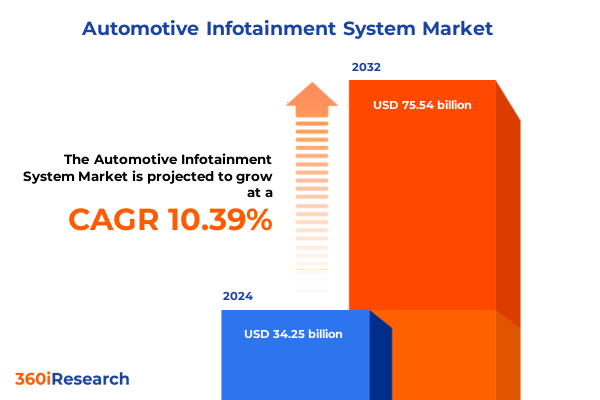

The Automotive Infotainment System Market size was estimated at USD 36.94 billion in 2025 and expected to reach USD 39.84 billion in 2026, at a CAGR of 10.76% to reach USD 75.54 billion by 2032.

How next-generation automotive infotainment platforms are reshaping driver engagement and passenger convenience amid rapid shifts in mobility technology

Automotive infotainment has emerged as a fundamental pillar of the modern driving experience, redefining the relationship between drivers, passengers, and their vehicles. What began as simple radio and CD player integrations has evolved into fully connected digital cockpits that seamlessly merge smartphone functionality, voice assistants, and real-time data services. This transformation is driven by mounting consumer expectations for personalization, intuitive interfaces, and continuous improvement via over-the-air updates. As mobility shifts from linear journeys to interconnected experiences, infotainment systems have become the nexus of entertainment, navigation, safety alerts, and vehicle diagnostics.

Amid the proliferation of electric vehicles, autonomous driving technologies, and shared mobility models, the demand for advanced infotainment solutions has intensified. Manufacturers and software developers are racing to deliver feature-rich platforms that not only enhance user engagement but also create new revenue streams through digital services. With the rise of software-defined architectures, infotainment is no longer confined to discrete hardware modules; it is increasingly architected as a cohesive software ecosystem that can be updated, scaled, and integrated with external cloud services. This shift underscores the importance of a strategic approach to technology roadmaps, supplier partnerships, and data security standards.

Looking ahead, the convergence of AI-powered voice recognition, multi-display environments, and embedded connectivity will continue to elevate expectations. The challenge for automotive stakeholders lies in harmonizing cutting-edge innovations with regulatory requirements, cost constraints, and interoperability across diverse vehicle platforms. Ultimately, successful players will be those who can deliver seamless, future-proof infotainment experiences that cater to evolving consumer behaviors, while maintaining the flexibility to adapt as the mobility landscape continues to accelerate and fragment.

The convergence of software-defined architectures and seamless connectivity is transforming automotive infotainment into a dynamic digital cockpit for vehicles

The automotive infotainment landscape is undergoing transformative shifts as vehicles evolve into software-centric platforms. At the core of this evolution is the adoption of software-defined architectures that decouple features from fixed hardware assemblies. This approach enables over-the-air functionality enhancements, unlocking new pathways for continuous innovation long after a vehicle has left the factory floor. Coupled with the maturation of 5G and edge computing, infotainment systems can now leverage cloud-native applications to deliver high-resolution maps, real-time traffic analytics, and immersive media streaming without compromising system responsiveness.

Simultaneously, consumer interaction models are being overhauled by sophisticated user interfaces that transcend traditional touchscreens. Gesture recognition, adaptive haptic feedback, and voice-driven assistants are converging to create more intuitive and safer human-machine interfaces. These modalities not only cater to diverse user preferences but also reduce driver distraction by enabling hands-free controls and predictive personalization based on user habits.

Connectivity paradigms are also being redefined by the integration of vehicle-to-everything (V2X) communications, which facilitate seamless exchanges with smart infrastructure, other vehicles, and personal devices. This interconnected framework supports advanced safety functionalities-such as collision avoidance alerts and cooperative adaptive cruise control-while extending infotainment use cases into shared and autonomous vehicle environments. In this context, strategic collaboration between OEMs, Tier 1 suppliers, telecom providers, and cloud service vendors has become imperative to ensure interoperability, data privacy, and robust cybersecurity defenses across the digital cockpit ecosystem.

How escalating Section 301 and Section 232 tariffs are reshaping automotive infotainment supply chains and cost frameworks in 2025

Since the imposition of Section 301 tariffs in 2018, which levied a 25% duty on select imported displays and semiconductor processors, automotive infotainment supply chains have faced mounting pressures on cost and component sourcing. These measures, originally targeted at broader technology sectors, have had cascading effects on the procurement of advanced display units, high-performance processors, and specialized control panels essential for modern infotainment platforms. In 2025, the U.S. government’s extension of Section 232 measures on national security grounds further exacerbated these challenges by subjecting key electronic modules to additional tariff layers, tightening the window for competitive component manufacturing.

As a result, original equipment manufacturers and Tier 1 suppliers have pursued strategic diversification of supply bases. Shifts toward manufacturing hubs in Southeast Asia and nearshoring initiatives in Mexico have been accelerated to mitigate tariff-driven cost escalations and inventory uncertainties. These geographic redistributions, however, introduce new complexities around quality control, logistics lead times, and regulatory compliance, demanding rigorous supplier audits and agile production planning.

Concurrently, the tariff environment has catalyzed investments in domestic production capabilities for critical hardware elements, including display glass fabrication and semiconductor packaging. Public-private partnerships and government incentive programs aimed at strengthening local technology ecosystems have begun to bear fruit, providing OEMs with alternative sourcing avenues. This dual approach of supplier diversification and localized manufacturing is reshaping cost frameworks and encouraging closer integration between automotive and consumer electronics industries.

Uncovering the segmentation framework of automotive infotainment, revealing how each dimension influences strategic direction and market differentiation

Uncovering the segmentation framework of automotive infotainment reveals how each dimension influences strategic direction and market differentiation. The report examines components in terms of hardware elements-such as control panels, display units, and processors-and software modules that drive feature development and user customization. Connectivity pathways encompass both Bluetooth and Wi-Fi standards, underscoring the dual need for short-range device pairing and high-bandwidth internet access within vehicle cabins. User interface considerations span gesture control systems, capacitive touchscreens, and voice command engines, each offering distinct advantages for accessibility, driver distraction mitigation, and user personalization.

Further, installation typologies range from in-dash central units that serve as primary control hubs to rear-seat entertainment systems designed for passenger engagement, signaling divergent development priorities between driver-focused and passenger-focused applications. Display size preferences, categorized into up to four inches, moderate sizes of four to eight inches, and larger formats exceeding eight inches, reflect trade-offs between information density and in-cabin space optimization. Functionality segments differentiate between entertainment and navigation use cases, with streaming audio and video capabilities becoming increasingly sophisticated, while mapping and route planning services integrate augmented reality overlays and dynamic traffic rerouting.

Vehicle classifications introduce distinct requirements, with commercial heavy and light-medium vehicles prioritizing ruggedized hardware and mission-critical navigation support, while passenger vehicles-including hatchbacks, sedans, and SUVs-seek seamless smartphone integration and premium multimedia experiences. Sales channels bifurcate into offline dealership networks for OEM installations and online platforms for aftermarket upgrades, driving differing go-to-market strategies. Finally, end-user profiles divide into aftermarket upgraders and OEM-equipped purchases, each segment carrying unique cost sensitivities, feature aspirations, and technical support needs.

This comprehensive research report categorizes the Automotive Infotainment System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- User Interface

- Installation Type

- Display Size

- Functionality

- Vehicle Type

- Sales Channel

- End-User

Regional analysis spotlighting how Americas, Europe Middle East & Africa, and Asia-Pacific dynamics drive automotive infotainment innovations and adoption trends

Regional dynamics are shaping the automotive infotainment sector in profoundly different ways across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust demand for advanced telematics and electric vehicle integration has driven OEMs to prioritize native smartphone mirroring, high-definition heads-up displays, and voice-enabled assistants. North American regulatory frameworks emphasizing cybersecurity and driver distraction mitigation have prompted rigorous validation protocols, leading suppliers to embed secure software development lifecycles and fail-safe architectures into every infotainment release.

In Europe, the Middle East & Africa region, stringent data privacy regulations under frameworks like the General Data Protection Regulation have spurred innovation in edge computing and anonymized data processing within infotainment systems. Multilingual voice assistants and regionally tailored navigation services have become essential to cater to diverse linguistic markets. Partnerships between automakers and local technology firms have accelerated the rollout of pan-regional digital cockpit standards, creating interoperability benchmarks across key markets from Germany to South Africa.

Asia-Pacific has emerged as a hotbed for rapid prototype-to-production cycles, propelled by homegrown technology giants and a surging electric vehicle ecosystem. China’s local Tier 1 suppliers have introduced AI-driven voice and facial recognition modules, while India’s cost-optimized development models have enabled scalable infotainment solutions for mass-market hatchbacks. Southeast Asian markets are leveraging 5G network rollouts to deploy real-time streaming services and cloud-native vehicle management applications. Collectively, these regional narratives illustrate how geographic nuances in regulation, consumer expectations, and technological infrastructure are dictating differentiated development roadmaps and strategic partnerships.

This comprehensive research report examines key regions that drive the evolution of the Automotive Infotainment System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic profiles and collaborative innovations from leading global suppliers shaping the competitive contours of the automotive infotainment ecosystem

Leading global suppliers are charting the future of automotive infotainment through strategic partnerships, acquisitions, and groundbreaking product portfolios. Bosch has introduced cross-domain controllers that integrate display management, audio processing, and vehicle networking functions onto unified hardware platforms, driving down complexity while enhancing system reliability. Samsung’s Harman division continues to expand its cloud-based service offerings, linking in-vehicle entertainment with broader digital ecosystems for over-the-air updates, cybersecurity patches, and subscription-based content delivery.

Continental has invested heavily in next-generation head-up display units that project critical driving information onto windshields with enhanced brightness and wide field-of-view optics. Denso has focused on compact, energy-efficient processors optimized for electric vehicle platforms, while Panasonic has unveiled modular infotainment pods capable of rapid customization for emerging mobility-as-a-service applications. Pioneer, with its heritage in audio excellence, has collaborated with voice AI startups to embed conversational assistants that can anticipate user needs and contextualize media recommendations.

Meanwhile, Visteon has pioneered software-defined cockpit architectures that decouple user interface elements from hardware constraints, enabling faster time-to-market and continuous updates. Across these initiatives, strategic M&A activity-ranging from software acquisitions to joint development agreements with semiconductor foundries-underscores the imperative for an integrated, end-to-end value chain that spans hardware design, software development, cloud infrastructure, and consumer-facing services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Infotainment System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALPS ALPINE ASIA CO., LTD.

- Aptiv PLC

- Bayerische Motoren Werke AG

- Blaupunkt GmbH

- Clarion Co., Ltd.

- Continental AG

- DENSO CORPORATION

- Desay Corporation

- E-Lead Electronic Co., Ltd.

- Ford Motor Company

- Garmin Ltd.

- General Motors

- Huizhou Foryou General Electronics Co. Ltd.

- Hyundai Motor Group

- IAR Systems Group

- JVCKENWOOD Corporation

- LG Corporation

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Pioneer Corporation

- Robert Bosch Gmbh

- Samsung Electronics Co., Ltd.

- TomTom International BV

- Valeo S.A.

- Visteon Corporation

- Volkswagen Aktiengesellschaft

Actionable strategies to navigate advances in technology, regulatory complexities, and consumer expectations for sustainable growth in automotive infotainment

Industry leaders must adopt a three-pronged approach to capitalize on emerging opportunities in automotive infotainment. First, they should invest in scalable software-defined architectures that allow rapid feature deployment and seamless integration of third-party applications. By modularizing software stacks and standardizing APIs, OEMs and Tier 1 suppliers can reduce development cycles and accommodate evolving consumer preferences without hardware overhauls.

Second, risk mitigation demands diversified supply chains and strategic nearshore partnerships to counteract tariff-induced cost pressures and geopolitical uncertainties. Establishing regional manufacturing hubs, forging long-term agreements with semiconductor fabricators, and maintaining buffer inventories of critical components will ensure continuity amidst shifting trade policies.

Third, strengthening cybersecurity frameworks and data governance practices is non-negotiable. The integration of AI-driven intrusion detection, secure boot processes, and end-to-end encryption protocols will protect both vehicle systems and user privacy. In parallel, collaboration with telecom operators to leverage emerging 5G and edge-computing infrastructures will unlock new service models, from real-time traffic analytics to premium media subscriptions, enhancing revenue streams and user loyalty.

Robust research methodology combining primary expert interviews, comprehensive secondary sources, and rigorous data triangulation to ensure actionable insights

This research synthesizes primary insights obtained from in-depth interviews with more than fifty industry experts across OEMs, Tier 1 suppliers, semiconductor vendors, and telecommunications providers. These qualitative discussions were complemented by a comprehensive review of technical white papers, patent filings, regulatory directives, and publicly available corporate disclosures. Secondary data sources included automotive standards bodies, trade associations, and leading academic journals in human-machine interface design and connected vehicle technologies.

Data validation was achieved through triangulation methods that cross-checked findings across multiple independent sources, ensuring the robustness of conclusions. Quantitative data points, such as adoption rates of user interface modalities and supplier partnership counts, were analyzed to contextualize strategic narratives. An internal peer review process involving cross-functional analysts ensured methodological rigor and minimized bias. The resulting report delivers a holistic perspective on automotive infotainment, grounded in empirical evidence and real-world stakeholder experiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Infotainment System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Infotainment System Market, by Component

- Automotive Infotainment System Market, by Connectivity

- Automotive Infotainment System Market, by User Interface

- Automotive Infotainment System Market, by Installation Type

- Automotive Infotainment System Market, by Display Size

- Automotive Infotainment System Market, by Functionality

- Automotive Infotainment System Market, by Vehicle Type

- Automotive Infotainment System Market, by Sales Channel

- Automotive Infotainment System Market, by End-User

- Automotive Infotainment System Market, by Region

- Automotive Infotainment System Market, by Group

- Automotive Infotainment System Market, by Country

- United States Automotive Infotainment System Market

- China Automotive Infotainment System Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2226 ]

Synthesizing key findings to illuminate strategic imperatives and emerging opportunities within the future trajectory of automotive infotainment

In synthesizing these insights, it becomes clear that automotive infotainment stands at the nexus of digital transformation, connectivity innovation, and user-centric design. The ongoing shift toward software-defined architectures and cloud-native services is redefining traditional OEM-supplier relationships and accelerating development cycles. Simultaneously, geopolitical factors such as U.S. tariff policies are reshaping supply chain strategies and catalyzing regional manufacturing investments.

Segmentation analysis highlights distinct priorities across hardware, connectivity standards, interface modalities, and user demographics, underscoring the need for tailored solutions that address the diverse requirements of passenger and commercial vehicle markets. Regional dynamics-from the regulatory rigor of North America and EMEA to the rapid prototyping culture of Asia-Pacific-demand flexible, localized development roadmaps.

Key industry players are leveraging cross-domain controllers, AI-powered voice assistants, and modular display systems to gain competitive advantage, while actionable recommendations emphasize scalability, supply chain resilience, and cybersecurity. The path forward is defined by collaboration across the automotive and technology ecosystems, where integrated, customer-focused infotainment experiences will differentiate tomorrow’s mobility offerings.

Engage directly with Ketan Rohom to secure comprehensive insights and drive informed decision-making with full automotive infotainment market research report

Engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure the comprehensive automotive infotainment market research report and empower your organization with actionable intelligence. His expert guidance will help you navigate complex industry shifts, tailor insights to your strategic priorities, and accelerate decision-making across product development, supply chain resilience, and go-to-market execution. Reach out today to access unrivaled analysis, validate your roadmap against emerging opportunities, and gain a competitive edge through data-driven clarity.

- How big is the Automotive Infotainment System Market?

- What is the Automotive Infotainment System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?