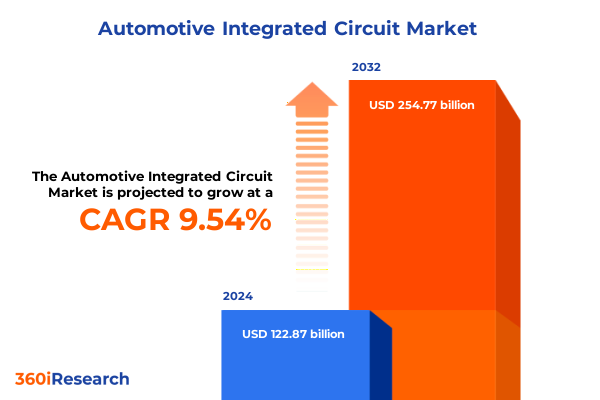

The Automotive Integrated Circuit Market size was estimated at USD 132.67 billion in 2025 and expected to reach USD 143.25 billion in 2026, at a CAGR of 9.76% to reach USD 254.77 billion by 2032.

Setting the Stage for the Next Era of Automotive Integrated Circuits Amidst Electrification and Autonomous Driving Evolution

The automotive integrated circuit arena is at the nexus of two powerful technological currents: electrification and autonomous driving. As vehicles evolve into sophisticated computing platforms, semiconductor components have emerged as the unseen enablers of next-generation functionality. This introduction sets the stage by tracing how microcontrollers, power management units, memory modules, and connectivity processors have transitioned from supportive roles to foundational elements in modern vehicle architectures.

Over the past two years, a meaningful reset has occurred in automotive semiconductor supply chains. Inventory imbalances stemming from pandemic disruptions have been addressed, and normalized demand from both OEMs and tier-one suppliers is stimulating renewed collaboration between automakers and chip manufacturers. Electrification mandates, regional emissions targets, and shifting consumer preferences are converging to intensify the need for high-performance power management ICs and sensor interface circuits capable of supporting battery electric vehicles and hybrid platforms. Simultaneously, growing interest in software-defined vehicle frameworks is fueling investment in infotainment processors and high-bandwidth communication chips, enabling over-the-air updates that future-proof hardware investments.

This introduction underscores how integrated circuit innovation is not just a supporting act but a driving force redefining vehicle dynamics, safety, and user experiences. It forms the foundation for the deeper exploration of transformative shifts, tariff impacts, segmentation nuances, regional variations, competitive movements, and actionable recommendations detailed in the subsequent sections.

Decoding the Transformative Shifts Reshaping Automotive Semiconductor Architectures Through Connectivity Intelligence and Power Management Innovations

The automotive semiconductor landscape is undergoing transformative shifts spurred by advancements in advanced driver assistance systems, electrification architectures, and connectivity frameworks. One of the most striking developments is the surge in demand for autonomous driving chips, as evidenced by a leading supplier’s upward revision of its fiscal 2025 outlook in response to resurgent orders from major automakers. Improved alignment across supply chains has unlocked a growth inflection point, signaling heightened appetite for powerful camera and radar processors that support Level 2 and Level 3 driving functionalities.

In parallel, the proliferation of advanced driver assistance features is reshaping semiconductor content per vehicle. Numerous safety systems-ranging from automatic emergency braking to lane departure warning-have achieved penetration well above 90 percent in new vehicle models, driving sustained investment in camera processing ICs, lidar-enabled SoCs, and sensor interface modules designed to accommodate complex data flows with minimal latency. This trajectory is complemented by aggressive electrification programs worldwide, prompting a surge in demand for power management ICs, silicon carbide MOSFET drivers, and high-density memory solutions that can withstand rigorous automotive environments while optimizing energy efficiency.

Moreover, the fusion of infotainment, telecommunication, and vehicle-to-everything connectivity has accelerated the integration of high-speed Bluetooth, cellular 5G, and in-vehicle Wi-Fi processors. These innovations are forging new paradigms in user experience and remote diagnostics, setting the stage for over-the-air software updates and data-driven service models that extend well beyond the traditional boundaries of automotive electronics. Collectively, these shifts are charting a course toward vehicles that are safer, more efficient, and capable of seamless interaction with broader digital ecosystems.

Understanding the Cumulative Impact of 2025 United States Tariffs on Automotive Integrated Circuit Supply Chains and Cost Structures

The advent of new tariff measures imposed by the United States in 2025 has introduced complex headwinds to automotive integrated circuit supply chains. In early April, U.S. authorities announced a series of levies that elevate duties on Chinese imports to a cumulative rate of 54 percent, amplifying cost pressures for ICs sourced from leading East Asian foundries and distributors. This decision aimed to bolster domestic production and address perceived trade imbalances but has reverberated across the global automotive value chain, compelling OEMs and tier-one suppliers to reevaluate sourcing strategies and inventory management practices.

In response to these measures, automakers have initiated near-shoring pilots and expanded partnerships with North American and European semiconductor fabs, seeking to mitigate tariff exposure while preserving access to cutting-edge node technologies. At the same time, Chinese customs authorities issued clarifications stipulating that ICs outsourced to wafer fabrication plants in Taiwan will be classified by origin at the fabrication site, effectively exempting many U.S.-designed chips from retaliatory duties. Although this nuance has provided partial relief for companies utilizing offshore foundries, the amplified complexity of multi-jurisdictional supply chains has increased the administrative overhead for procurement and compliance teams.

Moreover, ongoing trade negotiations have introduced an element of policy uncertainty that further complicates long-term capital planning. Proposed dialogues between U.S. and Chinese trade officials carry the potential to recalibrate tariff thresholds, but until definitive agreements materialize, industry stakeholders must balance near-term cost containment with resilience-building investments in diversified manufacturing footprints. The 2025 tariff landscape thus represents both a challenge and an impetus, driving innovation in localized manufacturing, advanced packaging techniques, and collaborative risk-sharing models across the automotive integrated circuit ecosystem.

Unveiling Key Segmentation Insights Across Product Types, Applications, Vehicle Categories, and Sales Channels in Automotive IC Markets

A nuanced view of the automotive integrated circuit market requires an appreciation of its multifaceted segmentation. Starting with product type, the market spans connectivity ICs, infotainment processors, memory ICs, microcontrollers, power management ICs, and sensor interface ICs. Connectivity solutions further divide into Bluetooth, cellular, and Wi-Fi chips, each catering to distinct bandwidth, latency, and reliability requirements in the vehicle environment. Memory modules encompass both volatile and non-volatile technologies, supporting everything from in-vehicle operating systems to data buffering for sensor fusion.

In terms of application, integrated circuits find use across advanced driver assistance systems, infotainment, power management, sensor acquisition, and telecommunication. ADAS-specific processing silicon includes dedicated camera, lidar, radar, and ultrasonic ICs engineered to operate under stringent safety and real-time constraints. Infotainment systems leverage high-performance SoCs capable of rendering complex user interfaces while managing audio and video streams. Power management ICs regulate voltage and current for electric powertrains and battery systems, whereas sensor acquisition front-ends digitize analog inputs from gyroscopes, accelerometers, and microphones.

Looking at vehicle type, product adoption patterns differ markedly among battery electric vehicles, fuel cell electric vehicles, hybrid electric vehicles, and internal combustion engine platforms. Hybrid vehicles-encompassing full hybrid, mild hybrid, and plug-in hybrid configurations-demand flexible control ICs that seamlessly switch between charging, regeneration, and propulsion modes. Lastly, the sales channel dimension distinguishes aftermarket segments-covering replacement and upgrade pathways-from original equipment manufacturing, which comprises tier-one and tier-two engagements. OEM partnerships often emphasize co-development and long-term design wins, while aftermarket providers focus on modular solutions for system retrofits and performance enhancements.

This comprehensive research report categorizes the Automotive Integrated Circuit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Vehicle Type

- Sales Channel

Mapping Regional Dynamics Driving Growth in the Americas, Europe Middle East Africa, and Asia Pacific Automotive IC Landscapes

Regional dynamics play a pivotal role in shaping automotive integrated circuit demand and innovation priorities. In the Americas, robust consumer appetite for electric and premium vehicles has driven automakers to prioritize power electronics and high-bandwidth connectivity solutions. North American OEMs are forging strategic alliances with local semiconductor manufacturers to accelerate the development of silicon carbide MOSFET drivers and advanced microcontrollers, reflecting a shared focus on energy efficiency and emission reduction.

Across Europe, the Middle East, and Africa, stringent emissions regulations and safety mandates are accelerating the uptake of ADAS controllers and domain-based central compute architectures. European automakers are investing heavily in zonal electronics frameworks that consolidate multiple functions onto fewer, higher-performance chips, aiming to meet CO₂ targets while reducing wiring complexity. Meanwhile, telematics and over-the-air software management are gaining traction in the EMEA region, underscoring an emerging shift toward subscription-based feature monetization and enhanced cybersecurity protocols.

In the Asia-Pacific region, a dual emphasis on cost competitiveness and rapid technology adoption defines the market landscape. China’s government incentives for new energy vehicles have catalyzed a surge in both local fab capacity expansions and international joint ventures. Japanese and South Korean suppliers continue to lead in advanced memory and logic node innovations, while India’s nascent EV sector is prioritizing affordable microcontroller and power management solutions tailored for two-wheeler and small passenger vehicle segments. The confluence of public policy, domestic manufacturing growth, and consumer demand has made Asia-Pacific the fastest moving frontier for automotive IC advancements.

This comprehensive research report examines key regions that drive the evolution of the Automotive Integrated Circuit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Landscape and Strategic Movements of Leading Players in the Automotive Integrated Circuit Industry

The competitive landscape of automotive integrated circuits is defined by a mix of global semiconductor leaders and specialized automotive-focused innovators. Infineon, NXP, and Renesas Electronics maintain strong footholds in microcontrollers and power management segments, leveraging deep relationships with tier-one automotive suppliers. These incumbents continue to expand product portfolios through incremental node shrinks and enhanced functional safety features designed to support ISO 26262 certification.

At the same time, companies like Texas Instruments and STMicroelectronics are accelerating their forays into mixed-signal and high-performance connectivity chips, targeting emerging use cases such as vehicle-to-vehicle communication and multi-domain secure gateways. Recent strategic maneuvers illustrate the intensity of competition: Onsemi’s $6.9 billion takeover bid for Allegro MicroSystems underscores a bid for scale in power management and sensor interface solutions, despite a challenging macroeconomic backdrop for public markets. Meanwhile, Nvidia’s foray into automotive AI has gained momentum as its automotive revenue unit achieved double-digit growth, demonstrating the potential for high-end GPUs and AI accelerators in next-generation autonomous architectures.

Emerging players such as Analog Devices and Qualcomm are carving out niches in RF transceivers and system-level connectivity, respectively, often through partnerships with OEMs to co-develop customized SoCs. Mobileye’s recent upgrade in its revenue outlook highlights the value of camera-centric processing platforms in advanced autonomous and driver-assist functions. These diverse strategic approaches-ranging from bolt-on acquisitions to deep-tech alliances-illustrate how leading companies are jockeying for position in a market defined by rapid technological convergence and rigorous safety and reliability requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Integrated Circuit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Infineon Technologies AG

- Microchip Technology Incorporated

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qualcomm Incorporated

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- SK Hynix Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Actionable Strategies for Industry Leaders to Navigate Innovation, Supply Chain Volatility, and Regulatory Complexities in Automotive ICs

To navigate the evolving automotive integrated circuit landscape, industry leaders should pursue a blend of long-term resilience and agile innovation. First, diversifying supply chains through strategic near-shoring and multi-sourcing partnerships can mitigate tariff volatility and logistical disruptions while preserving access to cutting-edge fabrication capacities. Concurrently, investing in advanced packaging and design-for-manufacturability capabilities will enhance cost competitiveness and reduce time to market for complex ICs.

Second, accelerating R&D in silicon carbide and gallium nitride power devices is critical to meeting stringent efficiency targets for electric powertrains. Aligning these efforts with software-defined vehicle architectures may unlock new business models, such as subscription-based performance upgrades and predictive maintenance services. Collaborations with software integrators and cloud providers will bolster these capabilities, ensuring seamless integration of hardware and firmware interfaces.

Third, companies must proactively engage with regulatory bodies to shape emerging standards for functional safety, cybersecurity, and electromagnetic compatibility. A concerted approach-backed by rigorous validation and certification frameworks-will enable faster deployment of advanced driver assistance and autonomous driving features. Finally, embedding sustainability practices throughout the semiconductor lifecycle-from materials sourcing to end-of-life recycling-will not only address ESG imperatives but also foster brand differentiation in an increasingly conscious market.

By combining supply chain diversification, technology leadership, regulatory engagement, and sustainability integration, industry participants can transform challenges into catalysts for growth, securing leadership positions in the automotive integrated circuit arena.

Demystifying the Rigorous Research Methodology Underpinning the Automotive Integrated Circuit Market Analysis and Insights

This report’s insights are founded on a robust, multi-stage research methodology designed to ensure accuracy, relevance, and depth. Primary research involved detailed interviews with senior executives at OEMs, tier-one suppliers, and semiconductor foundries, capturing first-hand perspectives on technology roadmaps, procurement challenges, and regulatory considerations. These interviews were complemented by targeted surveys of design engineers and purchasing managers to quantify adoption trends across product types and applications.

Secondary research encompassed an extensive review of public disclosures, including financial reports, patent filings, regulatory filings, and industry association publications. Proprietary databases were leveraged to analyze company-level product launches, strategic announcements, and M&A activities. Trade show materials and technical white papers provided additional insights into emerging architectures and process node advancements.

Data triangulation and validation were achieved through iterative cross-referencing, ensuring that quantitative observations aligned with qualitative insights. A dedicated validation workshop convened subject matter experts to review preliminary findings and refine sector-specific interpretations. Finally, the report’s structuring follows a bottom-up approach, segmenting the market by product type, application, vehicle category, and sales channel, while integrating regional nuances to deliver a granular view that supports strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Integrated Circuit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Integrated Circuit Market, by Product Type

- Automotive Integrated Circuit Market, by Application

- Automotive Integrated Circuit Market, by Vehicle Type

- Automotive Integrated Circuit Market, by Sales Channel

- Automotive Integrated Circuit Market, by Region

- Automotive Integrated Circuit Market, by Group

- Automotive Integrated Circuit Market, by Country

- United States Automotive Integrated Circuit Market

- China Automotive Integrated Circuit Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Imperatives from the Comprehensive Automotive Integrated Circuit Market Exploration

The exploration of automotive integrated circuits reveals a dynamic ecosystem propelled by electrification, autonomous driving, and enhanced connectivity. Semiconductors have evolved into critical enablers of safety, efficiency, and user experience, placing them at the heart of modern vehicle architectures. Supply chain realignment, driven by tariff policies and the pursuit of resilience, underscores the strategic importance of manufacturing diversification and policy engagement.

Segmentation analysis highlights the distinct requirements across product types-ranging from power management to infotainment logic-and underscores how application-specific demands, such as sensor acquisition and ADAS processing, shape design priorities. Regional insights illustrate divergent market drivers: the Americas’ emphasis on EV powertrains; EMEA’s regulatory-driven architecture consolidation; and Asia-Pacific’s rapid innovations powered by government incentives and local fab investments.

Competitive dynamics are characterized by established semiconductor giants expanding into automotive domains, targeted acquisitions to bolster core capabilities, and specialist players forging OEM alliances. Collective strategic recommendations emphasize supply chain diversification, advanced materials R&D, proactive regulatory engagement, and sustainability integration as critical levers for future success. This synthesis provides executive decision-makers with a cohesive framework for navigating the intricate automotive IC landscape, ensuring that organizations can capitalize on emerging opportunities and mitigate evolving risks.

Connect with Ketan Rohom to Secure Comprehensive Market Insights and Propel Your Automotive Integrated Circuit Strategies Forward

To explore the full scope of these critical insights and gain a competitive edge in the fast-evolving automotive integrated circuit domain, reach out to Ketan Rohom Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through tailored research solutions, answer any questions about our comprehensive report, and facilitate your purchase to ensure you have the strategic intelligence needed to drive innovation and seize market opportunities immediately.

- How big is the Automotive Integrated Circuit Market?

- What is the Automotive Integrated Circuit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?