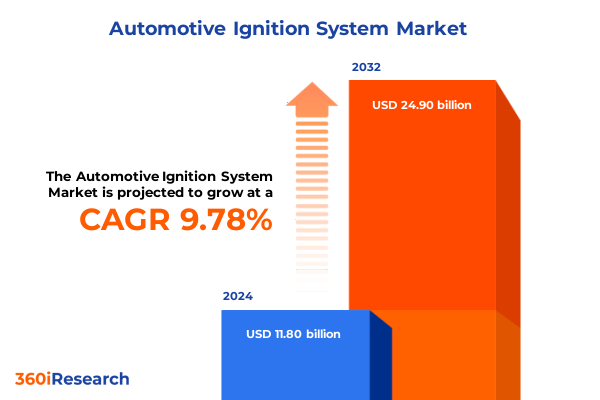

The Automotive Ignition System Market size was estimated at USD 12.80 billion in 2025 and expected to reach USD 13.90 billion in 2026, at a CAGR of 9.96% to reach USD 24.90 billion by 2032.

Exploring the dynamic factors reshaping the automotive ignition system market amid rising electrification, smart ignition advances, and regulatory changes

The automotive ignition system sector stands at the confluence of rapid technological evolution and shifting powertrain paradigms, making it a critical focus for industry leaders and suppliers alike. As internal combustion engines persist alongside hybrid and emerging alternative-fuel platforms, ignition components must balance legacy requirements with forward-looking performance benchmarks. Recent engineering advances have honed energy transfer precision, enabling reduced misfires and optimized combustion under increasingly stringent emission standards worldwide. Simultaneously, aftermarket channels continue to expand, driven by the growing global vehicle park and increasing average age of active fleets, underscoring the importance of robust service-life solutions.

Uncovering the transformational shifts driving the automotive ignition system landscape as digital integration, materials innovation, and sustainability converge

Emerging digital integration is redefining how ignition systems interact with engine management architectures. Modern ignition coils now encapsulate advanced sensors and communication modules, enabling continuous feedback to electronic control units and paving the way for predictive maintenance regimes. The rise of coil-on-plug configurations, which place the ignition coil directly atop each spark plug, exemplifies this shift, offering elevated ignition timing accuracy and minimizing energy losses associated with traditional spark plug wires. Concurrently, electrification trends are exerting dual pressures: while fully battery-electric vehicles bypass traditional ignition entirely, hybrid powertrains rely on refined ignition solutions to seamlessly transition between electric and combustion modes.

Examining the cumulative consequences of recent US automotive tariffs on ignition system supply chains, costs, and industry operations

The recent introduction of a 25% tariff on imported passenger vehicles in early April and on a broad array of automotive parts beginning May 3 has substantially reshaped cost structures for ignition system manufacturers and distributors. Supply chains, long optimized for lean cost management, now face immediate headwinds as duty costs are layered atop existing tariffs on steel, aluminum, and universal import levies. For parts such as spark plugs, ignition coils, and modules, the 25% duty has resulted in elevated landed costs, prompting tier-one and tier-two suppliers to reassess sourcing strategies and, in some cases, accelerate plans to relocate production capacities closer to end markets to mitigate future tariff exposure.

Revealing key insights across component, vehicle type, end use, and sales channel segments to inform strategic ignition system market decisions

Insights across the component segmentation reveal that ignition coils persist as the cornerstone technology, with designs evolving toward modular, coil-on-plug assemblies and intelligent variants that deliver real-time diagnostics to engine management systems. Spark plugs remain integral, with advances in precious-metal and ceramic formulations improving lifespan and high-temperature performance. Distributor caps and wires, though legacy elements in many engines, have been refined for resilience against electromagnetic interference and thermal cycling, while ignition modules benefit from tighter integration with vehicle network architectures.

This comprehensive research report categorizes the Automotive Ignition System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vehicle Type

- End Use

- Sales Channel

Unveiling regional dynamics in the ignition system market across Americas, Europe Middle East Africa, and Asia Pacific to guide targeted strategies

Across the Americas, robust aftermarket demand is fueled by a mature vehicle parc in North America and increasing two-wheeler penetration in Latin and South American markets. Aftermarket growth is further supported by a record-high average vehicle age in the United States, which elevates replacement part consumption and aftermarket service volumes. In Europe, Middle East & Africa, stringent Euro 7 and equivalent regional emission standards compel original equipment manufacturers to integrate advanced ignition strategies to meet compliant combustion profiles, while aftermarket channels benefit from wide dealership networks and rising consumer awareness of preventive maintenance.

This comprehensive research report examines key regions that drive the evolution of the Automotive Ignition System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading players shaping ignition system innovation, partnerships, and competitive positioning across the global automotive industry

Leading global players continue to fortify their positions through targeted R&D and strategic partnerships. Robert Bosch GmbH leverages its deep systems expertise to deliver high-voltage, compact coil designs and ion-sensing diagnostics that enhance combustion stability under lean-burn conditions citeturn1search1. Denso Corporation advances hybrid-centric ignition solutions optimized for rapid mode switching between electric and combustion drives, while Delphi Technologies focuses on smart ignition modules that integrate microcontroller-based controls for precise spark timing adaptations. In the aftermarket, NGK Spark Plugs U.S.A. Inc. and Standard Motor Products have expanded product catalogs with extensive coverage of coil-on-plug references, ensuring fitment for late-model vehicles and supporting near-universal service applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Ignition System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Continental AG

- Delphi Technologies, LLC

- DENSO CORPORATION

- Diamond Electric Holdings Co., Ltd.

- HELLA GmbH & Co. KGaA

- Hitachi Automotive Systems, Ltd.

- Marelli Holdings Co., Ltd.

- NGK SPARK PLUG CO., LTD.

- Robert Bosch GmbH

- TOKAI RIKA CO., LTD.

- Valeo SA

- Yamaha Motor Co., Ltd.

- YURA Corporation

Delivering actionable recommendations for industry leaders to navigate ignition system challenges and capitalize on emerging market opportunities

Industry leaders should prioritize the development of smart ignition assemblies with integrated diagnostics to meet evolving digital and emissions requirements while enhancing predictive maintenance capabilities. Mitigating tariff impacts can be achieved through nearshoring or reshoring critical component production, leveraging North American Free Trade frameworks or similar regional agreements to minimize exposure to blanket duties. OEMs and suppliers must also forge collaborative platforms to standardize communication protocols across ignition and powertrain control units, reducing integration costs and accelerating time to market.

Describing the research methodology encompassing data collection, primary interviews, triangulation, and validation processes supporting market insights

This study synthesizes secondary data from regulatory filings, trade journals, and automotive technology publications with primary insights gathered through structured interviews with senior executives at OEM powertrain divisions, ignition system suppliers, and leading aftermarket distributors. Quantitative data points were triangulated against publicly disclosed financial reports and industry association databases to ensure accuracy. Additionally, end-use perspectives were validated through dealer network surveys across major regions. Rigorous data cleaning and consistency checks underpin the analysis, providing a transparent methodology framework supporting the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Ignition System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Ignition System Market, by Component

- Automotive Ignition System Market, by Vehicle Type

- Automotive Ignition System Market, by End Use

- Automotive Ignition System Market, by Sales Channel

- Automotive Ignition System Market, by Region

- Automotive Ignition System Market, by Group

- Automotive Ignition System Market, by Country

- United States Automotive Ignition System Market

- China Automotive Ignition System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing critical findings and strategic imperatives defining the automotive ignition system market’s present trajectory and future evolution

The findings underscore an ignition system market in transition, driven by the dual currents of technological advancement and shifting powertrain architectures. While conventional combustion platforms retain importance, hybrid and connected vehicle demands are redirecting R&D toward smart, integrated ignition solutions. Meanwhile, external pressures such as trade policy changes and regulatory tightening continue to influence supply chain designs and cost management strategies. Companies that balance innovation with agility in sourcing and production will be best positioned to capture value in this evolving landscape.

Encouraging engagement with Ketan Rohom to secure key insights and guidance by purchasing the in-depth automotive ignition system market research report

To explore this comprehensive analysis further and gain direct access to the detailed market data, strategic insights, and actionable recommendations presented in this research, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with him will provide tailored guidance, facilitate your specific queries about the automotive ignition system space, and ensure you secure the in-depth findings that can drive your organization’s strategic decisions. Contacting Ketan today is the first step toward arming your team with the market intelligence necessary to stay ahead in an increasingly competitive environment.

- How big is the Automotive Ignition System Market?

- What is the Automotive Ignition System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?