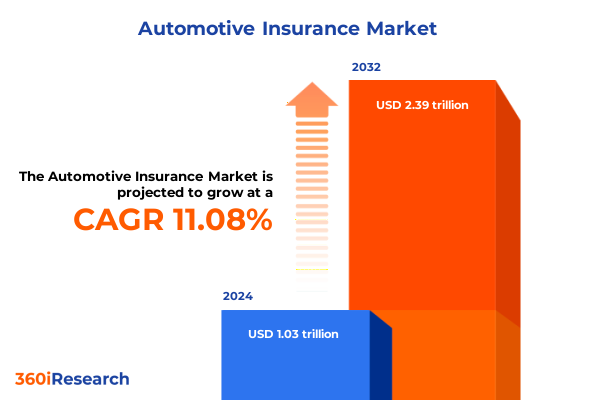

The Automotive Insurance Market size was estimated at USD 1.14 trillion in 2025 and expected to reach USD 1.26 trillion in 2026, at a CAGR of 11.16% to reach USD 2.39 trillion by 2032.

Robust Transparent and Rigorous Methodological Framework Underpinning Comprehensive Analysis of the Automotive Insurance Landscape

The automotive insurance sector in 2025 stands at a pivotal crossroads, driven by rapid technological advancements, shifting regulatory frameworks, and evolving consumer behaviors. Insurers are investing heavily in telematics platforms and usage-based insurance programs, integrating mobile applications and embedded vehicle data feeds to refine risk assessments and personalize pricing models in real time. Across the 2024–2025 filing season, major carriers have transitioned from hardware-dependent telematics to smartphone-based solutions, resulting in broad program rollouts and refreshed participation factors without overall rate impacts, underscoring a fundamental shift in industry architecture.

Amid these digital innovations, electric vehicles are commanding a growing share of policy portfolios and reshaping coverage requirements. Insurers are designing specialized products that account for battery replacement, charging infrastructure, and advanced driver assistance systems, as premiums for EVs have surged nearly 25% compared to gas-powered vehicles due to higher repair costs and unique risk profiles. Simultaneously, embedded insurance offerings at the point of sale are gaining traction among younger demographic cohorts, with nearly half of millennials and Gen Z expressing interest in purchasing policies directly through dealerships, illustrating a paradigm shift in distribution preferences.

Embracing Digital Disruption and Progressive Policy Innovation as Key Drivers Steering the Future Course of the Automotive Insurance Ecosystem

The automotive insurance landscape is undergoing transformative shifts fueled by digital disruption, data analytics, and policy innovation. Artificial intelligence and machine learning algorithms are now central to underwriting workflows, enabling insurers to analyze vast telematics datasets, anticipate emerging risk factors, and tailor coverage options to individual driving behaviors. This wave of analytical empowerment is fostering deeper customer engagement through personalized feedback loops and incentive programs that reward safe driving, fundamentally reorienting the value proposition of auto insurance.

Concurrent with innovation in risk assessment, policymakers are modernizing regulatory frameworks to accommodate evolving mobility trends. China’s issuance of dedicated electric vehicle insurance guidelines in early 2025 highlights a proactive approach to aligning risk classification systems with software and cybersecurity exposures intrinsic to connected EVs. These policy adjustments are complementing broader discussions around standardized telematics data governance, informed consent protocols, and cross-jurisdictional rate-approval processes, charting a path toward harmonized regulatory landscapes that facilitate product innovation while safeguarding consumer interests.

Assessing the Ripple Effects of 2025 Tariff Measures on Vehicle Replacement Costs and Broader Insurance Premium Dynamics in a Tariff-Driven Environment

Recent tariff measures imposed by the United States on imported vehicles and auto parts have generated significant ripple effects across insurance supply chains and claims expense structures. A comprehensive analysis by Insurify projects that annual full-coverage car insurance premiums will rise by 8% by the end of 2025 if 25% duties on Canada and Mexico, alongside steel and aluminum tariffs, remain in place, compared to a 5% increase without tariffs, indicating a 60% acceleration in rate growth attributable to these trade measures.

At the vehicle component level, 15% of the steel used in U.S. automaking and 60% of aluminum imports are subject to 25% duties, translating to incremental material cost increases of approximately $45 per vehicle for steel and $75 per vehicle for aluminum. Combined with rising domestic metal prices, these factors add nearly $240 to the average unit build cost, compelling insurers to adjust actuarial assumptions around replacement severity and parts availability when modeling future claims costs.

While insurers are monitoring these cost pressures, the actual rate-renewal impact exhibits a notable lag. Industry experts project minimal premium influence in 2025, with more pronounced adjustments materializing in policy renewals during late 2026 and into 2027, as carriers incorporate observed upticks in claim severities and secure regulatory approvals for rate changes. This deferred pass-through underscores the importance of proactive scenario planning and transparent stakeholder communications when navigating tariff-driven inflationary forces.

Unpacking Crucial Market Segments to Strategically Illuminate How Diverse Coverages Shape Automotive Insurance Demand Patterns

A nuanced evaluation of market segmentation reveals how diverse policy offerings and customer profiles intersect to shape product demand and competitive positioning. Insurers differentiate across core product lines-Collision Damage/Own Damage, Comprehensive, and Third Party-to address fault-based liability exposure, all-risk perils, and statutory liability requirements, calibrating underwriting models to balance capital efficiency with customer value propositions.

Coverage design further evolves through Accidental Cover, Natural Disaster Cover, and Theft Cover options, each reflecting distinct risk pools activated by the frequency and severity of collisions, weather-related hazards, and vehicle theft patterns. By tailoring endorsements and deductible structures, carriers can optimize portfolio performance and manage capital volatility.

Vehicle type segmentation stratifies commercial fleets-spanning Heavy Commercial Vehicles to Light & Medium Commercial Vehicles-and passenger cars, including Hatchbacks, Sedans, and SUVs. Fleet operators demand scalable multi-vehicle programs with integrated telematics, while individual owners of compact models prioritize digital self-service and flexible pay-as-you-drive offerings. Distribution channels encompass traditional Agents & Brokers, Direct Sales via digital portals, and Third-Party Aggregators, enabling insurers to balance cost-to-serve with targeted acquisition strategies. Finally, end-user segmentation across Business/Corporate Clients, Government & Public Sector entities, and Individual Customers informs specialized product bundles, risk transfer mechanisms, and service level agreements tailored to profile-specific needs.

This comprehensive research report categorizes the Automotive Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Cover Type

- Vehicle Type

- Distribution Channel

- End User

Exploring Distinct Regional Market Dynamics Across the Americas, EMEA, and Asia-Pacific While Shaping Adaptive Insurance Strategies

Regional market dynamics are defined by distinct regulatory regimes, risk profiles, and technological adoption curves across the Americas, Europe Middle East & Africa, and Asia-Pacific. North America, led by the United States, commands a dominant share of usage-based insurance activity, accounting for over 40% of the global UBI market in 2023, driven by widespread telematics penetration and a mature digital distribution infrastructure.

In Europe, Middle East, and Africa, insurers navigate a mosaic of state-level rate-filing requirements and consumer protection rules, fostering a cautious approach to rapid premium innovation. Advanced markets such as the U.K. and Germany utilize telematics data to refine risk selection and support climate-resilience initiatives, while emerging markets within EMEA prioritize basic coverage expansion and micro-insurance pilots to reach underinsured populations.

Asia-Pacific is characterized by exponential growth in electric vehicle sales and the proliferation of micro-mobility services. Insurers in China and Southeast Asia are forging partnerships with OEMs and fintech platforms to embed on-demand insurance at the point of vehicle subscription or battery-swap service, unlocking new usage-based models and digital engagement channels. This confluence of rapid EV adoption and agile distribution is coalescing into the region’s most dynamic insurance frontier.

This comprehensive research report examines key regions that drive the evolution of the Automotive Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Established and Emerging Industry Leaders and Their Strategic Maneuvers Driving Competitive Innovation in Auto Insurance Markets

Leading automotive insurers are leveraging technological innovation, strategic partnerships, and customer-centric product design to secure competitive advantage. State Farm has scaled its Drive Safe & Save telematics program through integration with OEM platforms, enabling pay-as-you-drive pricing and real-time feedback mechanisms that reduce accident frequency and enhance customer loyalty.

Progressive continues to refine its Snapshot usage-based framework, achieving penetration rates exceeding 70% in key personal auto segments by combining simplified mobile-app onboarding with dynamic rate adjustments. The insurer’s agile analytics engine facilitates swift incorporation of emerging risk indicators into underwriting, supporting rapid product iteration and differentiated discount structures.

Legacy carriers such as Allstate and Liberty Mutual are advancing hybrid telematics models, blending embedded OBD-II devices with smartphone-based data capture in programs like Drivewise® and RightTrack®. These initiatives emphasize customer engagement through gamified scoring and location-based incentives, reducing churn and fostering safer driving behaviors.

Digital-native entrants such as Root and Lemonade are harnessing smartphone sensor data and AI-driven scoring algorithms to offer fully usage-based policies with streamlined onboarding. Their direct-to-consumer platforms optimize risk stratification and lower operational overhead, compelling incumbents to accelerate digital transformation and partnership strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acko General Insurance Limited

- AIA Group Limited

- Allianz Group

- Allstate Insurance Company

- American International Group, Inc.

- Assicurazioni Generali S.p.A.

- Aviva PLC

- Axa SA

- Cholamandalam MS General Insurance Company Ltd.

- Future Generali India Insurance Co. Ltd.

- Go Digit General Insurance Limited

- HDFC ERGO General Insurance Co. Ltd.

- ICICI Lombard General Insurance Company Ltd.

- Liberty General Insurance Ltd.

- Magma General Insurance Limited

- MetLife, Inc.

- National Insurance Company Limited

- Raheja QBE General Insurance Company Limited

- Reliance General Insurance Co. Ltd.

- Royal Sundaram General Insurance Co. Limited

- SBI General Insurance Company Limited

- Shriram General Insurance Company Ltd.

- State Farm Mutual Automobile Insurance Company

- The New India Assurance Co. Ltd.

- The Oriental Insurance co. Ltd.

- Tokio Marine Holdings

- Universal Sompo General Insurance Co.Ltd

- Zuno General Insurance Limited

- Zurich Insurance Group

Strategic Roadmap for Industry Leaders to Accelerate Growth, Foster Resilience, and Navigate Evolving Insurance Challenges

To navigate evolving market dynamics and capitalize on emerging opportunities, insurers should prioritize the rapid expansion of usage-based insurance offerings and advanced telematics integrations. By embedding AI-powered anomaly detection into claims workflows, carriers can proactively identify high-severity incidents and allocate resources for expedited assessment and resolution, reducing average claim cycle times and improving customer satisfaction.

Strategic investments in data governance and privacy frameworks will be critical to maintaining consumer trust and regulatory compliance. Establishing transparent consent processes and adhering to standardized retention limits will not only mitigate legal risks but also enable deeper insights into longitudinal driving behaviors for refined pricing accuracy.

Given the trajectory of trade policies and material cost inflation, insurers should incorporate scenario-based modeling of tariff impacts into their actuarial frameworks to anticipate claim-cost escalations. Engaging proactively with state regulators to secure flexible rate structures and expedited approval pathways will support timely premium adjustments and preserve financial resilience amidst external cost pressures.

Finally, forging cross-sector partnerships-with automakers, telematics vendors, and climate-risk analytics firms-will facilitate the co-creation of innovative products that address mobility-as-a-service, electric vehicle coverage, and extreme weather contingencies. These collaborative ecosystems can unlock new revenue streams while reinforcing brand differentiation in a highly competitive landscape.

Robust Transparent and Rigorous Methodological Framework Underpinning Comprehensive Analysis of the Automotive Insurance Landscape

This analysis is anchored in a multi-tiered research methodology that integrates both secondary and primary data sources to ensure comprehensive coverage and analytical rigor. Secondary research encompassed a systematic review of industry publications, regulatory filings, insurer annual reports, and trade association insights to map current market dynamics and emerging trends.

Primary research involved in-depth interviews with senior executives across carrier underwriting, actuarial, and claims functions, as well as discussions with telematics vendors, automotive OEM risk teams, and regulatory bodies. These qualitative insights were triangulated with quantitative data, including telematics usage metrics, EV adoption rates, and claims severity indices, to validate hypotheses and identify divergence across market segments.

Analytical frameworks-such as Porter’s Five Forces and PESTEL analysis-were applied to contextualize competitive intensity, regulatory shifts, and technology adoption drivers. The segmentation analysis leveraged detailed breakdowns by product, cover type, vehicle class, distribution channel, and end-user profile to uncover strategic inflection points, while regional assessments were informed by jurisdiction-specific rate-filing regimes and mobility ecosystem maturity levels.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Insurance Market, by Product

- Automotive Insurance Market, by Cover Type

- Automotive Insurance Market, by Vehicle Type

- Automotive Insurance Market, by Distribution Channel

- Automotive Insurance Market, by End User

- Automotive Insurance Market, by Region

- Automotive Insurance Market, by Group

- Automotive Insurance Market, by Country

- United States Automotive Insurance Market

- China Automotive Insurance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Critical Insights to Strategically Chart a Holistic Forward-Looking Outlook on the Automotive Insurance Sector’s Trajectory

By synthesizing technological innovation, regulatory evolution, and shifting consumer preferences, this executive summary delineates a clear narrative for the 2025 automotive insurance sector. Digital and data-driven paradigms-anchored in telematics, AI, and usage-based models-are redefining risk assessment and customer engagement, creating pathways for personalized offerings and operational efficiencies.

Simultaneously, external forces such as trade policy adjustments and escalating material costs underscore the imperative for dynamic pricing strategies and agile regulatory engagement. Regional market heterogeneity-from mature telematics adoption in North America to rapid EV-centric expansion in Asia-Pacific-further emphasizes the need for localized go-to-market approaches and collaborative innovation networks.

Looking ahead, industry leaders who integrate advanced analytics, foster strategic partnerships, and proactively navigate emerging policy landscapes will be well-positioned to capture growth, drive profitability, and enhance resilience. The convergence of embedded insurance, electric mobility coverage, and climate-adaptive solutions signals a transformative era for automotive insurance, demanding decisive leadership and forward-looking strategy formulation.

Engaging Ketan Rohom to Secure Timely and Comprehensive Market Intelligence and Propel Strategic Automotive Insurance Decisions

To secure unrivaled in-depth insights and tailored strategic guidance on the complexities shaping the automotive insurance market, engage Ketan Rohom. As Associate Director of Sales & Marketing at 360iResearch, Ketan brings a wealth of expertise in translating comprehensive market intelligence into actionable strategies that drive growth, optimize risk management, and enhance competitive positioning. Reach out to Ketan to explore how this market research can inform critical decisions, unlock new opportunities, and position your organization to thrive amid evolving industry dynamics.

- How big is the Automotive Insurance Market?

- What is the Automotive Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?