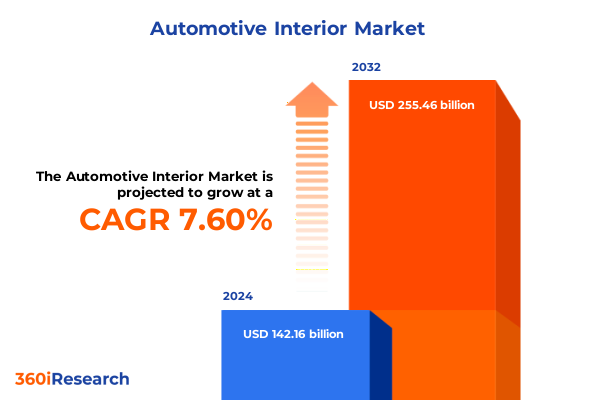

The Automotive Interior Market size was estimated at USD 152.33 billion in 2025 and expected to reach USD 163.22 billion in 2026, at a CAGR of 7.66% to reach USD 255.46 billion by 2032.

Unveiling the Intricacies of Automotive Interiors to Frame the Scope, Objectives, and Strategic Importance of the Market Analysis Ahead

Automotive interiors are undergoing an unprecedented transformation driven by shifting consumer expectations, technological advancements, and a heightened emphasis on sustainability. This report commences by outlining the scope of analysis, which encompasses major component categories such as seating systems and instrument panels, diverse material substrates ranging from memory foam and genuine leather to advanced synthetics, multiple propulsion architectures including battery electric and hybrid systems, as well as vehicle classifications spanning passenger cars to heavy commercial trucks. By establishing clear objectives-namely to identify core growth drivers, evaluate risk vectors like tariff fluctuations, and deliver actionable guidance-the introduction sets the stage for a holistic exploration of the market. Throughout the study, emphasis is placed on synthesizing qualitative insights from industry executives with quantitative survey findings, thus ensuring a balanced perspective. The opening section also articulates the report’s strategic importance for supply chain managers, design engineers, and corporate planners, positioning the analysis as an essential tool for navigating the complex dynamics of tomorrow’s automotive cabins.

Tracing the Dynamic Evolution of Design Innovation, Sustainable Material Adoption, and Technological Integration Reshaping Vehicle Cabin Experiences Globally

The automotive interior sector is being reshaped by the confluence of four major thematic shifts: sustainable materials, experiential personalization, smart cabin technologies, and modular architectures. First, sustainability has become a central design tenet, with manufacturers transitioning from conventional vinyl and plastic toward recycled fabrics, bio-based foams, and synthetic leather alternatives. Second, personalization now extends beyond color palettes to include adaptive seating, ambient lighting schemes, and haptic feedback interfaces, catalyzing heightened user engagement. Third, the rapid integration of digital ecosystems within the cabin-ranging from heads-up displays and over-the-air software updates to biometric sensing-has elevated the cockpit from a passive environment to an intelligent mobility hub. Finally, modular construction techniques enable scalable assembly across multiple vehicle lines, reducing development lead times while accommodating diverse propulsion platforms. Together, these transformative currents are redefining value creation, prompting original equipment manufacturers to forge cross-disciplinary partnerships and explore new business models to capitalize on evolving consumer demand.

Analyzing the Multifaceted Impact of 2025 Tariff Adjustments on Interior Component Supply Chains, Cost Structures, and Procurement Strategies within the United States Market

In 2025, the United States implemented a series of enhanced tariff measures targeting key imports of automotive interior components and raw materials, provoking a ripple effect through procurement and manufacturing strategies. Import levies on specialized textiles, high-performance polymers, and electronic modules led original equipment manufacturers to reassess global sourcing footprints. Consequently, many suppliers accelerated the diversification of their manufacturing bases, shifting assembly operations to tariff-exempt regions in Asia-Pacific and Latin America. Simultaneously, cost pressures triggered renegotiations of long‐term contracts, with many Tier 1 vendors exploring nearshoring options to mitigate duties and logistical complexities. Beyond direct cost implications, the tariff landscape catalyzed increased inventory buffering strategies, prompting certain automakers to pre-purchase critical materials to hedge against further policy volatility. While these adjustments introduced short-term disruptions, they have fostered a more resilient supply chain architecture-one that balances cost efficiency with regulatory agility.

Illuminating Distinct Trends and Growth Drivers across Component, Material, Propulsion, Vehicle, and Sales Channel Segments to Inform Targeted Investment Decisions

Market segmentation illuminates nuanced performance patterns across component and material classifications, propulsion architectures, vehicle categories, and distribution channels. The carpet, center console, door panel, headliner, instrument panel, and seating assemblies each exhibit distinct growth trajectories, with seating systems-encompassing both front and rear configurations-driving considerable innovation in ergonomics and safety compliance. Material preferences are diversifying as OEMs deploy alcantara in premium trims, fabric in entry-level models, and advanced foam options, including memory and PU variants, for enhanced comfort and weight optimization; genuine and synthetic leather choices reflect diverging consumer priorities between luxury and sustainability. In parallel, the shift toward battery electric and plug-in hybrid platforms has intensified demand for lightweight materials and integrated electronic interfaces, while internal combustion variants maintain legacy volumes in emerging economies. Commercial vehicle interiors, from heavy duty vocational truck cabs to lighter delivery vans, are embracing modular dashboard kits to streamline customization, and the growth of aftermarket channels is being propelled by ride-hailing and fleet-management Retrofit programs while OEM direct replacement parts continue to serve warranty-backed maintenance needs. This multi-dimensional segmentation framework identifies high-potential subsegments, signaling where resource allocation can yield the greatest strategic returns.

This comprehensive research report categorizes the Automotive Interior market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Material Type

- Propulsion

- Vehicle Type

- Sales Channel

Highlighting Regional Diversities and Strategic Opportunities across Americas, EMEA, and Asia-Pacific to Understand Geographically Driven Demand Variances in Interior Design

Regional dynamics are instrumental in shaping strategic priorities and product roadmaps for interior OEMs and assemblers. In the Americas, North American consumer preferences for robust seating systems and integrated infotainment solutions coincide with regulatory pushes for enhanced occupant safety, driving demand for advanced sensor-embedded panels. Meanwhile, in Central and South American markets, cost-effective materials and simplified design templates remain prevalent due to budget sensitivities, although rapid urbanization is gradually elevating expectations for comfort and connectivity. Across Europe, Middle East, and Africa, stringent European Union emissions targets and evolving mobility models are accelerating the adoption of lightweight bio-materials and seamless software ecosystems. The Middle East’s luxury vehicle segment underscores bespoke leather trim packages, while African markets prioritize durable, easy-to-clean finishes to address terrain and maintenance variables. Within Asia-Pacific, high-volume production hubs in China, India, and Southeast Asia are leveraging economies of scale to introduce localized material blends, and Japan and South Korea continue to lead in premium ergonomic seating and next-generation human-machine interface integration. These regional insights underscore the importance of geographically tailored R&D investments and supply chain configurations.

This comprehensive research report examines key regions that drive the evolution of the Automotive Interior market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players’ Strategic Initiatives, Collaborative Ventures, and Technological Innovations Shaping the Competitive Landscape in Automotive Interiors

The competitive arena for automotive interior solutions is characterized by strategic alliances, vertical integration efforts, and technology licensing agreements. Tier 1 suppliers are forging partnerships with semiconductor vendors to develop custom display modules and sensor arrays, while traditional seating companies are acquiring start-ups specializing in additive manufacturing to accelerate prototypes. In addition, cross‐industry collaborations between material innovators and automakers are producing next-generation bio-fabrics with enhanced durability metrics. Certain leading conglomerates have announced the consolidation of interior divestitures to streamline innovation pipelines, and several players have leveraged joint ventures in emerging markets to secure production capacity closer to regional end users. To preserve profit margins amid cost inflation pressures, top suppliers are implementing digital twins for interior assembly processes, optimizing cycle times and reducing scrap rates. These maneuvers are reshaping competitive positioning, as firms with integrated R&D capabilities and flexible manufacturing footprints gain a decisive advantage in winning OEM contracts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Interior market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Continental AG

- Denso Corporation

- Eissmann Automotive Deutschland GmbH

- Fritz Dräxlmaier GmbH & Co. KG

- Garmin Ltd.

- Gentex Corporation

- H.B. Fuller Company

- Hayashi Telempu Corporation

- Huizhou Desay SV Automotive Co., Ltd.

- Hyundai Mobis Co., Ltd.

- IAC Group

- Inteva Products, LLC

- Kyocera Corporation

- Lear Corporation

- LG Display Co., Ltd.

- Machino Plastics Limited

- Marelli Holdings Co., Ltd.

- Mondragon Assembly, S.Coop.

- Novares Group S.A.

- Panasonic Corporation

- Robert Bosch GmbH

Recommending Actionable Strategies for Industry Stakeholders to Leverage Emerging Trends, Mitigate Risks, and Drive Sustainable Growth in Automotive Cabin Solutions

Industry leaders must align product roadmaps with sustainable design imperatives by embedding recycled and bio-based materials into core component portfolios, thus meeting regulatory requirements while appealing to eco-conscious consumers. Investment in smart cabin ecosystems-including advanced AI-driven user profiling, predictive maintenance alerts, and multi-modal connectivity layers-will differentiate offerings in crowded market segments. Companies should optimize supply chains for agility by diversifying supplier networks across low-tariff regions, leveraging nearshore facilities, and instituting dynamic inventory management systems. Collaboration with propulsion system integrators will be essential to harmonize interior architectures with evolving battery electric and hybrid platforms, ensuring compatibility with high-voltage routing and thermal management requirements. Additionally, embracing digital manufacturing technologies such as 3D printing and VR-based assembly simulations can yield cost efficiencies and accelerate go-to-market timelines. By proactively implementing these strategies, stakeholders will fortify their market positions and capture expanding opportunities in both OEM and aftermarket channels.

Detailing a Rigorous Mixed-Method Research Approach Combining Qualitative Interviews, Quantitative Surveys, and Supply Chain Analysis for Reliable Insights

This research employs a mixed-methodology framework, commencing with an extensive literature review of public filings, regulatory documents, and academic journals to map foundational trends. Qualitative insights were garnered through in-depth interviews with senior executives, design engineers, and procurement leads at top automotive OEMs and Tier 1 suppliers. Parallelly, quantitative data were collected via structured surveys administered to procurement and engineering professionals across multiple regions, ensuring representation of both mature and emerging markets. Supply chain analyses integrated customs data and logistics flow models to quantify tariff impacts and cross-border lead times. Data triangulation techniques were applied to reconcile discrepancies between secondary data and primary findings, enhancing reliability. Finally, scenario planning workshops with subject-matter experts tested the implications of policy shifts and technology adoption pathways under varying cost and regulatory assumptions, culminating in robust strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Interior market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Interior Market, by Component Type

- Automotive Interior Market, by Material Type

- Automotive Interior Market, by Propulsion

- Automotive Interior Market, by Vehicle Type

- Automotive Interior Market, by Sales Channel

- Automotive Interior Market, by Region

- Automotive Interior Market, by Group

- Automotive Interior Market, by Country

- United States Automotive Interior Market

- China Automotive Interior Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Strategic Conclusions by Synthesizing Market Drivers, Disruptive Shifts, and Regulatory Impacts to Guide Stakeholders through Complex Interior Ecosystem Transformations

Synthesizing the research findings reveals that automotive interior development is at the nexus of sustainability, digitalization, and regulatory adaptation. The convergence of eco-friendly material mandates and passengers’ demand for connected, personalized environments is compelling a strategic realignment of design priorities. Tariff-induced supply chain disruptions of 2025 have underscored the necessity for manufacturing resilience and geographic diversification. Moreover, segment-specific insights highlight high-value opportunities in premium seating systems, advanced foam composites, and integrated HMI modules, particularly within electric vehicle architectures. Regional analysis confirms that no one-size-fits-all approach will succeed; instead, tailored solutions aligned with local regulations and consumer expectations are paramount. In this context, companies with agile methodologies, collaborative innovation models, and adaptive procurement strategies will emerge as the primary beneficiaries. Ultimately, this comprehensive overview equips stakeholders to navigate the intricate interior ecosystem with confidence and precision.

Engaging Custom Consultation and Report Access Options with Ketan Rohom to Empower Decision Makers with Tailored Insights on the Automotive Interior Market

For organizations seeking to transform strategic decision-making with comprehensive and granular insights on the evolving automotive interior landscape, the next step is to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engaging in a tailored consultation offers unparalleled access to the full market research report, complete with in-depth analyses, proprietary data models, and bespoke scenario planning. During this process, stakeholders can explore customized data breakdowns, clarify methodological approaches, and align findings with specific corporate objectives. Ketan Rohom will guide teams through the report’s most critical sections, ensuring clarity on emerging opportunities, risk mitigation tactics, and competitive benchmarks. Securing the complete publication enables rapid deployment of evidence-based strategies and positions leadership to capitalize on evolving consumer preferences, regulatory shifts, and technological breakthroughs. To initiate a personalized inquiry or obtain institutional licensing, reach out to Ketan Rohom, whose expertise in automotive interior insights will facilitate seamless integration of the research into organizational roadmaps.

- How big is the Automotive Interior Market?

- What is the Automotive Interior Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?