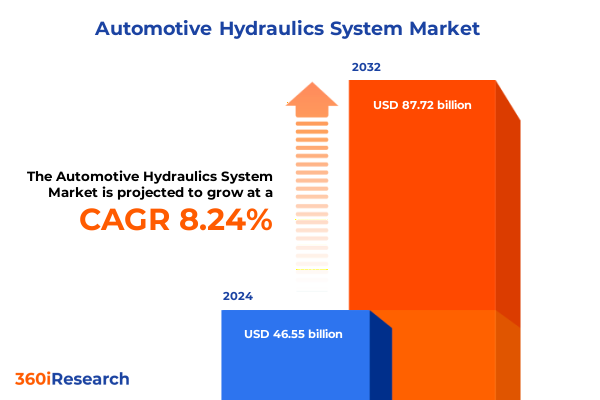

The Automotive Hydraulics System Market size was estimated at USD 49.66 billion in 2025 and expected to reach USD 52.97 billion in 2026, at a CAGR of 8.46% to reach USD 87.72 billion by 2032.

Pioneering the Fundamental Role of Automotive Hydraulic Systems in Ensuring Safety, Efficiency, and Comfort across Evolving Mobility Platforms

Automotive hydraulic systems serve as the silent workhorses behind critical vehicle functions, translating fluid power into paramount braking, steering, and suspension performance. By harnessing the incompressibility of hydraulic fluid, these systems deliver precise force multiplication and modulation, underpinning the reliability and safety that modern mobility demands. In the context of ever-evolving regulatory frameworks and consumer expectations, hydraulic architectures remain integral to maintaining robust vehicle dynamics and occupant protection.

As the automotive industry accelerates toward electrification and autonomy, hydraulic subsystems are undergoing unprecedented transformations. Electromechanical and electrohydraulic innovations are converging to reduce energy consumption, enhance responsiveness, and introduce software-defined control strategies. This introductory overview lays the foundation for understanding how traditional hydraulic principles are being revitalized by cutting-edge technologies to meet the stringent performance, efficiency, and sustainability criteria of next-generation vehicles.

Revolutionary Technological and Regulatory Forces Redefining Automotive Hydraulic Architectures for Electrification, Autonomy, and Enhanced Vehicle Dynamics

Automotive hydraulics are at the epicenter of a sweeping technological renaissance driven by electrification, autonomous driving capabilities, and digital integration. Electrohydraulic by-wire systems are supplanting centralized fluid circuits, enabling localized pressure generation, higher operational pressures, and lighter piping solutions. These advances yield faster response times and finer actuation control, addressing both performance targets and the weight-reduction imperatives of electric vehicle platforms.

Concurrently, adaptive and active suspension innovations are reshaping ride quality and handling through real-time damping adjustments. Sensor-driven electrohydraulic dampers communicate with advanced driver assistance systems to anticipate road irregularities, optimizing comfort and stability. Furthermore, AI-enabled predictive control algorithms in power steering systems are enhancing driver assistance features like lane centering and automated parking. Together, these transformative forces are redefining hydraulic subsystems as intelligent, software-governed assets rather than purely mechanical constructs.

Assessing the Comprehensive Impact of 2025 Section 232 Tariffs on U.S. Imports of Critical Hydraulic Components in the Automotive Industry

In March 2025, the U.S. government invoked Section 232 of the Trade Expansion Act to impose a 25% ad valorem tariff on imported automobiles and specified parts, including hydraulic components, effective April 3 and May 3 for vehicles and parts respectively. This measure targets national security concerns by incentivizing domestic production, but simultaneously elevates cost structures for import-dependent manufacturers and tier suppliers.

To mitigate the tariff burden, the Department of Commerce introduced an offset process in June 2025, enabling eligible U.S. auto assemblers to apply for duty reductions based on domestic production volumes. Under this program, manufacturers can secure offsets equivalent to a portion of the aggregate MSRP value of vehicles assembled domestically, thereby retaining competitiveness while fostering localized supply chains. The cumulative effect of these policies is reshaping sourcing strategies and accelerating investments in North American hydraulics manufacturing capabilities.

Unveiling Key Market Segmentation Insights Illuminating Product, Technology, Vehicle, and Sales Channel Trends Shaping Automotive Hydraulic Systems

The automotive hydraulics market is dissected through the lens of product type, technology, vehicle classifications, and sales pathways. Product insights reveal differentiated demands across braking, steering, and suspension assemblies; disc and drum configurations dictate fluid routing and actuation complexity, while electrohydraulic and traditional hydraulic steering constructs influence overall system integration and digital compatibility. Moreover, hydraulic struts and shock absorbers embody distinct design and performance criteria, catering to ride comfort and load management requirements.

Technological segmentation underscores the bifurcation between electrohydraulic steering solutions-characterized by high-pressure localized actuation and electronic control-and conventional hydraulic steering systems that rely on centralized pumps and hoses. This divide informs OEM selection criteria based on vehicle architecture and electrical architecture compatibility.

Vehicle type analysis distinguishes heavy commercial, light commercial, and passenger car segments, each presenting unique operating and regulatory demands. While commercial vehicles prioritize durability and load management, passenger cars increasingly emphasize energy efficiency and driver comfort, shifting hydraulic subsystem specifications accordingly.

Sales channel evaluation differentiates between OEM integration and aftermarket validation pathways. Original equipment manufacturers dictate early design-in requirements and technical standards, whereas aftermarket channels leverage modularity and cross-platform compatibility to support retrofit, repair, and upgrade scenarios.

This comprehensive research report categorizes the Automotive Hydraulics System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Vehicle Type

- Sales Channel

Critical Regional Dynamics Driving Automotive Hydraulic System Adoption across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics are driving varied adoption curves and innovation priorities across the Americas. North America is experiencing strengthened domestic manufacturing capabilities as tier suppliers and OEMs pivot investments in response to Section 232 duties. Government incentives and infrastructure funding are also stimulating localized production of hydraulic components, reinforcing supply chain resilience for U.S. and Mexican facilities.

In Europe, Middle East and Africa, stringent CO₂ and environmental regulations are compelling OEMs to deploy lightweight and energy-efficient hydraulic solutions. The European Union’s 2025 CO₂ targets and Euro 6 standards have catalyzed a surge in adaptive suspension technologies and compact electrohydraulic actuators, reflecting the region’s emphasis on sustainability and performance balance.

Across Asia-Pacific, robust automotive production in China, India, Japan, and South Korea is fueling demand for both conventional and electrified hydraulic systems. Government policies and trade incentives in key markets support burgeoning EV and hybrid vehicle programs, driving rapid scaling of high-pressure hydraulic pumps, valves, and accumulators designed for energy efficiency and modular assembly.

This comprehensive research report examines key regions that drive the evolution of the Automotive Hydraulics System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Developments and Innovation Strategies Shaping the Leading Players’ Portfolios in the Automotive Hydraulic Ecosystem

Leading global players are advancing hydraulic architectures to secure competitive differentiation. ZF Friedrichshafen AG’s introduction of carbon fiber-reinforced polymer shock absorbers underscores its drive toward lightweight solutions for EVs and performance vehicles, while KYB Corporation’s partnerships on magneto-rheological dampers and ECU integration showcase synergies between fluid power and autonomous control systems.

Innovative entrants such as Domin Limited are championing software-defined electrohydraulic suspension corners, achieving unprecedented valve reaction speeds and pressure precision. Their distributed actuation approach promises significant weight savings and energy efficiency gains, challenging incumbents to rethink centralized hydraulic layouts.

Meanwhile, Bosch Rexroth’s strategic alignment with HydraForce is shaping a unified compact hydraulics portfolio for mobile equipment, embedding digital valve controls and load-sensing technologies that enhance machine intelligence and modular integration. Their showcase at iVT Expo 2025 highlights load-holding valves and proportional relief solutions optimized for off-highway applications.

In the braking domain, Bosch’s hydraulic brake-by-wire system has successfully completed a 2,050-mile public-road test to the Arctic Circle, signaling the imminent market launch of fully redundant, pedal-less braking architectures. This milestone epitomizes the shift toward mechatronic safety domains and heralds widespread adoption of by-wire technologies by fall 2025.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Hydraulics System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Aisin Seiki Co., Ltd.

- Brembo S.p.A.

- Continental AG

- DENSO Corporation

- Eaton Corporation PLC

- Hitachi Astemo, Ltd.

- JTEKT Corporation

- Nexteer Automotive Corporation

- Parker-Hannifin Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Actionable Strategic Recommendations for Industry Leaders to Navigate Market Disruptions and Harness Emerging Hydraulic Technologies

Industry leaders should prioritize investments in electrohydraulic by-wire systems that decouple actuation nodes from centralized fluid reservoirs, thereby enabling modular, lighter, and more energy-efficient architectures. Collaborative partnerships with software developers will be essential to integrate predictive control algorithms and seamless OTA update capabilities into hydraulic subsystems.

To navigate tariff-induced cost pressures, executives must accelerate regional manufacturing initiatives and leverage available offset programs while securing preferential trade terms through strategic alliances. Proactive engagement with regulatory bodies can also facilitate timely inclusion of hydraulic components in free trade and domestic content policies.

Rigorous and Transparent Research Methodology Combining Primary Expert Insights and Secondary Data Triangulation for Robust Analysis

This analysis is underpinned by a rigorous blend of secondary research and primary expert consultations. Comprehensive data from government proclamations, industry press releases, technical papers, and market events were systematically reviewed to identify key trends and regulatory impacts. In parallel, structured interviews were conducted with senior R&D, product management, and supply chain executives across leading OEMs and tier suppliers to validate hypotheses and contextualize quantitative findings.

The research methodology incorporated data triangulation through cross-validation of diverse information streams, ensuring robust insights and minimizing bias. Where applicable, corroborating technical specifications and field trial data were analyzed to ascertain performance benchmarks. The synthesized output reflects an authoritative, multi-dimensional perspective designed to inform strategic decision-making in the dynamic automotive hydraulics sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Hydraulics System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Hydraulics System Market, by Product Type

- Automotive Hydraulics System Market, by Technology

- Automotive Hydraulics System Market, by Vehicle Type

- Automotive Hydraulics System Market, by Sales Channel

- Automotive Hydraulics System Market, by Region

- Automotive Hydraulics System Market, by Group

- Automotive Hydraulics System Market, by Country

- United States Automotive Hydraulics System Market

- China Automotive Hydraulics System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusive Perspectives Emphasizing the Strategic Imperatives and Collaborative Opportunities in the Future of Automotive Hydraulics

The evolution of automotive hydraulic systems is converging at the nexus of digitalization, electrification, and regulatory transformation. As fluid power subsystems transition toward software-defined, high-pressure architectures, stakeholders must embrace agile innovation models and value-chain realignment to maintain technological leadership. Continued emphasis on lightweight materials, adaptive control strategies, and localized production will define the competitive landscape.

In conclusion, harmonizing regulatory compliance, advanced engineering capabilities, and strategic partnerships will be imperative for organizations seeking to capitalize on the next wave of automotive mobility solutions. Proactive adaptation and investment in cutting-edge hydraulic technologies will unlock new performance paradigms, fortify supply chain resilience, and deliver sustainable value across vehicle platforms.

Connect with Ketan Rohom to Secure In-Depth Market Intelligence and Propel Strategic Decision Making in Automotive Hydraulics

Engage directly with Associate Director of Sales & Marketing Ketan Rohom to leverage tailored insights and strategic guidance essential for steering your business through the dynamic automotive hydraulics landscape. Reach out to discuss customized research packages, exclusive data access, and bespoke consulting services that will empower you to make informed decisions and capitalize on emerging opportunities. Secure your company’s competitive edge by obtaining the comprehensive market research report today and aligning your organization’s strategic roadmap with the latest industry intelligence.

- How big is the Automotive Hydraulics System Market?

- What is the Automotive Hydraulics System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?