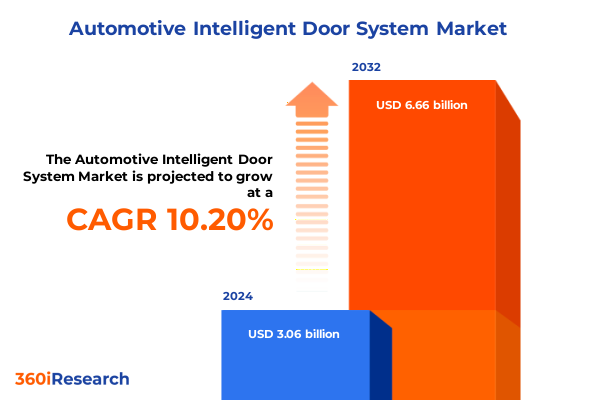

The Automotive Intelligent Door System Market size was estimated at USD 3.37 billion in 2025 and expected to reach USD 3.72 billion in 2026, at a CAGR of 10.66% to reach USD 6.86 billion by 2032.

Setting the Stage for Automotive Intelligent Door Systems by Unveiling Core Technologies, Market Drivers, and Strategic Imperatives Shaping the Industry

Automotive intelligent door systems have emerged as pivotal components in the evolution of modern vehicles, blending convenience, safety, and connectivity into a seamless user experience. As the industry pivots toward electrification, autonomous driving, and digitalization, these systems transcend traditional functions to serve as integral nodes within broader vehicle architectures. They facilitate secure access through biometric authentication, enhance occupant comfort via automated adjustments, and contribute to advanced driver assistance systems by integrating obstacle detection and digital key sharing capabilities.

In recent years, surging consumer expectations for personalized vehicle interactions, coupled with stringent safety regulations, have accelerated innovation in door mechanisms. The incorporation of sensor arrays and smart software platforms has unlocked features such as hands-free liftgates, proximity-based unlocking, and intelligent sliding door automation. These advancements not only elevate the overall user journey but also enable automakers to differentiate through unique feature bundles and digital services. Consequently, the value proposition of intelligent door systems extends well beyond hardware, encompassing over-the-air software updates, remote diagnostics, and integration with connected mobility ecosystems.

Against this backdrop, strategic decision-makers face the challenge of aligning product development roadmaps with emerging market trends, regulatory imperatives, and supply chain complexities. This executive summary distills the critical shifts reshaping the landscape, evaluates the impact of recent tariff measures, and highlights actionable insights across product, application, technology, end-user, and channel dimensions. By situating intelligent door systems within the larger context of future mobility, stakeholders can confidently navigate investment choices and partnership models that drive sustainable growth and competitive differentiation.

Unraveling Transformative Shifts in Automotive Intelligent Door Systems Driven by Technological Convergence, Sustainability Trends, and Evolving Consumer Expectations

The automotive intelligent door system sector has undergone transformative shifts driven by converging technologies and shifting regulatory frameworks. Manufacturers are integrating advanced sensor suites, such as camera-based, ultrasonic, infrared, and laser sensors, to achieve unprecedented levels of situational awareness. These sensor advancements have unlocked functionalities ranging from automatic obstacle detection during door movement to gesture-based control and digital twin integration for predictive maintenance.

Simultaneously, the rise of electric and autonomous vehicles is redefining platform architectures, enabling seamless communication between door modules and central vehicle management systems. This integration not only enhances occupant safety by coordinating door operations with autonomous parking maneuvers but also reduces complexity through centralized power distribution and shared control units. As a result, cross-functional collaboration between mechanical design teams, software developers, and electronics engineers has become a strategic imperative.

Furthermore, evolving consumer expectations around sustainability and user experience are fostering innovation in materials and powertrain compatibility. Lightweight composite materials, low-power electronics, and energy-harvesting mechanisms are gaining traction to align door system designs with stringent emissions and efficiency targets. In parallel, digital key solutions that leverage smartphone apps and cloud connectivity are reshaping how drivers interact with vehicle access, moving the industry beyond traditional key fobs to more secure and user-centric authentication methods.

Taken together, these trends reflect a broader shift toward holistic vehicle ecosystems, where intelligent door systems play a vital role in enhancing safety, convenience, and connectivity. Stakeholders who recognize and adapt to these shifts stand to capture emerging value pools and secure leadership positions in the next generation of mobility solutions.

Analyzing the Cumulative Impact of United States Tariffs Implemented through 2025 on Supply Chains, Component Costs, and Global Competitive Positioning

Since the imposition of Section 301 tariffs and subsequent trade measures, the U.S. automotive supply chain has navigated a complex tariff landscape that extends to key components integral to intelligent door systems. Steel and aluminum tariffs, initially set in 2018, continue to influence raw material costs for door frames and reinforcement beams, compelling manufacturers to absorb higher input prices or seek alternative suppliers. Concurrently, tariffs on electronic components sourced from major manufacturing hubs have elevated the cost basis for sensors, actuators, and control modules through 2025.

This cumulative tariff burden has prompted leading manufacturers to reassess their sourcing strategies by deepening domestic partnerships and localizing production. In some cases, joint ventures with U.S.-based electronics firms have been established to secure tariff‐exempt status for sensor assemblies. Furthermore, companies are investing in tariff engineering-redesigning bill of materials to shift content towards lower–duty categories or qualifying for exemption under free trade agreements.

Despite these efforts, the ripple effects of tariffs have extended beyond procurement costs. Extended lead times for certain imported subassemblies have disrupted launch schedules for new vehicle models, amplifying the importance of supply chain visibility and risk mitigation protocols. Stakeholders are increasingly leveraging digital twin technologies and real‐time analytics to forecast disruptions and reroute orders dynamically. As the tariff environment remains fluid, ongoing scenario planning and agile negotiation of supplier contracts have become essential strategies for sustaining profitability and timeliness in delivering intelligent door systems to market.

Illuminating Key Segmentation Insights in Automotive Intelligent Door Systems through Product, Application, Technology, End User, and Channel Perspectives

Automotive intelligent door systems encompass a diverse array of product configurations, ranging from traditional central locking mechanisms to sophisticated power liftgates and sliding door solutions. Within central locking, manufacturers differentiate offerings through electromechanical designs or magnetic locking modules, each balancing factors such as cost, reliability, and integration ease. Meanwhile, keyless entry has evolved from remote-fob solutions into proximity-based systems, where key cards and smartphone-enabled authentication coexist to meet varying consumer preferences and security requirements. Power liftgates further fragment into hands-free variants that detect user intent and switch-operated designs optimized for cost efficiency, while sliding door assemblies address both dual-track configurations favored in premium passenger vans and single-track options tailored to compact commercial vehicles.

Beyond product typologies, application-level segmentation reveals divergent dynamics across passenger cars, commercial vehicles-including light and heavy segments-and mass transit buses and coaches. Passenger car OEMs, driven by consumer demand for convenience and personalization, aggressively integrate advanced door features, whereas commercial fleet operators prioritize robustness, ease of maintenance, and total cost of ownership. On the technology front, the selection of camera-based, infrared, laser, or ultrasonic sensors hinges on performance requirements in diverse environmental conditions, with manufacturers often bundling multiple sensors to achieve redundancy and higher detection fidelity.

End-user segmentation bifurcates between original equipment manufacturers and aftermarket channels, the latter further subdivided into authorized service centers and independent repair garages. OEMs focus on seamless integration during assembly, whereas aftermarket providers emphasize retrofit compatibility and cost-effective upgrades. Finally, distribution channels span from direct sales and specialty brick-and-mortar outlets to e-commerce platforms and manufacturer websites, reflecting broader digital-commerce trends that allow consumers and fleet managers to procure advanced door modules with increasing convenience and custom configurability.

This comprehensive research report categorizes the Automotive Intelligent Door System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

- Channel

Examining the Key Regional Dynamics Shaping Automotive Intelligent Door System Adoption across Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics are critical in shaping the trajectory of automotive intelligent door system adoption, with each geography exhibiting unique regulatory, economic, and consumer behavior drivers. In the Americas, particularly North America, stringent safety mandates and rising labor costs have fueled a shift toward automation and sensor-based solutions. Local content requirements under various trade agreements further incentivize the localization of component manufacturing, fostering partnerships between domestic tier-one suppliers and global electronics firms to streamline production and reduce exposure to import duties.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the European New Car Assessment Programme and Gulf safety standards are driving the mandate of advanced occupant protection and pedestrian detection functionalities that door systems can facilitate. At the same time, Europe’s focus on emissions reduction encourages lightweight design and low-power electronics, while aftermarket service networks in EMEA invest in retrofit programs to extend the lifecycle of existing fleets. In rapidly urbanizing Middle Eastern and African markets, demand for robust sliding door systems in buses and shuttle services is rising, underpinned by public transit modernization initiatives.

In Asia-Pacific, the convergence of growing vehicle ownership, urban mobility solutions, and expansive manufacturing ecosystems positions the region as a hotbed for intelligent door innovations. China leads in volume, with domestic OEMs racing to differentiate through smartphone integration and digital key ecosystems. Meanwhile, Japan’s advanced robotics sectors contribute to precision manufacturing of sensor assemblies, and India’s cost-sensitive market stimulates development of modular, scalable systems. As a result, Asia-Pacific remains a focal point for joint ventures, local R&D centers, and pilot deployments that inform product roadmaps for global rollouts.

This comprehensive research report examines key regions that drive the evolution of the Automotive Intelligent Door System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation and Competitive Strategies in the Automotive Intelligent Door System Landscape across Diverse Global Players

Leading players in the automotive intelligent door system domain are pursuing multifaceted strategies to fortify their market positions. Established tier-one suppliers such as Continental and Bosch leverage deep integration with vehicle electronic architectures to offer turnkey door modules that align with advanced driver assistance systems. These firms invest significantly in in-house sensor R&D and forge alliances with semiconductor companies to secure next-generation LiDAR and ultrasonic technologies tailored for door safety and convenience functions.

Simultaneously, companies like Valeo and DENSO emphasize modular product platforms that accommodate diverse sensor configurations and powertrain interfaces, enabling rapid customization for OEMs across global vehicle segments. Their strategic playbooks often include co-development agreements with automakers and targeted acquisitions of niche technology firms specializing in biometrics or over-the-air software delivery. In parallel, emerging entrants and technology startups are carving out specialized niches-such as AI-driven gesture recognition or cloud-native digital key services-and attracting venture-capital backing to accelerate commercialization.

Furthermore, partnerships between traditional automotive suppliers and tech companies have gained prominence, exemplified by collaborations to embed smartphone ecosystems directly into door control units. These alliances not only enhance consumer experience but also create new aftersales revenue streams through subscription-based feature unlocks. Amidst this competitive mosaic, companies that balance scale-driven R&D investment with agile go-to-market models stand poised to capture leadership in the next wave of intelligent door system innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Intelligent Door System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Continental AG

- DENSO Corporation

- FORVIA

- Hirotec Corporation

- Label UK Automatic Door Solutions Ltd.

- Magna International Inc.

- Mitsui Kinzoku ACT Corporation

- Nabtesco Corporation

- NMB Technologies Corporation

- Nuki Home Solutions GmbH

- Renesas Electronics Corporation

- Ronstein Automation Technology Co., Ltd.

Providing Actionable Recommendations for Industry Leaders to Capitalize on Emerging Automotive Intelligent Door System Opportunities and Navigate Market Complexities

Industry leaders seeking to harness the full potential of intelligent door systems should prioritize the establishment of agile cross-functional teams that integrate hardware, software, and regulatory expertise. By doing so, organizations can accelerate iteration cycles and align product roadmaps with evolving safety standards and consumer preferences. In parallel, cultivating strategic partnerships with sensor manufacturers and software platforms will help secure early access to cutting-edge technologies while sharing the cost burden of R&D.

Moreover, diversifying supply chains through regionalized production hubs can mitigate tariff exposure and enhance responsiveness to local market requirements. Companies should actively explore tariff engineering opportunities and leverage free trade agreements to optimize bill of materials structures. Equally important is the deployment of digital supply chain tools-such as real-time analytics, blockchain-powered traceability, and digital twins-to forecast disruptions and enact contingency plans before they materialize.

From a go-to-market perspective, OEMs and aftermarket providers alike must invest in customer-centric digital channels that facilitate seamless configuration, order management, and post-sales support. Subscription models for software-based features represent another avenue to generate recurring revenue and strengthen brand loyalty. Finally, maintaining a forward-looking regulatory watch, combined with proactive stakeholder engagement, will ensure that door system offerings not only comply with emerging safety mandates but also shape industry norms through active participation in standard-setting bodies.

Detailing the Research Methodology Employed to Generate Rigorous Insights on Automotive Intelligent Door Systems Using Comprehensive Primary and Secondary Approaches

This research employs a rigorous two-pronged methodology combining primary and secondary data sources to deliver robust insights. The primary research phase consisted of in-depth interviews with C-level executives, product engineers, and supply chain managers at leading OEMs, tier-one suppliers, and aftermarket service providers. These interviews were structured to uncover strategic priorities, technology adoption hurdles, and tariff mitigation tactics. In parallel, a broad survey of end-users and fleet operators captured perspectives on feature preferences, reliability expectations, and purchasing criteria for intelligent door systems.

Secondary research complemented this firsthand data by analyzing corporate filings, patent portfolios, industry white papers, and regulatory documents. Technical standards publications provided critical context on sensor performance benchmarks and safety protocols. Additionally, trade association reports and government import/export statistics were examined to quantify the impact of tariff measures and regional production shifts. This blend of qualitative and quantitative sources enabled triangulation of findings and validation of emerging trends.

Data synthesis involved thematic coding of interview transcripts and statistical analysis of survey responses, with key insights cross-referenced against secondary findings. Ongoing peer reviews by subject-matter experts ensured accuracy and relevance. Finally, scenario planning exercises were conducted to evaluate the implications of potential regulatory changes and supply chain disruptions, shaping actionable recommendations for industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Intelligent Door System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Intelligent Door System Market, by Product

- Automotive Intelligent Door System Market, by Technology

- Automotive Intelligent Door System Market, by Application

- Automotive Intelligent Door System Market, by End User

- Automotive Intelligent Door System Market, by Channel

- Automotive Intelligent Door System Market, by Region

- Automotive Intelligent Door System Market, by Group

- Automotive Intelligent Door System Market, by Country

- United States Automotive Intelligent Door System Market

- China Automotive Intelligent Door System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Insights Highlighting the Strategic Imperatives and Future Outlook for Stakeholders Engaging with Automotive Intelligent Door Systems

In conclusion, automotive intelligent door systems occupy a strategic nexus of safety, convenience, and connectivity within next-generation vehicle platforms. The convergence of advanced sensors, digital key technologies, and modular architectures is reshaping how users interact with vehicles while driving new avenues for revenue through software services and aftermarket upgrades. Stakeholders that effectively navigate the cumulative impacts of trade measures, regional dynamics, and evolving consumer expectations will be best positioned to secure competitive advantage.

Looking ahead, continuous innovation in sensor fusion, artificial intelligence-driven control algorithms, and sustainable materials will define the next wave of product differentiation. Proactive engagement with regulatory bodies and deep collaboration across the value chain will be essential to align innovation timelines with safety mandates and market readiness. By leveraging the strategic recommendations outlined herein and maintaining agility in both design and sourcing practices, industry participants can unlock new growth opportunities and contribute to safer, smarter, and more connected mobility experiences.

Engage Directly with Ketan Rohom to Unlock Strategic Precision and Propel Your Automotive Intelligent Door System Decisions through Expert Research Access

Ketan Rohom, Associate Director of Sales & Marketing, extends a personal invitation to connect and explore how our in-depth automotive intelligent door system research can empower your strategic initiatives. By engaging directly, you will gain access to comprehensive data, expert analysis, and tailored insights designed to address your organization’s unique challenges. Whether you are evaluating new product development, optimizing supply chains, or seeking competitive differentiation, our report delivers the clarity and confidence you need to make informed decisions.

Initiating this collaboration is straightforward: schedule a dedicated consultation with Ketan to discuss the specific aspects of the market that matter most to you. Through this personalized engagement, you will uncover actionable intelligence that transcends generic commentary and is calibrated to your business priorities. Moreover, our flexible licensing options ensure that you can leverage the findings across business units, fueling innovation and growth.

Seize the opportunity to stay ahead in a rapidly evolving landscape. Reach out to Ketan Rohom today to secure your copy of the automotive intelligent door system market research report and join a cadre of industry leaders transforming tomorrow’s mobility solutions.

- How big is the Automotive Intelligent Door System Market?

- What is the Automotive Intelligent Door System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?