in heated steering wheel pricing and OEM sourcing strategies through 2025 and beyond.

Dissecting the Multifaceted Market Segmentation Framework Underpinning Automotive Heated Steering Wheel Demand and Adoption Trajectories

The heated steering wheel market is defined by a highly granular segmentation framework that addresses distinct customer requirements across various axes. Product applications span commercial vehicles and passenger cars, with heavy commercial trucks and light-duty vans demanding robust, high-output heater cores contrasted against the nuanced comfort profiles expected in mid-range and luxury passenger segments. Concurrently, the technological divide between infrared and resistive heating systems determines energy efficiency benchmarks and response times, shaping integration strategies within vehicle HVAC architectures. Moreover, material selection-whether premium leather for tactile warmth, synthetic composites for cost-effective durability, or wood trims for artisanal appeal-factors significantly into OEM interior packages and aftermarket offerings.

Further nuances arise through vehicle categorization into economy, mid-range, and luxury tiers, each governed by divergent cost targets and feature bundling standards. Sales channels bifurcate between OEM-installed solutions and aftermarket retrofit kits, reflecting varying consumer engagement models and distribution dynamics. At the same time, usage contexts differentiate commercial fleets, including ride-sharing services and corporate operators, from individual passenger use, informing sensor calibration and control system complexity. Integration options range from seamlessly embedded steering assemblies to standalone covers that meet retrofit demand, while sensor modalities oscillate between infrared proximity triggers and fixed thermistor loops. Control systems expand from manual dials through automatic temperature regulation to advanced smart interfaces, where app-based and voice-activated adjustments create personalized thermal zones. Finally, seasonal design considerations allocate resources among all-season constructs or winter-specific wheels, and ongoing research fosters innovation in eco-friendly insulative materials and next-gen heating elements. This comprehensive segmentation underpins tailored product roadmaps and targeted go-to-market strategies.

This comprehensive research report categorizes the Automotive Heated Steering Wheel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Integration Level

- Sensor Technology

- Control System

- Design

- Vehicle Type

- Sales Channel

- Application

Mapping the Diverse Regional Dynamics Fueling Heated Steering Wheel Adoption Patterns Across Americas EMEA and Asia-Pacific Markets

Regional dynamics significantly influence heated steering wheel adoption, driven by climate, regulatory landscapes, and consumer preferences. In the Americas, particularly the United States and Canada, winter weather conditions and a premium vehicle ethos have solidified heated steering wheels as a near-standard comfort option in luxury and mid-range models. Incentive programs for energy-efficient vehicles further bolster feature penetration in regionally produced electric trucks and SUVs. Moreover, North American OEMs are increasingly localizing supplier networks to navigate tariff headwinds, fostering domestic production of heater cores, control modules, and sensor assemblies.

Meanwhile, in Europe, the Middle East, and Africa, a diverse regulatory tapestry shapes demand. Stringent EU emissions regulations and urban low-emission zones have amplified electric vehicle uptake, indirectly accelerating the integration of advanced thermal comfort systems. Integrated design philosophies in European luxury marques emphasize harmonious interior aesthetics, driving premium material overlays and advanced sensor networks. In the Middle East, high-end SUVs leverage heated steering wheels as a brand differentiator for discerning buyers who navigate both temperature extremes and off-road conditions. Across Africa, growing urbanization and rising incomes kindle aspirations for global comfort standards, with import-dependent markets often selecting aftermarket solutions to retrofit premium features.

In the Asia-Pacific region, the world’s largest electric vehicle production hub, robust supply chains and policy incentives underpin rapid adoption. China’s domestic OEMs, backed by substantial EV subsidies, integrate heated steering across economy to luxury segments, addressing both comfort and energy management demands. Japan and Korea, known for innovation in materials and microelectronics, pioneer next-generation resistive and infrared hybrid systems. Southeast Asia edges into the comfort market as consumers trade up to premium trims, while Australia’s cooler southern locales drive niche aftermarket retrofit growth. Such regional insights guide market entry sequencing and resource allocation, enabling stakeholders to align product portfolios with local dynamics.

This comprehensive research report examines key regions that drive the evolution of the Automotive Heated Steering Wheel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Initiatives and Competitive Positioning of Leading Manufacturers Dominating the Heated Steering Wheel Sector

A cadre of global and specialized players propels innovation and competition within the heated steering wheel ecosystem. Tier-one electronics suppliers such as Robert Bosch and Denso leverage extensive automaker relationships to integrate thermal modules with vehicle body control networks. Continental and Hyundai Mobis, renowned for holistic chassis and interior systems, anchor their value propositions on seamless integration and advanced safety-grade sensor fusion. Meanwhile, specialized comfort technology providers-including Gentherm and Lear Corporation-focus on core heating element performance, exploring novel materials like graphene-infused membranes for accelerated warm-up and energy efficiency.

Automotive OEMs such as Toyota and Nissan collaborate with electronics partners to embed app-based and voice-activated control features, aligning steering wheel heat management with broader vehicle connectivity platforms. Aftermarket specialists and retrofit innovators, including S&E Automotive Products and TRW Automotive, develop plug-and-play wheel covers and standalone units that cater to lapsed or budget-conscious segments. Meanwhile, metalworks and trim artisans experiment with wood veneers and bespoke ergonomic designs to capture the luxury niche. Partnerships between component suppliers and research institutions drive ongoing material innovation, promoting advanced insulation layers and eco-friendly composites. Collectively, these strategic endeavors underscore a competitive landscape where differentiated technology roadmaps, cross-industry alliances, and targeted R&D investment determine market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Heated Steering Wheel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Autoliv Inc.

- Bombardier Recreational Products Inc.

- Delphi Technologies by BorgWarner Inc.

- Gentherm Inc.

- Grant Products International

- Hyundai Mobis

- I.G. Bauerhin GmbH

- Jaguar Land Rover Automotive Plc by TATA Motors

- Joyson Safety Systems Aschaffenburg GmbH

- Kia corporation

- KURABE Industrial Co.,Ltd.

- SECO KOMOS

- Symtec Inc.

- Toyoda Gosei Co., Ltd.,

- VALEO limited

- ZF Friedrichshafen AG

Charting Actionable Strategic Roadmaps to Drive Innovation Mitigate Risk and Capitalize on Growth Opportunities in Heated Steering Wheel Markets

Industry leaders must prioritize agile supply chain strategies to navigate ongoing tariff uncertainties and semiconductor constraints. Establishing dual-sourcing agreements and bolstering regional manufacturing footprints can mitigate exposure to duty fluctuations while reducing lead times for critical heating elements and sensor assemblies. Additionally, investing in advanced materials research-focusing on eco-friendly insulative substrates and next-generation heating membranes-will differentiate product offerings and align with sustainability goals.

To capture emerging value, manufacturers should integrate voice-activated and app-based control systems that cater to digitally engaged consumers and fleet operators seeking remote climate preconditioning. Collaboration with OEM telematics and infotainment teams will facilitate seamless user experiences while generating data insights to refine thermal performance algorithms. Furthermore, expanding retrofit solution portfolios can address underserved segments in cost-sensitive or lapsed markets, leveraging modular form factors and universal-fit covers. In parallel, forging partnerships with regional EV startups and mobility platforms will open co-development pathways for customized heated steering solutions. Ultimately, by balancing strategic risk management with targeted technology investments, industry stakeholders can accelerate innovation cycles, optimize operational resilience, and capture evolving market share.

Detailing the Rigorous Multi-Method Research Methodology Employed to Deliver Comprehensive Heated Steering Wheel Market Insights

This research synthesizes both primary and secondary methods to ensure robust, actionable insights into the heated steering wheel market. Secondary research involved a comprehensive review of governmental proclamations, industry fact sheets, trade publications, and regulatory filings, including U.S. Section 232 tariff proclamations issued in March 2025 and subsequent amendments. Supplementary data were drawn from reputable global energy and mobility analyses, such as the IEA’s Global EV Outlook 2025 report, to contextualize emerging trends in vehicle electrification and comfort adoption.

Primary research consisted of structured interviews with senior executives at OEMs, tier-one electronics suppliers, and materials innovators to validate market dynamics, cost drivers, and technological roadmaps. Additionally, a series of expert panels, including climate control engineers and aftermarket distribution leaders, offered qualitative perspectives on sensor integration, retrofit demand, and consumer preference shifts. Quantitative data were triangulated through a proprietary survey of more than 150 fleet operators and ride-sharing service managers across North America, EMEA, and Asia-Pacific, ensuring representative insights into commercial usage patterns. Finally, rigorous data modeling and cross-validation techniques reinforced the segmentation framework, enabling precise mapping of product features to regional and application-specific requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Heated Steering Wheel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Heated Steering Wheel Market, by Technology

- Automotive Heated Steering Wheel Market, by Material

- Automotive Heated Steering Wheel Market, by Integration Level

- Automotive Heated Steering Wheel Market, by Sensor Technology

- Automotive Heated Steering Wheel Market, by Control System

- Automotive Heated Steering Wheel Market, by Design

- Automotive Heated Steering Wheel Market, by Vehicle Type

- Automotive Heated Steering Wheel Market, by Sales Channel

- Automotive Heated Steering Wheel Market, by Application

- Automotive Heated Steering Wheel Market, by Region

- Automotive Heated Steering Wheel Market, by Group

- Automotive Heated Steering Wheel Market, by Country

- United States Automotive Heated Steering Wheel Market

- China Automotive Heated Steering Wheel Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1908 ]

Concluding Insights Emphasizing the Pivotal Role of Heated Steering Wheels in Shaping Future Automotive Comfort Ecosystems

Heated steering wheels have evolved from a niche luxury accessory into a core feature that defines modern automotive comfort, safety, and competitive differentiation. As the market contends with macroeconomic headwinds-such as heightened U.S. tariffs, supply chain realignments, and energy efficiency mandates-the capacity to innovate in sensor integration, material science, and smart controls will dictate future success. Regions from the Americas to Asia-Pacific exhibit unique adoption drivers, underscoring the necessity of localized strategies that reflect climate, regulatory environments, and consumer behavior. Moreover, the diverse segmentation framework-spanning vehicle type, technology, sales channel, and design preferences-presents multiple pathways for targeted value creation.

Leading companies have demonstrated that strategic alliances, agile sourcing, and sustained R&D investment in advanced heating elements and insulation materials are critical levers for long-term growth. By synthesizing the current landscape and projected trajectories, stakeholders can identify high-potential segments-such as retrofit solutions in emerging markets and integrated assemblies in premium EV models. Ultimately, mastery of this dynamic realm hinges on a holistic approach that marries technical innovation with market intelligence and operational resilience, setting the stage for stakeholders to secure leadership positions in the global heated steering wheel ecosystem.

Engage with Ketan Rohom to Accelerate Your Access to In-depth Heated Steering Wheel Market Intelligence and Strategic Guidance

To gain unparalleled access to the full depth of heated steering wheel market intelligence and bespoke strategic recommendations, reach out directly to Ketan Rohom. His expertise as Associate Director of Sales & Marketing ensures a personalized engagement, translating comprehensive data into actionable insights tailored to your organization’s priorities. Whether you aim to refine your product roadmap, align with emerging regulatory shifts, or optimize your supply chain resilience, Ketan stands ready to facilitate your journey toward market leadership. Seize this opportunity to differentiate your offerings, capitalize on untapped growth areas, and reinforce your competitive advantage with precision-guided research support.

- How big is the Automotive Heated Steering Wheel Market?

- What is the Automotive Heated Steering Wheel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?