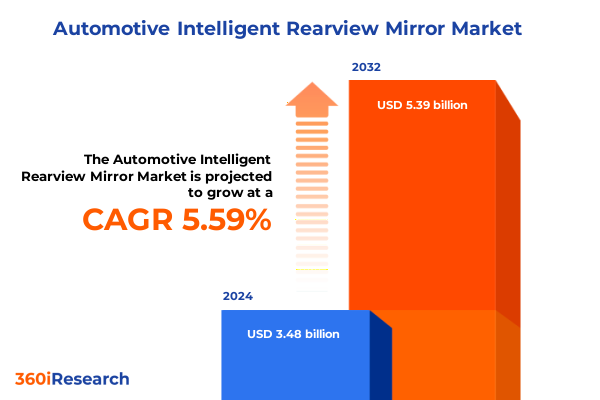

The Automotive Intelligent Rearview Mirror Market size was estimated at USD 3.68 billion in 2025 and expected to reach USD 3.90 billion in 2026, at a CAGR of 5.58% to reach USD 5.39 billion by 2032.

Setting the Stage for Next-Generation Automotive Intelligent Rearview Mirrors by Understanding Their Role in Modern Vehicle Ecosystems

The evolution of automotive viewing systems has transcended the traditional mirror, ushering in an era where intelligent rearview solutions are integral to vehicle ecosystems. As consumer demand intensifies for enhanced situational awareness, safety, and connectivity, manufacturers and Tier 1 suppliers are racing to embed advanced camera monitor systems, display mirrors, and hybrid solutions that seamlessly integrate with onboard electronics. Against this backdrop, a strategic understanding of product architecture, functional differentiation, and end-user use cases is essential for stakeholders who seek to navigate technological complexity and capitalize on emerging adoption pathways.

This executive summary provides a structured lens through which to examine the interplay between sensor fusion, software analytics, and human-machine interface design in modern mirror solutions. It highlights the factors driving rapid deployment across electric and conventional powertrains, outlines the significance of display technology selection for image fidelity and energy efficiency, and underscores the implications of evolving regulatory requirements on system certification and validation. By framing the discussion in this way, industry leaders can align their product roadmaps and investment decisions with clear insights into competitive positioning and customer value propositions.

Exploring the Technological Advancements and Mobility Trends That Are Redefining Automotive Intelligent Rearview Mirror Applications Across Vehicles

In recent years, the automotive landscape has witnessed seismic shifts in how rearview functionality is conceptualized and delivered. The transition from mechanical mirrors to camera monitor systems represents more than a hardware upgrade-it embodies the convergence of optics, electronics, and artificial intelligence to deliver enhanced safety and driver confidence. Early adopters have demonstrated that high-resolution imaging combined with night vision, dynamic range optimization, and real-time object detection can reduce blind spots and improve situational awareness in complex driving environments.

Concurrently, trends in vehicle electrification and autonomous mobility have elevated the role of intelligent mirrors as part of broader sensor networks. These components now interface with surround-view cameras, advanced driver assistance systems, and over-the-air update frameworks to support continuous feature enhancements. As such, rearview solutions are evolving into multifunctional modules that extend beyond rearward visibility to include augmented reality overlays, lane departure alerts, and cross-traffic detection. This transformative momentum is reshaping collaboration models between OEMs and technology providers, forging partnerships that leverage deep learning expertise, semiconductor miniaturization, and cloud-based analytics.

Moving forward, the ability to anticipate shifting consumer expectations and regulatory standards will be critical. Stakeholders must balance the integration of cutting-edge capabilities with considerations around cybersecurity, data privacy, and system robustness under extreme operational conditions. In doing so, they will unlock new dimensions of user experience and competitive differentiation.

Assessing the Comprehensive Effects of 2025 United States Tariff Measures on the Supply Chain and Cost Structures of Intelligent Rearview Mirror Components

The implementation of new tariff measures in the United States has introduced significant considerations for the sourcing and manufacturing strategies of intelligent rearview mirror components. With duties imposed on a spectrum of imported parts, including high-precision cameras, semiconductor chips, and display panels, suppliers have encountered elevated landed costs that directly influence bill-of-materials optimization. This environment has prompted Tier 1 manufacturers to reevaluate their global production networks, diversify procurement sources, and explore nearshoring opportunities to maintain price competitiveness and supply chain resiliency.

Impacts extend beyond cost inflation; lead-time volatility has increased as logistics providers adjust to tariff-induced routing changes and customs inspection protocols. Companies that previously depended on a narrow set of overseas suppliers have implemented dual-sourcing models and established buffer inventories, ensuring continuity during periods of regulatory flux. Meanwhile, collaborative initiatives with customs authorities and local trade associations aim to expedite classification processes and identify applicable tariff exemptions for advanced technology goods.

Despite these headwinds, some industry players view the tariff landscape as a catalyst for greater vertical integration and domestic investment in component fabrication. By reinforcing local manufacturing capabilities, stakeholders can benefit from reduced exposure to currency fluctuations and transportation bottlenecks, ultimately securing a more agile response to fluctuating demand and policy shifts. In turn, this adaptation fosters a more stable environment for the introduction of next-generation mirror solutions.

Unveiling Deep Segmentation Insights Across Technology, Powertrain, Display, Sales Channels, and Vehicle Type Dimensions for Mirror Solutions

When examining intelligent rearview mirrors through a technology lens, camera monitor systems are at the forefront of innovation, delivering real-time high-definition imaging paired with advanced analytics, while display mirrors appeal to cost-conscious segments by offering a familiar form factor enhanced with digital overlays. Hybrid mirrors strive to balance both worlds, embedding small camera modules within traditional mirror enclosures to meet incremental upgrade budgets without sacrificing user acceptance. This layered technological segmentation informs product roadmaps and priority investment areas for research and development teams.

Overlaying powertrain differentiation reveals that battery electric vehicles are often equipped with sophisticated display solutions to maximize efficiency and leverage the inherent electronic architecture, while hybrid electric vehicles may adopt modular mirror upgrades that align with their transitional positioning. Internal combustion engine vehicles frequently receive retrofit-friendly packages, enabling aftermarket installations and extended lifecycle monetization. Understanding the interplay between vehicle architecture and rearview mirror options is critical for OEMs looking to orchestrate platform harmonization and capitalize on volume transitions.

Display technology selection constitutes another axis of differentiation, with LCD panels delivering reliable performance at scale and OLED technology emerging as a premium offering that provides deeper contrast ratios, wider viewing angles, and lower power consumption. Sales channel strategies likewise influence configuration choices, as offline dealerships prioritize bundle deals and visible demos to drive customer confidence, whereas online platforms emphasize configurator tools, subscription models, and remote diagnostics capabilities. Finally, the dichotomy between commercial vehicles and passenger cars underscores usage patterns and durability requirements. Heavy commercial vehicles demand ruggedized solutions with extended operational lifespans, light commercial vehicles benefit from cost-efficient scalability, and passenger segments ranging from hatchback to SUV seek differentiated styling and feature customization to align with personal mobility preferences.

This comprehensive research report categorizes the Automotive Intelligent Rearview Mirror market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Powertrain

- Display Technology

- Sales Channel

- Vehicle Type

Analyzing Regional Variations in Adoption Drivers, Infrastructure Compatibility, and Regulatory Dynamics Across Key Global Automotive Markets

Across the Americas, regulatory emphasis on safety standards and crash avoidance systems has accelerated the incorporation of camera-based mirror replacements into mainstream vehicle lines. North American and South American OEMs alike are leveraging government incentives and compliance mandates to support the rollout of advanced driver assistance systems, cultivating an environment conducive to early deployment of both aftermarket and factory-fit mirror technologies. Market participants who align with regional homologation requirements and local sourcing objectives gain a distinct competitive advantage in this geography.

In Europe, Middle East, and Africa, a heterogeneity of regulations and infrastructure maturity shapes adoption dynamics. Western European countries with stringent emissions and safety directives have integrated digital mirror systems into premium and mass-market segments, while emerging markets in the Middle East and Africa evaluate cost-benefit trade-offs against nascent infrastructure investments. Stakeholders in this region must navigate a complex tapestry of certification pathways and prioritize modular designs that accommodate variable climate conditions and service network capacities.

The Asia-Pacific landscape is driven by rapid urbanization, high vehicle density, and aggressive electrification agendas. Leading markets in East Asia have embraced intelligent mirror technologies as part of comprehensive smart mobility ecosystems, often incorporating over-the-air update capabilities and multilingual user interfaces. Meanwhile, South and Southeast Asian markets focus on cost-effective solutions that can be retrofitted to existing fleets, underscoring the importance of scalable manufacturing and localized assembly partnerships. In each regional cluster, successful mirror strategies are those that marry technical sophistication with regulatory alignment and channel-specific go-to-market approaches.

This comprehensive research report examines key regions that drive the evolution of the Automotive Intelligent Rearview Mirror market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Players’ Strategic Initiatives, Partnerships, and Innovation Portfolios in the Intelligent Rearview Mirror Market

Among the forefront innovators, several global technology providers and Tier 1 suppliers distinguish themselves through strategic partnerships, patent portfolios, and end-to-end system offerings. These companies have invested heavily in research centers and collaborative test beds with leading OEMs, enabling rapid prototyping of next-generation mirror modules that integrate sensors, displays, and connectivity stacks. Their collaborative ecosystems often extend to software developers, semiconductor foundries, and design houses, ensuring that each product iteration meets stringent quality and performance standards.

Mergers and acquisitions have also played a critical role, with cross-sector alliances allowing mirror specialists to acquire AI-driven video analytics start-ups or display panel manufacturers to secure capacity for high-contrast OLED production. This consolidation trend supports a holistic value proposition, delivering turnkey solutions that simplify integration for both OEMs and aftermarket channels. Strategic licensing agreements further enable flexible deployment models, whether as fully embedded factory options or plug-and-play retrofit kits.

Concurrently, a cadre of agile disruptors is carving niches by focusing on specialized use cases such as commercial vehicle telematics, fleet management integration, and lightweight mirror assemblies for two-wheelers. These participants leverage targeted investments and focused customer engagements to challenge incumbents and accelerate innovation. Taken together, these dynamics underscore a competitive landscape defined by technological depth, collaborative networks, and a relentless pursuit of performance differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Intelligent Rearview Mirror market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Aptiv PLC

- Continental AG

- Denso Corporation

- Ficosa International S.A.

- FORVIA SA

- Gentex Corporation

- HELLA GmbH & Co. KGaA

- Hyundai Mobis Co., Ltd.

- Ichikoh Industries, Ltd.

- Magna International Inc.

- Panasonic Corporation

- Pioneer Corporation

- Robert Bosch GmbH

- Samvardhana Motherson International Limited

- SL Corporation

- Stoneridge, Inc.

- Tokai Rika Co., Ltd.

- Valeo SA

- Visteon Corporation

Crafting Strategic Imperatives and Operational Tactics for Industry Leaders to Capitalize on Emerging Opportunities in Mirror Technologies

To thrive in the intelligent rearview mirror ecosystem, industry leaders must adopt a multi-pronged strategic playbook that aligns technological investments with market imperatives. Prioritizing advanced imaging and AI capabilities is essential, but so too is the establishment of flexible supply chains that can navigate dynamic tariff and regulatory environments. By integrating semiconductor manufacturing partnerships, deep optics expertise, and display suppliers early in product development cycles, stakeholders can reduce time to market and mitigate cost pressures.

Strategic collaborations with OEMs remain a cornerstone of go-to-market success. These alliances should extend beyond conventional sourcing agreements to encompass joint road-mapping exercises, co-development of software algorithms, and shared pilot deployments. Such approaches foster mutual ownership of performance and safety outcomes, accelerating validation cycles and establishing clear pathways for global certification.

Furthermore, adopting a customer-centric orientation in aftermarket channels will drive incremental revenue streams and brand loyalty. Tailored subscription models that offer software upgrades, extended warranties, and remote diagnostics can enhance lifecycle value. Finally, leaders must remain vigilant of emerging mobility paradigms-such as shared fleets, autonomous shuttles, and micro-mobility platforms-and tailor mirror offerings to support versatile installation form factors, interoperability requirements, and predictive maintenance frameworks.

Through this combination of foresight, agility, and collaborative rigor, organizations can position themselves at the vanguard of rearview mirror innovation and secure sustainable competitive advantage.

Detailing the Research Framework Combining Qualitative and Quantitative Approaches to Ensure Comprehensive Coverage and Analytical Rigor

This research initiative employs a hybrid methodology that blends primary qualitative interviews with quantitative data triangulation to deliver robust intelligence. In-depth discussions with OEM engineering leads, Tier 1 procurement executives, and aftersales managers provided firsthand insights into technology adoption rationales, supply chain challenges, and performance benchmarks. These conversations were complemented by a structured survey targeting a broad spectrum of industry stakeholders, capturing end-user requirements and platform preferences across global regions.

Secondary research underpins the analysis with comprehensive reviews of regulatory filings, patent databases, technical white papers, and trade publications from both established and emerging markets. This backdrop ensures a rigorous understanding of safety standards, certification pathways, and intellectual property trends. A dedicated team conducted a comparative assessment of display technologies by collating data from display manufacturers, semiconductor foundries, and independent labs to evaluate contrast performance, power consumption, and integration complexity.

To validate and refine findings, multiple rounds of analysis were conducted using cross-functional expert panels, including specialists in optics, software algorithms, and manufacturing scalability. A final quality control phase applied consistency checks and peer reviews to guarantee that conclusions and recommendations align with real-world feasibility and strategic relevance. This multifaceted approach ensures that the executive summary delivers actionable insights grounded in empirical evidence and sector expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Intelligent Rearview Mirror market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Intelligent Rearview Mirror Market, by Technology

- Automotive Intelligent Rearview Mirror Market, by Powertrain

- Automotive Intelligent Rearview Mirror Market, by Display Technology

- Automotive Intelligent Rearview Mirror Market, by Sales Channel

- Automotive Intelligent Rearview Mirror Market, by Vehicle Type

- Automotive Intelligent Rearview Mirror Market, by Region

- Automotive Intelligent Rearview Mirror Market, by Group

- Automotive Intelligent Rearview Mirror Market, by Country

- United States Automotive Intelligent Rearview Mirror Market

- China Automotive Intelligent Rearview Mirror Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights and Forward-Looking Perspectives to Highlight the Strategic Significance of Intelligent Rearview Mirrors

As intelligent rearview mirrors transition from niche novelty to essential vehicle components, the strategic imperative for stakeholders is clear: embrace the confluence of optics, electronics, and data analytics to deliver unparalleled driver experience and safety enhancements. The transformative potential of these solutions hinges on the integration of high-performance imaging, robust AI algorithms, and seamless connectivity that supports both factory-fit and aftermarket implementations.

In navigating the complexities of 2025 tariff changes, segmentation nuances, and regional regulatory dynamics, decision-makers must cultivate supply chain resilience while partnering closely with technology providers. The varied adoption rates across powertrain types, display technologies, and distribution channels underscore the necessity for adaptable go-to-market frameworks and customer-centric value propositions. Those organizations that fine-tune their product portfolios to accommodate differentiated use cases-from heavy commercial fleets to premium passenger SUVs-will realize sustained competitive advantage.

Ultimately, success in this domain will be defined by collaborative ecosystems that facilitate rapid innovation cycles, rigorous performance validation, and informed scalability. By aligning strategic direction with granular market insights, companies can chart a course toward robust growth and leadership in the evolving landscape of automotive intelligent rearview mirror technologies.

Engaging with Ketan Rohom to Unlock Customized Intelligence That Drives Informed Decisions and Accelerates Market Leadership

Don’t let this strategic window close without securing the detailed intelligence and tailored recommendations your organization needs. Engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to discuss how our comprehensive automotive intelligent rearview mirror report can be customized to address your most pressing challenges and growth objectives. Ketan’s deep understanding of the technology landscape, market dynamics, and end-user requirements will ensure you receive actionable insights and prioritization frameworks that align with your business model and investment horizon.

By partnering with Ketan, you will gain access to exclusive executive summaries, dedicated analyst support, and the option for bespoke workshops designed to integrate key findings into your strategic planning process. His consultative approach will help you identify priority areas for product innovation, supply chain optimization, and go-to-market acceleration. Reach out to arrange a personalized briefing or to obtain licensing details, and take the next step toward leveraging cutting-edge market intelligence that empowers your organization to lead in the evolving rearview mirror technology arena.

- How big is the Automotive Intelligent Rearview Mirror Market?

- What is the Automotive Intelligent Rearview Mirror Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?