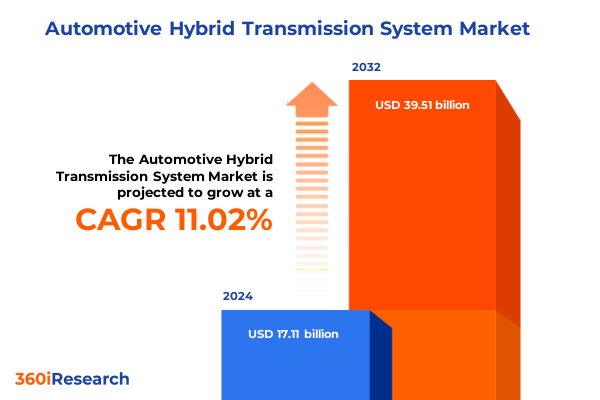

The Automotive Hybrid Transmission System Market size was estimated at USD 18.98 billion in 2025 and expected to reach USD 21.05 billion in 2026, at a CAGR of 11.04% to reach USD 39.51 billion by 2032.

Pioneering the Next Era of Automotive Efficiency Through Hybrid Transmission Innovations and Strategic Vision in a Rapidly Evolving Mobility Landscape

The accelerating shift toward electrified powertrains has propelled hybrid transmission systems to the forefront of automotive innovation and sustainable mobility strategies. By expertly combining internal combustion engines with electric propulsion, hybrid transmissions deliver both fuel efficiency gains and performance enhancements that align with tightening emissions regulations and evolving consumer preferences. As global vehicle manufacturers strive to balance environmental mandates with driver expectations, hybrid transmission architectures have emerged as a pivotal intersection of power, efficiency, and adaptability.

In this context, understanding the nuances of parallel, power-split, series, and series-parallel configurations is crucial to evaluating each OEM's strategic positioning. Moreover, distinctions among full, mild, and plug-in hybrid powertrains underscore how manufacturers tailor electrification levels to market demands and regulatory frameworks. Looking beyond core technologies, variations in passenger car and commercial vehicle applications, as well as drive layout choices and component integrations, further reveal the intricate fabric of hybrid transmission innovation. This introduction sets the stage for a thorough examination of market shifts, policy impacts, segmentation insights, and strategic imperatives essential for stakeholders seeking to capitalize on the next wave of automotive evolution.

Navigating Disruptive Paradigm Shifts in Hybrid Powertrain Architectures as Electrification and Digitalization Redefine Transmission Performance Standards

Hybrid transmissions are undergoing transformative shifts driven by the convergence of electrification, connectivity, and advanced manufacturing methods. From the widespread adoption of electrified gearsets to the integration of smart power electronics capable of real-time torque vectoring, these technologies are redefining performance benchmarks. Traditional hydraulic controls are giving way to digitally optimized systems that enable seamless transitions between power sources, resulting in improved responsiveness and driveability.

At the same time, digital twins and virtual validation models are accelerating development cycles, reducing hardware iterations while enhancing system reliability. Automation in assembly and precise additive manufacturing of clutch packs and planetary gear sets is elevating production efficiency and consistency, allowing original equipment manufacturers to scale hybrid transmission offerings at lower cost and with greater customization. As the automotive ecosystem embraces software-defined vehicles, transmissions are evolving into platform-level modules that interface with vehicle management systems, ensuring optimized energy flows and predictive maintenance capabilities. Each of these dynamics underscores a pivotal transformation in how hybrid transmissions are conceived, engineered, and delivered to market.

Assessing the Strategic and Operational Consequences of United States 2025 Tariff Policies on Hybrid Transmission Supply Chains and Cost Structures

As the United States implemented new tariff measures on hybrid transmission components in early 2025, supply chain stakeholders encountered a new set of cost and planning challenges. With levies applied to imported planetary gear sets and power electronics, manufacturers reassessed their sourcing strategies and manufacturing footprints. Those with vertically integrated component production found themselves better insulated from tariff-induced cost pressures, whereas those relying on specialized overseas suppliers faced heightened procurement costs and extended lead times.

In reaction, several OEMs and tier-one suppliers expedited local assembly initiatives and formed strategic joint ventures to secure domestic supply channels. This strategic pivot not only mitigated financial exposure but also strengthened in-country capabilities to service the growing hybrid vehicle fleet. Meanwhile, development roadmaps adjusted to prioritize modular designs that could absorb cost variances without compromising performance targets. The net outcome is a hybrid transmission market that has become more resilient, yet also more regionally segmented, as industry players balance tariff dynamics with the imperative to maintain competitive total cost of ownership.

Unveiling Critical Market Segmentation Dynamics Through Transmission, Hybrid Integration, Vehicle Configuration, Drive Layout, Component, and End-user Perspectives

Understanding the market’s nuanced dynamics requires examining how different transmission architectures influence strategic choices. The relative simplicity of parallel configurations appeals to cost-focused applications, whereas power-split and series-parallel designs offer refined energy management through seamless blending of electric and mechanical power. Pure series layouts, while less common, showcase the potential for compact, electric-focused drivetrains. Hybrid types further differentiate market movement: full hybrids emphasize maximal fuel savings and electric-only driving, mild hybrids strike a balance between cost and efficiency, and plug-in hybrids deliver extended electric range for urban mobility.

Vehicle type introduces another dimension of complexity. Passenger cars leverage hybrid transmissions to meet stringent emissions standards and consumer expectations for smooth acceleration, while commercial vehicles prioritize torque, durability, and lifecycle cost reductions. Drive layout segmentation influences the integration of traction and distribution systems: front-wheel-drive models benefit from packaging efficiencies, rear-wheel-drive setups retain performance heritage, and all-wheel-drive variants deliver superior traction for diverse conditions. Component specialization also shapes competitive advantage. Clutch packs, electric motors, and planetary gear sets demand precise engineering tolerances, whereas power electronics must excel in thermal management and control algorithms. Finally, the distinction between aftermarket and OEM channels underscores how end user preferences and service networks drive product design and aftermarket support strategies.

This comprehensive research report categorizes the Automotive Hybrid Transmission System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Transmission Type

- Hybrid Type

- Vehicle Type

- Drive Layout

- Component Type

- End User

Delineating Regional Growth Catalysts and Adoption Trends Across Americas, EMEA, and Asia-Pacific Hybrid Transmission Markets Under Varying Policy and Infrastructure Conditions

Regional market trajectories for hybrid transmissions are shaped by policy incentives, infrastructure readiness, and consumer acceptance curves. In the Americas, electrification targets and federal support programs have accelerated adoption in passenger and light commercial segments. Industry players are scaling up production of parallel and series-parallel systems domestically, while expanding service networks to support aftermarket growth. Meanwhile, North American drive layouts remain weighted toward front-wheel-drive platforms, although performance and all-terrain variants are gaining traction in premium and specialty niches.

Across Europe, the Middle East, and Africa, stringent carbon regulations and urban low-emission zones are catalyzing a shift toward full-hybrid and plug-in architectures. Embedded local content requirements have prompted several global suppliers to establish manufacturing hubs within the region, particularly for power electronics and planetary gear assemblies. In Asia-Pacific, government subsidies and robust EV infrastructure deployment have created fertile ground for advanced power-split and series configurations. Japanese and South Korean OEMs continue to lead with innovations in electric motor integration, while emerging markets in Southeast Asia are beginning to adopt mild hybrid solutions due to lower initial cost and simpler integration.

This comprehensive research report examines key regions that drive the evolution of the Automotive Hybrid Transmission System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Competitive Landscape of Hybrid Transmission Systems Through Technological Excellence and Strategic Collaborations

The competitive landscape of hybrid transmissions is dominated by companies that combine engineering expertise with global manufacturing scale. Leading automotive suppliers have invested heavily in research partnerships with universities and advanced materials firms to reduce weight and improve thermal performance. Several top-tier OEMs have internalized key transmission functions, leveraging proprietary control software to differentiate their hybrid offerings. Collaboration between traditional manufacturers and new entrants in the software and power electronics sectors has also intensified, creating cross-industry alliances that accelerate system integration.

Companies in this space are pursuing diverse routes to market leadership. Some focus on modular, platform-agnostic transmission systems that can be easily adapted across multiple vehicle lines, while others emphasize bespoke solutions optimized for flagship models. Strategic acquisitions of electric motor and power electronics startups have enabled legacy suppliers to bolster their technology portfolios and expand IP holdings. As the market evolves, partnerships between OEMs, tier-one suppliers, and regional assemblers will continue to define the competitive playing field, with success hinging on both technological differentiation and robust supply chain networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Hybrid Transmission System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Allison Transmission Holdings, Inc.

- BorgWarner Inc.

- Dowlais Group plc

- Eaton Corporation plc

- Hyundai Transys Inc.

- JATCO Ltd.

- Magna International Inc.

- Ricardo plc

- Schaeffler AG

- ZF Friedrichshafen AG

Formulating Actionable Strategic Imperatives for Industry Leaders to Capitalize on Hybrid Transmission Advancements and Regulatory Evolutions for Competitive Advantage

Industry leaders must prioritize flexibility and resilience as they navigate shifting policy regimes and dynamic consumer demand. Companies should integrate scenario planning into their product roadmaps, ensuring that modular transmission platforms can accommodate varying electrification levels and regional component sourcing requirements without extensive redesign. Strategic alliances with local assembly partners and power electronics manufacturers can mitigate tariff exposure, while joint development agreements with software firms will be critical for enhancing system-level intelligence and predictive maintenance capabilities.

Moreover, investing in digital engineering tools and virtual validation processes will shorten development cycles and reduce cost overruns. At the same time, companies should cultivate aftermarket service ecosystems by offering over-the-air transmission diagnostics and performance updates, thereby generating new revenue streams and strengthening customer loyalty. By adopting these actionable imperatives, decision-makers can position their organizations to capitalize on the rapid evolution of hybrid powertrains, turning challenges into competitive advantages.

Detailing the Rigorous Research Methodology Encompassing Data Collection, Expert Consultations, and Analytical Frameworks Underpinning the Hybrid Transmission Market Study

This analysis combines comprehensive secondary research with targeted primary data collection to ensure robust findings. Secondary inputs include industry announcements, technical white papers, and policy publications from regulatory bodies, which provided baseline context on technology trends and tariff frameworks. Primary research involved structured interviews with OEM powertrain engineers, tier-one supplier executives, and regional policy experts to validate insights and uncover emerging priorities. Triangulation of these sources ensures that conclusions reflect both technical feasibility and market realities.

Analytical methods encompass technology readiness assessments, value chain mapping, and sensitivity analysis to evaluate the impact of tariff scenarios on cost structures. Market segmentation was derived by synthesizing product portfolios with end-user adoption patterns, while regional evaluations accounted for infrastructure capacity and regulatory incentives. Quality control procedures, including peer reviews by subject matter experts and iterative feedback loops with in-house analysts, reinforce the credibility of the report’s strategic recommendations and core conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Hybrid Transmission System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Hybrid Transmission System Market, by Transmission Type

- Automotive Hybrid Transmission System Market, by Hybrid Type

- Automotive Hybrid Transmission System Market, by Vehicle Type

- Automotive Hybrid Transmission System Market, by Drive Layout

- Automotive Hybrid Transmission System Market, by Component Type

- Automotive Hybrid Transmission System Market, by End User

- Automotive Hybrid Transmission System Market, by Region

- Automotive Hybrid Transmission System Market, by Group

- Automotive Hybrid Transmission System Market, by Country

- United States Automotive Hybrid Transmission System Market

- China Automotive Hybrid Transmission System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Illuminate the Future Trajectory of Hybrid Transmission Innovation, Market Dynamics, and Strategic Growth Opportunities

The convergence of electrification mandates, advanced materials, and digitalization is ushering in a new chapter for automotive transmissions. Hybrid systems no longer represent a transitional technology, but rather a cornerstone of sustainable mobility strategies that reconcile performance with emission goals. The analysis highlights how transmission architecture innovation, supply chain resilience amid tariff fluctuations, and targeted segmentation strategies coalesce to define a highly competitive environment.

Looking ahead, the capacity to deliver modular, software-enhanced transmission systems at scale will distinguish market leaders from followers. Regional dynamics will continue to influence investment patterns, with infrastructure maturity and policy structures shaping the pace of adoption. By synthesizing these findings, stakeholders can chart clear pathways for product development, strategic alliances, and market entry, ensuring they remain at the forefront of the fast-evolving hybrid transmission sector.

Seize Strategic Insight: Connect with Ketan Rohom to Secure Comprehensive Hybrid Transmission Market Intelligence Tailored for Executive Decision-making

Engage directly with Ketan Rohom to unlock a comprehensive, data-driven report that empowers you to navigate complex market scenarios, benchmark against peers, and refine your strategic roadmap. Your next competitive edge in hybrid transmission systems is just a conversation away. Reach out to secure tailored insights, accelerated market entry tactics, and exclusive forecasts designed to elevate your decision-making and drive lasting business growth.

- How big is the Automotive Hybrid Transmission System Market?

- What is the Automotive Hybrid Transmission System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?