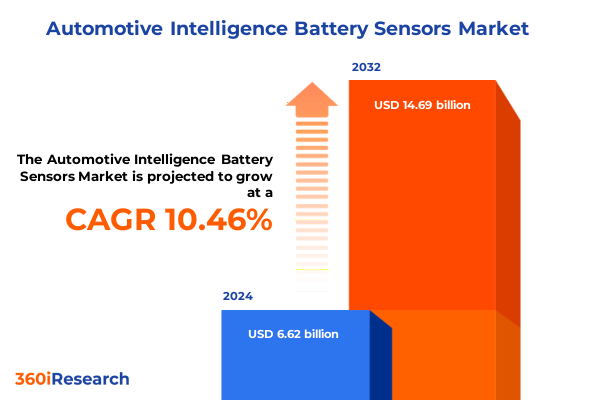

The Automotive Intelligence Battery Sensors Market size was estimated at USD 7.23 billion in 2025 and expected to reach USD 7.90 billion in 2026, at a CAGR of 10.64% to reach USD 14.69 billion by 2032.

Embracing Intelligent Battery Sensors as the Cornerstone of Automotive Electrification Strategies That Redefine Performance and Reliability

As the automotive industry accelerates its shift toward electrification, battery sensor technologies have emerged as critical enablers of vehicle performance, safety, and longevity. Intelligent battery sensors-which monitor parameters such as current flow, voltage levels, and temperature distribution-serve as the nervous system of modern electric, hybrid, and fuel cell vehicles. Through continuous diagnostics, these sensors mitigate risks of thermal runaway, optimize energy management, and support predictive maintenance models that underlie next generation service offerings. Consequently, manufacturers and tier suppliers are allocating significant R&D resources to refine sensor accuracy, integration, and resilience.

Moreover, the evolution of sensor architectures from discrete measurement devices to integrated smart modules reflects a broader convergence of automotive electronics, data analytics, and connectivity. By leveraging on-board processing, edge computing, and secure communication protocols, battery sensors now feed real-time intelligence into vehicle control units and cloud platforms. This transformation not only enhances operational transparency but also empowers autonomous systems to make split-second decisions under varying environmental and load conditions. As a result, the design and deployment of these sensors have become central to OEM strategies seeking to balance driving range, safety compliance, and total cost of ownership.

Identifying the Major Technology and Policy Shifts Across the Automotive Ecosystem That Will Transform Battery Sensor Applications and Drive Innovation

Across the automotive ecosystem, a confluence of technological advances and regulatory mandates is poised to recalibrate battery sensor innovation. On the technology front, the proliferation of low-power edge processors and miniaturized microelectromechanical systems has enabled sensors to deliver higher resolution data with minimal energy overhead. Concurrently, the integration of artificial intelligence and machine learning into sensor firmware is ushering in self-calibrating capabilities, pattern recognition algorithms for anomaly detection, and adaptive thresholding that can respond dynamically to varying operational stresses.

Regulatory bodies in major markets are intensifying safety standards, demanding more rigorous battery management protocols and transparent diagnostic reporting. Such frameworks are compelling automakers to adopt standardized communication interfaces and cybersecurity measures that safeguard data integrity from cell level through pack level. In parallel, the shift toward hydrogen fuel cell electric vehicles is driving specialized temperature sensors and pressure transducers capable of enduring corrosive media and high-pressure environments. Consequently, sensor developers are expanding their portfolios to address these niche requirements while maintaining cross-platform compatibility.

Assessing the Cumulative Effects of the 2025 United States Tariff Measures on Automotive Battery Sensor Supply Chains and Cost Structures

In 2025, new United States tariff measures on imported semiconductor components, raw sensor materials, and electronic modules have exerted notable pressure on the global supply chain for battery sensor technologies. Originally intended to bolster domestic manufacturing capacity, these levies have resulted in higher input costs for some tier suppliers, prompting them to reconsider sourcing strategies and accelerate the localization of critical production steps. At the same time, manufacturers operating across North America have responded by forging collaborative partnerships with domestic foundries and assembly houses to mitigate exposure to international trade fluctuations.

Furthermore, the cumulative impact of these tariff adjustments has extended beyond direct procurement expenses. Increased duties on intermediary components have driven OEMs to reexamine design architectures in search of cost-effective alternatives, such as silicon carbide substrates and multi-functional sensor chips that reduce part counts. As a result, the industry is witnessing a parallel shift toward modularized sensor designs that can be produced closer to end markets. This strategic realignment not only addresses tariff-induced constraints but also supports agile scaling in response to evolving consumer demand for electrified vehicles.

Unveiling Critical Insights from Multi-Dimensional Segmentation to Illuminate Automotive Battery Sensor Market Dynamics and Opportunities

A nuanced understanding of market dynamics emerges when battery sensor technologies are evaluated across multiple dimensions of segmentation. Vehicle type plays a defining role, with electric vehicles prioritizing high-precision voltage sensing for range optimization, fuel cell electric vehicles driving demand for advanced temperature and pressure monitoring to protect sensitive stacks, and hybrid electric vehicles balancing both requirements under fluctuating operational modes. Sensor type further delineates opportunities, as current sensors predominate in cell-level monitoring solutions, temperature sensors become indispensable for thermal management modules, and voltage sensors underpin pack-level balancing and diagnostic protocols.

Transportation mode introduces additional complexity: commercial vehicles demand ruggedized sensor enclosures and real-time telematics integration to ensure reliability over extended duty cycles, while passenger vehicles emphasize sensor miniaturization and cost efficiency to deliver seamless consumer experiences. Two-wheelers, with their compact form factors, require lightweight, low-power sensors that can withstand vibration and extreme temperature swings. In terms of application, cell monitoring sensors are critical for early detection of anomalies, module monitoring devices facilitate uniform performance across cluster configurations, onboard charging sensors enable fast-charging safety measures, and pack monitoring assemblies serve as the final line of defense against system-level faults. Finally, the choice between aftermarket and original equipment manufacturer channels influences sensor design priorities: aftermarket solutions focus on retrofit adaptability and straightforward diagnostics, whereas OEM integrations demand bespoke interfaces and rigorous validation to align with vehicle platforms.

This comprehensive research report categorizes the Automotive Intelligence Battery Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Sensor Type

- Transportation Mode

- Application

- Sales Channel

Analyzing Regional Variations in Adoption and Innovation to Reveal Strategic Priorities for Automotive Battery Sensor Deployment Worldwide

Regional landscape analyses reveal distinct drivers and adoption patterns for battery sensors around the globe. In the Americas, the United States leads through a combination of robust policy incentives for electrification, a growing network of charging infrastructure, and an expanding domestic semiconductor ecosystem. Canada and Mexico complement this growth by serving as strategic manufacturing hubs and by aligning regulatory frameworks with North American trade partners to streamline component flows.

Europe, the Middle East, and Africa present a diverse tapestry of market conditions. Stricter emissions targets in the European Union are accelerating uptake of advanced pack monitoring solutions, while the United Kingdom’s focus on zero-emission vehicle mandates is stimulating investments in sensor validation and homologation. In the Middle East, initial deployments of hydrogen fuel cell vehicles are generating demand for high-temperature sensors within emerging refueling networks. Certain regions in Africa are exploring two-wheeler electrification pilots where compact battery sensor modules can extend range and enhance operational safety in challenging climates.

In the Asia-Pacific region, China’s leadership in electric vehicle production is driving volume requirements for low-cost, high-throughput sensor manufacturing. Japan and South Korea continue to pioneer materials science innovations that improve sensor longevity, whereas India’s expanding two-wheeler EV segment is creating a specialized market for lightweight temperature and current sensing solutions. Across APAC, the convergence of industrial-scale production with nimble startup innovation fosters an ecosystem where sensor developers and automakers collaborate intensely to optimize performance and cost-effectiveness.

This comprehensive research report examines key regions that drive the evolution of the Automotive Intelligence Battery Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Shaping the Future Competitive Landscape of Battery Sensor Technologies

Key industry players are distinguishing themselves through technological leadership, strategic partnerships, and targeted investments in downstream capabilities. Leading semiconductor firms are leveraging their fabrication expertise to produce sensor chips with integrated analog front ends and digital signal processors, enabling higher accuracy and lower power consumption. Component manufacturers are forming alliances with automotive OEMs to co-develop next-generation sensor modules that align with proprietary battery management systems and vehicle control architectures.

Simultaneously, niche technology providers specializing in solid-state sensors, fiber-optic measurement techniques, and wireless telemetry are gaining traction by offering unique value propositions, such as enhanced electromagnetic resilience and over-the-air firmware updates. In parallel, forward-looking companies are pursuing mergers and acquisitions to consolidate capabilities across the value chain, ensuring end-to-end control from wafer processing through final sensor assembly. These strategic moves are reshaping the competitive landscape and elevating the importance of cross-domain expertise, including materials science, data analytics, and cybersecurity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Intelligence Battery Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abertax Technologies Ltd.

- Abertax Technologies Limited

- ams OSRAM AG

- AMS AG

- Anfield Sensors Inc..

- Autotech Components Pvt. Ltd

- BYD Company Ltd.

- Contemporary Amperex Technology Co., Limited

- Continental AG

- Furukawa Electric Co., Ltd.

- HELLA GmbH & Co. KGaA

- Infineon Technologies AG

- Inomatic GmbH

- Inomatic GmbH

- LG Chem Ltd.

- MELEXIS

- Mitsubishi Electric Corporation

- MTA Automotive Solutions Pvt. Ltd.

- Nuvoton Technology Corporation

- NXP Semiconductors N.V.

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Vishay Intertechnology, Inc.

Delivering Targeted Strategic Recommendations to Empower Industry Leaders in Maximizing Value Creation from Advanced Battery Sensor Solutions

To thrive amid rapid technological evolution and shifting trade dynamics, industry leaders must adopt a proactive strategic posture. Investing in modular sensor architectures that support multiple vehicle platforms will foster economies of scale and facilitate rapid design iterations. In parallel, cultivating a diversified supplier network-incorporating both domestic and regional partners-can mitigate tariff exposure while ensuring continuity of supply for critical sensor components.

Furthermore, deploying advanced digital twin models to simulate battery pack behavior under diverse operational scenarios can streamline validation cycles and reduce time to market. Leaders should also engage in standardization consortia and regulatory working groups to influence emerging safety and data communication protocols. Finally, prioritizing R&D efforts in AI-driven sensor analytics-encompassing predictive maintenance algorithms and anomaly detection frameworks-will enable new service-based revenue streams and reinforce long-term competitiveness.

Outlining a Robust Research Methodology Combining Quantitative Analysis and Qualitative Insights to Ensure Data Integrity and Relevance

This analysis draws upon a multi-faceted research framework designed to ensure rigor, transparency, and relevance. Primary research comprised in-depth interviews with senior executives and technical experts from OEMs, sensor manufacturers, and tier one suppliers, supplemented by on-site visits to production facilities and testing laboratories. Qualitative insights were further enriched through expert roundtables focused on emerging regulatory developments, materials innovations, and supply chain resilience.

Secondary research involved a comprehensive review of technical papers, patent filings, industry standards documentation, and public financial disclosures. Data triangulation techniques were applied to validate findings across independent sources, while an external panel of automotive electrification specialists provided methodological oversight. Throughout the process, all data points underwent stringent cross-verification to maintain consistency, minimize bias, and reflect the rapidly evolving nature of battery sensor technologies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Intelligence Battery Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Intelligence Battery Sensors Market, by Vehicle Type

- Automotive Intelligence Battery Sensors Market, by Sensor Type

- Automotive Intelligence Battery Sensors Market, by Transportation Mode

- Automotive Intelligence Battery Sensors Market, by Application

- Automotive Intelligence Battery Sensors Market, by Sales Channel

- Automotive Intelligence Battery Sensors Market, by Region

- Automotive Intelligence Battery Sensors Market, by Group

- Automotive Intelligence Battery Sensors Market, by Country

- United States Automotive Intelligence Battery Sensors Market

- China Automotive Intelligence Battery Sensors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Strategic Takeaways to Reinforce Decision-Making for Stakeholders Navigating the Evolving Automotive Battery Sensor Ecosystem

Drawing together the strategic themes uncovered throughout this executive summary, a clear mandate emerges for stakeholders to accelerate sensor innovation, optimize supply chain structures, and engage collaboratively across the automotive ecosystem. The integration of next-generation intelligent sensors will be pivotal in meeting stringent safety and performance standards, while also unlocking digital services that enhance vehicle uptime and customer satisfaction.

As regulations tighten and competitive pressures mount, organizations that embrace a holistic approach-encompassing technology development, localized manufacturing, and data-driven services-will be best positioned to lead the transition toward sustainable mobility. By synthesizing these takeaways, decision-makers can chart a course that balances risk mitigation with growth ambitions, ensuring that automotive battery sensors remain a strategic differentiator in the electrified vehicle landscape.

Connect with Associate Director of Sales and Marketing Ketan Rohom to Access Exclusive Automotive Battery Sensor Market Intelligence Tailored to Your Strategic Needs

For organizations poised at the forefront of mobility innovation, securing this comprehensive intelligence can be transformative. By engaging directly with Associate Director of Sales and Marketing Ketan Rohom, stakeholders gain privileged access to detailed analyses, bespoke insights, and strategic guidance tailored specifically to automotive battery sensor deployments. Such collaboration ensures decision-makers are equipped with the clarity needed to navigate complex supply chains, emerging regulations, and technological inflection points. Reach out now to obtain the definitive market research report and accelerate your pathway to market leadership.

- How big is the Automotive Intelligence Battery Sensors Market?

- What is the Automotive Intelligence Battery Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?