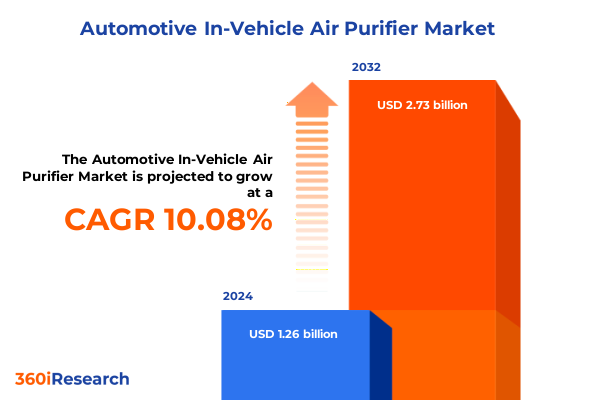

The Automotive In-Vehicle Air Purifier Market size was estimated at USD 1.38 billion in 2025 and expected to reach USD 1.52 billion in 2026, at a CAGR of 10.14% to reach USD 2.73 billion by 2032.

Unveiling the Critical Role of In-Vehicle Air Purification Amid Rising Pollution and Health-Conscious Automotive Consumer Trends

As urbanization accelerates and environmental concerns increasingly influence consumer behavior, the significance of maintaining high-quality air inside vehicles has never been more paramount. The rise of sophisticated in-cabin air purification systems reflects a broader shift toward health-centric mobility solutions, driven by growing awareness of particulate matter, allergens, and volatile organic compounds encountered on daily commutes. In this context, automotive manufacturers and suppliers are under intensifying pressure to integrate advanced filtration and purification technologies that not only comply with evolving regulatory benchmarks but also align with rising customer expectations for wellness-focused features.

Against this backdrop, in-vehicle air purifiers have emerged as critical safety and comfort enhancements, extending the conventional role of climate control systems. Today's drivers and passengers demand seamless integration of air quality management within vehicle ecosystems, underscoring the intertwining of health, convenience, and connected car experiences. This confluence of factors sets the stage for robust industry exploration into cutting-edge membrane materials, sensor-driven automation, and modular designs suitable for diverse vehicular architectures. As a result, stakeholders across the value chain-from component manufacturers to aftermarket service providers-are compelled to reimagine product portfolios and channel strategies to capture this high-growth opportunity.

Driving Innovation and Sustainability Through Evolutionary Shifts in Consumer Expectations Regulatory Frameworks and Technology Integration in Automobility

In recent years, the automotive air purification sector has undergone a profound metamorphosis, shaped by the convergence of electrification mandates, digitalization imperatives, and sustainability objectives. Electric vehicles, propelled by stringent greenhouse gas regulations, have become key conduits for embedding intelligent air quality systems that optimize cabin environments while minimizing energy consumption. Concurrently, the integration of Internet of Things–enabled sensors has empowered real-time monitoring and adaptive filtration, allowing vehicles to automatically adjust to fluctuating external pollution levels.

Regulatory bodies across major markets have introduced more rigorous in-cabin air quality standards, compelling automakers to adopt high-efficiency HEPA filters and hybrid purification modules that combine activated carbon and ultraviolet sterilization. These policies, coupled with heightened consumer scrutiny of health-related vehicle features, have accelerated collaboration between OEMs and specialized technology firms to co-develop next-generation solutions. Moreover, the rise of shared mobility and ride-hailing fleets has underscored the need for rapid-purification cycles and hygienic interiors, pushing suppliers to innovate compact, low-noise devices that cater to intensive usage scenarios. Collectively, these transformative shifts are redefining product roadmaps, forging strategic alliances, and unlocking new revenue streams in both original equipment and aftermarket channels.

Assessing the Far-reaching Consequences of 2025 United States Tariff Adjustments on In-Vehicle Air Purifier Supply Chains Costs and Market Dynamics

The enactment of revised United States tariffs in early 2025 has had significant ramifications across the in-vehicle air purifier supply chain. Manufacturers reliant on imported filtration media and electronic components found their cost bases recalibrated as duties on select raw materials and finished modules increased. This shift has prompted strategic sourcing realignments, with some tier-one suppliers accelerating the development of domestic manufacturing capabilities to mitigate exposure to cross-border levies.

In turn, downstream stakeholders, including OEMs and aftermarket distributors, have had to reassess procurement timelines and pricing strategies. End users have exhibited sensitivity to incremental cost pass-throughs, compelling industry participants to explore value engineering approaches without compromising filtration efficacy. Interestingly, the adjusted tariff landscape has also fostered deeper partnerships with North American specialty chemical producers, enabling closer collaboration on custom-graded activated carbon and membrane formulations. While some firms have absorbed short-term margin pressure, others have leveraged the tariff realignment as an inflection point to fortify regional supply resilience and optimize inventory management practices for future policy shifts.

Decoding Market Composition Through Vehicle Type Technology Distribution Channels Sales Platforms and Price Tiers Illuminating Hidden Growth Drivers

Dissecting the market through multiple lenses reveals distinct growth vectors shaped by vehicle architecture, purification mechanisms, channel dynamics, sales environments, and price positioning. Evaluating by vehicle type uncovers that commercial fleets, passenger cars, and electric vehicle segments each exhibit unique adoption curves, with battery electric vehicles and plug-in hybrids demanding specialized filtration protocols suited to their electrical architectures. Technology segmentation highlights that activated carbon modules remain popular for odor control, while HEPA filters dominate fine particulate removal, complemented increasingly by ionizers and UV-based sterilization to neutralize microbial threats.

Analysis by distribution channel distinguishes a clear divergence between aftermarket retail outlets, service centers, and OEM ecosystems encompassing dealership-fitted and factory-integrated installations, each presenting varying degrees of customization and warranty alignment. Within sales channel assessment, offline auto workshops and specialty stores maintain their stronghold among traditional buyers, even as e-commerce platforms and official brand websites gain traction with digitally savvy consumers seeking convenience and curated bundles. Finally, price range stratification between low-end, mid-range, and high-end offerings underscores the market’s ability to cater to budget-conscious drivers and premium customers, influencing product feature sets and long-term maintenance plans.

This comprehensive research report categorizes the Automotive In-Vehicle Air Purifier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Power Source

- Vehicle Type

- Distribution Channel

Uncovering Regional Divergence in In-Vehicle Air Purification Adoption Drivers Across Americas Europe Middle East and Africa and Asia-Pacific Markets

Geographic nuances play a pivotal role in shaping regional dynamics for in-vehicle air purification systems. In the Americas, stringent emissions standards and heightened public health awareness have driven swift uptake, with both OEMs and aftermarket specialists collaborating to deliver retrofit and factory-fitted solutions. North American consumers’ preference for holistic cabin comfort has accelerated adoption in passenger vehicles, while Latin American urban pollution challenges have spurred fleet operators to invest in ruggedized, cost-effective modules.

Across Europe, the Middle East, and Africa, regulatory harmonization and cross-border trade agreements have facilitated technology diffusion. European OEMs leverage advanced filtration designs to meet the world’s most exacting in-cabin air quality directives, whereas emerging markets in the Middle East and Africa prioritize durability and ease of maintenance amid challenging environmental conditions. Asia-Pacific, meanwhile, represents a complex mosaic, where megacities’ severe air pollution and rising disposable incomes fuel demand for premium purification packages in leading vehicle models. Collaboration between regional electronics giants and automotive suppliers has yielded scalable, IoT-enabled systems tailored to varied climate zones and regulatory frameworks, reinforcing the region’s position as a hotbed of innovation and volume consumption.

This comprehensive research report examines key regions that drive the evolution of the Automotive In-Vehicle Air Purifier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators and Their Strategic Roadmaps Transforming In-Vehicle Air Purifier Solutions Through Partnerships and Technological Mastery

The competitive landscape is defined by a cadre of established automotive suppliers and nimble technology innovators. Legacy component manufacturers have expanded their portfolios through strategic acquisitions of specialty filter houses and partnerships with semiconductor firms to embed sensor arrays. Simultaneously, start-ups with expertise in nanomaterials and photocatalytic coatings have attracted OEM collaborations, accelerating the launch of next-generation modules capable of neutralizing gaseous pollutants and biological pathogens in real time.

Industry leaders differentiate through multi-tiered value propositions, ranging from turnkey OEM integration to scalable aftermarket kits compatible across vehicle platforms. Some have introduced subscription-based maintenance services enabling seamless filter replacement and system health monitoring, thus fostering recurring revenue streams and deepening customer engagement. Others have invested heavily in modular architectures that facilitate streamlined retrofitting, reducing installation times and permitting cross-model standardization. As competition intensifies, alliances between global suppliers and regional distributors are increasingly instrumental in extending market reach and optimizing service networks, while joint R&D programs continue to push the boundaries of air purification performance and system intelligence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive In-Vehicle Air Purifier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Denso Corporation

- Eureka Forbes Limited

- Guangzhou Ionkini Technology Co., Ltd.

- Honeywell International Inc.

- IQAir AG

- Kent RO Systems Limited

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Mahle GmbH

- MANN+HUMMEL International GmbH & Co. KG

- Medify Air LLC

- Panasonic Corporation

- Reffair Innovations Private Limited

- Robert Bosch GmbH

- Scosche Industries Inc.

- Sharp Corporation

- SoleusAir West

- WYND Technologies, Inc.

- Xiamen Airbus Electronic Technology Co., Ltd.

- Xiaomi Corporation

Crafting Proactive Strategies for Automotive Stakeholders to Capitalize on Emerging Air Purification Trends and Mitigate Supply Chain and Regulatory Challenges

To capitalize on the momentum in in-vehicle air purification, industry leaders should prioritize collaborative development of next-generation filter media that balance energy efficiency with superior contaminant capture. Establishing strategic partnerships with regional material suppliers can help diversify sourcing and insulate against tariff volatility, while co-investment in localized manufacturing hubs will reduce lead times and enhance supply-chain resilience. Furthermore, embedding IoT-enabled air quality sensors into vehicle telematics ecosystems will create value-added services through predictive maintenance alerts and personalized air quality reporting.

In parallel, companies should explore tiered product portfolios to address the full spectrum of vehicle segments, from cost-sensitive commercial fleets to premium electric vehicles, leveraging insights from distribution channel segmentation to optimize OEM and aftermarket go-to-market strategies. Digital sales channels offer untapped potential; enhancing online configurators and subscription models for filter replenishment can deepen customer loyalty and yield predictive revenue flows. Finally, proactive engagement with regulatory bodies to shape harmonized in-cabin air quality standards will reinforce industry credibility and catalyze wider adoption, positioning forward-thinking stakeholders as architects of the future mobility experience.

Outlining a Robust Research Framework Leveraging Multisource Data Collection In-Depth Expert Interviews and Comprehensive Secondary Analysis

This research synthesis draws upon a multifaceted methodology designed to deliver rigorous, actionable insights. Primary intelligence was garnered through in-depth interviews with senior executives at OEMs, Tier-1 suppliers, and aftermarket distributors, uncovering real-world deployment challenges and strategic priorities. Supplementary expert dialogues with materials scientists and environmental health authorities provided nuanced perspectives on evolving filtration technologies and regulatory trajectories.

Comprehensive secondary analysis encompassed an extensive review of automotive emissions directives, patent filings, and technical whitepapers, supplemented by detailed examination of financial reports and corporate presentations to map investment patterns and alliance structures. Regional trade data and customs statistics were triangulated with market penetration figures to assess the impact of policy shifts, while scenario-based modeling illuminated potential outcomes of evolving trade environments. This integrated approach ensures that the findings encapsulate both macro-level trends and granular operational considerations, empowering stakeholders with a holistic understanding of the in-vehicle air purification ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive In-Vehicle Air Purifier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive In-Vehicle Air Purifier Market, by Product Type

- Automotive In-Vehicle Air Purifier Market, by Technology

- Automotive In-Vehicle Air Purifier Market, by Power Source

- Automotive In-Vehicle Air Purifier Market, by Vehicle Type

- Automotive In-Vehicle Air Purifier Market, by Distribution Channel

- Automotive In-Vehicle Air Purifier Market, by Region

- Automotive In-Vehicle Air Purifier Market, by Group

- Automotive In-Vehicle Air Purifier Market, by Country

- United States Automotive In-Vehicle Air Purifier Market

- China Automotive In-Vehicle Air Purifier Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Critical Insights to Empower Decision-Makers in Navigating the Future Landscape of In-Vehicle Air Purification Innovation and Market Dynamics

In-vehicle air purification stands at the nexus of consumer wellness concerns, regulatory evolution, and technological innovation. The industry’s trajectory will be shaped by the ability of stakeholders to orchestrate resilient supply chains, pioneer advanced filtration solutions, and deliver seamless integration across a diverse vehicle fleet. Success hinges on harnessing cross-industry partnerships, embracing digital service ecosystems, and proactively influencing policy frameworks to foster harmonized quality benchmarks.

As consumer awareness of in-cabin air quality intensifies, the distinction between basic climate control and intelligent purification systems will become a key competitive differentiator. Companies that navigate the complex interplay of tariffs, material sourcing, and channel strategies while aligning with regional adoption patterns will secure leadership positions in this dynamic market. By synthesizing the insights presented throughout this report, decision-makers can chart a course that anticipates emerging challenges and leverages innovation to deliver superior in-vehicle environments, ultimately elevating brand equity and driving sustainable growth.

Experience Unmatched Industry Foresight and Propel Your Strategic Position with an Automotive Air Purification Market Research Report from Ketan Rohom

To unlock comprehensive insights that can elevate your strategic positioning in the burgeoning in-vehicle air purification landscape, secure your exclusive copy of the complete market research report by reaching out directly to Ketan Rohom, Associate Director of Sales & Marketing. With his expert guidance, you will gain unparalleled visibility into emerging competitive dynamics, transformative regulatory developments, and advanced technological innovations shaping the industry’s trajectory. Leverage this authoritative resource to inform critical investment decisions, establish forward-thinking partnerships, and anticipate the shifting demands of automotive OEMs and end users alike. Begin your journey toward data-driven, future-ready strategies today by contacting Ketan Rohom and taking the definitive step toward market leadership.

- How big is the Automotive In-Vehicle Air Purifier Market?

- What is the Automotive In-Vehicle Air Purifier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?