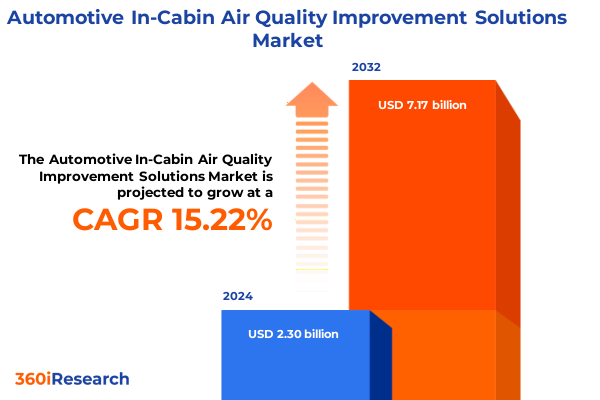

The Automotive In-Cabin Air Quality Improvement Solutions Market size was estimated at USD 2.64 billion in 2025 and expected to reach USD 3.02 billion in 2026, at a CAGR of 15.32% to reach USD 7.17 billion by 2032.

Exploring the Critical Role of In-Cabin Air Quality Solutions Amid Rising Health Concerns and Technological Advancements in the Automotive Industry

Over the past decade, growing public awareness of air pollution hazards and mounting evidence linking exposure to vehicle cabin contaminants to respiratory and cardiovascular ailments have propelled in-cabin air quality from a peripheral concern to a central focus for automakers and suppliers alike. Modern vehicles increasingly transport occupants through densely polluted urban corridors, where fine particulate matter (PM2.5), volatile organic compounds (VOCs), pollen, and microbial pathogens can accumulate within enclosed interiors. As a result, proactive measures to safeguard occupant health have gained prominence at both the consumer and regulatory levels, driving demand for robust solutions that not only remove airborne particulates but also neutralize chemical and biological threats.

Simultaneously, the automotive industry is undergoing a profound transformation toward electrification, connectivity, and autonomous systems. These shifts create novel opportunities for integrated air management strategies that leverage advanced sensors, real-time data analytics, and on-demand purification technologies. OEMs are now embedding intelligent air quality monitoring suites within vehicle control systems, enabling dynamic adjustment of filtration and purification protocols based on external conditions and passenger preferences. Moreover, collaborations between automotive tier-one suppliers and specialized filtration and purification innovators have intensified, reflecting a growing ecosystem of cross-sector partnerships.

This executive summary provides a comprehensive introduction to the emerging landscape of in-cabin air quality improvement solutions, outlining transformative trends, trade policy implications, segmentation insights, and regional dynamics. Subsequent sections delve into the impact of recent United States tariffs on supply chains, dissect key market segments, profile leading industry players, and offer actionable recommendations for stakeholders seeking to optimize in-cabin air safety strategies in this evolving automotive ecosystem.

Unveiling the Paradigm Shifts Reshaping In-Cabin Air Quality Solutions Through Electrification, Connectivity, and Sustainability Drivers in Modern Vehicles

In the wake of electrification, the traditional under-hood packaging constraints have shifted, granting designers greater freedom to integrate sophisticated air treatment modules without impeding powertrain considerations. EV platforms, by virtue of reduced engine compartment complexity, enable the seamless incorporation of multi-stage filtration and advanced purification technologies such as UV-C sterilization and ionization. Coupled with real-time air quality sensing networks, these systems now adapt ventilation rates and purification intensity to match ambient pollutant levels and specific contaminant profiles, thereby ensuring optimized cabin environments under diverse driving conditions.

Advanced connectivity and data analytics are further reshaping the in-cabin air management paradigm. Connected vehicles feed continuous telemetry back to centralized analytics platforms, empowering fleet operators, ride-hailing services, and private vehicle owners to benchmark air quality performance and anticipate maintenance intervals for filters and UV lamps. Meanwhile, emerging autonomous vehicle architectures place heightened emphasis on interior environmental quality as occupants transition from active drivers to passive passengers. In shared mobility scenarios, rapid air sanitization between passenger cycles has become a critical differentiator to shore up consumer confidence.

Lastly, evolving sustainability mandates and consumer preferences are catalyzing a shift toward eco-friendly materials and energy-efficient purification processes. Lightweight filter media and low-power UV-C modules align with broader OEM decarbonization goals, while recyclable and bio-based filter components reduce lifecycle environmental footprints. Collectively, these technological and institutional transformations are converging to fuel a new generation of intelligent, resilient in-cabin air quality solutions that seamlessly fuse health, comfort, and operational efficiency.

Assessing the Impact of New United States Tariffs in 2025 on Supply Chains, Cost Structures, and Innovation in In-Cabin Air Quality Systems

Since early 2025, the United States’ revised tariff schedules have introduced targeted duties on select imported automotive components and specialty filter materials, reshaping cost structures across in-cabin air quality solution supply chains. New levies on activated carbon substrates and advanced sensor modules sourced from key overseas manufacturing hubs have intensified margins pressures for both OEMs and tier-one suppliers. Concurrently, heightened Section 301 duties on certain filtration assemblies and photolytic sterilization equipment have compelled stakeholders to reassess their global procurement strategies in favor of closer-to-home or diversified small-batch sourcing arrangements.

In response to these trade policy shifts, numerous manufacturers are accelerating nearshoring initiatives and forging strategic alliances with domestic material producers to mitigate exposure to import tariffs and border delays. These moves carry multiple cascading effects: supply chain resilience is strengthened through reduced logistical complexity and lead-time volatility, yet initial capital outlays for establishing local production lines and validating new suppliers have risen. Moreover, some innovative purification technologies that previously relied on specialized foreign exchange partnerships are now undergoing recalibrations, as the incremental cost of cross-border components exceeds entry-level breakeven thresholds.

Looking forward, the cumulative impact of United States tariff adjustments in 2025 underscores the critical importance of agile sourcing strategies and flexible manufacturing footprints. Industry players that proactively engage in dual-sourcing frameworks, regional supplier development, and lean inventory optimization will be better positioned to weather policy-driven cost fluctuations while sustaining investments in next-generation in-cabin air quality enhancements.

Revealing How Product Categories, Technologies, Distribution Routes, Vehicle Classes, and Usage Scenarios Define In-Cabin Air Quality Market Dynamics

Understanding nuanced product category distinctions is fundamental to tailoring solutions that resonate with diverse automotive requirements. A clear demarcation emerges between air purification systems designed to neutralize chemical and microbial threats through ionizers, ozone generators, and UV-C sterilization, and air quality monitoring systems that continuously track volatile organic compounds, particulates, and humidity levels. Filtration assemblies further differentiate offerings by integrating activated carbon filters for odour and VOC control, combination filters that blend multiple media for broad-spectrum protection, and HEPA elements to capture ultra-fine particulates, all while traditional HVAC modules maintain baseline airflow and temperature management.

Equally instructive are the technology and distribution channel lenses. Filtration technology forms the backbone of particulate removal, whereas purification technology layers in biological and chemical neutralization, and sensing technology provides the real-time feedback loops essential for adaptive control. These technology streams interface differently with offline retail ecosystems, where in-vehicle hardware upgrades and professional service interventions dominate, and online retail channels, which facilitate direct-to-consumer peripheral devices, replacement filters, and remote diagnostics subscriptions.

Segmentation by vehicle class and application adds another dimension of granularity. Commercial vehicle operators often prioritize modular retrofit kits and ruggedized monitoring platforms to meet fleet health and regulatory compliance needs, while passenger car drivers value seamless integration, aesthetic design, and digital connectivity features. Use cases split between air quality enhancement-focused on active purification and filtration-and air quality monitoring-emphasizing data-driven insights and predictive maintenance-help stakeholders align product roadmaps with end-user demands and regulatory imperatives.

This comprehensive research report categorizes the Automotive In-Cabin Air Quality Improvement Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- Vehicle Type

- Application

Uncovering Regional Nuances in In-Cabin Air Quality Evolution with Distinct Trends Emerging Across Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, the United States leads the trajectory for in-cabin air quality advancement, driven by stringent regulations under the Environmental Protection Agency and California Air Resources Board that increasingly treat cabin environment as a component of vehicular emissions compliance. OEMs headquartered in North America are incorporating multi-stage filtration and advanced sensor arrays as standard or optional equipment in passenger vehicles, while retrofit demand for ride-hailing and fleet operators has surged in tandem with heightened consumer health consciousness. Meanwhile, Canadian automakers emphasize cold-climate considerations, optimizing HVAC dehumidification and purification modules to combat microbial proliferation in colder northern regions.

Across Europe, the Middle East, and Africa, the European Union’s exacting air quality directives and expanding urban low-emission zones in major cities have catalyzed the integration of intelligent in-cabin management systems in both premium and mass-market segments. In Western Europe, partnerships between automotive OEMs and specialized filter manufacturers underscore a collaborative ecosystem geared toward next-generation materials and digital air quality diagnostics. Conversely, rapid infrastructure growth in the Middle Eastern Gulf states is giving rise to bespoke solutions designed to address high dust loads and temperature extremes, while South Africa’s urban centers are witnessing growing interest in modular aftermarket purification kits.

In the Asia-Pacific region, escalating urban air pollution and evolving national vehicle standards are forging a robust market for in-cabin air quality technologies. China’s Ministry of Ecology and Environment has introduced guidelines that prompt passenger car manufacturers to incorporate particulate sensors and self-cleaning filter systems, while Japan’s focus on micro-allergen control has spurred UV-C sterilization integration. India’s burgeoning automotive sector is also charting a course toward greater cabin health awareness, with an array of localized filter media innovations emerging to meet diverse climatic and air quality challenges.

This comprehensive research report examines key regions that drive the evolution of the Automotive In-Cabin Air Quality Improvement Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Driving Innovation, Strategic Collaborations, and Competitive Positioning in the In-Cabin Air Quality Improvement Landscape

A number of established component suppliers are shaping the competitive contours of the in-cabin air quality arena through expansive product portfolios and global manufacturing footprints. Denso and Robert Bosch GmbH leverage decades of automotive HVAC expertise to deliver integrated multi-stage filtration and sensor systems, with Bosch advancing its Bluehorizon sensor modules that seamlessly interface with vehicle electronics. Mann+Hummel has similarly cemented its leadership in filter media innovation, introducing novel activated carbon composites and combination filter architectures optimized for minimal airflow resistance and enhanced contaminant retention.

Specialized purification and monitoring technology providers are also stepping into the fray, carving out niches in ozone generation, UV-C sterilization, and intelligent data analytics. Emerging firms such as Camfil and Life Savers Inc. are collaborating with vehicle OEMs and fleet operators to pilot real-time air quality monitoring platforms, while smaller startups are focusing on modular retrofit pods and subscription-based filter replacement services. These strategic collaborations and joint ventures not only accelerate time-to-market but also foster co-innovation across the value chain, blending automotive and life-science competencies.

On the OEM front, automakers are increasingly internalizing air quality solution development as a differentiator in premium segments and as a compliance strategy in regulated markets. Mercedes-Benz has introduced its air filtration plus package with advanced sensor fusion and air recirculation control, while Tesla’s integrated HEPA-grade filtration systems have set benchmarks for particulate capture efficiency in electric vehicles. Likewise, Hyundai Motor Company is investing in in-house research on anti-allergen cabin coatings and UV-C sterilization modules as part of its smart mobility vision. These initiatives highlight a blurring of traditional supplier-OEM boundaries and underscore the imperative for continuous innovation in the cabin air quality space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive In-Cabin Air Quality Improvement Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADA Electrotech (Xiamen) Co., Ltd.

- Air International Thermal Systems

- Amphenol Corporation

- Axetris AG

- CabinAir Sweden AB

- Continental AG

- Crispify Ltd.

- DENSO Corporation

- Eberspächer Group GmbH & Co. KG

- Ford Motor Company

- Freudenberg SE

- Hanon Systems

- Mahle GmbH

- MANN+HUMMEL International GmbH & Co. KG

- Marelli Holdings Co., Ltd.

- Paragon Robotics, LLC

- Prodrive Technologies B.V.

- Purafil, Inc. by Filtration Group Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- Sensirion AG

- Toyota Industries Corporation

- Valeo S.A.

Crafting Targeted Strategic Imperatives for Industry Leaders to Accelerate Adoption, Partnerships, and Technological Excellence in In-Cabin Air Quality Markets

The growing complexity of in-cabin air quality dynamics calls for a multipronged strategy that balances technological innovation with market agility. Industry leaders should prioritize investments in advanced sensor fusion and machine learning algorithms to refine predictive maintenance models, enabling proactive filter change alerts and optimizing purification cycles in real time. By integrating these capabilities into vehicle telematics suites, manufacturers can deliver differentiated value that resonates with health-conscious consumers and fleet operators alike.

Furthermore, forging strategic partnerships across material science research institutes, digital health startups, and ecosystem players can accelerate the co-development of next-generation filter media and sterilization modules. Collaborative research consortia should be established to explore emerging purification techniques such as plasma catalysis and photocatalytic oxidation, while pooled data sharing agreements can deepen understanding of region-specific pollutant profiles, informing localized product customization.

To mitigate policy-induced cost pressures and supply chain volatility, companies must adopt hybrid sourcing frameworks that leverage both regional production hubs and diversified global suppliers. Lean inventory management and just-in-time assembly processes can help curb tariff liabilities and reduce working capital needs, particularly for high-value components like UV-C lamps and ozone generators. Scaling modular manufacturing lines will also enable rapid configuration shifts to respond to evolving regulatory mandates.

Finally, overt engagement with regulatory bodies and standards organizations is imperative to shape forthcoming cabin air quality guidelines and ensure interoperability of sensor and purification technologies. By participating in air quality standardization committees and sharing performance data, industry stakeholders can influence policy formation and foster aligned compliance pathways, ultimately driving trustworthy, science-backed solutions into mainstream automotive applications.

Detailing a Robust Research Methodology Leveraging Primary Interviews, Secondary Data Analysis, and Rigorous Validation Techniques to Ensure Report Accuracy

A rigorous, multi-stage research framework underpins the insights presented in this report. Initially, an exhaustive secondary research phase was conducted, encompassing academic journals, patent registries, regulatory publications, and relevant white papers to map the current landscape of in-cabin air quality technologies and identify emerging innovation trends. This foundational review informed the development of a comprehensive data repository on industry stakeholders, technology pathways, and regulatory frameworks across major automotive markets.

Building on secondary findings, an extensive primary research program was executed through structured interviews and surveys with key stakeholders, including executives at OEMs, tier-one suppliers, specialized technology providers, and fleet operators. These engagements provided qualitative and quantitative perspectives on strategic priorities, technology adoption barriers, and regional market nuances. Interview insights were systematically coded to extract thematic patterns related to supply chain dynamics, partnership ecosystems, and innovation roadmaps, thereby enriching the analytical depth of subsequent segmentation and competitive assessments.

To ensure methodological robustness, a triangulation approach was embraced whereby primary feedback was cross-validated against secondary data and publicly disclosed information, such as company filings and product launch announcements. Rigorous data validation routines, including consistency checks and peer reviews, were undertaken to uphold accuracy and objectivity. Finally, narrative synthesis and expert panel deliberations were employed to distill actionable recommendations and refine the report’s strategic imperatives, guaranteeing that the final findings align with the real-world needs of automotive industry decision-makers and technology innovators.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive In-Cabin Air Quality Improvement Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Product Type

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Technology

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Distribution Channel

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Vehicle Type

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Application

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Region

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Group

- Automotive In-Cabin Air Quality Improvement Solutions Market, by Country

- United States Automotive In-Cabin Air Quality Improvement Solutions Market

- China Automotive In-Cabin Air Quality Improvement Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Strategic Imperatives to Illuminate the Future Trajectory of In-Cabin Air Quality Enhancement in the Evolving Automotive Ecosystem

As the automotive industry navigates toward a future defined by electrification, autonomous mobility, and heightened health consciousness, in-cabin air quality improvement solutions have emerged as a critical pillar of value creation. Stakeholders across the value chain, from filter media specialists to OEM innovation teams, are aligning their strategic imperatives to deliver cleaner, safer, and more comfortable cabin environments. The convergence of advanced purification technologies, real-time sensing capabilities, and data-driven maintenance paradigms promises to reshape traditional approaches to occupant wellbeing and regulatory compliance.

Regional dynamics and tariff landscapes have underscored the necessity for flexible sourcing architectures and localized manufacturing footprints, while segmentation analyses reveal that differentiated product strategies tailored to vehicle type, application, and distribution channels can unlock new revenue streams and strengthen competitive positioning. Meanwhile, collaborative ventures between material science researchers, digital health startups, and automotive system integrators are accelerating the translation of cutting-edge scientific advances into practical, scalable solutions.

Looking ahead, the pace of innovation will likely intensify as consumer demand for personalized cabin environments converges with emerging sustainability mandates. Industry leaders that proactively embrace cross-sector partnerships, engage with regulatory bodies on standard setting, and leverage predictive analytics for maintenance optimization will be best equipped to capture the upside of this dynamic market. Ultimately, those organizations that fuse technological excellence with operational resilience will define the next generation of in-cabin air quality leadership.

Inviting You to Connect with Ketan Rohom for Exclusive Access to In-Depth In-Cabin Air Quality Solutions Market Research Findings

For organizations poised to capitalize on the transformative opportunities within the in-cabin air quality domain, accessing the complete market research report will provide unparalleled strategic clarity. To explore detailed analyses, proprietary segmentation insights, and our complete suite of actionable recommendations, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored licensing options and deliver the comprehensive intelligence necessary to inform product roadmaps, supply chain strategies, and partnership decisions in this rapidly evolving automotive landscape. Our team stands ready to discuss customization opportunities that align research findings with your unique strategic objectives and operational requirements.

- How big is the Automotive In-Cabin Air Quality Improvement Solutions Market?

- What is the Automotive In-Cabin Air Quality Improvement Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?