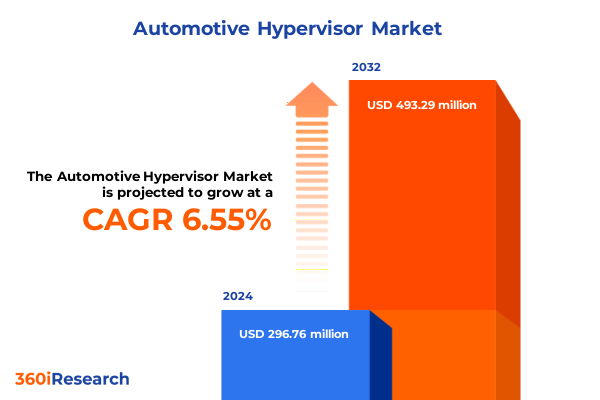

The Automotive Hypervisor Market size was estimated at USD 309.08 million in 2025 and expected to reach USD 325.06 million in 2026, at a CAGR of 6.90% to reach USD 493.29 million by 2032.

Navigating the Next Frontier in Vehicle Virtualization for Enhanced Safety Connectivity and Efficiency Through Automotive Hypervisor Technologies

In an era where software-defined vehicles are rapidly becoming the norm, the automotive hypervisor emerges as a foundational technology enabling the safe, efficient, and scalable virtualization of in-vehicle systems. By decoupling hardware from software functions, hypervisors create isolated execution environments for critical safety applications, infotainment services, and connectivity modules, all while minimizing the proliferation of legacy electronic control units. This architectural paradigm shift not only reduces system complexity and costs but also lays the groundwork for future enhancements in autonomous driving, over-the-air updates, and cross-domain orchestration. Consequently, stakeholders across the ecosystem-including original equipment manufacturers, semiconductor suppliers, and software developers-are intensifying their focus on hypervisor platforms that promise to harmonize diverse workloads under robust safety certifications.

As the automotive industry converges on centralized computing strategies, the ability to securely partition processing resources and ensure real-time responsiveness becomes paramount. The evolution of hypervisor technologies, from general-purpose virtualization layers to specialized real-time kernels compliant with stringent automotive safety standards, underscores the acceleration of innovation in this space. This introduction sets the stage for a deeper exploration of the transformative shifts redefining vehicle architectures, the impact of external policy forces such as tariffs, and the segmentation, regional, and competitive insights essential for informed decision-making. Transitioning from foundational concepts, the subsequent section will examine the key catalysts propelling the hypervisor landscape forward and the innovations reshaping tomorrow’s mobility solutions.

Disruptive Catalysts and Cutting-Edge Innovations Reshaping Automotive Virtualization and Driving a Paradigm Shift in Vehicle Software Architectures

The automotive software ecosystem is undergoing a profound metamorphosis driven by the need to manage ever-increasing computational demands while maintaining uncompromising safety and security standards. Central to this shift is the rise of domain controllers, which consolidate multiple functions-ranging from advanced driver assistance systems (ADAS) to infotainment-onto shared hardware platforms. As a result, hypervisors have evolved from basic virtual machine monitors to sophisticated real-time hypervisors that support hardware partitioning, memory isolation, and mixed-criticality workloads. This transition enables seamless coexistence of safety-critical applications and non-safety functions on the same system, eradicating silos of electronic control units and reducing both weight and power consumption.

Simultaneously, semiconductor advancements in system-on-chip (SoC) architectures offer integrated GPUs, AI accelerators, and high-speed interconnects, which complement hypervisor capabilities by accelerating compute-intensive tasks like sensor fusion and deep neural network inference. Open standards such as AUTOSAR Adaptive and Posix-compliant interfaces foster interoperability, allowing hypervisors to host containerized services and modular software components. Alongside technical enablers, the collaboration between traditional automotive suppliers and tech giants is catalyzing the development of turnkey solutions that deliver pre-certified hypervisors, middleware stacks, and development tools. Moving from isolated proof-of-concepts to large-scale pilot projects, manufacturers are increasingly validating end-to-end architectures in real-world environments, setting the stage for mass deployment.

In essence, the convergence of architectural consolidation, hardware innovation, and cross-industry partnerships marks a pivotal moment for automotive virtualization. As complexity escalates, the ability to orchestrate heterogeneous workloads through advanced hypervisor frameworks is not just an incremental improvement but a fundamental requirement for next-generation mobility. The following section delves into how external policy measures, specifically the 2025 United States tariffs, will influence these transformative trends and the broader supply chain dynamics.

Unraveling the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Automotive Hypervisor Supply Chains and Technology Adoption

The introduction of new tariffs by the United States in 2025 has injected a fresh layer of complexity into the global supply chain for automotive electronics, directly affecting the cost structure and sourcing strategies for hypervisor-enabled platforms. Key semiconductors, memory modules, and system-on-chip components imported from targeted regions now carry additional levies, prompting original equipment manufacturers to reassess their procurement and production footprints. As a result, there has been a noticeable uptick in nearshoring initiatives and strategic alliances with domestic foundries to mitigate exposure to external tariff shocks. This shift not only influences hardware pricing but also alters timelines for certification and integration, as localized manufacturing often requires requalification of components under varying environmental and functional safety standards.

Moreover, these tariffs have spurred increased negotiation leverage for domestic suppliers, accelerating investment in automotive-grade chip fabrication and advanced packaging technologies. Tier-1 integrators are responding by diversifying their supplier base, seeking multi-sourcing agreements for critical SoCs and memory devices to ensure continuity and cost predictability. While short-term headwinds include potential price inflation and extended lead times, the long-term effect may prove beneficial for regional resilience, incentivizing the establishment of robust ecosystems capable of supporting large-scale hypervisor deployment. Transitioning from dependency on a limited set of international suppliers to more geographically balanced supply chains can also foster innovation through closer collaboration between OEMs and regional technology partners.

Ultimately, while the immediate impact of the 2025 tariffs has introduced price volatility and logistical challenges, the reconfiguration of supply chains may yield a more agile and secure foundation for automotive virtualization. By compelling industry players to reevaluate sourcing, localize critical production, and strengthen partnerships with domestic semiconductor vendors, these policies could accelerate the maturation of hypervisor technologies and reinforce the strategic autonomy of the automotive sector.

Illuminating Critical Segmentation Perspectives Across Components Applications Vehicle Types Deployment Models and End Users for Strategic Clarity

A nuanced understanding of market segmentation reveals how different components, applications, and deployment models influence the adoption and evolution of automotive hypervisor solutions. On the component front, hardware forms the backbone of any virtualization platform, with electronic control units providing the deterministic compute units, memory modules ensuring data integrity, and system-on-chip designs integrating processing cores, accelerators, and security enclaves onto a single die. Complementing these are services tailored to seamless integration and ongoing maintenance, which are crucial for managing software updates and sustaining compliance with evolving safety standards. Within the software domain, application software delivers functional capabilities, middleware orchestrates communication and resource management, and operating systems establish the foundational environment where hypervisors operate.

When viewed through the lens of application use cases, ADAS emerges as a primary driver, demanding real-time partitioning and fail-safe mechanisms to support features like lane keeping, automated emergency braking, and adaptive cruise control. Simultaneously, body electronics virtualization offers opportunities to consolidate lighting controls, door modules, and climate systems, thereby enhancing diagnostic capabilities and reducing wiring complexity. Infotainment platforms, with their high-bandwidth multimedia streams and connectivity services, require hypervisors to enforce strict quality-of-service guarantees and security isolation to prevent cross-application interference. Powertrain systems further underscore the criticality of deterministic execution, as engine management and electric drive control necessitate precise timing and resource allocation.

Vehicle type also shapes hypervisor deployment patterns. In commercial vehicles, including buses, trucks, and vans, the emphasis on fleet management, telematics, and operational efficiency makes virtualization an attractive path for integrating telematics control units and driver assistance modules. Passenger cars, ranging from hatchbacks to sedans and SUVs, prioritize a blend of safety functions and user experience features, driving demand for consolidated compute architectures that deliver seamless over-the-air updates and personalized in-vehicle services. Deployment preferences oscillate between on-premise solutions, which facilitate localized testing and certification, and cloud-based platforms that offer remote diagnostics, software distribution, and continuous monitoring. Finally, the end-user perspective differentiates aftermarket enhancements, where retrofits and third-party add-ons require flexible hypervisor frameworks, from original equipment manufacturer programs that benefit from deep integration and pre-certified software stacks.

This comprehensive research report categorizes the Automotive Hypervisor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Vehicle Type

- Deployment Model

- End User

Discerning Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Automotive Hypervisor Markets

Regional dynamics exert a profound influence on how hypervisor technologies are adopted, refined, and monetized across global markets. In the Americas, a robust network of OEMs and Tier-1 suppliers, coupled with favorable government incentives for domestic semiconductor production, has accelerated investments in real-time hypervisors for next-generation vehicles. Collaborative initiatives between automotive manufacturers and leading chipmakers in the United States and Canada have fostered integrated hardware-software platforms that meet stringent functional safety regulations, creating a strong foundation for both passenger and commercial vehicle applications.

Across Europe, the Middle East, and Africa, a diverse regulatory landscape and emphasis on sustainability have guided the adoption of hypervisor platforms tailored to local priorities. European authorities’ rigorous homologation requirements and cybersecurity mandates have driven demand for hypervisor solutions that support comprehensive diagnostic capabilities and secure communication protocols. In the Middle East and Africa, urbanization trends and the expansion of public transportation networks have highlighted the need for virtualization frameworks that can be deployed in commercial fleets to improve operational efficiency and passenger safety. These markets often leverage partnerships with established European technology suppliers, ensuring compliance and interoperability across heterogeneous environments.

The Asia-Pacific region stands out for its rapid growth trajectory, underpinned by large domestic automotive industries in China, Japan, and South Korea, as well as aggressive investment in autonomous and connected vehicle initiatives. Government support for research and development, coupled with a vast ecosystem of semiconductor fabs and software development firms, has spurred the creation of localized hypervisor variants optimized for regional standards and use cases. Collaboration among carmakers, system integrators, and startup ventures has yielded innovative proof-of-concepts for smart mobility services, further reinforcing the strategic importance of virtualization in this dynamic market environment.

This comprehensive research report examines key regions that drive the evolution of the Automotive Hypervisor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Automotive Hypervisor Ecosystem With Competitive Differentiators and Alliances

The competitive landscape of automotive hypervisor providers is characterized by a mix of established software vendors, semiconductor incumbents, and emerging specialists, each leveraging distinct strengths to capture market share. Green Hills Software, with its INTEGRITY™-178 RTOS hypervisor, commands a leading position through its proven safety certifications and robust partitioning capabilities, making it a go-to choice for critical applications. BlackBerry’s QNX™ Hypervisor builds on a long lineage of automotive-grade operating systems, delivering a flexible environment for hosting mixed-criticality workloads alongside legacy QNX Neutrino processes. Wind River, with its VxWorks® Hypervisor, differentiates itself by offering deep integration with advanced development tools and cloud-based analytics, enabling seamless OTA updates and performance monitoring.

Semiconductor leaders like NVIDIA have introduced dedicated hypervisor extensions within their Drive Platforms, catering to AI-driven functionalities and high-throughput sensor processing. Meanwhile, Intel and NXP collaborate closely with automotive OEMs to embed virtualization layers directly within their processor architectures, optimizing resource allocation and security. Specialized integrators such as Elektrobit have developed modular hypervisor solutions that support rapid certification, while startups focus on niche segments like secure boot management and hardware-assisted isolation. This mosaic of participants underscores the richness of the ecosystem, where strategic alliances between software and hardware providers are increasingly prevalent, aligning roadmaps to deliver end-to-end virtualization stacks that meet evolving safety, security, and performance requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Hypervisor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BlackBerry Limited

- Elektrobit Automotive GmbH

- ETAS GmbH

- Green Hills Software, Inc.

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Lynx Software Technologies, Inc.

- OpenSynergy GmbH

- Sasken Technologies Ltd.

- Siemens AG

- SYSGO AG

- Wind River Systems, Inc.

Strategic Imperatives and Tactical Roadmaps Offering Industry Leaders Concrete Recommendations to Capitalize on Hypervisor Opportunities and Mitigate Risks

To capitalize on emerging opportunities and navigate potential risks in the evolving hypervisor landscape, industry leaders must adopt a multi-faceted approach that balances technological advancement with strategic foresight. Investing in scalable hypervisor frameworks that support mixed-criticality workloads can streamline software development lifecycles and expedite time-to-market for new vehicle platforms. Cultivating partnerships with semiconductor vendors ensures early access to next-generation processors optimized for virtualization, while joint certification efforts can reduce compliance overheads and accelerate deployment.

Moreover, embedding security by design within hypervisor architectures-through hardware-assisted isolation, secure boot mechanisms, and continuous monitoring-will be essential to satisfy increasingly stringent cybersecurity standards. Organizations should develop clear roadmaps for migrating from federated ECUs to domain controllers, aligning cross-functional teams to manage integration and maintenance services effectively. Monitoring geopolitical and policy developments, particularly tariff changes and trade agreements, enables supply chain resilience by identifying alternative sourcing strategies and nearshoring opportunities.

Finally, building a robust ecosystem of development partners, testing facilities, and service providers can support aftermarket implementations and over-the-air update capabilities. By prioritizing modular, updatable software stacks and leveraging data-driven insights from cloud-based analytics, companies can deliver personalized user experiences, optimize fleet performance, and unlock new revenue streams through software-enabled services. This holistic set of recommendations equips decision-makers with the strategic imperatives needed to harness the full potential of automotive hypervisor technologies.

Transparent Research Methodology Integrating Primary Interviews and Secondary Analysis to Ensure Rigorous Data Triangulation and Insight Accuracy

Our research methodology integrates a structured blend of primary and secondary data collection to guarantee comprehensive market coverage and rigorous analysis. Primary insights were garnered through in-depth interviews with key stakeholders, including senior executives at OEMs, Tier-1 integrators, semiconductor architects, and software specialists, providing firsthand perspectives on technology adoption, certification challenges, and strategic roadmaps. Secondary research involved a thorough review of industry publications, regulatory documents, patent filings, and academic whitepapers, ensuring that market dynamics are contextualized within both technical and policy frameworks.

Quantitative data was triangulated across multiple sources to validate trends and identify discrepancies, while qualitative assessments were peer-reviewed by subject matter experts to confirm accuracy and relevance. We employed scenario-based modeling to assess the implications of tariff shifts, regional regulatory changes, and hardware availability on supply chain strategies and product roadmaps. A final validation phase included workshops with industry practitioners to align findings with real-world experiences, ensuring that our conclusions and recommendations reflect current constraints and opportunities. This meticulous approach underpins the robustness of our analysis and supports confidence in the strategic insights provided.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Hypervisor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Hypervisor Market, by Component

- Automotive Hypervisor Market, by Application

- Automotive Hypervisor Market, by Vehicle Type

- Automotive Hypervisor Market, by Deployment Model

- Automotive Hypervisor Market, by End User

- Automotive Hypervisor Market, by Region

- Automotive Hypervisor Market, by Group

- Automotive Hypervisor Market, by Country

- United States Automotive Hypervisor Market

- China Automotive Hypervisor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications to Illuminate the Path Forward in Automotive Hypervisor Innovation and Market Adoption

The landscape of automotive hypervisor technology is rapidly maturing, driven by the imperative to consolidate vehicle electronics, enhance safety, and deliver sophisticated user experiences. Through this analysis, core trends emerge: the shift to domain controllers, the integration of AI accelerators within SoCs, and the adoption of real-time hypervisors designed for mixed-criticality applications. Policy measures such as the 2025 tariffs have added complexity but also spurred strategic realignments toward more resilient supply chains and local manufacturing partnerships.

Segmentation insights highlight the varying demands across components, applications, vehicle types, deployment models, and end users, underscoring the need for adaptable platforms that can deliver deterministic performance while supporting modular software ecosystems. Regional dynamics reveal distinct market drivers in the Americas, EMEA, and Asia-Pacific, suggesting tailored strategies for technology deployment and collaboration. Competitive analysis shows that established vendors and emerging specialists alike are forging alliances to offer integrated hardware-software stacks that balance performance, security, and compliance.

Ultimately, the convergence of technological innovation, regulatory evolution, and strategic partnerships sets the stage for hypervisors to become the linchpin of software-defined vehicles. Organizations that embrace these insights, invest in secure and scalable frameworks, and foster collaborative ecosystems will be best positioned to lead in the era of connected, autonomous, and electrified mobility.

Seize the Opportunity Gain Unparalleled Insight by Engaging with Ketan Rohom to Secure Your Comprehensive Automotive Hypervisor Market Research Report Today

To explore tailored hypervisor solutions and secure your comprehensive insight into the latest developments shaping vehicle virtualization, reach out today to Ketan Rohom, Associate Director of Sales & Marketing at your market intelligence partner. With a deep understanding of emerging technologies and regional dynamics, he can guide you through the specifics of our in-depth report, ensuring you receive the precise data and strategic foresight needed to outpace competitors. Don’t miss the opportunity to leverage expert analysis, validated forecasts, and actionable recommendations that will empower your organization to navigate regulatory challenges, optimize integration pathways, and seize transformative growth possibilities. Contact Ketan now to unlock the full potential of automotive hypervisor innovation and position your enterprise at the forefront of the software-defined vehicle era.

- How big is the Automotive Hypervisor Market?

- What is the Automotive Hypervisor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?